US Machine Tools Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

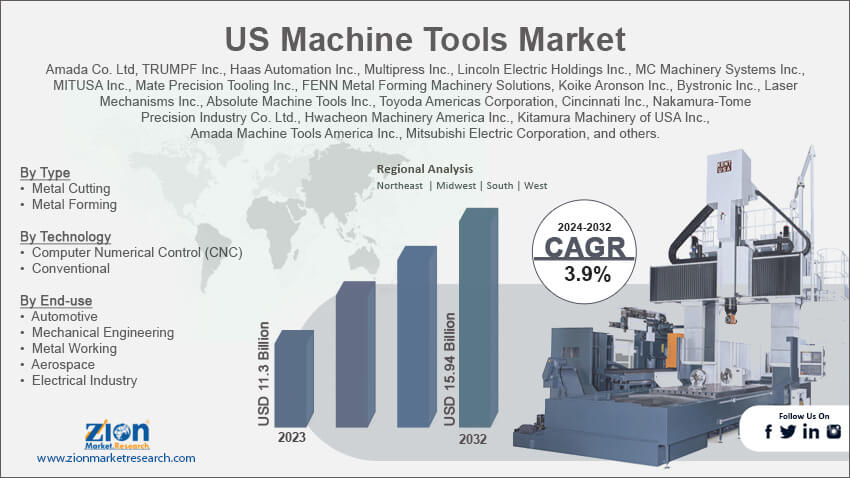

US Machine Tools Market By Type (Metal Cutting and Metal Forming), By Technology (Computer Numerical Control (CNC) and Conventional), By End-use (Automotive, Mechanical Engineering, Metal Working, Aerospace, Electrical industry and Others) and By Country-State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 11.3 Billion | USD 15.94 Billion | 3.9% | 2023 |

US Machine Tools Industry Prospective:

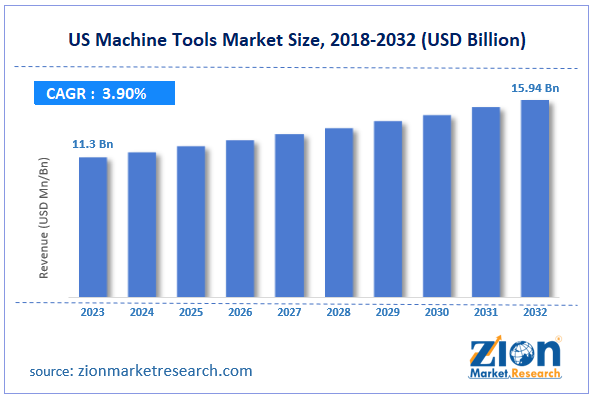

The US machine tools market size was worth around USD 11.3 billion in 2023 and is predicted to grow to around USD 15.94 billion by 2032 with a compound annual growth rate (CAGR) of roughly 3.9% between 2024 and 2032.

US Machine Tools Market: Overview

Achieving optimal product consistency is facilitated by the application of numerical control in machine tool operations. These tools are used for cutting, sculpting, molding, abrading, nibbling, and drilling metals and other hard materials. They not only boost total output but also reduce the demand for human labor in the cutting process. One of the key factors propelling the market expansion is the increasing demand for US-made metal products. Additionally, the country is employing machine tools more frequently as a result of the pressing requirement for electric vehicles (EVs), autonomous cars, and self-driving trucks. Furthermore, advancements in the hardware and software of CNC machines, coupled with the creation of multi-axis and robotic arms, are driving market growth.

Key Insights

- As per the analysis shared by our research analyst, the US machine tools market is estimated to grow annually at a CAGR of around 3.9% over the forecast period (2024-2032).

- In terms of revenue, the US machine tools market size was valued at around USD 11.3 billion in 2023 and is projected to reach USD 15.94 billion, by 2032.

- The rising product launch is expected to propel the market growth over the projected period.

- Based on the type, the metal cutting segment is expected to dominate the market over the forecast period.

- Based on the technology, the computer numerical control (CNC) segment is expected to hold a prominent market share over the forecast period.

- Based on the end-use, the automotive segment is expected to hold the largest market share during the forecast period.

- Based on the state, California is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

US Machine Tools Market: Growth Drivers

Growing demand for automation in manufacturing drives market growth

The growing need for automation in production processes is having an increasing impact on the US machine tool market. Manufacturers looking to boost output, save expenses, and stay competitive in the market are finding that automation is becoming indispensable. Furthermore, combining machine tools with automated systems like robotics and AI-powered solutions allows for less human error, shorter production cycles, and consistent quality. This need is especially apparent in industries where efficiency and precision are essential, such as consumer electronics, aerospace, and the automobile sector. Furthermore, driving the need for automated machine tools is the growing trend towards Industry 4.0, which highlights the digitalization of production processes. Businesses are spending money on linked, intelligent machinery that can foresee maintenance needs, streamline production processes, and provide real-time data analysis, thus driving the US machine tool market growth.

US Machine Tools Market: Restraints

Rising cost pressure from the demand side impedes market growth

The main obstacle to the growth of the US machine tools market is the increasing demand-side pressure on costs. These days, a demanding customer base and significant cost demands present a challenging environment for machine tool producers. The price of steel is one of the most important and widely used raw materials in machine tools, and changes in its price directly impact the world market. Raw material costs are subject to constant fluctuations, mostly due to a range of macroeconomic factors like labor costs, inflation, and regulatory changes.

US Machine Tools Market: Opportunities

Rising introduction of advanced software offers a lucrative opportunity for market growth

The rising introduction of advanced software by the key market players is expected to offer a lucrative opportunity for the US machine tools market growth during the forecast period. For instance, in September 2023, The Manufacturing Intelligence division of Hexagon announced the launch of HxGN Production Machining, a new software suite designed to enable machine shops to attain operational excellence in the production of discrete parts, tools, and components using machine tools at any scale, from one-off prototypes to mass production, and across a variety of industries, including the aerospace and medical. Within the suite are features such as shop-floor production intelligence, CAD (computer-aided design) for manufacturing and design review, CAM (computer-aided manufacturing) for CNC (computer numerical control) machine-tool programming, process simulation and G-code verification and optimization, automation and collaboration enabled by Hexagon's digital-reality platform Nexus.

US Machine Tools Market: Challenges

High operating cost poses a major challenge to market expansion

High operating expenses can have a big impact on the US machine tool market by making it harder for new players to enter the market and limiting their ability to expand internationally. These expenses include raw supplies, labor, power, and following rules. Labor costs are typically greater in the US because American workers enjoy better compensation and benefits than those in many other nations. Furthermore, energy expenses, particularly those associated with electricity, can be substantial and affect the total cost of manufacturing machine tools. The price of raw materials, such as steel and aluminum, which are impacted by changes in the market, has an impact on operating expenses. Strict legislative requirements, such as those about safety and the environment, also make compliance more expensive for businesses. Thus, posing a major challenge for the US machine tools industry.

US Machine Tools Market: Segmentation

The US machine tools industry is segmented based on type, technology, end-use and state.

Based on the type, the US machine tools market is bifurcated into metal cutting and metal forming. The metal cutting segment is expected to dominate the market over the forecast period. Metal cutting machines are used for cutting or grinding away extra material from a workpiece. Different kinds of metal cutting machines exist, including gear cutting machines, lathe machines, grinding machines, drilling machines, and machining centers. In several end-use industries, including aerospace, mechanical engineering, automotive, and metalworking, metal cutting machines are used extensively to cut a variety of ferrous and non-ferrous metals and produce finished tools with the required geometry. Numerous advantages are provided to the final product, including surface texture or finish, increased dimensional accuracy, complex shape, and required size. The growing need for advanced automated metal-cutting equipment is anticipated to drive the US machine tools market expansion.

Based on the technology, the US machine tools industry is segmented into computer numerical control (CNC) and conventional. The computer numerical control (CNC) segment is expected to hold a prominent market share over the forecast period. Often referred to as "computer numerically controlled" (CNC) machines sophisticated metalworking tools that can create the intricate pieces required by modern technology. With the advancement of computers, the use of CNCs as lathes, press brakes, punch presses, abrasive jet cutters, laser cutters, and other industrial instruments has been growing rapidly. Programmable B axis integration reduces material costs in CNC machines, especially those that are automatically converted from Swiss-type machines to fixed machines. Swiss machines also leave behind an expensive ground bar. This leads to a rise in the need for these devices.

Based on the end-use, the US machine tools market is segmented into automotive, mechanical engineering, metal working, aerospace, electrical industry and others. The automotive segment is expected to hold the largest market share during the forecast period. The manufacturing of vehicle components now uses machine tools much more frequently. Machine tools are widely used for metal cutting and the fabrication of small machine components, even though the automotive industry uses a range of manufacturing techniques. This is because they offer benefits such as enhanced accuracy, dependability, and efficiency.

US Machine Tools Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US Machine Tools Market |

| Market Size in 2023 | USD 11.3 Billion |

| Market Forecast in 2032 | USD 15.94 Billion |

| Growth Rate | CAGR of 3.9% |

| Number of Pages | 222 |

| Key Companies Covered | Amada Co. Ltd, TRUMPF Inc., Haas Automation Inc., Multipress Inc., Lincoln Electric Holdings Inc., MC Machinery Systems Inc., MITUSA Inc., Mate Precision Tooling Inc., FENN Metal Forming Machinery Solutions, Koike Aronson Inc., Bystronic Inc., Laser Mechanisms Inc., Absolute Machine Tools Inc., Toyoda Americas Corporation, Cincinnati Inc., Nakamura-Tome Precision Industry Co. Ltd., Hwacheon Machinery America Inc., Kitamura Machinery of USA Inc., Amada Machine Tools America Inc., Mitsubishi Electric Corporation, and others. |

| Segments Covered | By Type, By Technology, By End-use, and By Region |

| States Covered in US | California, Florida, New York, Washington, Texas, New Jersey, Georgia, Oregon, Arizona, and Colorado |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

State Analysis

California is expected to dominate the market over the forecast period

California is expected to dominate the market over the forecast period. Many innovative manufacturing firms, especially those in the electronics, aerospace, and defense sectors, are based in California. Increased investment in high-performance machine tools as a result of the demand for efficiency and precision has sped up revenue growth. Furthermore, the need for sophisticated CNC (Computer Numerical Control) machines and other automated instruments has skyrocketed as digital technologies like robots, the Internet of Things, and artificial intelligence (AI) are integrated into industrial processes. The state of California, where innovation is highly rewarded, is where this trend is most apparent. As machine tool technology is investigated and developed further, especially in Silicon Valley, more specialized and efficient tools are also being produced. Investments have been drawn to these developments, substantially increasing US machine tools market revenue.

US Machine Tools Market: Competitive Analysis

The US machine tools market is dominated by players like:

- Amada Co. Ltd

- TRUMPF Inc.

- Haas Automation Inc.

- Multipress Inc.

- Lincoln Electric Holdings Inc.

- MC Machinery Systems Inc.

- MITUSA Inc.

- Mate Precision Tooling Inc.

- FENN Metal Forming Machinery Solutions

- Koike Aronson Inc.

- Bystronic Inc.

- Laser Mechanisms Inc.

- Absolute Machine Tools Inc.

- Toyoda Americas Corporation

- Cincinnati Inc.

- Nakamura-Tome Precision Industry Co. Ltd.

- Hwacheon Machinery America Inc.

- Kitamura Machinery of USA Inc.

- Amada Machine Tools America Inc.

- Mitsubishi Electric Corporation

The US machine tools market is segmented as follows:

By Type

- Metal Cutting

- Metal Forming

By Technology

- Computer Numerical Control (CNC)

- Conventional

By End-use

- Automotive

- Mechanical Engineering

- Metal Working

- Aerospace

- Electrical Industry

- Others

By State

- California

- Florida

- New York

- Washington

- Texas

- New Jersey

- Georgia

- Oregon

- Arizona

- Colorado

- Others

Table Of Content

Methodology

FrequentlyAsked Questions

Achieving optimal product consistency is facilitated by the application of numerical control in machine tool operations. These tools are used for cutting, sculpting, molding, abrading, nibbling, and drilling metals and other hard materials. They not only boost total output but also reduce the demand for human labor in the cutting process.

One of the key factors propelling the market expansion is the increasing demand for US-made metal products. Additionally, the country is employing machine tools more frequently as a result of the pressing requirement for electric vehicles (EVs), autonomous cars, and self-driving trucks. Furthermore, advancements in the hardware and software of CNC machines, coupled with the creation of multi-axis and robotic arms, are driving market growth.

According to the report, the US machine tools market size was worth around USD 11.3 billion in 2023 and is predicted to grow to around USD 15.94 billion by 2032.

The US machine tools market is expected to grow at a CAGR of 3.9% during the forecast period.

US machine tools market growth is driven by California. It is currently the nation's highest revenue-generating market due to the increasing automotive industry.

The US machine tools market is dominated by players like Amada Co. Ltd, TRUMPF Inc., Haas Automation Inc., Multipress Inc., Lincoln Electric Holdings Inc., MC Machinery Systems Inc., MITUSA Inc., Mate Precision Tooling Inc., FENN Metal Forming Machinery Solutions, Koike Aronson Inc., Bystronic Inc., Laser Mechanisms Inc., Absolute Machine Tools Inc., Toyoda Americas Corporation, Cincinnati Inc., Nakamura-Tome Precision Industry Co. Ltd., Hwacheon Machinery America Inc., Kitamura Machinery of USA Inc., Amada Machine Tools America Inc. and Mitsubishi Electric Corporation among others.

The US machine tools market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed