US Generator Market Size Report, Share, Analysis, Growth, 2032

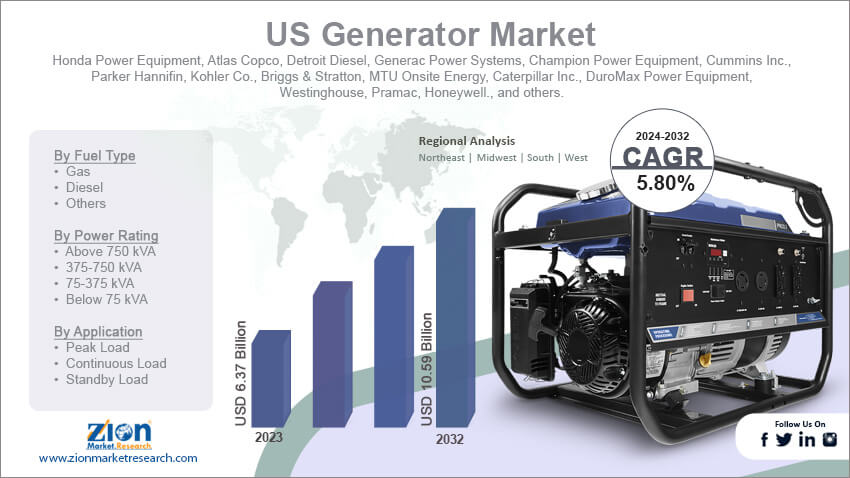

US Generator Market By Fuel Type (Gas, Diesel, and Others), By Power Rating (Above 750 kVA, 375-750 kVA, 75-375 kVA, Below 75 kVA), By End-User (Construction, Mining, Residential, Manufacturing, Oil & Gas, Commercial, Pharmaceuticals, Information Technology, Telecom, and Others), By Application (Peak Load, Continuous Load, and Standby Load), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

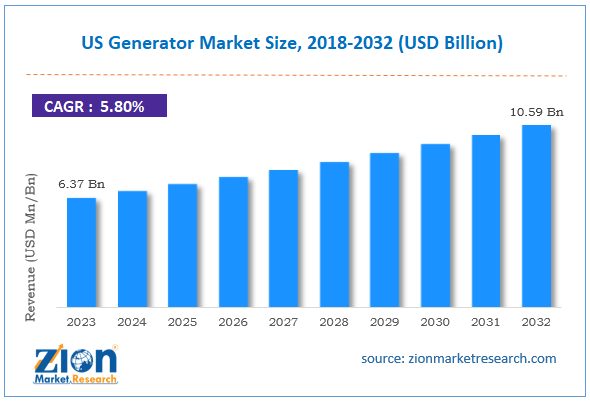

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.37 Billion | USD 10.59 Billion | 5.80% | 2023 |

US Generator Industry Prospective:

The US generator market size was worth around USD 6.37 billion in 2023 and is predicted to grow to around USD 10.59 billion by 2032 with a compound annual growth rate (CAGR) of roughly 5.80% between 2024 and 2032.

US Generator Market: Overview

The US generator industry is a growing market dealing with the development, sale, and application of electricity-generating mechanical devices. A generator, also known as an electricity generator, converts either fuel-based or motion-based potential and kinetic energy into electric power. The energy thus generated is used in an external circuit for further applications. Some of the common sources of mechanical energy used by generators include gas turbines, steam turbines, wind turbines, internal combustion engines, water turbines, and hand cranks. Modern and highly advanced generators may source energy using hydrogen-based fuel or solar power. These generators are more environmentally friendly as compared to fuel-powered versions. In mechanical terms, a typical generator is made using two parts. One is the stationary part and the other is the rotating part. Together they form a magnetic circuit. The rotating part is called a rotor. It is an electrical machine. The stationary part is called the stator. The US generator industry has been growing rapidly in the last decade. Some of the crucial contributors to the regional market demand are the healthcare and IT industries. During the projection period, the demand for environmentally friendly solutions is likely to register a higher growth rate.

Key Insights:

- As per the analysis shared by our research analyst, the US generator market is estimated to grow annually at a CAGR of around 5.80% over the forecast period (2024-2032)

- In terms of revenue, the US generator market size was valued at around USD 6.37 billion in 2023 and is projected to reach USD 10.59 billion, by 2032.

- The US generator market is projected to grow at a significant rate due to the increasing demand for stable energy in the healthcare sector

- Based on the fuel type, the diesel segment is growing at a high rate and will continue to dominate the regional market as per industry projection

- Based on the end-user, the oil & gas segment is anticipated to command the largest market share

- Based on region, Eastern and midwestern states are projected to dominate the regional market during the forecast period

Request Free Sample

Request Free Sample

US Generator Market: Growth Drivers

Increasing demand for stable energy in the healthcare sector will fuel the market demand rate

The increasing demand for continuous and stable energy in the regional healthcare industry will fuel the US generator market. The healthcare infrastructure in the US is world-renowned. The country spent nearly USD 1.1 trillion on healthcare in 2021, as per official records. In addition to this, over 90% of the regional population has access to healthcare plans. These programs allow American citizens to seek medical attention for some of the most serious medical conditions. As per the US Department of Health and Human Services, the Affordable Care Act (ACA) Health Insurance Marketplace plan has helped over 20 million people in the country. The 2024 Marketplace Open Enrollment Period was launched in November 2023. In addition to this, the number of hospitals in the US is rapidly expanding. In June 2024, Indiana University (IU) Health announced plans to expand its healthcare facilities. The specialty services provider is working on the construction of a new health campus spread across 44 acres with an investment of USD 4.29 billion. Upon completion, the site will become the largest healthcare project in the country. In July 2024, UCSF Benioff Children’s Hospitals received approval for constructing a massive hospital building in the Oakland region. The state-of-the-art medical facility for children-specific medical needs will be built with an investment of USD 1.49 billion.

Waste-water treatment plants in the US will promote the use of electricity generators in the region

The demand for generators in the US region is expected to flourish due to growing applications in waste-water treatment plants. These equipment are required to supply essential energy during power shortages. Waste-water treatment plants must perform perpetual functions thus facility managers must ensure zero disruption of electricity supply. The US has more than 16000 waste-water management facilities fueling demand in the US generator market.

US Generator Market: Restraints

High cost of generators may limit the industry’s adoption rate

The regional US industry for generators is projected to witness growth limitations due to the high cost of the generators. For instance, gas-powered generators may cost between USD 500 to USD 3,200. The expense of gas-powered generators escalates due to surging prices of fuel in the US and other parts of the world. Additionally, natural gas generators are priced between USD 2,200 and USD 25,000. The cost of installing generators further adds to the overall expense. In certain regions, officials may require potential generator users to obtain relevant permits.

US Generator Market: Opportunities

Increasing the launch of new and advanced generators may create expansion possibilities

The US generator market is expected to generate growth opportunities due to the increasing launch of sophisticated generators. Increasing advancements in the field of energy efficiency, reduced fuel requirement, development of renewable energy-powered generators, and innovation in the structural design of the devices may assist regional market players generate better revenue. In April 2024, Cummins Power Generation announced the launch of two generator models following the line of its existing and widely popular CentumTM Series. The company has launched C3000D6EB and C2750D6E. The respective power output is 3000kW and 2750kW respectively. The products are specifically designed to be used in waste-water treatment units, healthcare facilities, and data centers. Additionally, the development of portable chargers with high energy output capacity may further propel the industry demand rate. Solar power generators are becoming widely popular in the US region as the country focuses on reducing carbon emissions.

US Generator Market: Challenges

Pollution caused by fuel generators may challenge the market expansion rate

Generators that run on fuel such as diesel and natural gas lead to environmental pollution. Studies indicate that one-time use of fuel-powered generators releases the same amount of carbon monoxide (CO) as multiple internal combustion-engine cars. The regional US generator industry players can face tough competition in the international market due to the growing popularity of power generators from other countries. For instance, generators made in Japan and Europe are registering more users across the US and neighboring countries.

US Generator Market: Segmentation

The US generator market is segmented based on fuel type, power rating, end-user, application, and region.

Based on the fuel type, the regional market segments are gas, diesel, and others. In 2023, the highest demand was observed in diesel generators since they often deliver higher power. In 2022, diesel fuel consumption in the US was around 125 million gallons per day as per the US Energy Information Administration. Gas-powered generators are also widely popular in the region. Natural gas is the most affordable non-renewable energy source thus driving the demand for gas-powered electricity producers. Solar generators may register higher revenue during the projection period.

Based on power rating, the US generator industry is fragmented into above 750 kVA, 375-750 kVA, and below 75 kVA.

Based on the end-user, the regional market divisions are construction, mining, residential, manufacturing, oil & gas, commercial, pharmaceuticals, information technology, telecom, and others. In 2023, the oil & gas sector was a leading revenue generator. The US oil & gas sector was valued at more than USD 334 billion in 2023. It is one of the world’s most valuable industries. The information technology sector is a rapidly growing market. The growth in the number of data centers and IT companies will fuel the segmental demand.

Based on application, the US generator industry segments are peak load, continuous load, and standby load.

US Generator Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US Generator Market |

| Market Size in 2023 | USD 6.37 Billion |

| Market Forecast in 2032 | USD 10.59 Billion |

| Growth Rate | CAGR of 5.80% |

| Number of Pages | 229 |

| Key Companies Covered | Honda Power Equipment, Atlas Copco, Detroit Diesel, Generac Power Systems, Champion Power Equipment, Cummins Inc., Parker Hannifin, Kohler Co., Briggs & Stratton, MTU Onsite Energy, Caterpillar Inc., DuroMax Power Equipment, Westinghouse, Pramac, Honeywell., and others. |

| Segments Covered | By Fuel Type, By Power Rating, By End-User, By Application, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US Generator Market: Regional Analysis

Eastern and midwestern states register the highest revenue during the forecast period

The US generator market is expected to grow in the eastern and midwestern states of the country. These regions including states such as Indiana, Illinois, Minnesota, Wisconsin, New Jersey, Ohio, and North Carolina are home to some of the leading developers of advanced generators. In August 2022, Caterpillar Inc. added three new generators to its existing list of standby diesel generators in the North American region including the US market. The novel additions included generators with 60 Hz power nodes ranging from 20 to 30 kW aiming at industries such as small industrial facilities, telecommunication units, and commercial applications. The regional market is expected to be driven by the growing end-user applications. For instance, the oil & gas sector with increased investments is expected to create more demand for high-power output generators. The US is expected to increase its manufacturing capabilities. The US is currently the largest producer of advanced electronic and computer items. In addition to this, the surge in investments related to data centers will create expansion possibilities for the regional generator manufacturers.

US Generator Market: Competitive Analysis

The US generator market is led by players like:

- Honda Power Equipment

- Atlas Copco

- Detroit Diesel

- Generac Power Systems

- Champion Power Equipment

- Cummins Inc.

- Parker Hannifin

- Kohler Co.

- Briggs & Stratton

- MTU Onsite Energy

- Caterpillar Inc.

- DuroMax Power Equipment

- Westinghouse

- Pramac

- Honeywell.

The US generator market is segmented as follows:

By Fuel Type

- Gas

- Diesel

- Others

By Power Rating

- Above 750 kVA

- 375-750 kVA

- 75-375 kVA

- Below 75 kVA

By End-User

- Construction

- Mining

- Residential

- Manufacturing

- Oil & Gas

- Commercial

- Pharmaceuticals

- Information Technology

- Telecom

- Others

By Application

- Peak Load

- Continuous Load

- Standby Load

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

The US generator industry is a growing market dealing with the development, sale, and application of electricity-generating mechanical devices.

The increasing demand for continuous and stable energy in the regional healthcare industry will fuel the US generator market.

According to study, the US generator market size was worth around USD 6.37 billion in 2023 and is predicted to grow to around USD 10.59 billion by 2032.

The CAGR value of the US generator market is expected to be around 5.80% during 2024-2032.

The US generator market is expected to grow in the eastern and midwestern states of the country.

The US generator market is led by players like Honda Power Equipment, Atlas Copco, Detroit Diesel, Generac Power Systems, Champion Power Equipment, Cummins Inc., Parker Hannifin, Kohler Co., Briggs & Stratton, MTU Onsite Energy, Caterpillar Inc., DuroMax Power Equipment, Westinghouse, Pramac, and Honeywell.

The report explores crucial aspects of the US generator market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed