U.S. Cell Separation Market Size, Share, Analysis, Trends, Growth, Forecasts 2032

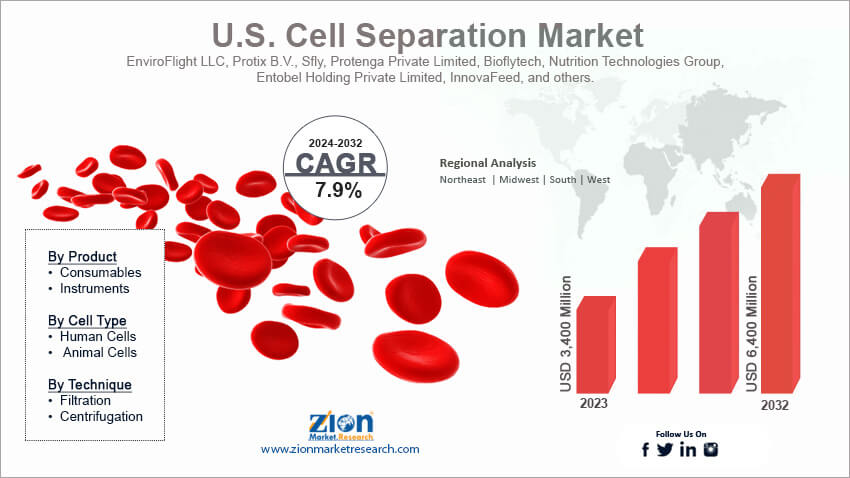

U.S. Cell Separation Market By Product (Consumables and Instruments), By Cell Type (Human Cells and Animal Cells), By Technique (Filtration and Centrifugation), By End-Use (Biotechnology & Biopharmaceutical Firms, Hospitals & Diagnostics Laboratories, Cell Banks, and Research Labs & Institutes), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

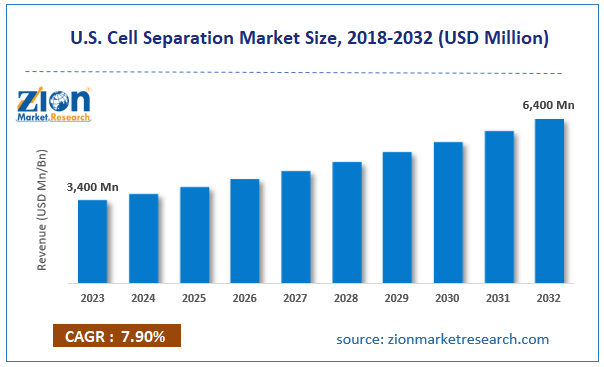

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3,400 Million | USD 6,400 Million | 7.9% | 2023 |

U.S. Cell Separation Industry Prospective:

The U.S. cell separation market size was evaluated at $3,400 million in 2023 and is slated to hit $6,400 million by the end of 2032 with a CAGR of nearly 7.9% between 2024 and 2032.

U.S. Cell Separation Market: Overview

Cell separation, also referred to as cell sorting or cell isolation, is a method of isolating one or more particular cell populations from a heterogeneous blend of cells. It is useful for studying individual cells and offers insights into particular functions of the human body. Reportedly, cell separation can be termed as a key catalyst for precision medicine along with enhancing the ability of these medicines for treating a huge populace with the help of generalized techniques.

Key Insights

- As per the analysis shared by our research analyst, the U.S. cell separation market is projected to expand annually at the annual growth rate of around 7.9% over the forecast timespan (2024-2032)

- In terms of revenue, the U.S. cell separation market size was evaluated at nearly $3,400 million in 2023 and is expected to reach $6,400 million by 2032.

- The U.S. cell separation market is anticipated to grow rapidly over the forecast timeline owing to the surging occurrence of chronic disorders and contagious ailments.

- In terms of product, the consumables segment is slated to register the highest CAGR over the forecast period.

- Based on cell type, the animal cells segment is predicted to dominate the segmental space in the U.S. in the upcoming years.

- On the basis of technique, the centrifugation segment is slated to dominate the segmental expansion in the forecast timeline.

- In terms of end-use, the biotechnology & biopharmaceutical firms segment is slated to maintain industry dominance over the forecast timeline.

Request Free Sample

Request Free Sample

U.S. Cell Separation Market: Growth Factors

Rise in the need for finding new drugs to treat chronic diseases can prop up the market growth in the U.S.

Surging occurrence of chronic disorders and contagious ailments are a few of the factors that are predicted to positively impact the expansion of the U.S. cell separation market. A rise in the number of firms investing in research activities for developing new cell & gene therapies is predicted to propel the demand for cell separation. In addition to this, supportive government guidelines along with demand for biologics have impelled the expansion of the market in the country. According to the American Cancer Society, in 2021, nearly 2 million cancer cases were recorded in the U.S., and about 6 lack deaths occurred due to cancer. Moreover, there is notable growth of the biologics sector in the U.S. For the record, in 2022, about 15 novel biologics received approval from the U.S. FDA.

U.S. Cell Separation Market: Restraints

Expensiveness of using new cell separation techniques can retard the growth of the industry in the U.S.

Surging costs of technologies used in cell separation solutions along with complex techniques used in cell separation can create hurdles in the growth of the U.S. cell separation industry. Moreover, a lack of awareness about the benefits of using cell separation systems along with their lesser adoption by the customers can obstruct the growth of the industry in the country.

U.S. Cell Separation Market: Opportunities

Launching of new cell separation systems to open new facets of growth for the market in the U.S.

Introduction of new technologies such as fluorescence-activated cell sorting, microfluidics, and magnetic-activated cell sorting are predicted to open new growth avenues for the U.S. cell separation market. Escalating demand for cell separation systems in clinical applications is likely to boost the growth of the market in the country.

U.S. Cell Separation Market: Challenges

Stringent legislation regulating clinical applications of cell separation processes can challenge the industry surge in the U.S.

Supply chain disruptions and high costs of developing cell separation solutions can pose a huge challenge to the expansion of the U.S. cell separation industry. Moreover, strict laws implemented by the U.S. FDA regarding the use of cell separation solutions in clinical applications are expected to put brakes on the growth path of the industry in the country.

U.S. Cell Separation Market: Segmentation

The U.S. cell separation market is divided into product, cell type, technique, end-use, and region.

In terms of product, the U.S. cell separation market across the globe is bifurcated into consumables and instruments segments. Additionally, the consumables segment, which gained approximately 72% of the market revenue in 2023, is forecast to register the highest CAGR during the forecast timeline owing to a rise in the repeated purchases of consumables. Moreover, a surge in the funding of research activities by biopharmaceutical & biotech firms for developing sophisticated biologics will steer the segmental surge in the years ahead.

Based on the cell type, the U.S. cell separation industry is divided into human cells and animal cell segments. Additionally, the animal cell segment, which accrued about 47% of the industry share in 2023, is set to dominate the segment in the U.S. in the years ahead and this can be due to the large-scale use of animal cells in drug discovery & development activities for monitoring pharmacokinetics, preliminary toxicity, and efficiency of new drugs.

On the basis of technique, the U.S. cell separation market is sectored into filtration and centrifugation segments. Moreover, the centrifugation segment, which accounted for about 35% of the market share of the country in 2023, is anticipated to lead the segmental surge owing to the large-scale use of density gradient centrifugation and differential centrifugation in cell separation processes.

Based on the end-use, the U.S. cell separation industry is segmented into biotechnology & biopharmaceutical firms, hospitals & diagnostics laboratories, cell banks, and research labs & institutes segments. Furthermore, biotechnology & biopharmaceutical firms, which garnered nearly 40% of the industry share in 2023, are predicted to retain their industry domination owing to an increase in the research activities for developing new-generation therapeutics needing cell separation methods.

U.S. Cell Separation Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Cell Separation Market |

| Market Size in 2023 | USD 3,400 Million |

| Market Forecast in 2032 | USD 6,400 Million |

| Growth Rate | CAGR of 7.9% |

| Number of Pages | 207 |

| Key Companies Covered | EnviroFlight LLC, Protix B.V., Sfly, Protenga Private Limited, Bioflytech, Nutrition Technologies Group, Entobel Holding Private Limited, InnovaFeed, and others. |

| Segments Covered | By Product, By Cell Type, By Technique, By End-Use, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Key Developments

- In the first half of 2023, BD declared the launching of a new kind of cell separation method that integrates two new techniques, thereby allowing researchers to view data concerning cells covered in traditional flow cytometry.

- In July 2024, NanoCellect Biomedical, a key player in microfluidic cell sorting systems, introduced VERLO™ Image-Guided Cell Sorter, a new kind of cell sorter for redefining the flow cytometry analysis as well as cell sorting.

- In June 2024, Sphere Fluidics, a key firm providing microfluidics-based solutions for single-cell isolation as well as single-cell analysis, launched Cyto-Cellect®PLUS for improving cell development workflow.

U.S. Cell Separation Market: Competitive Space

The U.S. cell separation market profiles key players such as:

- EnviroFlight LLC

- Protix B.V.

- Sfly

- Protenga Private Limited

- Bioflytech

- Nutrition Technologies Group

- Entobel Holding Private Limited

- InnovaFeed

The U.S. cell separation market is segmented as follows:

By Product

- Consumables

- Instruments

By Cell Type

- Human Cells

- Animal Cells

By Technique

- Filtration

- Centrifugation

By End-Use

- Biotechnology & Biopharmaceutical Firms

- Hospitals & Diagnostics Laboratories

- Cell Banks

- Research Labs & Institutes

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

Cell separation, also referred to as cell sorting or cell isolation, is a method of isolating one or more particular cell populations from a heterogeneous blend of cells. It is useful for studying individual cells and offers insights into particular functions of the human body..

The U.S. cell separation market growth over the forecast period can be owing to a rise in the number of firms investing in research activities for developing new cell & gene therapies.

According to a study, the global U.S. cell separation industry earnings were $3,400 million in 2023 and is projected to reach $6,400 million by the end of 2032.

The global U.S. cell separation market is anticipated to record a CAGR of nearly 7.9% from 2024 to 2032.

The U.S. cell separation market is led by players such as Thermo Fisher Scientific, Inc., Danaher Corporation, STEMCELL Technologies Inc., Bio-Rad Laboratories, Inc., Corning Inc., Akadeum Life Sciences, Terumo Corporation, Agilent Technologies, Inc., and Merck KGaA.

The U.S. cell separation market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed