Ultraviolet (UV) Tapes Market Size, Share, Trends, Growth & Forecast 2034

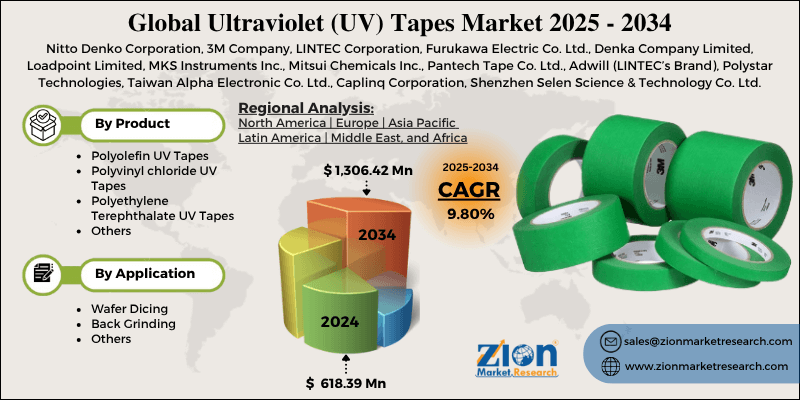

Ultraviolet (UV) Tapes Market By Product (Polyolefin UV Tapes, Polyvinyl Chloride UV Tapes, Polyethylene Terephthalate UV Tapes, and Others), By Application (Wafer Dicing, Back Grinding, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

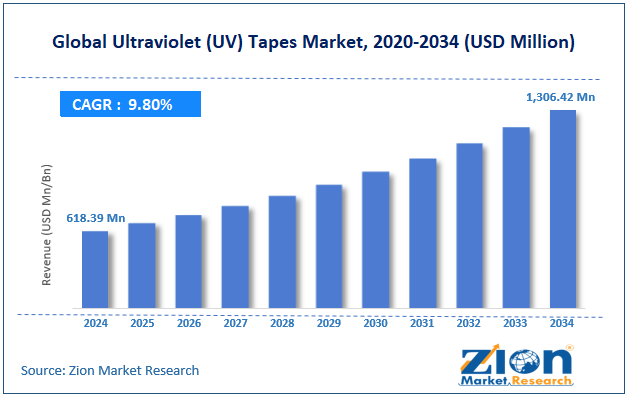

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 618.39 Million | USD 1306.42 Million | 9.80% | 2024 |

Ultraviolet (UV) Tapes Industry Perspective:

The global ultraviolet (UV) tapes market size was approximately USD 618.39 million in 2024 and is projected to reach around USD 1306.42 million by 2034, with a compound annual growth rate (CAGR) of approximately 9.80% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global ultraviolet (UV) tapes market is estimated to grow annually at a CAGR of around 9.80% over the forecast period (2025-2034)

- In terms of revenue, the global ultraviolet (UV) tapes market size was valued at around USD 618.39 million in 2024 and is projected to reach USD 1306.42 million by 2034.

- The ultraviolet (UV) tapes market is projected to grow significantly due to the increasing demand for wafer dicing and packaging applications, the growth of display panel manufacturing, and the rise in demand for clean processing and high-precision materials.

- Based on product, the polyolefin UV tapes segment is expected to lead the market, while the polyethylene terephthalate UV tapes segment is expected to grow considerably.

- Based on application, the wafer dicing segment is the dominant segment, while the back grinding segment is projected to witness substantial revenue growth over the forecast period.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Ultraviolet (UV) Tapes Market: Overview

Ultraviolet tapes are specialized adhesive materials that harden or cure when exposed to UV light, offering strong bonding and easy peel-off without leaving residues. They are extensively used in semiconductor manufacturing, glass processing, and electronics assembly due to their optimal heat resistance, precision masking properties, and chemical stability. The global ultraviolet (UV) tapes market is poised for significant growth, driven by the rise in electronics miniaturization, increased demand in display panel manufacturing, and advancements in UV-curable adhesive technologies. With the rising trend of lightweight, compact, and high-performing electronic devices, manufacturers depend on UV tapes for clean and precise processing. Their easy peel-off properties help avoid contamination and chip damage, holding importance in microelectronics. This is primarily required by wearable and smartphone manufacturers seeking reliability at the micro-level.

Moreover, UV tapes are extensively used for glass lamination, protection, and bonding in OLED, LCD, and flexible display panels. As global display production increases with the adoption of foldable devices and smart TVs, UV tapes offer crucial adhesive and residue-free detachment capabilities. The industry benefits from improvements in display technology and high production volumes in the APAC region. Furthermore, current advancements in adhesive chemistry are enhancing the performance of UC tape, improving its peel strength, heat resistance, and transparency. Companies are developing next-generation UV-curable polymers well-suited for high-stress environments, increasing UV tape applications beyond conventional wafer processes.

Nevertheless, the global market faces limitations due to factors such as the high initial cost of UV tapes and complex manufacturing and handling requirements. UV tapes, being highly specialized, are more expensive than traditional adhesive tapes. This higher cost may hamper small manufacturers and restrict adoption in cost-sensitive markets. The ROI depends on the precision requirements and the volume of production. Similarly, UV tapes need specialized handling, controlled environments, and UV curing equipment. Small fabrication units may find these requirements technically challenging, which can hinder production scalability. Incorrect UV exposure may result in adhesion failures or incomplete curing.

Still, the global ultraviolet (UV) tapes industry benefits from several favorable factors, including growing demand for advanced packaging solutions and a rise in automotive and EV electronics. The global shift towards 3D and chiplet packaging presents new opportunities for UV tapes. Their ability to secure ultra-thin wafers and support complex frameworks makes them vital for next-generation packaging infrastructures. Additionally, EVs need well-developed sensors, PCBs, and chips. UV tapes are primarily used in automotive manufacturing, particularly for ADAS and infotainment systems, creating lucrative opportunities in the automotive sector.

Ultraviolet (UV) Tapes Market Dynamics

Growth Drivers

How is the ultraviolet (UV) tapes market driven by the rising adoption of wearable and flexible electronics?

The proliferation of flexible electronics, comprising curved displays, foldable smartphones, and wearable health devices, is propelling the demand for UV tapes with clean-release properties and advanced elasticity. UV tapes promise secure and removable bonding on bendable substrates, increasing their use in micro-LED and flexible OLED production. Companies like Teraoka Seisakusho and Furukawa Electric are developing specialized UV tapes for flexible display lamination and roll-to-roll processing. This progressing segment presents a robust alliance between UV tape advancement and flexible device evolution.

How are improvements in UV-curable adhesive technologies fueling the ultraviolet (UV) tapes market?

Recent advancements in UV-curable adhesive formulations have improved the performance, environmental sustainability, and efficiency of UV tapes. These new-generation tapes offer higher peel strength, shorter curing times, and low residue removal, thereby increasing their suitability for high-precision manufacturing. The UV-curable adhesives industry is anticipated to grow at a 9.2% CAGR by 2030, supporting the growth of UV tapes.

In 2024, Hitachi Chemical launched eco-friendly UV tapes with low volatile compounds, complying with stringent US and EU environmental regulations. This technological progress enhances process reliability, lessens downtime, and meets global sustainability goals, thus reinforcing the adoption of the ultraviolet (UV) tapes market.

Restraints

Limited awareness among small-scale manufacturers negatively impacts the market progress

While large electronics and semiconductor companies are aware of the advantages of UV tape, small-scale manufacturers often lack the technical expertise and knowledge to integrate it effectively. A 2024 survey found that more than 40% of SMEs in APAC electronics assembly were dependent on conventional tapes due to insufficient training on UV tape handling. This knowledge gap results in low adoption in regions where small-scale flexible display or electronics production is surging. Without proper training programs and awareness campaigns, industry expansion in these domains remains restricted.

Opportunities

How does the adoption of eco-friendly and low-VOC UV tapes create promising avenues for the growth of the ultraviolet (UV) tapes industry?

Sustainability trends are creating opportunities for the makers of UV tapes to develop eco-friendly formulations. In 2024, Hitachi Chemical introduced UV tapes with low VOC content to meet the environmental standards of the US and the EU. Eco-conscious semiconductor and electronics companies prefer low-emission adhesives for regulatory compliance and corporate social responsibility. The demand for recyclable materials and green manufacturing processes can open fresh markets for specialized UV tapes. This trend supports the global sustainability initiatives and regulatory shifts, positively impacting the ultraviolet (UV) tapes industry.

Challenges

Reliance on high-tech end-use industries restricts the market growth

The semiconductor, electronics, and automotive sectors primarily drive the UV tape market. Any slowdown in these sectors directly impacts the demand. For example, global semiconductor revenue dropped by 3% in 2023, underscoring vulnerability to cyclical market trends. Progressing technologies may also move away from conventional UV tape usage. Their reliance makes industry sensitive to economic cycles, regional trade policies, and tech disturbances.

Ultraviolet (UV) Tapes Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Ultraviolet (UV) Tapes Market |

| Market Size in 2024 | USD 618.39 Million |

| Market Forecast in 2034 | USD 1,306.42 Million |

| Growth Rate | CAGR of 9.80% |

| Number of Pages | 213 |

| Key Companies Covered | Nitto Denko Corporation, 3M Company, LINTEC Corporation, Furukawa Electric Co. Ltd., Denka Company Limited, Loadpoint Limited, MKS Instruments Inc., Mitsui Chemicals Inc., Pantech Tape Co. Ltd., Adwill (LINTEC’s Brand), Polystar Technologies, Taiwan Alpha Electronic Co. Ltd., Caplinq Corporation, Shenzhen Selen Science & Technology Co. Ltd., CCT Tapes, and others. |

| Segments Covered | By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Ultraviolet (UV) Tapes Market: Segmentation

The global ultraviolet (UV) tapes market is segmented by product, application, and region.

Based on product, the global ultraviolet (UV) tapes industry is divided into polyolefin UV tapes, polyvinyl chloride UV tapes, polyethylene terephthalate UV tapes, and others. The polyolefin UV tapes segment registers a leading market share owing to its optimal balance of adhesion strength, clean removal properties, and flexibility during wafer dicing and grinding. Polyolefin tapes also offer excellent chemical and thermal resistance, making them highly suitable for advanced electronics and semiconductor applications.

On the other hand, the polyethylene terephthalate UV tapes held a second-leading position, fueled by their high tensile strength, transparency, and dimensional stability, which are beneficial in precision glass processing and display panel manufacturing. PET tapes are progressively used for applications needing mechanical durability and optical clarity.

Based on application, the global ultraviolet (UV) tapes market is segmented into wafer dicing, back grinding, and others. The wafer dicing segment held a dominating share of the market, since these tapes securely hold ultra-thin wafers during cutting. They avoid micro-cracks, damage, and contamination, promising high production and precision in semiconductor manufacturing. With the advancement of IoT devices, 5G, and AI, the demand for UV tapes in wafer dicing is continuing to surge worldwide. Their strong adhesion and clean peel-off make them vital in modern fabs.

Conversely, the back grinding segment holds a second rank in the market, as UV tapes safeguard wafers during thinning processes to achieve the desired thickness. They offer mechanical support, residue-free removal, and strong adhesion, preventing wafer breakage. Rising adoption of wafer-level packaging and advanced 3D IC technologies is fueling the need for UV tapes in back grinding. This segment is progressing majorly in North America and the Asia Pacific.

Ultraviolet (UV) Tapes Market: Regional Analysis

What factors will help the Asia Pacific witness significant growth over the forecast period?

The Asia Pacific is projected to maintain its dominant position in the global ultraviolet (UV) tapes market, owing to its dominance in semiconductor manufacturing, rapid display panel and electronics production, and the presence of leading UV tape manufacturers. The Asia Pacific region is home to leading semiconductor hubs, including South Korea, Taiwan, and China, which collectively account for more than 70% of global wafer production. The significant volume of dicing operations and wafer fabrication propels notable demand for UV tapes. Leading fabs in APAC depend on UV tapes for residue-free performance, precision, and protection of ultra-thin wafers.

Moreover, economies such as South Korea, China, and Japan hold a leadership position in manufacturing, producing more than 60% of the global display panels and smartphones. UV tapes are extensively used for OLED, LCD, and flexible display manufacturing, supporting dicing and lamination processes. The scale of production assures constant, large-volume demand for high-performing UV tapes. Several worldwide UV tape suppliers, such as Taiyo Holdings, Nitto Denko, and 3M, have manufacturing facilities located in the APAC region. Local production reduces lead times and logistics costs while supporting the speedy supply of electronics and semiconductor manufacturers. This proximity reinforces the industry's dominance in the Asia Pacific.

North America maintains its position as the second-largest region in the global ultraviolet (UV) tapes industry, driven by advanced microelectronics and display industries, technological innovation and R&D, as well as growth in EV and automotive electronics. Canada and the US have a progressing microelectronics and display sector, comprising OLED, advanced PCB manufacturing, and flexible electronics. UV tapes are crucial for wafer handling, lamination, and protective masking in these processes. The demand for high-class and reliable material supports consistent UV tape consumption.

Additionally, North America heavily invests in research and development for semiconductor packaging, advanced adhesives, and microfabrication technologies. Companies are focusing on the development of next-generation UV tapes with improved adhesion, transparency, and thermal resistance. Advancement hubs in Austin and Silicon Valley augment the adoption of these specialized tapes.

Furthermore, the growth of EVs and automotive driving solutions in North America is surging the production of semiconductors and PCBs. UV tapes are widely used in protecting sensitive components and automotive electronics during back-grinding and wafer processes. This trend is expected to drive market growth.

Ultraviolet (UV) Tapes Market: Competitive Analysis

The leading players in the global ultraviolet (UV) tapes market are:

- Nitto Denko Corporation

- 3M Company

- LINTEC Corporation

- Furukawa Electric Co. Ltd.

- Denka Company Limited

- Loadpoint Limited

- MKS Instruments Inc.

- Mitsui Chemicals Inc.

- Pantech Tape Co. Ltd.

- Adwill (LINTEC’s Brand)

- Polystar Technologies

- Taiwan Alpha Electronic Co. Ltd.

- Caplinq Corporation

- Shenzhen Selen Science & Technology Co. Ltd.

- CCT Tapes

Ultraviolet (UV) Tapes Market: Key Market Trends

Growth in display panel applications:

UV tapes are gaining popularity in OLED, LCD, and flexible display manufacturing, where optical clarity and clean peeling are vital. The growing worldwide demand for foldable devices and high-resolution displays is driving manufacturers to adopt specialized UV tapes. This trend is highly prevalent in the APAC region, the leading hub for large-scale display production.

Focus on advanced UV-curable adhesives:

Manufacturers are investing in R&D to develop next-generation UV tapes with higher adhesion, transparency, and thermal resistance. These advancements enhance production, reduce contamination, and facilitate use in complex packaging, such as 3D ICs. Advanced adhesive technologies are becoming a main differentiator among UV tape suppliers.

The global ultraviolet (UV) tapes market is segmented as follows:

By Product

- Polyolefin UV Tapes

- Polyvinyl chloride UV Tapes

- Polyethylene Terephthalate UV Tapes

- Others

By Application

- Wafer Dicing

- Back Grinding

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Ultraviolet tapes are specialized adhesive materials that harden or cure when exposed to UV light, offering strong bonding and easy peel-off without leaving residues. They are extensively used in semiconductor manufacturing, glass processing, and electronics assembly due to their optimal heat resistance, precision masking properties, and chemical stability.

The global ultraviolet (UV) tapes market is projected to grow due to increasing demand from the semiconductor and electronics industries, advancements in adhesive formulations, and growing investments in the solar energy and photovoltaic sectors.

According to study, the global ultraviolet (UV) tapes market size was worth around USD 618.39 million in 2024 and is predicted to grow to around USD 1306.42 million by 2034.

The CAGR value of the ultraviolet (UV) tapes market is expected to be approximately 9.80% from 2025 to 2034.

Investment and partnership opportunities exist in collaborations with display and semiconductor manufacturers, as well as the development of advanced UV-curable adhesives, and expansion into emerging markets such as EV electronics and the Asia Pacific.

Pricing trends in the UV tape market indicate moderate increases, driven by technological enhancements, rising raw material costs, and surging demand in the electronics and semiconductor sectors.

Asia Pacific is expected to lead the global ultraviolet (UV) tapes market during the forecast period.

The key players profiled in the global ultraviolet (UV) tapes market include Nitto Denko Corporation, 3M Company, LINTEC Corporation, Furukawa Electric Co., Ltd., Denka Company Limited, Loadpoint Limited, MKS Instruments, Inc., Mitsui Chemicals, Inc., Pantech Tape Co., Ltd., Adwill (LINTEC’s Brand), Polystar Technologies, Taiwan Alpha Electronic Co., Ltd., Caplinq Corporation, Shenzhen Selen Science & Technology Co., Ltd., and CCT Tapes.

The competitive landscape in the UV tapes market is highly consolidated, dominated by global players such as Nitto Denko, 3M, Sekisui, and Taiyo Holdings, who compete through strategic partnerships, product innovation, and regional expansion.

The report examines key aspects of the ultraviolet (UV) tapes market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed