US In Car Audio System Market Size, Share, Trends, Growth and Forecast 2032

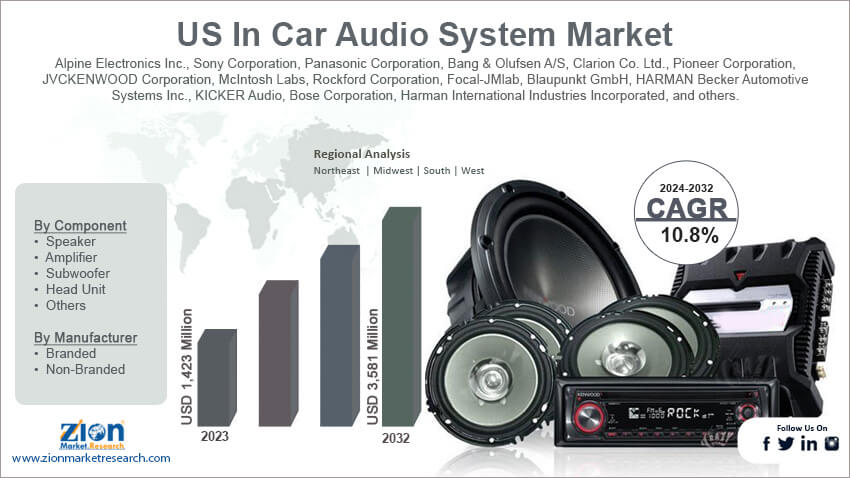

US In Car Audio System Market By Component (Speaker, Amplifier, Subwoofer, Head Unit, and Others), By Manufacturer (Branded and Non-Branded), By Vehicle Type (ICE and EV), By Sales Channel (OEM and Aftermarket), and By Country-State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

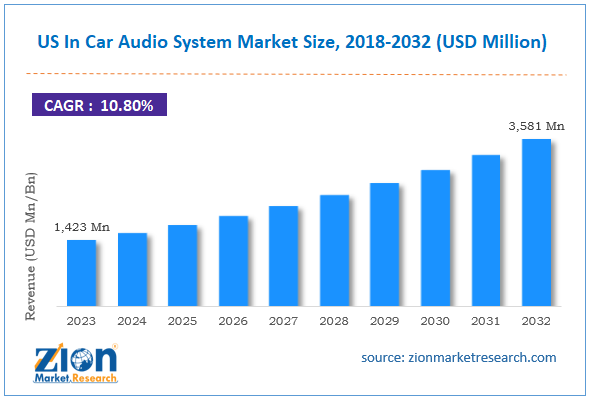

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,423 Million | USD 3,581 Million | 10.8% | 2023 |

US In Car Audio System Industry Prospective:

The US In Car Audio System market size was worth around USD 1,423 million in 2023 and is predicted to grow to around USD 3,581 million by 2032 with a compound annual growth rate (CAGR) of roughly 10.8% between 2024 and 2032.

US In Car Audio System Market: Overview

Any device installed inside a car or other vehicle to educate and entertain its occupants is referred to as an "in-car audio system". High-quality sound can be produced by sound systems like podcast and audiobook players, head units, speakers, amplifiers, and car radios. The new features of the automobile audio system, which promote comfort and safety while driving, include hands-free calling and Bluetooth. Increased demand for luxury automobiles with high-end sound systems, the integration of IOT and ADAS into in-car audio systems, and growth in passenger car sales are the primary factors fueling the US in-car audio system market.

Key Insights

- As per the analysis shared by our research analyst, the US In Car Audio System market is estimated to grow annually at a CAGR of around 10.8% over the forecast period (2024-2032).

- In terms of revenue, the US In Car Audio System market size was valued at around USD 1,423 million in 2023 and is projected to reach USD 3,581 million, by 2032.

- The increasing product launch is expected to propel the US In Car Audio System market growth over the projected period.

- Based on the component, the speaker segment is expected to dominate the market over the forecast period.

- Based on the manufacturer, the branded segment is expected to capture a significant market share during the analysis period.

- Based on the state, California is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

US In Car Audio System Market: Growth Drivers

The emergence of IoT-enabled smart speaker drives market growth

One major trend driving the US In Car Audio System market's growth is the emergence of Internet of Things (IoT)-enabled smart speakers. As automotive infotainment systems become more advanced and differentiated in terms of capabilities, automakers have been working with technology providers to add more advanced features to more product segments over time. Amazon, for instance, has teamed with various automakers to include Alexa, their artificial intelligence-powered voice assistant, into popular automobile infotainment systems. Other automakers interested in this alliance include BMW, Ford, Toyota/Lexus, and Audi.

US In Car Audio System Market: Restraints

The high cost of advanced technology audio systems impedes market growth

Advanced features and state-of-the-art audio technologies in car audio systems enhance the listening experience overall by offering superior sound quality, more connectivity possibilities, and cutting-edge functionality. But there's a cost to this advancement. Automobile audio systems become much more expensive to produce when such cutting-edge technologies are used. This also results in a significant increase in the final retail cost of these advanced audio systems. Price-sensitive customers and some market groups with tight budgets may need help owing to this price increase. These customers could find it challenging to justify the higher cost connected with the newest audio technologies, possibly choosing more traditional or reasonably priced audio solutions instead. Thus, the high cost of advanced technology audio systems might be impeding the US In Car Audio System industry.

US In Car Audio System Market: Opportunities

Rising product launch offers a lucrative opportunity for market growth

The increasing product launch is expected to offer a lucrative opportunity for the US In Car Audio System Industry. For instance, in October 2023, a new model in their portfolio of car AV receivers, the XAV-AX8500, was unveiled by Sony Electronics Inc. The XAV-AX8500 offers an experience that can be tailored to the user's own visual and audio preferences, all while maintaining industry-leading quality. This new model has a large HD screen with a unique tilt and swivel mechanism, as well as other customization choices for better audio and visual performance. Similarly, in January 2024, Tech fans and automotive enthusiasts alike should get intrigued with JBL, a historical name in the audio industry, with the arrival of the JBL Legend 700. This 7-inch Double-Din car stereo deftly blends state-of-the-art technology with superb sound quality to make for an engaging traveling companion. The JBL Legend 700 is designed to improve the in-car entertainment experience with its svelte 7-inch touchscreen display and modern, user-friendly UI. The JBL Legend 700 guarantees a smooth and unobtrusive connection to any smartphone through wireless Apple CarPlay and Android Auto, enabling safe and practical operation while driving.

US In Car Audio System Market: Challenges

Space and design constraints pose a major challenge to market expansion

The automotive industry's shift toward smaller, electrified vehicles poses unique challenges for the integration of audio equipment because of their limited interior space. Careful planning and engineering expertise are needed for the design and integration of audio components in compact and electric cars. The compact interiors of these cars require innovative approaches in terms of choosing and setting up audio components. The size, positioning, and presentation of speakers, amplifiers, subwoofers, and other significant audio components may all be impacted by this restriction. Engineers must design to maximize sound quality and performance under these constraints, often selecting effective, compact systems without compromising the audio experience.

US In Car Audio System Market: Segmentation

The US In Car Audio System industry is segmented based on component, manufacturer, vehicle type, sales channel, and state.

Based on the component, the US In Car Audio System market is bifurcated into speaker, amplifier, subwoofer, head unit, and others. The speaker segment is expected to dominate the market over the forecast period. Speakers in the US In Car Audio System Market refer to transducers that produce sound. Material and design developments for greater audio quality are among the current trends. The integration of smart speakers and voice assistants is becoming more prevalent. In June 2023, Sony Electronics Inc. unveiled its GS vehicle speaker and subwoofer portfolio, which includes the XS-162GS, XS-160GS, XS-690GS, XS-680GS speakers, and the XS-W124GS and XS-W104GS subwoofers. For individuals looking for a step-up acoustic system from their factory car audio, the GS series is designed to produce a smooth, detailed sound that will transform an ordinary drive into a true audio experience.

Based on the manufacturer, the US In Car Audio System industry is segmented into branded and non-branded. The branded segment is expected to capture a significant market share during the analysis period. Branded manufacturing in the US In Car Audio System Market includes established enterprises that manufacture audio systems under well-known brand names. These systems frequently highlight innovative technologies, greater sound quality, and seamless integration. Trends include ongoing innovation, the incorporation of cutting-edge technology, and strategic relationships with car manufacturers to provide customized and co-branded solutions, driving market growth.

Based on the vehicle type, the US In Car Audio System market is segmented into ICE and EV.

Based on the sales channel, the US In Car Audio System industry is segmented into OEM and Aftermarket.

US In Car Audio System Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US In Car Audio System Market |

| Market Size in 2023 | USD 1,423 Million |

| Market Forecast in 2032 | USD 3,581 Million |

| Growth Rate | CAGR of 10.8% |

| Number of Pages | 223 |

| Key Companies Covered | Alpine Electronics Inc., Sony Corporation, Panasonic Corporation, Bang & Olufsen A/S, Clarion Co. Ltd., Pioneer Corporation, JVCKENWOOD Corporation, McIntosh Labs, Rockford Corporation, Focal-JMlab, Blaupunkt GmbH, HARMAN Becker Automotive Systems Inc., KICKER Audio, Bose Corporation, Harman International Industries Incorporated, and others. |

| Segments Covered | By Component, By Manufacturer, By Vehicle Type, By Sales Channel, and By Region |

| States Covered in US | California, Florida, New York, Washington, Texas, New Jersey, Georgia, Oregon, Arizona, and Colorado |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US In Car Audio System Market: State Analysis

California is expected to dominate the market over the forecast period

California is expected to dominate the US In Car Audio System market over the forecast period. The market growth in the area is attributed to the presence of major players such as Panasonic, Harman, and others. The constant innovation and strategic collaboration amplify the market penetration in the area. For instance, in November 2023, the launch of the Fisker Pulse audio system powered by ELS STUDIO 3D® on the brand-new 2023 Fisker Ocean Extreme and Fisker Ocean One was announced by Panasonic Automotive Systems Company of America, a tier-one automotive supplier and division of Panasonic Corporation of North America, in partnership with Fisker Inc. With its 15 high-performance speakers and Panasonic's studio-quality sound, the ELS STUDIO 3D system, which was specially created to encourage sustainability and high performance, enhances the all-electric Fisker Ocean SUV, which is referred to as "The World's Most Sustainable Vehicle." Thus, this strategic approach drives the In Car Audio System market growth in California state.

US In Car Audio System Market: Competitive Analysis

The US In Car Audio System market is dominated by players like:

- Alpine Electronics Inc.

- Sony Corporation

- Panasonic Corporation

- Bang & Olufsen A/S

- Clarion Co. Ltd.

- Pioneer Corporation

- JVCKENWOOD Corporation

- McIntosh Labs

- Rockford Corporation

- Focal-JMlab

- Blaupunkt GmbH

- HARMAN Becker Automotive Systems Inc.

- KICKER Audio

- Bose Corporation

- Harman International Industries Incorporated

The US In Car Audio System market is segmented as follows:

By Component

- Speaker

- Amplifier

- Subwoofer

- Head Unit

- Others

By Manufacturer

- Branded

- Non-Branded

By Vehicle Type

- ICE

- EV

By Sales Channel

- OEM

- Aftermarket

By State

- California

- Florida

- New York

- Washington

- Texas

- New Jersey

- Georgia

- Oregon

- Arizona

- Colorado

- Others

Table Of Content

Methodology

FrequentlyAsked Questions

Any device installed inside a car or other vehicle to educate and entertain its occupants is referred to as an "in car audio system". High-quality sound can be produced by sound systems like podcast and audiobook players, head units, speakers, amplifiers, and car radios. The new features of the automobile audio system, which promote comfort and safety while driving, include hands-free calling, Bluetooth.

Increased demand for luxury automobiles with high-end sound systems, the integration of IOT and ADAS into in-car audio systems, and growth in passenger car sales are the primary factors fueling the US in car audio system market.

According to the report, the US In Car Audio System market size was worth around USD 1,423 million in 2023 and is predicted to grow to around USD 3,581 million by 2032.

The US In Car Audio System market is expected to grow at a CAGR of 10.8% during the forecast period.

US In Car Audio System market growth is driven by California. It is currently the nation's highest revenue-generating market due to the presence of major players.

The US In Car Audio System market is dominated by players like Alpine Electronics Inc., Sony Corporation, Panasonic Corporation, Bang & Olufsen A/S, Clarion Co. Ltd., Pioneer Corporation, JVCKENWOOD Corporation, McIntosh Labs, Rockford Corporation, Focal-JMlab, Blaupunkt GmbH, HARMAN Becker Automotive Systems Inc., KICKER Audio, Bose Corporation and Harman International Industries Incorporated among others.

The US In Car Audio System market report covers the geographical market along with a comprehensive In Car Audio System competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed