U.S. Carpets and Rugs Market Size, Share, Analysis, Trends, Growth, 2032

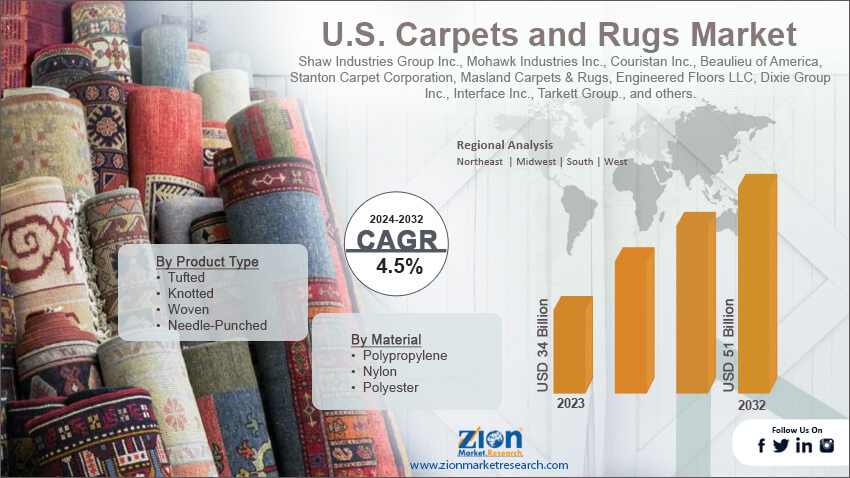

U.S. Carpets and Rugs Market By Product Type (Tufted, Knotted, Woven, and Needle-Punched), By Material (Polypropylene, Nylon, and Polyester), By End-User (Residential and Automotive & Transportation), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

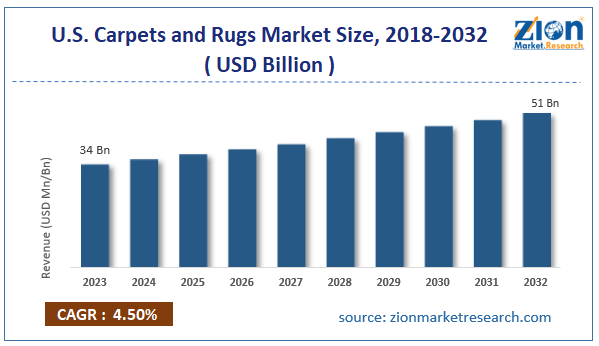

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 34 Billion | USD 51 Billion | 4.5% | 2023 |

U.S. Carpets and Rugs Industry Prospective:

The U.S. carpets and rugs market size was evaluated at $34 billion in 2023 and is slated to hit $51 billion by the end of 2032 with a CAGR of nearly 4.5% between 2024 and 2032.

U.S. Carpets and Rugs Market: Overview

Carpets and rugs are a key subset of interior design utilized in home comfort, thereby providing both functional & aesthetic advantages. There are various kinds of carpets and rugs, including broadloom carpets, shag carpets, patterned carpets, oriental rugs, loop pile carpets, shag rugs, Persian rugs, flatweave rugs, and cut pile carpets.

Key Insights

- As per the analysis shared by our research analyst, the U.S. carpets and rugs market is projected to expand annually at the annual growth rate of around 4.5% over the forecast timespan (2024-2032)

- In terms of revenue, the U.S. carpets and rugs market size was evaluated at nearly $34 billion in 2023 and is expected to reach $51 billion by 2032.

- The U.S. carpets and rugs market is anticipated to grow rapidly over the forecast timeline owing to an increase in customer expenditures and a flourishing real estate sector.

- In terms of product type, the tufted segment is slated to register the highest CAGR over the forecast period.

- Based on material, the nylon segment is predicted to contribute majorly towards the U.S. industry revenue in the upcoming years.

- On the basis of end-user, the automotive & transportation segment is expected to record the fastest CAGR over the forecast timeline.

- Region-wise, the southern carpets and rugs industry is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

U.S. Carpets and Rugs Market: Growth Factors

A surge in consumer spending on carpets & rugs in the U.S. to boost the market growth in the country

An increase in customer expenditure and the flourishing real estate sector have contributed remarkably towards the progression of the U.S. carpets and rugs market. Furthermore, renovation of & remodeling of households along with DIY trends will prompt market expansion in the U.S. in the years to come. Apart from this, massive demand for new materials and the use of eco-friendly products will prompt the expansion of the market across the U.S. Growing demand for hypoallergenic carpets & rugs for reducing allergens and dust mites have provided impetus to the expansion of the U.S. market landscape. An increase in online shopping trends among people and an increment in e-commerce activities have culminated in huge sales of the product. In addition, an increase in the millennial population and Gen Z buyers preferring carpets & rugs will bolster the market penetration in the country.

U.S. Carpets and Rugs Market: Restraints

Access to alternate products is cost-effective prices to diminish the industry growth in the U.S.

Growing health & safety issues and fluctuations in the raw component costs can hinder the growth of the U.S. carpets and rugs industry. Furthermore, strict laws pertaining to VOC emissions and product bio-degradability can shrink the industry's growth in the U.S. Easy availability of substitutes can pose a huge threat to the industry growth in the country.

U.S. Carpets and Rugs Market: Opportunities

Huge product penetration in various U.S. states will open new market growth facets

Humungous demand for environmentally friendly products and the launching of new technologies for manufacturing products will open new growth avenues for the U.S. carpets and rugs market. Need for personalization and customization of products is likely to prop up the expansion of the market in the country in the near future. Surging health & wellness trends will increase the size of the market in the U.S.

U.S. Carpets and Rugs Market: Challenges

A surge in the economic depressions to ongoing conflicts can challenge the industry expansion by 2032

An increase in price wars and economic instabilities is likely to obstruct the expansion of the U.S. carpets and rugs industry. Rapidly changing customer preferences and strict regulatory compliance can create obstacles in the growth path of the industry in the U.S.

U.S. Carpets and Rugs Market: Segmentation

The U.S. carpets and rugs market is divided into product type, material, end-user, and region.

In terms of product type, the U.S. carpets and rugs market across the globe is bifurcated into tufted, knotted, woven, and needle-punched segments. Additionally, the tufted segment, which gained about three-fourths of the U.S. market proceeds in 2023, is expected to register the highest gains during the time interval from 2024 to 2032, subject to the ability of the tufted products in providing a balance between quality and cost of the carpets & rugs in the country. An enhanced demand for tufted carpets & rugs having exceptional patterns, durability, and vibrant colors and fulfilling the need for interior designs will prop up the market growth in the U.S.

Based on the material, the U.S. carpets and rugs industry is divided into polypropylene, nylon, and polyester segments. Additionally, the nylon segment, which accrued about 60% of the industry revenue in 2023, is set to make major contributions towards the industry share in the U.S. during the forecast timeline owing to the ability of nylon carpets & rugs in resisting heavy foot activities and retaining their appearance over the time.

On the basis of end-user, the U.S. carpets and rugs market across the globe is segmented into residential and automotive & transportation segments. Moreover, the automotive & transportation segment, which gained about two-thirds of the U.S. market proceeds in 2023, is expected to register the highest gains during the time-interval from 2024 to 2032 due to large-scale utilization of carpets & rugs in trains, cars, airplanes, and cars. Moreover, beneficial features of the product, such as noise reduction, interior aesthetics, and comfort, will drive the growth of the market in the country. Moreover, the need for stain resistance, customization, and durability will prop up the growth of the market in the country.

U.S. Carpets and Rugs Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Carpets and Rugs Market |

| Market Size in 2023 | USD 34 Billion |

| Market Forecast in 2032 | USD 51 Billion |

| Growth Rate | CAGR of 4.5% |

| Number of Pages | 216 |

| Key Companies Covered | Shaw Industries Group Inc., Mohawk Industries Inc., Couristan Inc., Beaulieu of America, Stanton Carpet Corporation, Masland Carpets & Rugs, Engineered Floors LLC, Dixie Group Inc., Interface Inc., Tarkett Group., and others. |

| Segments Covered | By Product Type, By Material, By End-User, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. Carpets and Rugs Market: Regional Insights

The Midwestern region of the U.S. to dominate the market growth over the forecast timeline

Midwestern region, which accounted for 52% of the U.S. carpets and rugs market share in 2023, is expected to establish a dominating position in the U.S. market in the ensuing years. In addition to this, the regional market surge in the forecast timeline can be a result of humungous demand for rugs and carpets due to their exceptional insulating features. Moreover, cold winters and the need for durable carpets will further drive the regional market trends. Affordability and rise in the disposable income of customers will embellish the expansion of the market in the country.

Southern carpets and rugs industry is predicted to register the highest growth rate annually in the next few years. The growth of the industry in the country can be due to seasonal variations in the region and an increase in housing as well as construction activities. Apart from this, remodeling activities as well as renovation of buildings in the southern state of the country, will drive the market trends in the U.S. Thriving real-estate and rental businesses will further spur the market growth in the region.

Key Developments

- In February 2024, Rugs USA, a key player in focusing on home décor items, launched Custom by Rugs, a custom-sized rug for consumers. Reportedly, the firm is entering a partnership with Shaw Industries Group, Inc., a key provider of flooring & surface services, for providing over 201 styles of rugs for indoor & outdoor commercial & residential sectors.

- In September 2023, Ernesta, a key direct-to-consumer firm manufacturing custom-sized rugs, introduced designer-quality rugs in the U.S.

U.S. Carpets and Rugs Market: Competitive Space

The U.S. carpets and rugs market profiles key players such as:

- Shaw Industries Group Inc.

- Mohawk Industries Inc.

- Couristan Inc.

- Beaulieu of America

- Stanton Carpet Corporation

- Masland Carpets & Rugs

- Engineered Floors LLC

- Dixie Group Inc.

- Interface Inc.

- Tarkett Group.

The U.S. carpets and rugs market is segmented as follows:

By Product Type

- Tufted

- Knotted

- Woven

- Needle-Punched

By Material

- Polypropylene

- Nylon

- Polyester

By End-User

- Residential

- Automotive & Transportation

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

Carpets and rugs are a key subset of interior design and are utilized in home comfort, thereby providing both functional & aesthetic advantages.

The U.S. carpets and rugs market growth over the forecast period can be owing to renovation of & remodeling of households along with DIY trends in the U.S.

According to a study, the U.S. carpets and rugs industry size was $34 billion in 2023 and is projected to reach $51 billion by the end of 2032.

The global U.S. carpets and rugs market is anticipated to record a CAGR of nearly 4.5% from 2024 to 2032.

The Southern carpets and rugs industry is set to register the fastest CAGR over the forecasting timeline owing to seasonal variations in the region and an increase in housing as well as construction activities. Apart from this, remodeling activities as well as renovation of buildings in the southern state of the country, will drive the market trends in the U.S. Thriving real-estate and rental businesses will further spur the market growth in the region.

The U.S. carpets and rugs market is led by players such as Shaw Industries Group Inc., Mohawk Industries Inc., Couristan Inc., Beaulieu of America, Stanton Carpet Corporation, Masland Carpets & Rugs, Engineered Floors LLC, Dixie Group Inc., Interface Inc., and Tarkett Group.

The U.S carpets and rugs market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed