U.S. Electric Vehicle Supply Equipment Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

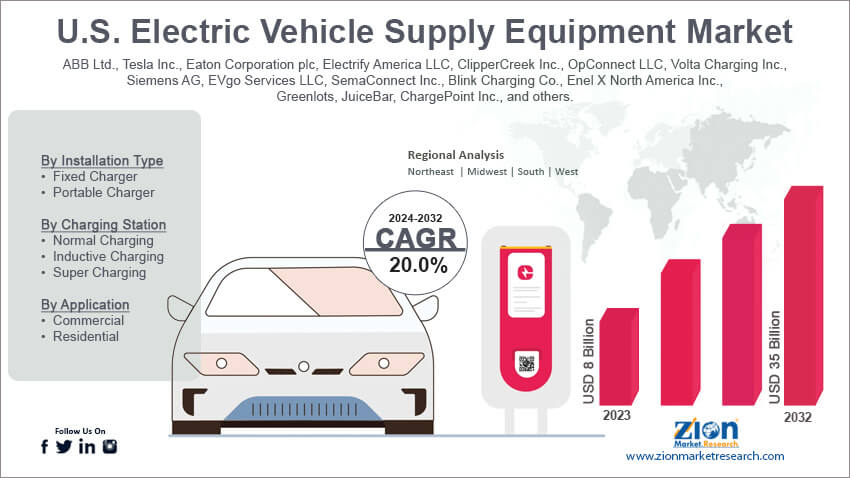

U.S. Electric Vehicle Supply Equipment Market By Installation Type (Fixed Charger and Portable Charger), By Charging Station (Normal Charging, Inductive Charging, and Super Charging), By Application (Commercial and Residential), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

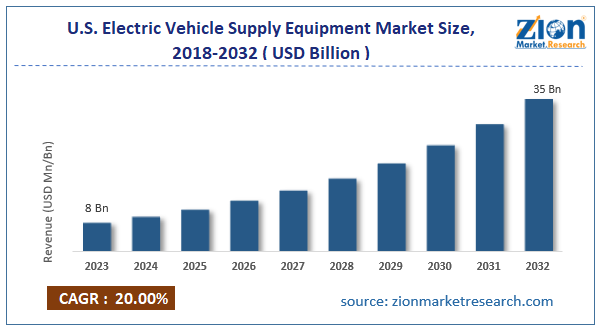

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8 Billion | USD 35 Billion | 20% | 2023 |

U.S. Electric Vehicle Supply Equipment Industry Prospective:

The U.S. electric vehicle supply equipment market size was evaluated at $8 billion in 2023 and is slated to hit $35 billion by the end of 2032 with a CAGR of nearly 20% between 2024 and 2032.

U.S. Electric Vehicle Supply Equipment Market: Overview

Electric vehicle supply equipment is a kind of hardware used to charge electric vehicles. It provides power & communication between electric vehicles and the electric grid. The product is divided into main types including charging stations, charging cables, and connector types.

Key Insights

- As per the analysis shared by our research analyst, the U.S electric vehicle supply equipment market is projected to expand annually at the annual growth rate of around 20% over the forecast timespan (2024-2032)

- In terms of revenue, the U.S. electric vehicle supply equipment market size was evaluated at nearly $8 billion in 2023 and is expected to reach $35 billion by 2032.

- The U.S. electric vehicle supply equipment market is anticipated to grow rapidly over the forecast timeline owing to a rise in the acceptance of electric cars along with supportive government policies.

- In terms of installation type, the fixed charger segment is slated to register the fastest CAGR over the forecast period.

- Based on charging station, the normal charging segment is predicted to dominate the segmental space in the U.S. in the upcoming years.

- Based on application, the commercial segment is expected to lead the segmental growth in the U.S. in the ensuing years.

Request Free Sample

Request Free Sample

U.S. Electric Vehicle Supply Equipment Market: Growth Factors

An increase in EV demand due to their eco-friendly nature boosts the market growth in the U.S.

A rise in the acceptance of electric cars along with supportive government policies is likely to embellish the expansion of the U.S. electric vehicle supply equipment market. A surge in the allocation of funds by government and private players in setting up fast-charging electric stations along highways is likely to pave the way for humungous growth for the market in the country. Growing awareness about the benefits of using electric vehicles along with awareness about a clean environment will proliferate the size of the market in the U.S. Huge customer demand for home charging along with easy access to electric vehicles is likely to prop up the scope of growth of the market in the U.S. A surge in the launching of new products will further prompt the expansion of the market in the country.

U.S. Electric Vehicle Supply Equipment Market: Restraints

Massive installation costs of product can impede the growth of industry in the country

Low availability of charging destinations, rising population, and huge costs of deploying the equipment can hinder the growth of the U.S. electric vehicle supply equipment industry. Swift technological innovations can also lead to obsolesce of the existing products, thereby halting the growth of the industry.

U.S. Electric Vehicle Supply Equipment Market: Opportunities

Large-scale use of home charging to generate new horizons of growth for the market in the U.S.

Easy availability of home charging in residential complexes and integration of smart home tools with energy management systems can open new facets of growth for the U.S. electric vehicle supply equipment market. Need for proficient and scalable fleet charging services is likely to create new vistas of growth for the market in the country.

U.S. Electric Vehicle Supply Equipment Market: Challenges

Huge maintenance costs can restrict the expansion of the industry in the country over 2024-2032

Lack of standard protocols related to the production and sale of the product in the country can challenge the expansion of the U.S. electric vehicle supply equipment industry. High maintenance charges and growing upfront prices can deter the growth of the industry in the country.

U.S. Electric Vehicle Supply Equipment Market: Segmentation

The U.S. electric vehicle supply equipment market is divided into installation type, charging station, application, and region.

In terms of installation type, the U.S. electric vehicle supply equipment market is divided into fixed charger and portable charger segments. Furthermore, the fixed charger segment, which accumulated approximately 40% of the market proceeds in 2023, is forecast to record the fastest cumulative annual growth rate during the analysis period. This can be attributed to the rise in the focus of various state authorities in the U.S. on installing fixed charging stations as they prove to be cost-effective along with reducing downtime of electric vehicles.

Based on the charging station, the U.S. electric vehicle supply equipment industry is segregated into normal charging, inductive charging, and super charging segments. Additionally, the normal charging segment, which accrued about two-thirds of the industry size in 2023, is set to lead the segmental sphere in the U.S. in the ensuing years. This can be a result of an increase in government investments towards setting up new public charging infrastructure facilities with the rise in the demand for electric vehicles.

On the basis of application, the U.S. electric vehicle supply equipment market is sectored into commercial and residential segments Moreover, the commercial segment, which dominated the segmental growth in 2023, is projected to continue its domination of the segment in the near future owing to a prominent increase in setting up of electric vehicle charging stations at airports, parking spaces, commercial complexes, and shopping malls in the U.S.

U.S. Electric Vehicle Supply Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Electric Vehicle Supply Equipment Market |

| Market Size in 2023 | USD 8 Billion |

| Market Forecast in 2032 | USD 35 Billion |

| Growth Rate | CAGR of 20% |

| Number of Pages | 208 |

| Key Companies Covered | ABB Ltd., Tesla Inc., Eaton Corporation plc, Electrify America LLC, ClipperCreek Inc., OpConnect LLC, Volta Charging Inc., Siemens AG, EVgo Services LLC, SemaConnect Inc., Blink Charging Co., Enel X North America Inc., Greenlots, JuiceBar, ChargePoint Inc., and others. |

| Segments Covered | By Installation Type, By Charging Station, By Application, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Key Developments

- In June 2024, SAE International® joined hands with Pearson VUE to provide electric vehicle supply equipment technician certification.

- In the first half of 2024, LG Electronics established its first setup for manufacturing advanced EV chargers in the U.S. For the record, the new unit will have an annual production capacity of manufacturing more than 10,000 EV chargers.

U.S Electric Vehicle Supply Equipment Market: Competitive Space

The U.S electric vehicle supply equipment market profiles key players such as:

- ABB Ltd.

- Tesla Inc.

- Eaton Corporation plc

- Electrify America LLC

- ClipperCreek Inc.

- OpConnect LLC

- Volta Charging Inc.

- Siemens AG

- EVgo Services LLC

- SemaConnect Inc.

- Blink Charging Co.

- Enel X North America Inc.

- Greenlots

- JuiceBar

- ChargePoint Inc.

The U.S. electric vehicle supply equipment market is segmented as follows:

By Installation Type

- Fixed Charger

- Portable Charger

By Charging Station

- Normal Charging

- Inductive Charging

- Super Charging

By Application

- Commercial

- Residential

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

Electric vehicle supply equipment is a kind of hardware that is utilized to charge electric vehicles.

The U.S. electric vehicle supply equipment market growth over the forecast period can be owing to a surge in the allocation of funds by government and private players in setting up fast-charging electric stations along highways.

According to a study, the global U.S. electric vehicle supply equipment industry earnings were $8 billion in 2023 and is projected to reach $35 billion by the end of 2032.

The global U.S. electric vehicle supply equipment market is anticipated to record a CAGR of nearly 20% from 2024 to 2032.

The U.S. electric vehicle supply equipment market is led by players such as ABB Ltd., Tesla Inc., Eaton Corporation plc, Electrify America LLC, ClipperCreek Inc., OpConnect LLC, Volta Charging Inc., Siemens AG, EVgo Services LLC, SemaConnect Inc., Blink Charging Co., Enel X North America Inc., Greenlots, JuiceBar, and ChargePoint Inc.

The U.S. electric vehicle supply equipment market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

Choose License Type

List of Contents

U.S. Electric Vehicle Supply EquipmentIndustry Prospective:OverviewKey InsightsGrowth FactorsRestraintsOpportunitiesChallengesSegmentationReport ScopeKey DevelopmentsU.S Electric Vehicle Supply Equipment Competitive SpaceThe U.S. electric vehicle supply equipment market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed