US Energy Drinks Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

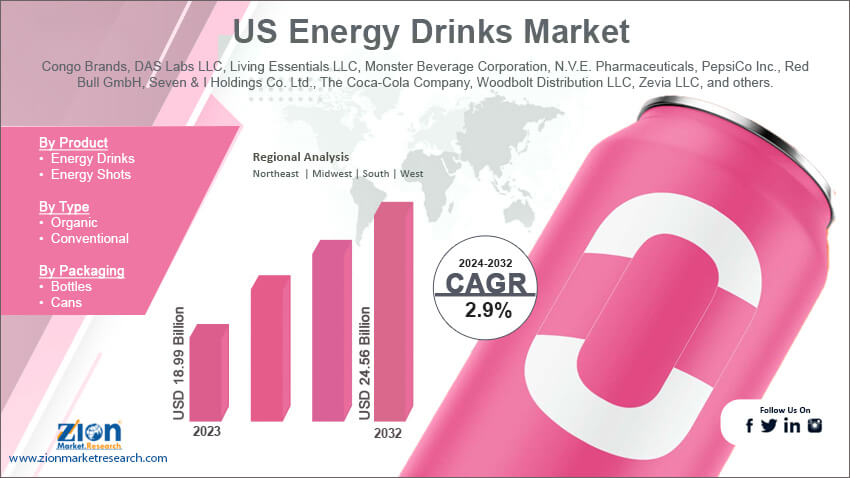

US Energy Drinks Market By Product (Energy Drinks and Energy Shots), By Type (Organic and Conventional), By Packaging (Bottles, Cans, and Others), By Trade (On-Trade and Off-Trade), and By Country-State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

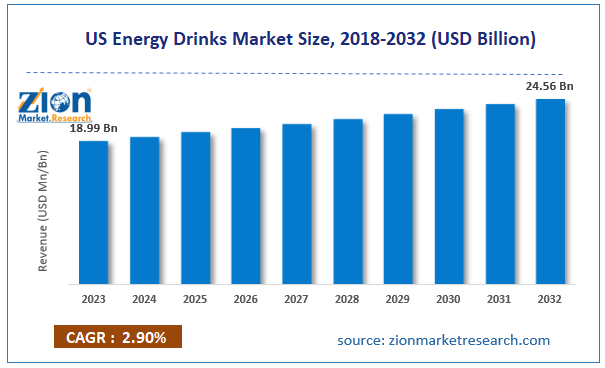

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 18.99 Billion | USD 24.56 Billion | 2.9% | 2023 |

US Energy Drinks Industry Perspective:

The US energy drinks market size was worth around USD 18.99 billion in 2023 and is predicted to grow to around USD 24.56 billion by 2032 with a compound annual growth rate (CAGR) of roughly 2.9% between 2024 and 2032.

US Energy Drinks Market: Overview

Energy drinks mostly have high proportions of stimulants such as taurine, ginseng, guarana, and caffeine. Enhancing cognitive and motor abilities is how it accomplishes this. Energy drinks differ in their level of carbonation. They are not the same as sports drinks, which are designed to replace electrolytes and water lost during or following exercise. As they are brewed, may have less caffeine, and have fewer chemicals, they are also different from tea and coffee. Product manufacturers of energy drinks claim that their drinks increase vigor. The US energy drink industry is growing due to the popularity of these beverages, which provide both instant energy and cerebral & physical stimulation.

Key Insights

- As per the analysis shared by our research analyst, the US energy drinks market is estimated to grow annually at a CAGR of around 2.9% over the forecast period (2024-2032).

- In terms of revenue, the US energy drinks market size was valued at around USD 18.99 billion in 2023 and is projected to reach USD 24.56 billion, by 2032.

- The rising product launch is expected to propel the US energy drinks market growth over the projected period.

- Based on the product, the energy drinks segment is expected to dominate the market over the forecast period.

- Based on the type, the organic segment is expected to grow at a rapid rate over the projected period.

- Based on the state, California is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

US Energy Drinks Market: Growth Drivers

Growing demand for health and fitness products drives market growth

Because diabetes and many other chronic diseases are so common, consumers are becoming increasingly conscious of the value of nutritious beverages and an active lifestyle. As a result of growing health concerns, customers are selecting low-sugar, low-calorie, or sugar-free eating habits in beverages. Customers much prefer natural sweeteners in their beverages, such as stevia. Coca-Cola and PepsiCo Inc. are a couple of companies that have committed to reducing sugar and eliminating artificial additives from their products. Moreover, during the projected period, rising energy drink consumption is anticipated to propel the US energy drinks market growth rate. These days, many choose energy drinks above other beverages because they satisfy their need for rapid hydration.

US Energy Drinks Market: Restraints

Concerns over health and product safety impede market growth

High levels of sugar and caffeine, which are the main ingredients in energy drinks, have been directly related to several health problems, including obesity, cardiac difficulties, and elevated blood pressure, particularly in young adults and adolescents. In addition, overindulgence in coffee can result in numerous other issues including anxiety. Additionally, costly recalls that harm a brand's reputation and finances might be brought on by incidents like product contamination or mislabeling. Thus, strict quality control methods are required, but they also significantly raise operating costs and add unnecessary complexity. One of the primary problems for businesses is still balancing cost and safety. Thus, this is expected to hamper the US energy drinks industry over the analysis period.

US Energy Drinks Market: Opportunities

Rising partnerships offer an attractive opportunity for market growth

The increasing partnership among the market players is expected to offer a lucrative opportunity for the US energy drinks industry expansion over the projected period. For instance, in April 2024, as part of a multi-year relationship, WWE, a division of TKO Group Holdings, and Nutrabolt, the company that owns C4 Energy, announced that C4 Ultimate Energy, one of the fastest-growing energy drink brands in the US, will become the first-ever Official Energy Drink Partner of WWE. As WWE's first-ever Official Energy Drink Partner, C4 will gain visibility and prominent branding across a variety of WWE properties and high-end live events, such as WrestleMania XL on Saturday, April 6 and Sunday, April 7, where it will sponsor the WrestleMania Skycam for the first time, providing the WWE Universe with an unparalleled viewing experience. The countrywide introduction of WWE and C4 Energy's first-ever co-branded C4 Ultimate Energy Drink varieties with WWE inspiration came before the extended relationship. Currently available nationwide in two delectable flavors—Ruthless Raspberry and Berry Powerbomb—the collaboration will grow this month with the introduction of a brand-new flavor, Nectarine Guava Knockout, which is only available at Circle K. This flavor packs a powerful punch of sweet nectarine and tropical guava colliding to create a knockout flavor that rules supreme. Fans can work hard and play hard without ever missing a beat thanks to C4 Ultimate Energy, which is free of sugar and artificial coloring.

US Energy Drinks Market: Challenges

A high level of competition poses a major challenge to market expansion

Several well-known brands and recent entries are fighting for market share in the fiercely competitive US energy drink market. Price wars and narrowed profit margins may result from this fierce rivalry. Brands find it harder and harder to set their items apart from the competition as the market gets more saturated. Customers may become weary of certain flavors, making it difficult to maintain growth through the introduction of new products. Thus, the high level of competition in the US energy drinks market poses a major challenge for the expansion.

US Energy Drinks Market: Segmentation

The US energy drinks industry is segmented based on product, type, packaging, trade, and state.

Based on the product, the US energy drinks market is bifurcated into energy drinks and energy shots. The energy drinks segment is expected to dominate the market over the forecast period. Energy drinks contain stimulants like taurine, B vitamins, caffeine, and other substances that instantly boost alertness and energy levels. These drinks are different from energy, mostly because of their special mixes and the advantages they provide (such as preventing weariness and improving performance). Besides, the energy shots segment is expected to grow at a rapid rate during the projected period. The US market for energy shots is expanding due to several factors, including a growing need for portability and convenience. For customers who want to increase their energy levels while they're on the road, energy shots provide a quick and simple option. They are a great option for customers with hectic schedules because they are usually smaller and come in portable packaging.

Based on the type, the US energy drinks industry is segmented into organic and conventional. The organic segment is expected to grow at a rapid rate over the projected period. The organic industry is driven by consumers’ demand for more natural and healthful beverage options. The absence of chemicals, artificial additives, or pesticides is increasingly desired by customers. The popularity of organic energy drinks is being driven by concerns about the potential negative effects of consuming regular energy drinks, which have high sugar and artificial ingredient content, as well as growing health and wellness consciousness. One such product is Clean Energy Shot, which Wholesome Organics Co., a health food firm, released in December 2023. The intended market for this product is those looking for an organic energy boost with additional health benefits.

Based on the packaging, the US energy drinks market is segmented into bottles, cans, and others.

Based on the trade, the US energy drinks industry is segmented into on-trade and off-trade.

US Energy Drinks Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US Energy Drinks Market |

| Market Size in 2023 | USD 18.99 Billion |

| Market Forecast in 2032 | USD 24.56 Billion |

| Growth Rate | CAGR of 2.9% |

| Number of Pages | 224 |

| Key Companies Covered | Congo Brands, DAS Labs LLC, Living Essentials LLC, Monster Beverage Corporation, N.V.E. Pharmaceuticals, PepsiCo Inc., Red Bull GmbH, Seven & I Holdings Co. Ltd., The Coca-Cola Company, Woodbolt Distribution LLC, Zevia LLC, and others. |

| Segments Covered | By Product, By Type, By Packaging, By Trade, and By Region |

| States Covered in US | California, Florida, New York, Washington, Texas, New Jersey, Georgia, Oregon, Arizona, and Colorado |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US Energy Drinks Market: State Analysis

California is expected to dominate the market over the forecast period

California is expected to dominate the US energy drinks market over the forecast period. The market growth in the region is owing to the presence of major companies including several startups. The players in the state continuously launch innovative products with different flavors and tastes. For instance, in June 2024, Starbucks introduced freshly made iced energy drinks. Starbucks locations across the United States will sell the newly created Iced Energy Beverages, nondairy creamer, cold foam, and Caramel Vanilla Swirl Iced Coffee, in addition to the new Egg, Pesto & Mozzarella Sandwich, and Blueberry Streusel Muffin, all of which are available year-round. Furthermore, the increasing awareness regarding the benefits of organic energy drinks drives the market expansion in the California state.

US Energy Drinks Market: Competitive Analysis

The US energy drinks market is dominated by players like:Congo Brands

- DAS Labs LLC

- Living Essentials LLC

- Monster Beverage Corporation

- N.V.E. Pharmaceuticals

- PepsiCo Inc.

- Red Bull GmbH

- Seven & I Holdings Co. Ltd.

- The Coca-Cola Company

- Woodbolt Distribution LLC

- Zevia LLC

The US energy drinks market is segmented as follows:

By Product

- Energy Drinks

- Energy Shots

By Type

- Organic

- Conventional

By Packaging

- Bottles

- Cans

- Others

By Trade

- On-Trade

- Off-Trade

By State

- California

- Florida

- New York

- Washington

- Texas

- New Jersey

- Georgia

- Oregon

- Arizona

- Colorado

- Others

Table Of Content

Methodology

FrequentlyAsked Questions

Mostly found in high proportions in energy drinks are stimulants such as taurine, ginseng, guarana, and caffeine. Enhancing cognitive and motor abilities is how it accomplishes this. Energy drinks differ in their level of carbonation. They are not the same as sports drinks, which are designed to replace electrolytes and water lost during or following exercise. As they are brewed, may have less caffeine, and have fewer chemicals, they are also different from tea and coffee.

One of the main factors propelling the US energy drinks market's expansion is the growing public awareness of health issues and the increased engagement in sports and other fitness-related activities. In addition, several product innovations—like the creation of sports drinks with unique flavors—are contributing to this rise.

According to the report, the US energy drinks market size was worth around USD 18.99 billion in 2023 and is predicted to grow to around USD 24.56 billion by 2032.

The US energy drinks market is expected to grow at a CAGR of 2.9% during the forecast period.

The US energy drinks market growth is driven by California. It is currently the nation's highest revenue-generating market due to the increasing awareness.

The US energy drinks market is dominated by players like Congo Brands, DAS Labs LLC, Living Essentials, LLC, Monster Beverage Corporation, N.V.E. Pharmaceuticals, PepsiCo, Inc., Red Bull GmbH, Seven & I Holdings Co., Ltd., The Coca-Cola Company, Woodbolt Distribution, LLC and Zevia LLC among others.

The US energy drinks market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed