U.S. Commercial Banking Market Size, Share, Analysis, Industry Growth, Forecasts 2032

U.S. Commercial Banking Market By Product (Commercial Lending, Syndicated Loans, and Treasury Management), By Function (Accepting Deposits, Credit Creation, and Advancing Loans), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

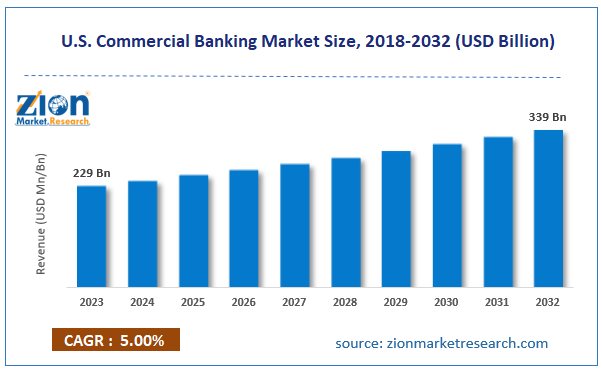

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 229 Billion | USD 339 Billion | 5% | 2023 |

U.S Commercial Banking Industry Prospective:

The US commercial banking market size was evaluated at $229 billion in 2023 and is slated to hit $339 billion by the end of 2032 with a CAGR of nearly 5% between 2024 and 2032.

U.S Commercial Banking Market: Overview

Commercial banking is a key part of the banking system offering a slew of financial services to the government and various kinds of businesses & institutions. The core services provided to individuals in commercial banking activities include business loans & credits, cash flow management, deposit services, trade finance, and investment banking.

Key Insights

- As per the analysis shared by our research analyst, the U.S commercial banking market is projected to expand annually at the annual growth rate of around 5% over the forecast timespan (2024-2032)

- In terms of revenue, the U.S. commercial banking market size was evaluated at nearly $229 billion in 2023 and is expected to reach $339 billion by 2032.

- The U.S. commercial banking market is anticipated to grow rapidly over the forecast timeline owing to an increase in digital banking tools along with the introduction of new products & services by fintech firms.

- In terms of product, the commercial lending segment is slated to register the fastest CAGR over the forecast period.

- Based on function, the accepting deposits segment is predicted to dominate the segmental space in the U.S. in the upcoming years.

Request Free Sample

Request Free Sample

U.S. Commercial Banking Market: Growth Factors

Technological breakthroughs in banking activities to boost the growth of the market in the U.S.

Rapid economic development and technological innovations are likely to prop up the expansion of the U.S. commercial banking market. An increase in digital banking tools along with the introduction of new products & services by fintech firms is likely to boost the growth of the market in the country. Escalating demand for financing small & medium-sized firms and the need for financial services for individuals will pave the way for the expansion of the market in the U.S. Moreover, a rise in global trade along with cross-border investments is likely to catapult the growth of the market in the country. Apart from this, acceptance of advanced risk management tools and fraud detection software in commercial banking services along with a surge in interest rates in the emerging economies will chart a profitable landscape for the U.S. market.

U.S. Commercial Banking Market: Restraints

Surging issues related to data security are projected to halt the growth of industry in the U.S.

Rising cyber-security threats and issues with data privacy as well as complicated state laws can obstruct the expansion of the U.S. commercial banking industry. Economic volatility and instability in business can hinder the growth of the industry in the U.S.

U.S. Commercial Banking Market: Opportunities

Introduction of AI tools in enhancing commercial banking activities to open new growth avenues for the market in the U.S.

Launching of improved digital banking tools along with a surge in the use of AI tools in improving services of commercial banking activities will crop up the expansion of the U.S. commercial banking market. Innovations in digital banking systems and a rise in cashless payments as well as payments through digital wallets will propel the expansion of the market in the country.

U.S. Commercial Banking Market: Challenges

Altering consumer preferences to challenge the growth of the industry in the U.S.

Risks of litigations and geopolitical instabilities can prove to be a hindrance in the growth path of the U.S. commercial banking industry. Altering customer tastes and adopting alternate banking services can put brakes on the industry growth in the U.S. Apart from this, operational challenges can hamper the growth of the business in the country.

U.S. Commercial Banking Market: Segmentation

The U.S. commercial banking market is divided into product, function, and region.

In terms of product, the U.S. commercial banking market across the globe is divided into commercial lending, syndicated loans, and treasury management segments. Furthermore, the commercial lending segment, which accumulated approximately two-fifths of the market proceeds in 2023, is forecast to register the fastest cumulative annual growth rate during the analysis time frame owing to the constant demand for commercial lending activities from various business verticals for aiding their business operations along with expanding their businesses. Moreover, commercial lending includes providing term loans, financing of instruments, and credit loans to giant business firms.

Based on the function, the U.S. commercial banking industry is segregated into accepting deposits, credit creation, and advancing loan segments. Additionally, the accepting deposits segment, which accrued about 47% of the industry size in 2023, is set to lead the segmental sphere in the U.S. in the upcoming years owing to the need for huge funds for commercial banks. Furthermore, the need for maintaining liquidity and financing banking functions will steer the segmental surge.

U.S. Commercial Banking Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Commercial Banking Market |

| Market Size in 2023 | USD 229 Billion |

| Market Forecast in 2032 | USD 339 Billion |

| Growth Rate | CAGR of 5% |

| Number of Pages | 212 |

| Key Companies Covered | Citigroup Inc., Bank of America Corp, JP Morgan Chase and Co., Morgan Stanley, Wells Fargo and Co., US Bancorp, Goldman Sachs Group Inc., PNC., and others. |

| Segments Covered | By Product, By Function, and By Region |

| Regions Covered in U. S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Key Developments

- In February 2024, MasterCard declared the launching of a new online opening account for U.S debit cards & prepaid products to offer a seamless experience to the end-users based in the U.S.

- In the first half of 2024, JPMorgan Chase, a key commercial banking firm, introduced a new credit card analyzing tool driven by AI. Such moves will prop up the growth of commercial banking activities in the U.S.

- In the first quarter of 2024, Citigroup, a key player in the commercial banking sector, announced of focusing on creating sustainable financing services and such moves will improve the scope of growth of commercial banking services in the U.S.

U.S Commercial Banking Market: Competitive Space

The U.S. commercial banking market profiles key players such as:

- Citigroup Inc.

- Bank of America Corp

- JP Morgan Chase and Co.

- Morgan Stanley

- Wells Fargo and Co.

- US Bancorp

- Goldman Sachs Group Inc.

- PNC.

The U.S. commercial banking market is segmented as follows:

By Product

- Commercial Lending

- Syndicated Loans

- Treasury Management

By Function

- Accepting Deposits

- Credit Creation

- Advancing Loans

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

Commercial banking is a key part of the banking system offering a slew of financial services to the government and various kinds of businesses & institutions.

The U.S. commercial banking market growth over the forecast period can be owing to escalating demand for financing small & medium-sized firms and the need for financial services for individuals.

According to a study, the global U.S. commercial banking industry earnings were $229 billion in 2023 and is projected to reach $339 billion by the end of 2032.

The global U.S. commercial banking market is anticipated to record a CAGR of nearly 5% from 2024 to 2032.

The U.S. commercial banking market is led by players such as Citigroup Inc., Bank of America Corp, JP Morgan Chase and Co., Morgan Stanley, Wells Fargo and Co., US Bancorp, Goldman Sachs Group Inc., and PNC.

The U.S. commercial banking market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed