U.S. B2C Payment Market Size, Share, Analysis, Trends, Growth, 2032

U.S. B2C Payment Market By Payment Method (Cash, Credit & Debit Cards, Bank Transfers, and Digital Wallets), By Application (Media & Entertainment, Retail, E-Commerce, and Travel & Hospitability), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

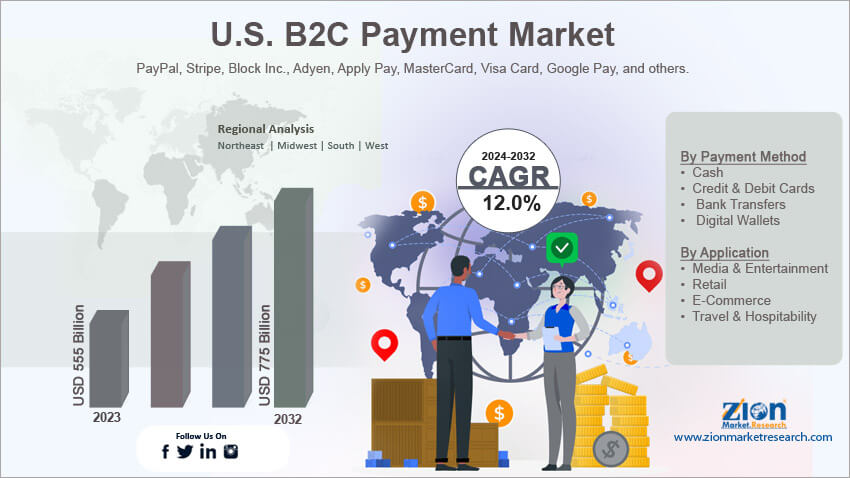

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 555 Billion | USD 775 Billion | 12% | 2023 |

U.S. B2C Payment Industry Perspective:

The U.S. B2C payment market size was evaluated at $555 billion in 2023 and is slated to hit $775 billion by the end of 2032 with a CAGR of nearly 12% between 2024 and 2032.

U.S. B2C Payment Market: Overview

B2C payment also referred to as business-to-consumer payment, includes all transactions where businesses sell goods & services directly to customers. Technological advancements and changing consumer preferences along with rapid economic growth have paved the way for humungous demand for B2C payments in the U.S.

Key Insights

- As per the analysis shared by our research analyst, the U.S. B2C payment market is projected to expand annually at the annual growth rate of around 12% over the forecast timespan (2024-2032)

- In terms of revenue, the U.S. B2C payment market size was evaluated at nearly $555 billion in 2023 and is expected to reach $775 billion by 2032.

- The global U.S. B2C payment market is anticipated to grow rapidly over the forecast timeline owing to an increase in digital payments and a surge in mobile wallets.

- In terms of payment method, the digital wallets segment is slated to register the highest CAGR over the forecast period.

- Based on application, the e-commerce segment is predicted to contribute majorly towards the U.S. industry share in the upcoming years.

- Region-wise, the Southern region B2C payment industry is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

U.S. B2C Payment Market: Growth Factors

Growing preference for online payment systems is likely to embellish the market growth in the U.S.

An increase in digital payments and a surge in mobile wallets will boost the growth of the U.S. B2C payment market. A surge in the QR code payments will embellish the expansion of the market in the country. Flourishing e-commerce sector along with focusing on various businesses in the U.S. on Omni channel payments will drive the market trends in the U.S. A rise in contactless payments along with the use of new technologies such as NFC in these kinds of payments will propel the growth of the market in the country. Breakthroughs in cyber-security for preventing online frauds have further impelled the market space in the U.S. A rise in online cross-border fiscal transactions will accentuate the growth of the U.S. market.

U.S. B2C Payment Market: Restraints

Huge concerns related to data security can falter the growth of the industry in the U.S.

Growing concerns related to data privacy and strict laws governing the use of B2C payments in the U.S. can restrain the expansion of the U.S. B2C payment market. Technological integration of new online systems with the current ones can prove to be complicated and costly for businesses, thereby restricting the adoption of B2C payment systems in various states of the U.S.

U.S. B2C Payment Market: Opportunities

Easy access to flexibility in online payments can open new growth facets for the market in the U.S.

Availability of flexible payment options and the rise in the cryptocurrency use for making payments are some of the factors that are likely to favorably influence the growth of the U.S. B2C payment market. Additionally, customized payment offers to customers based on their spending behavior are likely to pave the way for the expansion of the market in the country.

U.S. B2C Payment Market: Challenges

Resistance to changing behavior of a few customers can severely impact the growth of the industry in the U.S.

Some of the end-users avoid the use of new payment methods due to lack of familiarity and this can prove to be a huge challenge in the growth path of the U.S B2C payment industry. Moreover, growing issues with the interoperability of B2C payment systems along with a rise in the transaction fee involved in the payments can deter people from adopting these payment methods.

U.S. B2C Payment Market: Segmentation

The U.S. B2C payment market is divided into payment method, application, and region.

In terms of type, the U.S. B2C payment market across the globe is bifurcated into cash, credit & debit cards, bank transfers, and digital wallets segments. Additionally, the digital wallets segment, which gained approximately 69% of the market revenue in 2023, is forecast to register the highest CAGR during the timespan from 2024 to 2032. The key driver of the segmental growth can be attributed to the ease of use of digital wallets along with their biometric authentication. Apart from this, digital wallets also provide the transaction history of the end-users, thereby helping them track their spending habits and allocate budgets accordingly. Furthermore, an increase in discounts & loyalty points to customers using digital wallets will further drive the segmental surge.

Based on the application, the U.S. B2C payment industry is divided into media & entertainment, retail, e-commerce, and travel & hospitality segments. Additionally, the e-commerce segment, which accrued about 33% of the industry share in 2023, is set to lead the segmental surge in the U.S. in the years ahead. Moreover, the segmental growth can be due to the rise in the use of cryptocurrency, credit cards, debit cards, direct online payments through online banking, and buy now pay later payment methods.

U.S. B2C Payment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. B2C Payment Market |

| Market Size in 2023 | USD 555 Billion |

| Market Forecast in 2032 | USD 775 Billion |

| Growth Rate | CAGR of 12% |

| Number of Pages | 205 |

| Key Companies Covered | PayPal, Stripe, Block Inc., Adyen, Apply Pay, MasterCard, Visa Card, Google Pay, and others. |

| Segments Covered | By Payment Method, By Application, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. B2C Payment Market: Regional Insights

Northeast of the U.S. is expected to dominate the U.S. B2C Payment market surge over 2024-2032

The Northeast region, which accounted for 41% of the U.S. B2C payment market share in 2023, is expected to establish a key position in the U.S. market in the upcoming years. In addition to this, the regional market expansion in the forecast timespan can be credited to the rise in the number of tech-savvy end-users in the City of New York in the Northeastern part of the U.S. Apart from this, the availability of strong digital payment infrastructure in this region along with large-scale use of cashless payments in the region will drive the market trends in the Northeastern part of the U.S.

Southern region B2C payment industry is predicted to register the highest growth rate annually within the next couple of years. The growth of the industry in the region can be due to the large-scale use of online payment methods in the southern region of the U.S. Moreover, the presence of key players in this region will further boost the industry growth in the region.

Key Developments

- In September 2023, Bank of America introduced B2C payment in Canada intending to bolster the digital payment systems.

- In March 2024, Gupshup introduced a conversation cloud for facilitating AI-based B2C communications.

U.S. B2C Payment Market: Competitive Space

The U.S. B2C payment market profiles key players such as:

- PayPal

- Stripe

- Block Inc.

- Adyen

- Apply Pay

- MasterCard

- Visa Card

- Google Pay

The U.S. B2C payment market is segmented as follows:

By Payment Method

- Cash

- Credit & Debit Cards

- Bank Transfers

- Digital Wallets

By Application

- Media & Entertainment

- Retail

- E-Commerce

- Travel & Hospitability

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

B2C payment is also referred to as business-to-consumer payment and includes all transactions where businesses sell goods & services directly to customers.

The U.S. B2C payment market growth over the forecast period can be owing to the flourishing e-commerce sector along with focusing of various businesses in the U.S. on Omni channel payments.

According to a study, the global U.S. B2C payment industry size was $555 billion in 2023 and is projected to reach $775 billion by the end of 2032.

The global U.S. B2C payment market is anticipated to record a CAGR of nearly 12% from 2024 to 2032.

The southern region B2C payment industry is set to register the fastest CAGR over the forecasting timeline owing to the large-scale use of online payment methods in the southern region of the U.S. Moreover, the presence of key players in this region will further boost the industry growth in the region.

The U.S. B2C payment market is led by players such as PayPal, Stripe, Block, Inc., Adyen, Apply Pay, MasterCard, Visa Card, and Google Pay.

The U.S B2C payment market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed