U.S. Carbon Capture Utilization and Storage (CCUS) Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

U.S. Carbon Capture Utilization and Storage (CCUS) Market By Transport (Terminals, Ships, and Pipelines), By Technology (Pre-Combustion Capture, Post-Combustion Capture, and Oxy-Fuel Combustion Capture), By End-Use (Oil & Gas, Cement, Power Generation, Chemical & Petrochemicals, and Iron & Steel), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

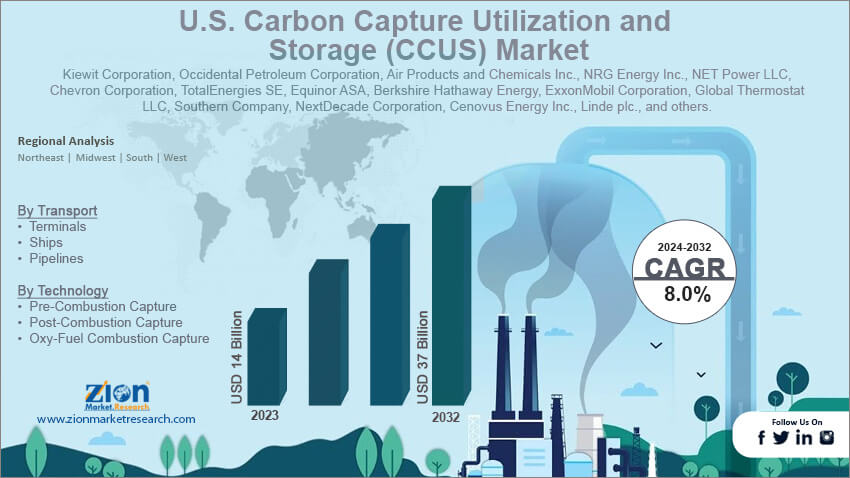

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 14 Billion | USD 37 Billion | 8% | 2023 |

U.S. Carbon Capture Utilization and Storage (CCUS) Industry Prospective:

The U.S. carbon capture utilization and storage (CCUS) market size was evaluated at $14 billion in 2023 and is slated to hit $37 billion by the end of 2032 with a CAGR of nearly 8% between 2024 and 2032.

U.S. Carbon Capture Utilization and Storage (CCUS) Market: Overview

Carbon Capture Utilization and Storage (CCUS) is a collection of systems that help minimize carbon emissions from various kinds of industrial processes along with enhancing power production. The key aim of using CCUS is reducing seasonal fluctuations.

Key Insights

- As per the analysis shared by our research analyst, the U.S. carbon capture utilization and storage (CCUS) market is projected to expand annually at the annual growth rate of around 8% over the forecast timespan (2024-2032)

- In terms of revenue, the U.S. carbon capture utilization and storage (CCUS) market size was evaluated at nearly $14 billion in 2023 and is expected to reach $37 billion by 2032.

- The global U.S. carbon capture utilization and storage (CCUS) market is anticipated to grow rapidly over the forecast timeline owing to favorable government support and tax incentives such as 45Q promoting the use of CCUS technologies.

- In terms of transport, the terminals segment is slated to register the highest CAGR over the forecast period.

- Based on technology, the oxy-fuel combustion capture segment is predicted to contribute majorly towards the U.S. industry revenue in the upcoming years.

- Based on end-use, the power generation segment is predicted to lead the segmental space in the upcoming years.

Request Free Sample

Request Free Sample

U.S. Carbon Capture Utilization and Storage (CCUS) Market: Growth Factors

Supportive government policies to embellish the expansion of the market in the country by 2032

Favorable government support and tax incentives such as 45Q promoting the use of CCUS technologies will steer the growth of the U.S. carbon capture utilization and storage (CCUS) market. Notable investments from public and private players will impel the expansion of the market in the country. Strong infrastructural growth including the transport of captured carbon dioxide and storing it in a proper place will drive the market trends in the U.S. Humungous demand for carbon-dioxide-enhanced oil recovery methods will proliferate the size of the market in the U.S. Corporate investments will further scale up the market growth in the country.

U.S. Carbon Capture Utilization and Storage (CCUS) Market: Restraints

Escalating costs of CCUS can impede the growth of the industry in the U.S. over 2024-2032

Surging prices of carbon capture and storage systems in the U.S. along with a decrease in crude oil prices leading to its reduced acceptance can impede the growth of the U.S. carbon capture utilization and storage (CCUS) industry. An increase in the need for strong infrastructure for the storage and transport of carbon can hinder the expansion of the industry in the country.

U.S. Carbon Capture Utilization and Storage (CCUS) Market: Opportunities

Technological breakthroughs in CCUS can open new growth avenues for the market in the U.S. by 2032

Technological innovations in capture systems including direct air capture systems along with demand for reducing the costs of technologies are anticipated to open new avenues of growth for the U.S. carbon capture utilization and storage (CCUS) market. In addition to this, the integration of CCUS with renewable energy projects is anticipated to prop up the growth of the market in the country.

U.S. Carbon Capture Utilization and Storage (CCUS) Market: Challenges

Increasing environmental issues can challenge the industry growth over the forecast period

Growing ecological concerns and a rise in operating costs can challenge the surge of the U.S. carbon capture utilization and storage (CCUS) industry. Technological barriers can pose a huge threat to the expansion of the industry in the country. Political uncertainties can prove detrimental to the expansion of the industry in the country.

U.S. Carbon Capture Utilization and Storage (CCUS) Market: Segmentation

The U.S. carbon capture utilization and storage (CCUS) market is divided into transport, technology, end-use, and region.

In terms of transport, the U.S. carbon capture utilization and storage market across the globe is bifurcated into terminals, ships, and pipelines segments. Additionally, the terminals segment, which accumulated about two-fifths of the market share in 2023, is slated to register the highest CAGR during the period from 2024 to 2032 subject to a rise in the use of transport terminals for transporting captured carbon dioxide from ships, pipelines, and various other modes of transportation.

Based on the technology, the U.S. carbon capture utilization and storage industry is divided into pre-combustion capture, post-combustion capture, and oxy-fuel combustion capture segments. Additionally, the oxy-fuel combustion capture segment, which accrued about 58% of the industry revenue in 2023, is set to make major contributions towards the industry revenue in the U.S. during the forecasting timeline owing to the ability of the technology in enhancing the efficacy of captured carbon dioxide along with a need for minimizing GHG emissions from power units & industrial processes.

On the basis of end-use, the U.S. carbon capture utilization and storage market is sectored into oil & gas, cement, power generation, chemical & petrochemicals, and iron & steel segments. Moreover, the power generation segment, which gathered nearly 59% of the market share in 2023, is anticipated to lead the segmental sphere in the coming year owing to the ability of CCUS in reducing carbon emissions along with improving energy security.

U.S. Carbon Capture Utilization and Storage (CCUS) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Carbon Capture Utilization and Storage (CCUS) Market |

| Market Size in 2023 | USD 14 Billion |

| Market Forecast in 2032 | USD 37 Billion |

| Growth Rate | CAGR of 8% |

| Number of Pages | 225 |

| Key Companies Covered | Kiewit Corporation, Occidental Petroleum Corporation, Air Products and Chemicals Inc., NRG Energy Inc., NET Power LLC, Chevron Corporation, TotalEnergies SE, Equinor ASA, Berkshire Hathaway Energy, ExxonMobil Corporation, Global Thermostat LLC, Southern Company, NextDecade Corporation, Cenovus Energy Inc., Linde plc., and others. |

| Segments Covered | By Transport, By Technology, By End-Use, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. Carbon Capture Utilization and Storage (CCUS) Market: Regional Insights

Northeast region of the U.S. to dominate the market in the country over the analysis timeline

The Northeast region, which accounted for 51% of the U.S. carbon capture utilization and storage (CCUS) market share in 2023, is expected to establish a key position in the U.S. market in the ensuing years. In addition to this, the regional market expansion in the forecast timeline can be credited to de-carbonization goals set by respective governments of the states in the Northeastern part of the U.S. Presence of a large number of heavy industries and an increase in the renewable energy generation in the region will further proliferate the growth of the business in the Northeastern part of the U.S.

Western carbon capture utilization and storage industry in the U.S. is predicted to register the highest gains annually in the next couple of years. The growth of the industry in the region can be subject to strict law enforcement in states such as Oregon, Washington, and California related to regulating carbon emissions in the environment. For instance, California is focusing on neutralizing carbon by the end of 2045 by promoting the use of CCUS systems in the state. Reportedly, the state has enforced the regulation referred to as Senate Bill 32 for curtailing emissions. Moreover, Washington has enacted the Clean Energy Transformation Act that aids the use of CCUS technologies in the state to curb carbon emissions in the atmosphere.

Key Developments

- In May 2023, Occidental and ADNOC joined hands to create megaton-scale direct capture of air, thereby helping in the exploration of carbon capture, use, and storing ventures in the U.S.

- In the third quarter of 2021, Royal Dutch Shell, TotalEnergies SE, and Equinor ASA allocated funds worth $683 million in carbon capture and storage venture in Norway. Such moves will boost the growth of the carbon capture utilization and storage (CCUS) market in the U.S.

U.S. Carbon Capture Utilization and Storage (CCUS) Market: Competitive Space

The U.S. carbon capture utilization and storage (CCUS) market profiles key players such as:

- Kiewit Corporation

- Occidental Petroleum Corporation

- Air Products and Chemicals Inc.

- NRG Energy Inc.

- NET Power LLC

- Chevron Corporation

- TotalEnergies SE

- Equinor ASA

- Berkshire Hathaway Energy

- ExxonMobil Corporation

- Global Thermostat LLC

- Southern Company

- NextDecade Corporation

- Cenovus Energy Inc.

- Linde plc.

The U.S. carbon capture utilization and storage (CCUS) market is segmented as follows:

By Transport

- Terminals

- Ships

- Pipelines

By Technology

- Pre-Combustion Capture

- Post-Combustion Capture

- Oxy-Fuel Combustion Capture

By End-Use

- Oil & Gas

- Cement

- Power Generation

- Chemical & Petrochemicals

- Iron & Steel

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

Carbon Capture Utilization and Storage (CCUS) is a collection of systems that help minimize carbon emissions from various kinds of industrial processes along with enhancing power production.

The global U.S. carbon capture utilization and storage (CCUS) market growth over the forecast period can be owing to strong infrastructural growth including the transport of captured carbon dioxide and storing it in a proper place.

According to a study, the global U.S. carbon capture utilization and storage (CCUS) industry size was $14 billion in 2023 and is projected to reach $37 billion by the end of 2032.

The global U.S. carbon capture utilization and storage (CCUS) market is anticipated to record a CAGR of nearly 8% from 2024 to 2032.

The U.S. carbon capture utilization and storage (CCUS) market is led by players such as Kiewit Corporation, Occidental Petroleum Corporation, Air Products and Chemicals Inc., NRG Energy Inc., NET Power LLC, Chevron Corporation, TotalEnergies SE, Equinor ASA, Berkshire Hathaway Energy, ExxonMobil Corporation, Global Thermostat LLC, Southern Company, NextDecade Corporation, Cenovus Energy Inc., and Linde plc.

The western carbon capture utilization and storage (CCUS) industry is set to register the fastest CAGR over the forecasting timeline owing to strict law enforcement in states such as Oregon, Washington, and California related to regulating carbon emissions in the environment. For instance, California is focusing on neutralizing carbon by the end of 2045 by promoting the use of CCUS systems in the state.

The U.S. carbon capture utilization and storage (CCUS) market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

Choose License Type

List of Contents

(CCUS)Industry Prospective: (CCUS) OverviewKey Insights (CCUS) Growth Factors (CCUS) Restraints (CCUS) Opportunities (CCUS) Challenges (CCUS) Segmentation (CCUS) Report Scope (CCUS) Regional InsightsKey DevelopmentsThe U.S. carbon capture utilization and storage (CCUS) market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed

-market-size.png)