US Diabetes Devices Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

US Diabetes Devices Market By End-Use (Diagnostic Centers, Hospitals, and Homecare), By Type (Receiver, BGM Devices, Lancets, Blood Glucose Meters, Insulin Delivery Devices, Pens, Pumps, Testing Strips, Syringes, and Others), By Distribution Channel (Online Pharmacies, Diabetes Clinics, Retail Pharmacies, Hospital Pharmacies, and Others), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

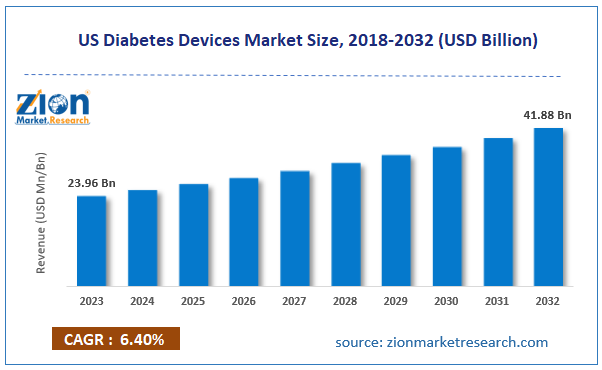

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 23.96 Billion | USD 41.88 Billion | 6.40% | 2023 |

US Diabetes Devices Industry Prospective:

The US diabetes devices market size was worth around USD 23.96 billion in 2023 and is predicted to grow to around USD 41.88 billion by 2032 with a compound annual growth rate (CAGR) of roughly 6.40% between 2024 and 2032.

US Diabetes Devices Market: Overview

The US diabetes devices industry deals with the development, production, distribution, and use of diabetes-printed medical devices. This equipment helps in detecting or managing the condition that affects nearly 12% of the US population. In addition to this, US diabetes device manufacturers operate in several international markets. US-based diabetes device makers indulge in production and distribution activities in other countries. The regional industry is filled with several types of diabetes devices such as glucose meters, insulin pumps, ketone monitors, insulin pens, and others. Each device offers certain advantages and limitations. For instance, insulin pumps help in delivering consistent subcutaneous insulin infusion. They are computerized devices that are highly effective in diabetes management. The demand for medical equipment for diabetes is growing at a rapid rate in the US. The surge in the number of regional diabetic patients is a key driver for the US market. However, the high cost of medical treatment in the country may limit the industry's expansion rate. During the forecast period, more growth opportunities can be expected as market players continue to invest in research & development (R&D) and international expansion.

Key Insights:

- As per the analysis shared by our research analyst, the US diabetes device market is estimated to grow annually at a CAGR of around 6.40% over the forecast period (2024-2032)

- In terms of revenue, the US diabetes device market size was valued at around USD 23.96 billion in 2023 and is projected to reach USD 41.88 billion, by 2032.

- The US diabetes device market is projected to grow at a significant rate due to the growing number of diabetic patients in the US

- Based on the end-use, the hospitals segment is growing at a high rate and will continue to dominate the regional market as per industry projection

- Based on the distribution channel, the hospital pharmacies segment is anticipated to command the largest market share

- Based on region, Eastern regions are projected to dominate the regional market during the forecast period

Request Free Sample

Request Free Sample

US Diabetes Devices Market: Growth Drivers

Growing number of diabetic patients in the US will drive the market demand rate

The US diabetes devices market is expected to witness steady growth in the US due to the rising number of patients. As per the American Diabetes Association, more than 38.4 million Americans were affected by diabetes in 2021. More than 1.2 million similar cases are reported every year in the country. The condition has been associated with several causes that lead to the prevalence of type 1 and type 2 diabetes. For instance, type 1 diabetes is caused due to an autoimmune reaction of the body. It destroys pancreatic cells that are responsible for producing insulin. The symptoms may take years to develop. On the other hand, type 2 diabetes is associated with several risk factors. The most common reasons include resistance to insulin, obesity, a family history of type 2 diabetes, a sedentary lifestyle, and polycystic ovary syndrome among others. As per official estimates, more than 29 million American citizens are expected to become diabetic by 2050 due to several environmental, genetic, and lifestyle-based factors.

Surging diabetes prevention and management awareness programs in the country will fuel demand for medical devices

The US healthcare agencies and government have been working toward generating awareness about diabetes prevention and management. In July 2024, the Mary Tyler Moore Vision Initiative announced the launch of its first-ever campaign for public service. The program features well-known US personalities such as Reese Witherspoon, Oprah Winfrey, Julia Louis-Dreyfus, and Kevin Kline. In 2016, the Centers for Disease Control and Prevention (CDC) launched a campaign called Do I Have Prediabetes in association with the American Medical Association, Ad Council, and the American Diabetes Association. The ongoing campaign has been influential in generating awareness among the local population about diabetes. In November 2023, pharmaceutical company Abbott announced the rolling out of the National Diabetes Awareness Month initiative. It aims to promote the use of continuous glucose monitors (CGM). Such initiatives are likely to promote growth in the US diabetes devices market.

US Diabetes Devices Market: Restraints

High cost of diabetes treatment and devices may limit the industry’s growth rate

The US industry for diabetes devices is expected to be restricted by the higher cost of medical equipment and diabetes treatment. As per reports published by the National Institutes of Health (NIH), annual medical expenditure incurred by a diabetic patient in the US is around USD 19,736. Around USD 12,022 is solely used for managing diabetes. In addition to this, the cost of advanced diabetes devices is significantly high. An insulin pump can cost over USD 6500 in the US with a life expectancy of 3 to 4 years.

US Diabetes Devices Market: Opportunities

Increasing investments in R&D for novel diabetic devices may generate massive growth opportunities

The US diabetes device market players are expected to generate growth opportunities during the projection period. The surge in research & innovation for the development of novel diabetic devices will prove beneficial for the industry players. Businesses operating in the sector are working on developing high-performance, accurate, and minimally invasive devices focusing on patients' comfort. In April 2024, US-based startup Biolinq announced that it had received a total investment of USD 58 million. The company is developing a user-friendly glucose-monitoring device. The tool uses microneedles for measuring blood sugar in type-2 diabetic patients. It does not require an additional device to show results. In May 2024, Eli Lilly and Company announced an investment of USD 9 billion to upgrade its production facility at a new Indiana-based site. The company will use the investment to enhance the production rate of active pharmaceutical ingredients (APIs) used in Mounjaro and Zepbound injections. They are used by adults living with type 2 diabetes and obesity.

US Diabetes Devices Market: Challenges

Rising cases of counterfeit medical devices in the US market will challenge the market expansion rate

The US regional industry for diabetes devices will be challenged by the growing cases of counterfeit products being sold in the commercial market. In June 2024, Roche, a leading biotechnology company in the world, claimed that highly dangerous counterfeit goods were being sold on Amazon sites in the US. In the same month, Elli Lilly published an open letter highlighting the dangers of compounded and fake versions of diabetes and weight loss medications. These products can prove extremely harmful to the users leading to rapid health deterioration and in some cases ultimately causing death.

US Diabetes Devices Market: Segmentation

The US diabetes devices market is segmented based on end-use, type, distribution channel, and region.

Based on the end-use, the regional market segments are diagnostic centers, hospitals, and home care. In 2023, the highest growth was observed in the hospitals segment. The higher segmental demand is due to advancements in diabetes management technology and increased demand for quality patient care. In addition to this, the growing focus on early diagnosis and overall treatment is further promoting the segmental growth rate. Diabetes in the US is higher in people above the age of 45 years.

Based on type, the regional US diabetes device industry is divided into receivers, BGM devices, lancets, blood glucose meters, insulin delivery devices, pens, pumps, testing strips, syringes, and others.

Based on the distribution channel, the US diabetes devices industry divisions are online pharmacies, diabetic clinics, retail pharmacies, hospital pharmacies, and others. In 2023, the highest revenue generator was the hospital pharmacies sector since these facilities are more trustworthy. The retail pharmacies segment in the US holds strong dominance due to the growing number of such stores. The US witnessed an increase of 3.701% in the pharmacy and drug stores number in 2023 as compared to 2022.

US Diabetes Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US Diabetes Devices Market |

| Market Size in 2023 | USD 23.96 Billion |

| Market Forecast in 2032 | USD 41.88 Billion |

| Growth Rate | CAGR of 6.40% |

| Number of Pages | 230 |

| Key Companies Covered | Sanofi, Johnson & Johnson, LifeScan, Dexcom, Novo Nordisk, Medtronic, GlucoMe, Roche Diabetes Care, Abbott Laboratories, Senseonics, Tandem Diabetes Care, Insulet Corporation, Ascensia Diabetes Care, Becton Dickinson, Eli Lilly and Company., and others. |

| Segments Covered | By End-Use, By Type, By Distribution Channel, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US Diabetes Devices Market: Regional Analysis

Eastern regions of the US register the highest growth rate during the projection period

The US diabetes devices market is expected to be led by Eastern states in the country. As per recent studies published by NIH, age-standardized diabetes cases were highest in certain parts of the country. These regions included areas such as Virginia, Mississippi, South Carolina, Texas, Louisiana, Georgia, and Alabama. The US is one of the world’s leading nations in terms of healthcare infrastructure. Over 92% of the regional population has access to health insurance. The US government is working on improving the statistics even further. Additionally, the general population is more aware of the reasons that can cause diabetes. In June 2024, the US witnessed the launch of the country’s first over-the-counter (OTC) glucose sensors. Dexcom and Abbott announced that they had received the necessary approval from the US Food & Drugs Administration (FDA) authority that allowed the sale of OCT CGMs. In June 2024, another leading company Novo Nordisk announced that it plans to invest around USD 4.1 billion for the construction of a second fill & finishing manufacturing unit in North Carolina.

US Diabetes Devices Market: Competitive Analysis

The US diabetes devices market is led by players like:

- Sanofi

- Johnson & Johnson

- LifeScan

- Dexcom

- Novo Nordisk

- Medtronic

- GlucoMe

- Roche Diabetes Care

- Abbott Laboratories

- Senseonics

- Tandem Diabetes Care

- Insulet Corporation

- Ascensia Diabetes Care

- Becton Dickinson

- Eli Lilly and Company.

The US diabetes devices market is segmented as follows:

By End-Use

- Diagnostic Centers

- Hospitals

- Homecare

By Type

- Receiver

- BGM Devices

- Lancets

- Blood Glucose Meters

- Insulin Delivery Devices

- Pens

- Pumps

- Testing Strips

- Syringes

- Others

By Distribution Channel

- Online Pharmacies

- Diabetes Clinics

- Retail Pharmacies

- Hospital Pharmacies

- Others

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

The US diabetes devices industry deals with the development, production, distribution, and use of diabetes-printed medical devices.

The US diabetes devices market is expected to witness steady growth in the US due to the rising number of patients.

According to study, the US diabetes devices market size was worth around USD 23.96 billion in 2023 and is predicted to grow to around USD 41.88 billion by 2032.

The CAGR value of the US diabetes devices market is expected to be around 6.40% during 2024-2032.

The US diabetes devices market is expected to be led by Eastern states in the country.

The US diabetes devices market is led by players like Sanofi, Johnson & Johnson, LifeScan, Dexcom, Novo Nordisk, Medtronic, GlucoMe, Roche Diabetes Care, Abbott Laboratories, Senseonics, Tandem Diabetes Care, Insulet Corporation, Ascensia Diabetes Care, Becton Dickinson, and Eli Lilly and Company.

The report explores crucial aspects of the US diabetes devices market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed