US Lithium-Ion Battery Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

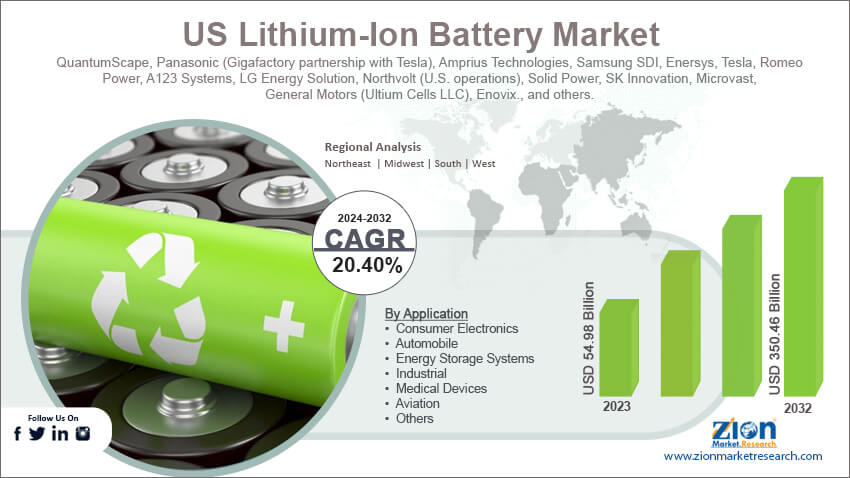

US Lithium-Ion Battery Market By Application (Consumer Electronics, Automobile, Energy Storage Systems, Industrial, Medical Devices, Aviation, and Others), By Product (Lithium Manganese Oxide (LMO), Lithium Cobalt Oxide (LCO), Lithium Titanate (LTO), Lithium Iron Phosphate (LFP), Lithium Nickel Cobalt Aluminum Oxide (NCA), and Others), By Component (Aluminum Foil, Electrolyte, Anode, Cathode, Separator, and Others), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

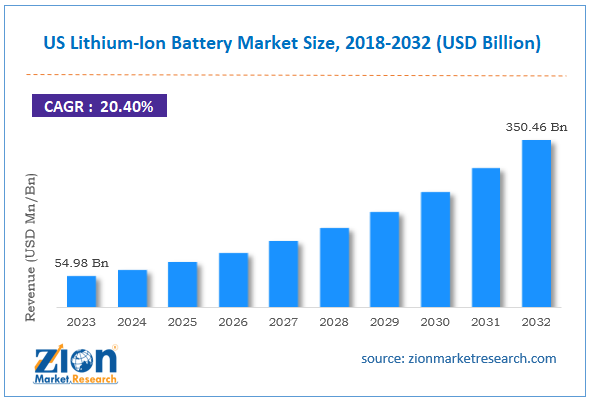

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 54.98 Billion | USD 350.46 Billion | 20.40% | 2023 |

US Lithium-Ion Battery Industry Prospective:

The US lithium-ion battery market size was worth around USD 54.98 billion in 2023 and is predicted to grow to around USD 350.46 billion by 2032 with a compound annual growth rate (CAGR) of roughly 20.40% between 2024 and 2032.

US Lithium-Ion Battery Market: Overview

The US lithium-ion battery industry is a growing market dealing with domestic production, distribution, and application of lithium-ion (Li-ion) batteries across industries. These energy-saving devices are currently the most widely used and popular form of rechargeable batteries. They are used to power day-to-day items such as smartphones and laptops. However, their end applications go beyond charging small-scale products as they are also used for powering large-scale structures such as aircraft and marine ships. Li-ion batteries are made using multi or single lithium-ion cells. They also consist of a protective circuit board. Li-ion batteries comprise several parts, including anode, cathode, electrodes, electrolytes, separator, and current collectors. The electrical current produced through lithium-ion batteries results from Li ions moving between the anode and cathode in the internal circuit. The electrons are located in the outer circuit and move in opposite directions. The US is focusing on reshoring manufacturing capacity for higher growth in the US lithium-ion battery in the future, along with focusing on de-risking away from China.

Key Insights:

- As per the analysis shared by our research analyst, the US lithium-ion battery market is estimated to grow annually at a CAGR of around 20.40% over the forecast period (2024-2032)

- In terms of revenue, the US lithium-ion battery market size was valued at around USD 54.98 billion in 2023 and is projected to reach USD 350.46 billion, by 2032.

- The US lithium-ion battery market is projected to grow at a significant rate due to the rising use of Li-ion batteries in electric vehicles (EVs)

- Based on the application, the automobile segment is growing at a high rate and will continue to dominate the regional market as per industry projection

- Based on the component, the cathode segment is anticipated to command the largest market share

- Based on region, Eastern states are projected to dominate the regional market during the forecast period

Request Free Sample

Request Free Sample

US Lithium-Ion Battery Market: Growth Drivers

Rising use of Li-ion batteries in electric vehicles (EVs) will fuel the market growth rate

The US lithium-ion battery market is expected to grow due to the rising use of rechargeable batteries in the EV sector. The US has shown exceptional growth in terms of EV-related innovation. The country currently lacks EV production capacity compared to its global competitors, such as China. It is one of the major reasons for the regional government to invest more in the country’s EV sector. These investments are directed toward several key aspects, such as developing supporting infrastructure, promoting domestic production of EV parts, and encouraging higher adoption rates among customers. As of August 2024, investments in the US EV sector have reached over USD 300 billion compared to 2021. In June 2024, Toyota, a leading Japanese EV maker, announced that it would invest over USD 1 billion for the construction of a new mega-site for EV battery production in North Carolina. The investment is expected to create more than 5000 jobs in the region. The company's decision regarding the investment was fueled by the current government’s launch of the Inflation Reduction Act (IRA).

Increasing demand for Li-ion batteries for consumer electronic products will generate massive return on investment (ROI)

Lithium-ion batteries are ideal for modern consumer electronic products since they are lightweight. Additionally, they also have longer lifetimes, making them suitable for use in consumed electronic items for providing energy. Lithium-ion batteries are the driving force for everyday consumer products such as smartphones, tablets, and laptops. Additionally, they have also shown extensive applications in other wireless products such as vacuum cleaners, hoverboards, and kitchen appliances. The higher energy density of Li-ion batteries makes them more popular as compared to nickel-cadmium (NiCd) batteries and other competitors. The growing use of consumer electronics in the United States is expected to fuel the US lithium-ion battery market.

US Lithium-Ion Battery Market: Restraints

Tough competition from global Li-ion battery producers will limit the industry’s growth rate

The US industry for lithium-ion batteries is expected to be limited due to the higher dominance shown by international players in Li-ion battery manufacturing. China, for instance, is the world’s leading manufacturer of lithium-ion batteries. The US sources a large portion of the Li-ion batteries for domestic use from the international market, especially China. In 2023, China exported nearly USD 11 billion worth of Li-ion batteries to the US. Additionally, the country lacks access to some of the essential materials required for Lithium-ion battery manufacturing.

US Lithium-Ion Battery Market: Opportunities

Surge in government measures to de-risk away from China and explore domestic production will generate expansion possibilities

The US lithium-ion battery market players are projected to register several new expansion opportunities during the forecast period. In recent times, the US government has been focusing on restoring Li-ion battery production capacity. The country officials are actively working toward reducing production dependency on other countries. In July 2024, the Loan Programs Office (LPO) of the U.S. Department of Energy (DOE) announced a direct loan of USD 1.2 billion to ENTEK Lithium Separators LLC (ENTEK). The announcement is currently pending approval. Once the grant is permitted, the move is expected to provide substantial financial assistance for the construction of a lithium-ion battery separator manufacturing facility in Terre Haute, Indiana. In November 2023, the Governor of Wake County, North Carolina, approved the construction of a new lithium-ion battery production facility called Forge Battery. The unit will be owned by Forge Nano, Inc., which is a leading materials science company.

US Lithium-Ion Battery Market: Challenges

Challenges with domestic manufacturing and supply chain issues will affect the market growth rate

The US lithium-ion battery industry is projected to face challenges as the battery production rate outmatches the demand rate. Currently, even though the demand for lithium-ion batteries is increasing, the production capacity on a global scale is much higher. This means that the US market players have to compete with a large number of international companies in the foreign market. On the other hand, domestic production of Li-ion batteries is equally challenging, especially in the form of several different alternatives, including internal combustion engine vehicles.

US Lithium-Ion Battery Market: Segmentation

The US lithium-ion battery market is segmented based on application, product, component, and region.

Based on the application, the regional market segments are consumer electronics, automobiles, energy storage systems, industrial, medical devices, aviation, and others. In 2023, the highest growth was registered in the automobile sector. The US EV industry is one of the most lucrative markets in the region. The surge in manufacturing of two-wheeler electric vehicles across the US will fuel demand for Li-ion batteries. In 2023, the US sold more than USD 1.201 billion units of EVs, as per official records.

Based on product, the US lithium-ion battery industry is divided into lithium manganese oxide (LMO), lithium cobalt oxide (LCO), lithium titanate (LTO), lithium iron phosphate (LFP), lithium nickel cobalt aluminum oxide (NCA), and others.

Based on the components, the regional market divisions are aluminum foil, electrolyte, anode, cathode, separator, and others. In 2023, the highest demand was the cathode segment. According to market research, the US is expected to produce over 0.801 million metric tons of cathodes annually by 2030. The regional demand is projected to reach over 1.29 million metric tons. Favorable government policies, the presence of robust manufacturing infrastructure, and the availability of raw materials are driving the segmental demand.

US Lithium-Ion Battery Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US Lithium-Ion Battery Market |

| Market Size in 2023 | USD 54.98 Billion |

| Market Forecast in 2032 | USD 350.46 Billion |

| Growth Rate | CAGR of 20.40% |

| Number of Pages | 210 |

| Key Companies Covered | QuantumScape, Panasonic (Gigafactory partnership with Tesla), Amprius Technologies, Samsung SDI, Enersys, Tesla, Romeo Power, A123 Systems, LG Energy Solution, Northvolt (U.S. operations), Solid Power, SK Innovation, Microvast, General Motors (Ultium Cells LLC), Enovix., and others. |

| Segments Covered | By Application, By Product, By Component, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US Lithium-Ion Battery Market: Regional Analysis

Eastern states to take the lead during the projection period

The US lithium-ion battery market will be led by Eastern states during the projection period. Regions such as New York, Georgia, North Carolina, and Tennessee are expected to deliver extensive revenue over the forecast duration. The regional investments for Li-ion battery production have grown at a rapid pace since the announcement of the IRA. Through the Inflation Reduction Act, the regional government has emphasized provisions related to energy and climate-related provisions along with other industries. The Act will deliver high incentives to customers opting for electric vehicles, including tax credits. Moreover, higher funds will be allotted to companies experimenting with clean energy. The growing focus on decarbonizing regional power grids by 2035 is expected to further promote Li-ion battery application in the US. The rechargeable batteries store energy obtained from renewable means that can be used at a later time. The energy demands in the US have been growing significantly driven by urbanization and industrialization. As the demand for clean energy grows, investments in the Li-ion battery sector will surge. Moreover, the regional consumer electronics market along with industrial applications of Li-ion batteries, will prompt greater investment opportunities.

US Lithium-Ion Battery Market: Competitive Analysis

The US lithium-ion battery market is led by players like:

- QuantumScape

- Panasonic (Gigafactory partnership with Tesla)

- Amprius Technologies

- Samsung SDI

- Enersys

- Tesla

- Romeo Power

- A123 Systems

- LG Energy Solution

- Northvolt (U.S. operations)

- Solid Power

- SK Innovation

- Microvast

- General Motors (Ultium Cells LLC)

- Enovix.

The US lithium-ion battery market is segmented as follows:

By Application

- Consumer Electronics

- Automobile

- Energy Storage Systems

- Industrial

- Medical Devices

- Aviation

- Others

By Product

- Lithium Manganese Oxide (LMO)

- Lithium Cobalt Oxide (LCO)

- Lithium Titanate (LTO)

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

- Others

By Component

- Aluminum Foil

- Electrolyte

- Anode

- Cathode

- Separator

- Others

By Region

- The U.S.

Table Of Content

Methodology

FrequentlyAsked Questions

The US lithium-ion battery industry is a growing market dealing with souring, domestic production, distribution, and application of lithium-ion (Li-ion) batteries across industries.

The US lithium-ion battery market is expected to grow due to the rising use of rechargeable batteries in the EV sector.

According to study, the US lithium-ion battery market size was worth around USD 54.98 billion in 2023 and is predicted to grow to around USD 350.46 billion by 2032.

The CAGR value of the US lithium-ion battery market is expected to be around 20.40% during 2024-2032.

The US lithium-ion battery market will be led by Eastern states during the projection period.

The US lithium-ion battery market is led by players like QuantumScape, Panasonic (Gigafactory partnership with Tesla), Amprius Technologies, Samsung SDI, Enersys, Tesla, Romeo Power, A123 Systems, LG Energy Solution, Northvolt (U.S. operations), Solid Power, SK Innovation, Microvast, General Motors (Ultium Cells LLC) and Enovix.

The report explores crucial aspects of the US lithium-ion battery market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed