US Baby Infant Formula Market Size, Share, Analysis, Trends, Growth, 2032

US Baby Infant Formula Market By Distribution Channel (Supermarkets, Hypermarkets, Pharmacy/Medical Stores, Specialty Stores, and Others), By Product Type (Growing-Up Milk, Specialty Baby Milk, Follow-On Milk, and Infant Milk), By Ingredients (Vitamins, Minerals, Protein, Fat, Carbohydrates, and Others), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

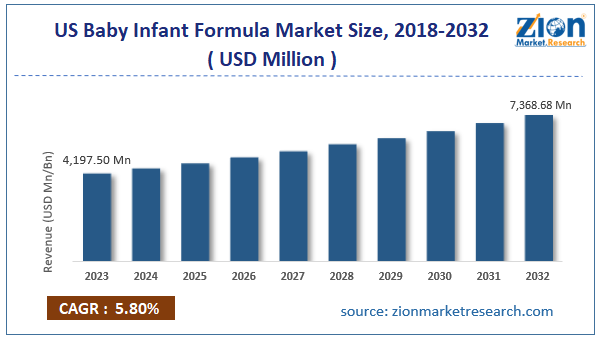

| USD 4,197.50 Million | USD 7,368.68 Million | 5.80% | 2023 |

US Baby Infant Formula Industry Prospective:

The US baby infant formula market size was worth around USD 4,197.50 million in 2023 and is predicted to grow to around USD 7,368.68 million by 2032 with a compound annual growth rate (CAGR) of roughly 5.80% between 2024 and 2032.

US Baby Infant Formula Market: Overview

The US baby infant formula industry caters to the nutritional needs of babies under the age of 12 years in the country. Infant formula is a specially designed baby product that focuses on substituting human milk. The formula is curated to provide all essential nutrients that a child under 12 years of age needs which is traditionally provided by breastfeeding mothers. According to the World Health Organization, a child should be exclusively breastfed until the first 6 months of life. The agency further recommends breastfeeding until 2 years of age for comprehensive growth of the child. However, in certain cases, mothers are unable to produce enough milk to feed the child. Additionally, several non-medical cases pose hindrances in allowing parents to breastfeed their children. Since infants have special nutritional needs, parents must ensure that the babies are sufficiently fed uncompromised nutrients at all times. The US baby infant formula industry is a highly regulated market with US government official bodies drafting clear guidelines determining the kind of raw materials that can be used for producing infant formula. The growing number of working mothers in the US is driving the market demand rate.

Key Insights:

- As per the analysis shared by our research analyst, the US baby infant formula market is estimated to grow annually at a CAGR of around 5.80% over the forecast period (2024-2032)

- In terms of revenue, the US baby infant formula market size was valued at around USD 4,197.50 million in 2023 and is projected to reach USD 7,368.68 million, by 2032.

- The US baby infant formula market is projected to grow at a significant rate due to the surge in working mothers’ population in the US

- Based on the distribution channel, the hypermarket segment is growing at a high rate and will continue to dominate the regional market as per industry projection

- Based on the ingredients, the carbohydrates segment is anticipated to command the largest market share

- Based on region, Eastern and midwestern states are projected to dominate the regional market during the forecast period

Request Free Sample

Request Free Sample

US Baby Infant Formula Market: Growth Drivers

Surge in the working mothers’ population in the US will fuel the market demand rate

The US baby infant formula market is projected to be led by the surge in the number of working mothers in the country. According to the Bureau of Labor Statistics, more than 74.6 million women in the US are currently working. They constitute nearly 46% of the country’s total workforce. Two main reasons for the higher regional working women population are excellent recovery from the impact of COVID-19 and economic evolution. Additionally, jobs in the US market are less rigid. They are flexible to meet the needs of employed women. For instance, the rise of hybrid work environments and flexible hours have encouraged more women to pursue becoming financially independent. In July 2024, the Economic Development Administration (EDA) wing of the US Department of Commerce announced a new funding phase for the Good Jobs Challenge awards. The funding round is expected to invest around USD 25 million into locally-led, high-quality workforce training programs. Thus, encouraging more people to opt for new job opportunities. In such cases, working parents may not have sufficient time in hand to feed their babies and may have to resort to infant formula milk.

Growing measures undertaken by the US government to promote product safety and efficiency will assist in generating more revenue

The US government and concerned official authorities such as the Food & Drugs Administration (FDA) authority have emphasized using safe ingredients and processes for producing infant formula. For example, in February 2024, the US government announced new provisions to ensure easy and consistent access to baby infant formula for families under the Women, Infants, and Children (WIC) program. The US Department of Agriculture (USDA) has collaborated with infant formula producers to ascertain consistent product supply even during emergencies, thus promoting growth in the US baby infant formula market.

US Baby Infant Formula Market: Restraints

Increase in reported cases of formula-induced deaths in babies will restrict the market expansion rate

The US industry for baby infant formula is projected to be restricted due to the growing cases of formula-related deaths in babies in the last few years. For instance, in March 2022, Abbott Laboratories had to recall a certain number of Similac PM 60/40 cans due to the reported death of at least two children and multiple illnesses caused due to exposure to the bacteria-tainted product. According to the reports submitted by the FDA, the company has failed to maintain clean surfaces that were used for producing and managing the product. In August 2024, the parents of the baby sued Abbott Nutrition for fraud, negligence, and failure to warn parents of the potential dangers of powdered formula. The parents have demanded a minimum of USD 450,000 per family.

US Baby Infant Formula Market: Opportunities

Increase in the number of products with novel ingredients may fuel the market expansion rate

The US baby infant formula market is projected to generate multiple growth opportunities during the projection period. The increasing focus on developing new products with novel and highly nutritious ingredients will promote the market adoption rate. In May 2024, ByHeart, an evolving infant nutrition company, announced that it had received additional funding of USD 95 million. ByHeart will use the funds to further promote commercial development and launch of its innovative products in the US market. The company has already managed to raise around USD 395 million from leading investors such as OCV Partners, Bellco Capital, and D1 Capital Partners among others. ByHeart has already been awarded Clean Label Project certification three times. In May 2024, Biomilq, a start-up based out of North Carolina, announced that it was working on recreating breastmilk outside the human body. If the company manages to achieve this feat, it will change the infant formula industry drastically.

US Baby Infant Formula Market: Challenges

Managing product shortages and supply chain disruptions may challenge the market expansion rate

In the last few years, the US has recorded a decline in access to infant formula among parents. The US baby infant formula industry has been severely impacted by a lack of access to essential raw materials and supply chain disruptions. In 2023, around 20.01% of parents in the country recorded difficulty in accessing infant formula. US manufacturers of breastmilk substitutes must continue to invest in upgrading production quantity and quality to survive in the long run.

US Baby Infant Formula Market: Segmentation

The US baby infant formula market is segmented based on distribution channel, product type, ingredients, and region.

Based on the distribution channel, the regional market divisions are supermarkets, hypermarkets, pharmacy/medical stores, specialty stores, hard discounts, and others. In 2023, the highest growth was observed in the hypermarket segment. The increasing product inventory at hard discount stores is driving the segmental demand. The hard discount segment is projected to grow at a CAGR of around 7% during the projection period. These units primarily focus on private-label products.

Based on product type, the US baby infant formula is divided into growing-up milk, specialty baby milk, follow-on milk, and infant milk.

Based on the ingredients, the regional market segments are vitamins, minerals, protein, fat, carbohydrates, and others. In 2023, the highest demand was observed in the carbohydrates segment. These ingredients are necessary for the overall development of a child and they must account for more than 40.01% of a child’s nutrients quotient. Most parents opt for cow milk-based infant formula for carbohydrates. During the forecast period, the vitamin segment is projected to grow at a CAGR of over 6.51%.

US Baby Infant Formula Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US Baby Infant Formula Market |

| Market Size in 2023 | USD 4,197.50 Million |

| Market Forecast in 2032 | USD 7,368.68 Million |

| Growth Rate | CAGR of 5.80% |

| Number of Pages | 212 |

| Key Companies Covered | Nature's One, Abbott Laboratories (Similac), Happy Family Organics, Reckitt Benckiser Group (Nutramigen), Mead Johnson Nutrition (Enfamil), Earth's Best, Nestlé (Gerber Good Start), Bobbie, Perrigo Nutritionals, The Honest Company., and others. |

| Segments Covered | By Distribution Channel, By Product Type, By Ingredients, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US Baby Infant Formula Market: Regional Analysis

Eastern and midwestern states to deliver the highest revenue during the projection period

The US baby infant formula market is projected to generate the highest growth in eastern and midwestern states during the projection period. These regions are home to some of the largest baby infant formula producers in the country. In October 2022, Abbott announced that it was planning to invest USD 500 million in the construction of a new nutrition facility for metabolic and specialty infant formulas. In January 2023, New York-based ByHeart announced that it had acquired a domestic infant formula-producing facility. The addition of the new manufacturing site will help the company triple its production capacity. The US market is projected to further benefit from the growing competition in the market. In October 2022, an award-winning infant formula brand from Europe, Kendamil, announced that it had received FDA approval for long-term distribution of its product in the US market thus becoming the first such European company to achieve this feat. In March 2024, U.S. Representative Rosa DeLauro and U.S. Senator Bob Casey launched the Infant Formula Made in America Act to prevent infant formula shortages in the company and increase domestic production of the same.

US Baby Infant Formula Market: Competitive Analysis

The US baby infant formula market is led by players like:

- Nature's One

- Abbott Laboratories (Similac)

- Happy Family Organics

- Reckitt Benckiser Group (Nutramigen)

- Mead Johnson Nutrition (Enfamil)

- Earth's Best

- Nestlé (Gerber Good Start)

- Bobbie

- Perrigo Nutritionals

- The Honest Company.

The US baby infant formula market is segmented as follows:

By Distribution Channel

- Supermarkets

- Hypermarkets

- Pharmacy/Medical Stores

- Specialty Stores

- Others

By Product Type

- Growing-Up Milk

- Specialty Baby Milk

- Follow-On Milk

- Infant Milk

By Ingredients

- Vitamins

- Minerals

- Protein

- Fat

- Carbohydrates

- Others

By Region

- The U.S.

Table Of Content

Methodology

FrequentlyAsked Questions

The US baby infant formula industry caters to the nutritional needs of babies under the age of 12 years in the country.

The US baby infant formula industry caters to the nutritional needs of babies under the age of 12 years in the country.

The US baby infant formula market is projected to be led by the surge in the number of working mothers in the country.

The US baby infant formula market is projected to be led by the surge in the number of working mothers in the country.

According to study, the US baby infant formula market size was worth around USD 4,197.50 million in 2023 and is predicted to grow to around USD 7,368.68 million by 2032.

According to study, the US baby infant formula market size was worth around USD 4,197.50 million in 2023 and is predicted to grow to around USD 7,368.68 million by 2032.

The CAGR value of the US baby infant formula market is expected to be around 5.80% during 2024-2032.

The US baby infant formula market is projected to generate the highest growth in eastern and midwestern states during the projection period.

The US baby infant formula market is led by players like Nature's One, Abbott Laboratories (Similac), Happy Family Organics, Reckitt Benckiser Group (Nutramigen), Mead Johnson Nutrition (Enfamil), Earth's Best, Nestlé (Gerber Good Start), Bobbie, Perrigo Nutritionals and The Honest Company.

The CAGR value of the US baby infant formula market is expected to be around 5.80% during 2024-2032.

The report explores crucial aspects of the US baby infant formula market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

The US baby infant formula market is projected to generate the highest growth in eastern and midwestern states during the projection period.

The US baby infant formula market is led by players like Nature's One, Abbott Laboratories (Similac), Happy Family Organics, Reckitt Benckiser Group (Nutramigen), Mead Johnson Nutrition (Enfamil), Earth's Best, Nestlé (Gerber Good Start), Bobbie, Perrigo Nutritionals and The Honest Company.

The report explores crucial aspects of the US baby infant formula market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed