US IT Asset Disposition Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

US IT Asset Disposition Market By End-User (Government, BFSI, Media & Entertainment, Healthcare, Energy & Utilities, and Others), By Asset Type (Storages, Servers, Peripherals, Computer/Laptops, and Others), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

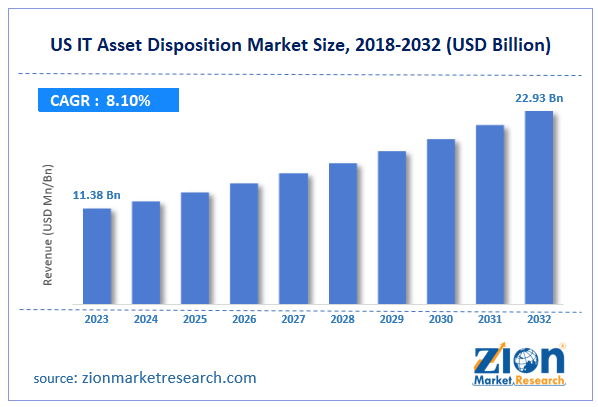

| USD 11.38 Billion | USD 22.93 Billion | 8.10% | 2023 |

US IT Asset Disposition Industry Prospective:

The US IT asset disposition market size was worth around USD 11.38 billion in 2023 and is predicted to grow to around USD 22.93 billion by 2032 with a compound annual growth rate (CAGR) of roughly 8.10% between 2024 and 2032.

US IT Asset Disposition Market: Overview

The US IT asset disposition (ITAD) industry deals with the policies and methods adopted by companies and businesses in the US for recycling or disposing of their IT equipment. The industry is sometimes also referred to as IT asset recycling. Modern organizations rely heavily on IT assets for business operations. The systems become undesired or outdated after some years of use. The process that a company follows to responsibly reuse the tool or dispose of the non-essential with minimal to no impact on the environment is known as ITAD. It deals with critical procedures once an IT equipment in an organization becomes redundant. Parameters such as compliance, security, and safety are paramount when drafting IT asset disposition processes in the US. The growing number of companies in the region heavily dependent on modern IT devices is driving the market demand rate. The constant need for companies to invest in the latest technologies, leading to reduced use of older systems, further promotes regional market expansion. However, complex regulations surrounding the export of waste will challenge the market players during the expansion period.

Key Insights:

- As per the analysis shared by our research analyst, the US IT asset disposition market is estimated to grow annually at a CAGR of around 8.10% over the forecast period (2024-2032)

- In terms of revenue, the US I T asset disposition market size was valued at around USD 11.38 billion in 2023 and is projected to reach USD 22.93 billion by 2032.

- The US IT asset disposition market is projected to grow at a significant rate due to the intensifying business density in the region

- Based on the end-user, the BFSI segment is growing at a high rate and will continue to dominate the market as per industry projection

- Based on the asset type, the computer/laptops segment is anticipated to command the largest regional market share

- Based on region, Western states are projected to dominate the regional market during the forecast period

Request Free Sample

Request Free Sample

US IT Asset Disposition Market: Growth Drivers

Intensifying business density in the region will promote market expansion rate

The US IT asset disposition market is expected to be led by the growing number of businesses operating in the region. The US is one of the world’s most technologically developed countries. It continues to set benchmark and global standards for innovations across major industries such as IT & telecommunications, power & utilities, and other industries. Companies in the US rely heavily on modern technological systems such as computers, laptops, servers, and other related accessories. In recent times, the number of IT asset-related investments across businesses and sectors has grown exponentially. This is further led by the rising focus of the regional government to improve the country’s manufacturing sector, especially in terms of the semiconductor industry.

For instance, in July 2024, the U.S. Department of Commerce announced a Notice of Intent (NOI) for launching research & development (R&D) competitions in the country. The government has announced an investment of USD 1.6 billion for establishing and accelerating domestic production of semiconductors and superior packaging. According to the Office of the New York State Comptroller, New York City was hosting more than 250,000 businesses as of October 2021. The number has since been rising. The growth in the number of companies operating out of the US directly impacts the value of IT asset consumption, leading to more demand for ITAD.

Strict government policies governing ITAD processes for each sector will promote the market growth trend

The US economic sector is heavily influenced and governed by several comprehensive and strict policies. Frameworks surrounding IT asset disposition are drafted in detail along with stringent implementation policies. The US legislation for ITAD covers several aspects through different laws such as the Gramm-Leach-Bliley Act requiring companies in the financial sector to disclose to consumers practices surrounding information-sharing. The Health Insurance Portability and Accountability Act (HIPAA) ensures that businesses destroy, purge, and clear patient-related protected health information before company electronics are set for reuse.

In case of compliance failures, strict actions are taken against companies. In September 2020, the U.S. Department of Veterans Affairs (VA) Office of Management registered a data breach incident resulting in information related to over 46,000 veterans being leaked. The company had to pay around USD 20 million to the affected veterans. Such actions are likely to promote higher adoption in the US IT asset disposition market.

US IT Asset Disposition Market: Restraints

Reducing product lifecycle and constraints during the disposal of advanced devices will limit the industry’s expansion rate

The US industry for IT asset disposition will be restricted by the rapid innovation rate in the information technology sector. The surging launch of new systems had led to a reduced life cycle of older-generation products. Companies are actively investing in the latest available digital solutions to keep up with the growing competition. The reduced lifecycle of systems used in organizations has led to more products requiring disposal after a limited time of use. In addition to this, the technical constraints of responsibility for disposing of advanced devices further limit the market’s expansion trajectory.

US IT Asset Disposition Market: Opportunities

Innovation in ITAD systems and technologies will generate more expansion possibilities

The US IT asset disposition market is expected to generate more growth opportunities due to the rising innovation rate in the industry. IT asset disposition solution providers are investing in using modern available tools and comprehensive strategies to mitigate the challenges faced when discarding IT-related assets. The integration of state-of-the-art technologies such as Artificial Intelligence (AI) and Machine Learning (ML) to design applications that aid 100% compliance and other critical aspects of IT asset disposition will be fruitful for the industry players. In addition, expansion into global territories may also assist in delivering improved revenue. Demand for efficient ITAD solution providers is rising worldwide across government and private sectors. US-based providers of IT asset disposition should invest in emerging markets for future growth.

US IT Asset Disposition Market: Challenges

Changing global conditions over export of hazardous materials will challenge the market expansion rate

The US IT asset disposition industry is expected to be challenged by the changing conditions globally over the export of hazardous materials. In July 2024, Basel Action Network (BAN) launched an online whistleblowers portal. The organization was the first to expose the dumping of electronic waste by developed countries in regions such as Africa and China. The portal will allow whistleblowers from across the world to highlight stories with evidence of companies failing to comply with international law without disclosing their identity. The US is yet to officially confirm the international treaty but such events are likely to impact the regional industry.

US IT Asset Disposition Market: Segmentation

The US IT asset disposition market is segmented based on end-user, asset type, and region.

Based on the end-user, the regional market segments are government, BFSI, media & entertainment, healthcare, energy & utilities, and others. In 2023, the highest demand was observed in the BFSI segment. Regional financial institutions are keepers of some of the country’s most confidential information related to customers, businesses, and government official bodies. The main laws impacting the segmental demand for ITAD are the Sarbanes-Oxley Act (SOX) and the Gramm-Leach-Bliley Act (GLBA). According to official records, data breach expenditure in the US was around USD 10 million in 2023.

Based on the asset type, the regional market divisions are storage, servers, peripherals, computers/laptops, and others. In 2023, the highest demand was registered in the computer/laptops segment. Portable smart devices such as laptops are the most commonly used modern consumer electronic items in every business and sector. These units hold a significant amount of private and confidential information. As per official reports, the US registers sales of more than 41 million laptops every year.

US IT Asset Disposition Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US IT Asset Disposition Market |

| Market Size in 2023 | USD 11.38 Billion |

| Market Forecast in 2032 | USD 22.93 Billion |

| Growth Rate | CAGR of 8.10% |

| Number of Pages | 232 |

| Key Companies Covered | ERI (Electronic Recyclers International), Arrow Electronics (Arrow Value Recovery), Blancco Technology Group, TES (Technology Recovery Group), Iron Mountain, Ally ITAD Solutions, Ingram Micro ITAD, Sims Lifecycle Services, SRS (Sims Recycling Solutions), HP (Hewlett-Packard), Dell Technologies, Tech Data, Greentec, Apto Solutions, CentricsIT., and others. |

| Segments Covered | By End-User, By Asset Type, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US IT Asset Disposition Market: Regional Analysis

Western states to dominate around half of the regional revenue share during the projection period

The US IT asset disposition market will be led by the Western states in the US during the projection period. California, located in the West of the US, is the region’s most influential tech hub. It is also world-renowned for hosting Silicon Valley, full of technology companies. The emergence of several new businesses across Western regions and other parts of the country will drive the regional market demand. The Banking, Financial Services, and Insurance (BFSI) industry in the US is one of the largest contributors to ITAD. For instance, in recent times, US banks have invested heavily in IT systems especially influenced by rising data breach incidents and fraud-related cases.

In addition to this, the US government has been focusing on encouraging development and establishment of a circular economy. In November 2023, the U.S. Department of Energy announced the launch of Re-X Before Recycling, its newest clean energy prize. The initiative will offer a total cash price of USD 4.5 million along with technical assistance and national laboratory analysis consultation worth USD 1.1 million to teams that develop novel ways of extending the lifetime of parts or products through remanufacturing, reusing, refurbishing, or repurposing.

US IT Asset Disposition Market: Competitive Analysis

The US IT asset disposition market is led by players like:

- ERI (Electronic Recyclers International)

- Arrow Electronics (Arrow Value Recovery)

- Blancco Technology Group

- TES (Technology Recovery Group)

- Iron Mountain

- Ally ITAD Solutions

- Ingram Micro ITAD

- Sims Lifecycle Services

- SRS (Sims Recycling Solutions)

- HP (Hewlett-Packard)

- Dell Technologies

- Tech Data

- Greentec

- Apto Solutions

- CentricsIT.

The US IT asset disposition market is segmented as follows:

By End-User

- Government

- BFSI

- Media & Entertainment

- Healthcare

- Energy & Utilities

- Others

By Asset Type

- Storages

- Servers

- Peripherals

- Computer/Laptops

- Others

By Region

- The U.S.

Table Of Content

Methodology

FrequentlyAsked Questions

The US IT asset disposition (ITAD) industry deals with the policies and methods adopted by companies and businesses in the US for recycling or disposing of their IT equipment.

The US IT asset disposition market is expected to be led by the growing number of businesses operating in the region.

According to study, the US IT asset disposition market size was worth around USD 11.38 billion in 2023 and is predicted to grow to around USD 22.93 billion by 2032.

The CAGR value of the US IT asset disposition market is expected to be around 8.10% during 2024-2032.

The US IT asset disposition market will be led by the Western states in the US during the projection period.

The US IT asset disposition market is led by players like ERI (Electronic Recyclers International), Arrow Electronics (Arrow Value Recovery), Blancco Technology Group, TES (Technology Recovery Group), Iron Mountain, Ally ITAD Solutions, Ingram Micro ITAD, Sims Lifecycle Services, SRS (Sims Recycling Solutions), HP (Hewlett-Packard), Dell Technologies, Tech Data, Greentec, Apto Solutions and CentricsIT.

The report explores crucial aspects of the US IT asset disposition market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

The US IT asset disposition (ITAD) industry deals with the policies and methods adopted by companies and businesses in the US for recycling or disposing of their IT equipment.

The US IT asset disposition market is expected to be led by the growing number of businesses operating in the region.

According to study, the US IT asset disposition market size was worth around USD 11.38 billion in 2023 and is predicted to grow to around USD 22.93 billion by 2032.

The CAGR value of the US IT asset disposition market is expected to be around 8.10% during 2024-2032.

The US IT asset disposition market will be led by the Western states in the US during the projection period.

The US IT asset disposition market is led by players like ERI (Electronic Recyclers International), Arrow Electronics (Arrow Value Recovery), Blancco Technology Group, TES (Technology Recovery Group), Iron Mountain, Ally ITAD Solutions, Ingram Micro ITAD, Sims Lifecycle Services, SRS (Sims Recycling Solutions), HP (Hewlett-Packard), Dell Technologies, Tech Data, Greentec, Apto Solutions and CentricsIT.

The report explores crucial aspects of the US IT asset disposition market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed