U.S. Data Center Colocation Market Size, Share, Trends, Growth 2032

U.S. Data Center Colocation Market By Colocation (Wholesale and Retail), By End-Use (Large Enterprises and SMEs), By Application (BFSI, Retail, Government & Defense, Manufacturing, Energy, Healthcare, and IT & Telecom), and By Region: Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

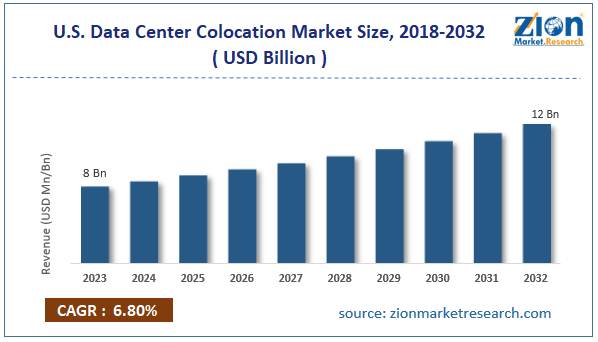

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8 Billion | USD 12 Billion | 6.8% | 2023 |

U.S. Data Center Colocation Industry Prospective:

The U.S. data center colocation market size was evaluated at $8 billion in 2023 and is slated to hit $12 billion by the end of 2032 with a CAGR of nearly 6.8% between 2024 and 2032.

U.S. Data Center Colocation Market: Overview

Data center colocation is a service where businesses rent spaces in a data center for deploying their hardware and servers. Furthermore, it helps firms in avoiding capital as well as operating costs related to constructing and maintaining data centers along with benefitting from strong data center infrastructure along with offering services to colocation provider.

Key Insights

- As per the analysis shared by our research analyst, the U.S. data center colocation market is projected to expand annually at the annual growth rate of around 6.8% over the forecast timespan (2024-2032)

- In terms of revenue, the U.S. data center colocation market size was evaluated at nearly $8 billion in 2023 and is expected to reach $12 billion by 2032.

- The global U.S. data center colocation market is anticipated to grow rapidly over the forecast timeline owing to a surge in the benefits provided by colocation, such as cost-efficacy, reliability, security & risk management, and scalability.

- In terms of colocation, the retail segment is slated to register the highest CAGR over the forecast period.

- Based on end-use, the large enterprises segment is predicted to dominate the segmental growth in the upcoming years.

- Based on application, the residential segment is predicted to contribute majorly towards the U.S. industry revenue in the upcoming years.

- Region-wise, the Northeast data center colocation industry in the U.S. is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

U.S. Data Center Colocation Market: Growth Factors

A rise in data storage needs will promote the market trends in the country in the upcoming years

A surge in the benefits provided by the colocation, such as cost-efficacy, reliability, security & risk management, and scalability, will prop up the growth of the U.S. data center colocation market. An increasing data storage requirement across various end-use sectors has led to an increment in data generation, thereby leading to huge demand for storing data. This, in turn, will proliferate the size of the market in the U.S. A humungous use of hybrid cloud and cloud models as well as an increase in edge computing activities will increase the size of the U.S. market space. Apart from this, the huge need for high-performing connections and regulatory compliance will embellish the expansion of the market in the country. Need for disaster recovery, cost-efficiency, and capital expenditure management activities will prompt the expansion of the market in the U.S.

U.S. Data Center Colocation Market: Restraints

A surge in cyber-terrorism can obstruct the expansion of the industry in the country

An increase in cyber-attacks and cutthroat competition from cloud solutions can impede the growth of the U.S. data center colocation industry. Furthermore, compliance issues and data sovereignty needs can create a huge impact on the expansion of the industry in the country. Latency issues and security constraints can also hamper the expansion of the industry in the U.S.

U.S. Data Center Colocation Market: Opportunities

An immense utilization of connected things will open new growth opportunities for the market in the U.S.

Humungous use of IoT along with a surge in the acceptance of cloud and highlight on sustainability will open new growth avenues for the U.S. data center colocation market. Furthermore, the need for outsourcing IT operations along with technological breakthroughs will proliferate the size of the market growth in the country.

U.S. Data Center Colocation Market: Challenges

Regulatory changes will halt the growth of the industry in the U.S. over forecast timeline

Geopolitical risks and natural calamities can challenge the expansion of the U.S. data center colocation industry. Swift regulatory changes can further impede the expansion of the industry in the country. Escalating energy prices and capacity inhibitions can obstruct the growth of the industry in the U.S.

U.S. Data Center Colocation Market: Segmentation

The U.S. data center colocation market is divided into colocation, end-use, application, and region.

In terms of colocation, the U.S. data center colocation market is bifurcated into wholesale and retail segments. Additionally, the retail segment, which gained approximately 59% of the market revenue in 2023, is forecast to register the fastest rate of growth yearly during the time interval from 2024 to 2032. The main factor fostering the segmental surge can be attributed to the escalating need for scalable data centers in the retail segment.

On the basis of end-use, the U.S. data center colocation industry is sectored into large enterprises and SMEs segments. The large enterprises segment, which accrued about 68% of the industry share in 2023, is set to lead the segmental expansion in the U.S. in the upcoming years. This expansion can be due to the immense deployment of data centers by large enterprises.

Based on the application, the U.S. data center colocation market is divided into BFSI, retail, government & defense, manufacturing, energy, healthcare, and IT & telecom segments. Moreover, the BFSI segment, which led the application space in 2023, is likely to contribute noticeably towards the market share in the country with growing demand for strong and secured data infrastructure facilities in the BFSI segment in the country. Additionally, strict laws related to data security in the BFSI segment and compliance issues will steer segmental surge.

U.S. Data Center Colocation Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Data Center Colocation Market |

| Market Size in 2023 | USD 8 Billion |

| Market Forecast in 2032 | USD 12 Billion |

| Growth Rate | CAGR of 6.8% |

| Number of Pages | 219 |

| Key Companies Covered | Compass Datacenters, CyrusOne, AUBix, DataBank, Edge Centres, DartPoints, Digital Realty, EdgeConneX, iMCritical, DC BLOX, Equinix, Yondr, Cyxtera Technologies, NTT Global Data Centers, PowerHouse Data Centers, Aligned, American Tower, CloudHQ, Quantum Loophole, Cologix, COPT Data Center Solutions, Corscale Data Centers, CoreSite, Prime Data Centers., and others. |

| Segments Covered | By Colocation, By End-Use, By Application, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. Data Center Colocation Market: Regional Insights

Southern region of the U.S. is expected to dominate the market surge over 2024-2032

The southern region, which garnered 51% of the U.S. data center colocation market share in 2023, is set to uphold its position in the U.S. market in the upcoming years. In addition to this, the regional market expansion in the forecast timeline can be credited to supportive climatic conditions and low energy costs. Moreover, infrastructural growth will further add to the market expansion in the country.

The Northeast data center colocation industry in the U.S. is predicted to record the highest rate of expansion annually within the next couple of years. The growth of the U.S data center colocation industry can be due to stable climatic conditions, growing demand for renewable energy, and presence of strong infrastructure in the region. A rise in connectivity and network issues will prop up the growth of the industry in the region.

Key Developments

- In March 2024, Eaton Corporation launched SmartRack modular data center in the U.S. for reducing time & installation charges. Apart from this, the new unit will fulfill the consumer needs for AI and edge computing.

- In the first quarter of 2024, Nautilus introduced new modular data unit, thereby adding to its new product line referred to as EcoCore.

U.S. Data Center Colocation Market: Competitive Space

The U.S. data center colocation market profiles key players such as:

- Compass Datacenters

- CyrusOne

- AUBix

- DataBank

- Edge Centres

- DartPoints

- Digital Realty

- EdgeConneX

- iMCritical

- DC BLOX

- Equinix

- Yondr

- Cyxtera Technologies

- NTT Global Data Centers

- PowerHouse Data Centers

- Aligned

- American Tower

- CloudHQ

- Quantum Loophole

- Cologix

- COPT Data Center Solutions

- Corscale Data Centers

- CoreSite

- Prime Data Centers.

The U.S. data center colocation market is segmented as follows:

By Colocation

- Wholesale

- Retail

By End-Use

- Large Enterprises

- SMEs

By Application

- BFSI

- Retail

- Government & Defense

- Manufacturing

- Energy

- Healthcare

- IT & Telecom

By Region

U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

Data center colocation is a service where businesses rent spaces in a data center for deploying their hardware & servers.

The U.S. data center colocation market growth over the forecast period can be owing to a humungous use of hybrid cloud and cloud models as well as an increase in edge computing activities.

According to a study, the global U.S. data center colocation industry size was $8 billion in 2023 and is projected to reach $12 billion by the end of 2032.

The global U.S. data center colocation market is anticipated to record a CAGR of nearly 6.8% from 2024 to 2032.

Northeast data center colocation industry of the U.S. is set to register the fastest CAGR over the forecasting timeline owing to stable climatic conditions, growing demand for renewable energy, and presence of strong infrastructure in the region. A rise in connectivity and network issues will prop up the growth of the industry in the region. .

The U.S. data center colocation market is led by players such as Compass Datacenters, CyrusOne, AUBix, DataBank, Edge Centres, DartPoints, Digital Realty, EdgeConneX, iMCritical, DC BLOX, Equinix, Yondr, Cyxtera Technologies, NTT Global Data Centers, PowerHouse Data Centers, Aligned, American Tower, CloudHQ, Quantum Loophole, Cologix, COPT Data Center Solutions, Corscale Data Centers, CoreSite, and Prime Data Centers.

The U.S. data center colocation market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed