US Home Mortgage Market Size, Share, Industry Analysis, Growth, 2032

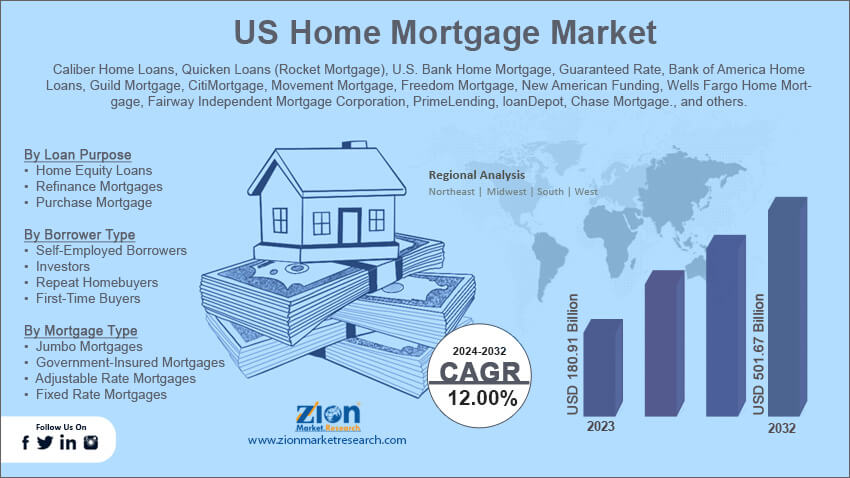

US Home Mortgage Market By Loan Purpose (Home Equity Loans, Refinance Mortgages, and Purchase Mortgages), By Borrower Type (Self-Employed Borrowers, Investors, Repeat Homebuyers, and First-Time Buyers), By Mortgage Type (Jumbo Mortgages, Government-Insured Mortgages, Adjustable Rate Mortgages, and Fixed Rate Mortgages), By Property Type (Investment Properties, Multi-Family Homes, Condominiums, and Single-Family Homes), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

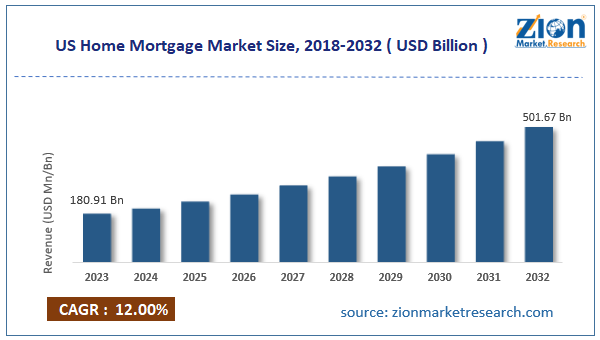

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 180.91 Billion | USD 501.67 Billion | 12.00% | 2023 |

US Home Mortgage Industry Prospective:

The US home mortgage market size was worth around USD 180.91 billion in 2023 and is predicted to grow to around USD 501.67 billion by 2032 with a compound annual growth rate (CAGR) of roughly 12.00% between 2024 and 2032.

US Home Mortgage Market: Overview

The US home mortgage industry is a crucial part of the overall US economy. It is one of the largest contributors to the regional gross domestic product (GDP). According to official reports, housing services contributed around 12% of the national GDP. A home mortgage is a type of home loan, which is facilitated by a mortgage company, bank, or any other financial institution. The loan obtained through a home mortgage is used for buying a residence that could either be a primary or a secondary home. Moreover, home mortgages can also be used for investment residences. The collateral in the case of a home mortgage is the home itself. During the signing of the agreement, the property is first transferred in the name of the lender. The main condition in this contract is that the house will be transferred to the borrower upon complete payment of the mortgage. In the US, home mortgages are one of the leading forms of debt. Home mortgages in the US are popular due to the low interest rates as compared to other loan forms. US citizens can either opt for floating or fixed interest rates which are locked when applying for the mortgage.

Key Insights:

- As per the analysis shared by our research analyst, the US home mortgage market is estimated to grow annually at a CAGR of around 12.00% over the forecast period (2024-2032)

- In terms of revenue, the US home mortgage market size was valued at around USD 180.91 billion in 2023 and is projected to reach USD 501.67 billion, by 2032.

- The US home mortgage market is projected to grow at a significant rate due to the increasing investments in the vacation home sector in the US

- Based on the loan purpose, the purchase mortgage segment is growing at a high rate and will continue to dominate the regional market as per industry projection

- Based on the mortgage type, the fixed-rate mortgages segment is anticipated to command the largest market share

- Based on region, Eastern states are projected to dominate the regional market during the forecast period

Request Free Sample

Request Free Sample

US Home Mortgage Market: Growth Drivers

Increasing investments in the vacation home sector in the US will drive the market demand rate

The US home mortgage market is expected to grow due to the rising investments in vacation homes or investment properties in the US. As per American regulations, a person who is neither a citizen of the country nor a permanent resident is eligible for a home mortgage to purchase a vacation property. The number of expatriates or immigrants in the US has drastically surged in the last decade. The global population is attracted to the country since it holds tremendous growth potential. The US is the center for promoting technological advancements across fields including energy, healthcare, automotive, and others. These factors are responsible for the increase in foreign investors in the domestic real-estate business. According to the National Association of REALTORS, foreign investments in regional existing homes were around USD 42 billion. Although the percentage is around 21% less as compared to 2023, the number is expected to rise during the projection period. India, Mexico, China, and Canada were the leading countries contributing to higher revenue in terms of the sale of existing homes in the country.

Growing efforts by the US government to promote affordable housing will prove beneficial for the industry

The US government has launched several new schemes to improve the house affordability index in the country. In June 2024, the Community Development Financial Institutions (CDFI) Fund announced the launch of a new program worth USD 100 million. The fund will be used over the coming three years toward financing and supporting housing in middle to low-income households. Such programs are expected to drive the demand in the US home mortgage market.

US Home Mortgage Market: Restraints

Economic uncertainty in the US will restrict the market expansion rate

The US industry for home mortgages is projected to be restricted due to the growing economic uncertainty in the country. According to the Bureau of Labor Statistics, the US encountered nearly 7.8 million job losses in the third quarter of 2023. The employment rate in 2023 was around 60%. Additionally, the US is witnessing an increasing rate of bank failures that are affecting the overall economic growth in the region. For instance, Republic First Bank of Philadelphia was closed by the Pennsylvania Department of Banking and Securities in April 2024. To prevent further harm to the depositors, the agency signed an agreement with Fulton Bank to over 32 branches of Republic First Bank. After the collapse of the Silicon Valley Bank in March 2023, the US lost around USD 20 billion.

US Home Mortgage Market: Opportunities

Digitizing home mortgage procedures will generate massive growth opportunities

The US home mortgage market has evolved substantially over the years. The credit risk undertaken by lenders at present times is between 70% to 100% as the loan-to-value ratio has increased. This makes the lender groups in the regional home mortgage sector more vulnerable to loss as the chances of fraud are drastically increased. The players in the home mortgage industry in the US are seeking more advanced technological solutions that can ease the process of verification and loan application to reduce manual errors. Some of the other vulnerabilities in manual home mortgage applications include poor credit decisions and the risk of compliance-related errors. In April 2024, the U.S. Attorney's Office, District of New Jersey charged two former mortgage loan originators based out of New Jersey with conspiring to commit bank fraud. The culprits had presented falsified documents to obtain low mortgage interest rates. Such incidents have led to an urgent need to digitize the procedures involved in obtaining home mortgages. In July 2024, Oper announced the launch of new Artificial Intelligence (AI) - backed product features for transforming the fulfillment and underwriting processes in digital mortgage procedures.

US Home Mortgage Market: Challenges

Growing cases of mortgage fraud and default may challenge the market expansion rate

The US home mortgage industry is expected to be challenged by the growing incidents of mortgage-related fraud. The list of mortgage defaults in the country has been growing which poses a threat to the mortgage sector in the country. Around 0.8% of all mortgage applications in the second quarter of 2023 were reported to have fraudulent content.

US Home Mortgage Market: Segmentation

The US home mortgage market is segmented based on loan purpose, borrower type, mortgage type, property type, and region.

Based on the loan purpose, the regional industry is divided into home equity loans, refinance mortgages, and purchase mortgages. In 2023, the highest demand was observed in the purchase mortgage segment. It dominated more than 50% of the total segmental share. This type of mortgage allows borrowers to buy a new home as the primary or secondary residence. The growing number of houses on sale in the US real-estate business is expected to fuel the segmental demand during the projection period.

Based on borrower type, the US home mortgage industry is divided into self-employed borrowers, investors, repeat homebuyers, and first-time buyers.

Based on the mortgage type, the regional market divisions are jumbo mortgages, government-insured mortgages, adjustable-rate mortgages, and fixed-rate mortgages. In 2023, the highest growth was observed in the fixed-rate mortgages. These are constant rates that do not change throughout the course of the loan. Adjustable rate mortgages change as per the economic conditions of the country. The current fixed interest rate for a 30-year period is around 7.03%.

Based on property type, the US home mortgage industry divisions are investment properties, multi-family homes, condominiums, and single-family homes.

US Home Mortgage Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US Home Mortgage Market |

| Market Size in 2023 | USD 180.91 Billion |

| Market Forecast in 2032 | USD 501.67 Billion |

| Growth Rate | CAGR of 12.00% |

| Number of Pages | 231 |

| Key Companies Covered | Caliber Home Loans, Quicken Loans (Rocket Mortgage), U.S. Bank Home Mortgage, Guaranteed Rate, Bank of America Home Loans, Guild Mortgage, CitiMortgage, Movement Mortgage, Freedom Mortgage, New American Funding, Wells Fargo Home Mortgage, Fairway Independent Mortgage Corporation, PrimeLending, loanDepot, Chase Mortgage., and others. |

| Segments Covered | By Loan Purpose, By Borrower Type, By Mortgage Type, By Property Type, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US Home Mortgage Market: Regional Analysis

Eastern states to continue delivering excellent return on investment (ROI) during the projection period

The US home mortgage market is projected to witness the highest growth in the eastern states of the country. Regions such as Georgia, Delaware, Massachusetts, and New York are some of the leading states with high demand for home mortgages. Delaware, for instance, has extremely affordable property taxes. Another state Tennessee passed a new law recently. The regulation provides incentives to promote housing facilities among multifamily sections of society. Florida has shown exceptional growth in the real-estate industry in recent times especially driven by growing investments in luxury homes and vacation housing. In July 2024, Florida announced the approval of new safeguards that protect applicants who are applying for home improvement loans for clean energy. The loans can now be used by homeowners even with poor credit scores but who want to upgrade to new roofs, air conditioners, and insulation. The surge in the number of advanced tools that can be used by home mortgage providers for easy processing will further contribute to the regional market demand. In March 2024, Zillow Home Loans announced the launch of a new tool BuyAbility. The technology combines the buyer's credit score and income with real-time mortgage rates to determine home prices within the budget.

US Home Mortgage Market: Competitive Analysis

The US home mortgage market is led by players like:

- Caliber Home Loans

- Quicken Loans (Rocket Mortgage)

- U.S. Bank Home Mortgage

- Guaranteed Rate

- Bank of America Home Loans

- Guild Mortgage

- CitiMortgage

- Movement Mortgage

- Freedom Mortgage

- New American Funding

- Wells Fargo Home Mortgage

- Fairway Independent Mortgage Corporation

- PrimeLending

- loanDepot

- Chase Mortgage.

The US home mortgage market is segmented as follows:

By Loan Purpose

- Home Equity Loans

- Refinance Mortgages

- Purchase Mortgage

By Borrower Type

- Self-Employed Borrowers

- Investors

- Repeat Homebuyers

- First-Time Buyers

By Mortgage Type

- Jumbo Mortgages

- Government-Insured Mortgages

- Adjustable Rate Mortgages

- Fixed Rate Mortgages

By Property Type

- Investment Properties

- Multi-Family Homes

- Condominiums

- Single-Family Homes

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

The US home mortgage industry is a crucial part of the overall US economy. It is one of the largest contributors to the regional gross domestic product (GDP).

The US home mortgage market is expected to grow due to the rising investments in vacation homes or investment properties in the US.

According to study, the US home mortgage market size was worth around USD 180.91 billion in 2023 and is predicted to grow to around USD 501.67 billion by 2032.

The CAGR value of the US home mortgage market is expected to be around 12.00% during 2024-2032.

The US home mortgage market is projected to witness the highest growth in the eastern states of the country.

The US home mortgage market is led by players like Caliber Home Loans, Quicken Loans (Rocket Mortgage), U.S. Bank Home Mortgage, Guaranteed Rate, Bank of America Home Loans, Guild Mortgage, CitiMortgage, Movement Mortgage, Freedom Mortgage, New American Funding, Wells Fargo Home Mortgage, Fairway Independent Mortgage Corporation, PrimeLending, loanDepot and Chase Mortgage.

The report explores crucial aspects of the US home mortgage market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed