US Ceramic & Porcelain Tiles Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

US Ceramic & Porcelain Tiles Market By Application (Public Infrastructure, Accommodation Facilities, Residential Buildings, Commercial Centers, Hospitals, and Others), By Type (Porcelain and Ceramic), By Usage (Wall Tiles and Floor Tiles), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

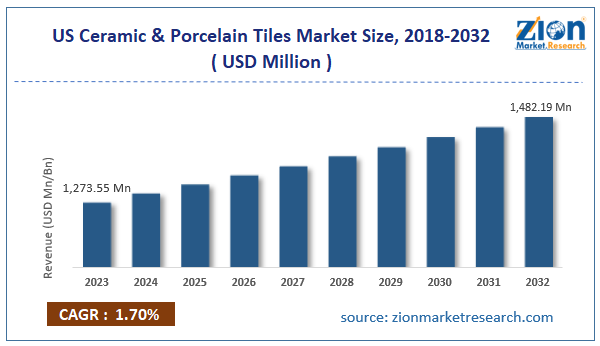

| USD 1,273.55 Million | USD 1,482.19 Million | 1.70% | 2023 |

US Ceramic & Porcelain Tiles Industry Prospective:

The US ceramic & porcelain tiles market size was worth around USD 1,273.55 million in 2023 and is predicted to grow to around USD 1,482.19 million by 2032 with a compound annual growth rate (CAGR) of roughly 1.70% between 2024 and 2032.

US Ceramic & Porcelain Tiles Market: Overview

The US industry for ceramic & porcelain tiles is a growing market driven by the rising use of porcelain or ceramic-based tiles across residential and non-residential facilities. Tiles made of ceramic or porcelain are highly popular among homeowners and commercial property owners across the US. They offer excellent durability, relative affordability, and superior aesthetic appeal. Since ceramic or porcelain are not mined from the Earth, they are more affordable as compared to their counterparts. They are man-made and hence less delicate than naturally occurring materials.

Although both ceramic and porcelain tend to have several similarities, they also have significant differences in terms of cost, maintenance, and porosity. Studies indicate that although the choice of porcelain or ceramic during structure remodeling is a personal choice, in most cases, porcelain is more recommended for bathroom floors whereas ceramic has higher applications in other areas of the facility. The demand for ceramic and porcelain in the US is growing due to a surge in home remodeling activities as well as the construction of new hotels and other accommodating facilities. Competition from international traders will impact the US ceramic & porcelain tiles market growth trend during the projection period.

Key Insights:

- As per the analysis shared by our research analyst, the US ceramic & porcelain tiles market is estimated to grow annually at a CAGR of around 1.70% over the forecast period (2024-2032)

- In terms of revenue, the US ceramic & porcelain tiles market size was valued at around USD 1,273.55 million in 2023 and is projected to reach USD 1,482.19 million by 2032.

- The US ceramic & porcelain tiles market is projected to grow at a significant rate due to the rising investments in home ownership and remodeling

- Based on the application, the residential buildings segment is growing at a high rate and will continue to dominate the regional market as per industry projection

- Based on the usage, the floor tiles segment is anticipated to command the largest market share

- Based on region, Easter states is projected to dominate the regional market during the forecast period

Request Free Sample

Request Free Sample

US Ceramic & Porcelain Tiles Market: Growth Drivers

Rising investments in home ownership and remodeling will impact the market demand rate

The US ceramic & porcelain tiles market is expected to grow due to the rising investments in homeownership across the country. In the last 5 years, the US has witnessed increased sales of standalone houses and apartments driven by several factors. The regional real estate industry has been highly influenced by the growing rate of investors seeking new investment opportunities in the housing sector. According to the National Association of REALTORS, between April 2022 and March 2023, international buyers bought around 84,600 existing homes in the country. In addition to this, home remodeling events have also surged in the US. Market research suggests the most popular form of US remodeling in the US was related to interior room remodeling.

Expansion into emerging and other developed nations may generate significant growth avenues for the industry players

US ceramic and porcelain tile companies are actively investing in entering new markets to tap into a broader consumer group. This is evident in the surge in international investments undertaken by regional players. The US market players are offering highly customized solutions depending on regional and cultural preferences. They are actively seeking more expansion opportunities in emerging nations such as India, African countries, and other regions.

Emerging economies are witnessing a surge in disposable income along with a higher urbanization rate. Changing consumer lifestyles and preferences is a common aspect of all developing nations. The US ceramic & porcelain tiles market companies can leverage the increasing demand for affordable yet durable solutions for residential and commercial centers.

US Ceramic & Porcelain Tiles Market: Restraints

Tough competition from international players will limit the industry’s growth rate

The US ceramic & porcelain tiles industry is expected to be restricted due to the growing international competition. The US industry is filled with several domestic and foreign players leading to extreme market segmentation and price wars. For instance, in 2024, reports emerged that ceramic tile manufacturers in the US were seeking import tariffs on tile suppliers from India. The petition was filed by the Coalition for Fair Trade in Ceramic Tile, a body representing nearly 90% of tile production in the US. The tariff rates are in the range of 408% to 828% and are expected to tackle the problems of ceramic tiles dumping from India.

US Ceramic & Porcelain Tiles Market: Opportunities

Product innovation and launch of superior tiles will generate more growth opportunities

The US ceramic & porcelain tiles market is expected to generate more growth opportunities during the projection period led by a higher rate of product innovation. US-based producers of porcelain or ceramic tiles are increasingly delivering more durable, aesthetically pleasing, and affordable solutions. In April 2024, the Georgia region in the US hosted the Georgia World Congress Center. Exhibitors from more than 40 countries participated in the event and showcased over 1000 ceramic tile and natural stone designs. The integration of smart technologies in porcelain or ceramic tiles has been a game-changer in the growing industry. These tiles are equipped with sensor technologies offering features such as temperature measurement and proactive response to responsible energy consumption. In addition, tile manufacturing technologies are undergoing several developments leading to the production of more versatile options. Increased launch of pieces for commercial centers holds high potential as per market research.

US Ceramic & Porcelain Tiles Market: Challenges

Availability of alternate solutions, fluctuating raw material prices, and other factors to challenge market expansion rate

The US industry for ceramic & porcelain tiles is projected to be challenged by the availability and increased demand for alternate solutions. Some popular substitutes include vinyl flooring and natural stone. For instance, tiles made of natural stone are more durable than porcelain tiles. In addition to this, the varying prices of raw materials required for ceramic and porcelain tiles will further complicate the manufacturing process. Disruptions in the supply chain, economic uncertainty, changing international trade relationships, and other factors will determine the industry’s growth trajectory over the forecast period.

US Ceramic & Porcelain Tiles Market: Segmentation

The US ceramic & porcelain tiles market is segmented based on application, type, usage, and region.

Based on the application, the regional market segments are public infrastructure, accommodation facilities, residential buildings, commercial centers, hospitals, and others. In 2023, the highest growth was witnessed in the residential buildings segment. The ongoing remodeling of several residential places to meet energy-based regulations in the US is driving the demand for porcelain and ceramic tiles. Accommodation facilities such as luxury hotels, hostels, motels, and other such facilities are also significant contributors to the segmental revenue. For instance, New York City has over 700 hotels as per official data.

Based on type, the regional market is divided into porcelain and ceramic.

Based on the usage, the US ceramic & porcelain tiles industry is divided into wall tiles and floor tiles. In 2023, the highest revenue generator was the floor tiles segment driven by greater use of the materials for flooring options. The tiles have found high demand in commercial and residential spaces driven by higher cost-efficiency and durability of the materials. Additionally, the surging input of interior decorators and designers to choose ceramic or porcelain tiles is further impacting the segmental demand. Under proper conditions, porcelain tiles can survive more than 6 decades.

US Ceramic & Porcelain Tiles Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US Ceramic & Porcelain Tiles Market |

| Market Size in 2023 | USD 1,273.55 Million |

| Market Forecast in 2032 | USD 1,482.19 Million |

| Growth Rate | CAGR of 1.70% |

| Number of Pages | 235 |

| Key Companies Covered | American Olean, Mohawk Industries, Bedrosians Tile & Stone, Dal-Tile (a division of Mohawk Industries), Eleganza Tiles, Florida Tile, Happy Floors, Lamosa USA, Marazzi USA, Arto Brick & California Pavers, Interceramic USA, Emser Tile, Tile Shop Holdings, MSI (M S International Inc.), Crossville Inc., and others. |

| Segments Covered | By Application, By Type, By Usage, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US Ceramic & Porcelain Tiles Market: Regional Analysis

Easter states to lead with a small margin during the projection period

The US ceramic & porcelain tiles market will be led by Eastern states during the projection period. Regions such as Florida, New York, Massachusetts, and others will drive the demand for porcelain and ceramic tiles in the coming years. The growth will be driven by a surge in the number of homeowners. For instance, Boston, a city in Massachusetts, is increasingly becoming a hub for students and working professionals, leading to increased demand for housing facilities. New York, on the other hand, is one of the most densely populated regions in the US due to the presence of the significant financial district and other commercial centers in the region.

As quoted by Architectural Digest, homeowners in the US spent around USD 8,484 on home improvement projects in 2022. Furthermore, the rising construction and development of new residential buildings conforming to environment-related regulations has resulted in higher demand for ceramic and porcelain tiles in the US. Moreover, growing tourism is driving the demand for affordable and luxury accommodation centers, furthering the use of porcelain and ceramic-based tiles. The ongoing investments toward the expansion of tile manufacturing facilities will be beneficial for tile distributors and consumers. For instance, Landmark Ceramics UST announced plans to invest USD 71.9 million to construct a new tile manufacturing plant in Tennessee.

US Ceramic & Porcelain Tiles Market: Competitive Analysis

The US ceramic & porcelain tiles market is led by players like:

- American Olean

- Mohawk Industries

- Bedrosians Tile & Stone

- Dal-Tile (a division of Mohawk Industries)

- Eleganza Tiles

- Florida Tile

- Happy Floors

- Lamosa USA

- Marazzi USA

- Arto Brick & California Pavers

- Interceramic USA

- Emser Tile

- Tile Shop Holdings

- MSI (M S International Inc.)

- Crossville Inc.

The US ceramic & porcelain tiles market is segmented as follows:

By Application

- Public Infrastructure

- Accommodation Facilities

- Residential Buildings

- Commercial Centers

- Hospitals

- Others

By Type

- Porcelain

- Ceramic

By Usage

- Wall Tiles

- Floor Tiles

By Region

- The U.S.

Table Of Content

Methodology

FrequentlyAsked Questions

The US industry for ceramic & porcelain tiles is a growing market driven by the rising use of porcelain or ceramic-based tiles across residential and non-residential facilities.

The US ceramic & porcelain tiles market is expected to grow due to the rising investments in homeownership across the country.

According to study, the US ceramic & porcelain tiles market size was worth around USD 1,273.55 million in 2023 and is predicted to grow to around USD 1,482.19 million by 2032.

The CAGR value of the US ceramic & porcelain tiles market is expected to be around 1.70% during 2024-2032.

The US ceramic & porcelain tiles market will be led by Eastern states during the projection period.

The US ceramic & porcelain tiles market is led by players like American Olean, Mohawk Industries, Bedrosians Tile & Stone, Dal-Tile (a division of Mohawk Industries), Eleganza Tiles, Florida Tile, Happy Floors, Lamosa USA, Marazzi USA, Arto Brick & California Pavers, Interceramic USA, Emser Tile, Tile Shop Holdings, MSI (M S International, Inc.) and Crossville Inc.

The report explores crucial aspects of the US ceramic & porcelain tiles market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

Choose License Type

List of Contents

US Ceramic Porcelain TilesIndustry Prospective:US Ceramic Porcelain Tiles OverviewKey Insights:US Ceramic Porcelain Tiles Growth DriversUS Ceramic Porcelain Tiles RestraintsUS Ceramic Porcelain Tiles OpportunitiesUS Ceramic Porcelain Tiles ChallengesUS Ceramic Porcelain Tiles SegmentationUS Ceramic Porcelain Tiles Report ScopeUS Ceramic Porcelain Tiles Regional AnalysisUS Ceramic Porcelain Tiles Competitive AnalysisThe US ceramic porcelain tiles market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed