U.S. Microfluidics Market Size, Share, Trends, Growth and Forecast 2032

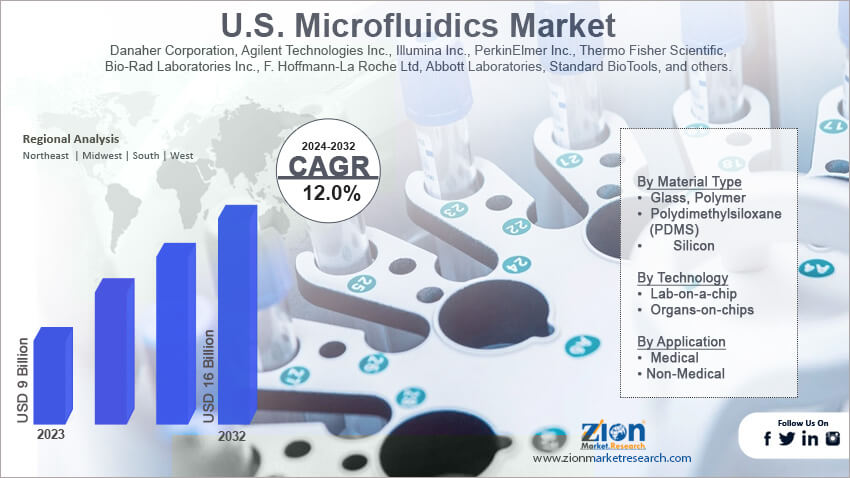

U.S. Microfluidics Market By Product (Microfluidic Devices and Microfluidic Components), By Material Type (Glass, Polymer, Polydimethylsiloxane (PDMS), and Silicon), By Technology (Lab-on-a-chip and Organs-on-chips), By Application (Medical and Non-Medical), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

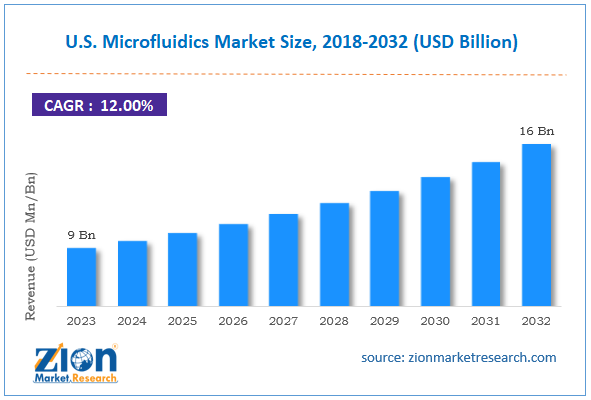

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9 Billion | USD 16 Billion | 12% | 2023 |

U.S. Microfluidics Industry Prospective:

The U.S. microfluidics market size was evaluated at $9 billion in 2023 and is slated to hit $16 billion by the end of 2032 with a CAGR of nearly 12% between 2024 and 2032.

U.S. Microfluidics Market: Overview

Microfluidics is a field dealing with fluid manipulation at a very small scale, particularly in channels having dimensions falling in the range of micrometers and millimeters. This technology finds a slew of applications such as medical diagnostics and environmental monitoring as well as medicine development and chemical synthesis.

Key Insights

- As per the analysis shared by our research analyst, the U.S. microfluidics market is projected to expand annually at the annual growth rate of around 12% over the forecast timespan (2024-2032)

- In terms of revenue, the U.S. microfluidics market size was evaluated at nearly $9 billion in 2023 and is expected to reach $16 billion by 2032.

- The U.S. microfluidics market is anticipated to grow rapidly over the forecast timeline owing to innovations in healthcare activities such as point-of-care testing and precision medicine.

- In terms of product, the microfluidic components segment is slated to register the highest CAGR over the forecast period.

- Based on material type, the polydimethylsiloxane (PDMS) segment is predicted to dominate the segmental space in the U.S. in the upcoming years.

- On the basis of technology, the lab-on-a-chip segment is slated to lead the segmental expansion in the forecast timeline.

- In terms of application, the medical segment is slated to maintain segmental dominance over the forecast timeline.

Request Free Sample

Request Free Sample

U.S. Microfluidics Market: Growth Factors

Breakthroughs in the healthcare sector to boost the expansion of the market in the U.S.

Innovations in healthcare activities such as point-of-care testing and precision medicine are predicted to contribute notably towards the growth of the U.S. microfluidics market. Technological breakthroughs in fabrication techniques such as additive manufacturing and lithography have made it easier for U.S. firms in manufacturing microfluidic equipment at cost-effective rates, thereby steering the market growth trends in the country. Furthermore, large-scale utilization of microfluidics in lab-on-a-chip equipment, cell-based assays, and high-throughput screening augments the speed of the drug discovery process, thereby increasing the demand for microfluidics in drug development activities. Growing use of microfluidics equipment in detecting environmental pollutants will add massively to the growth of the market in the U.S. Furthermore, integration of microfluidics with customer electronics & wearables for monitoring the health of individuals will bolster the market landscape in the U.S.

U.S. Microfluidics Market: Restraints

Massive prices of producing the product can restrict the expansion of the industry in the U.S.

Surging costs of manufacturing microfluidic devices and the complex processes involved in manufacturing & designing these devices can restrict the growth of the U.S. microfluidics industry. A prominent rise in the compatibility issues and tough approval process for microfluidics devices can further put brakes on the industry growth in the U.S.

U.S. Microfluidics Market: Opportunities

Humungous use of microfluidics in protein examination to generate new growth avenues for the market in the U.S.

Large-scale use of microfluidics for analyzing protein as well as genetic information at the micro-level is likely to open new growth opportunities for the U.S. microfluidics market. Need for enhancing cell culture as well as augmenting assay technologies is likely to shape the growth of the market in the U.S. Need for apt testing of safety & quality of food along with the necessity of adhering to the health protocols in the U.S. will prompt the market space in the country.

U.S. Microfluidics Market: Challenges

An increase in the operating charges of microfluidic equipment to challenge the growth of the industry in the U.S.

A rise in the operational costs of microfluidic devices and a complex regulatory process for approving the use of these devices can prove detrimental to the expansion of the U.S. microfluidics industry. Less product diversification and the growing risk of devices becoming obsolete can pose a huge challenge to the growth of the industry in the U.S.

U.S. Microfluidics Market: Segmentation

The U.S. microfluidics market is divided into product, material type, technology, application, and region.

In terms of product, the U.S. microfluidics market is bifurcated into microfluidic devices and microfluidic components segments. Additionally, the microfluidic components segment, which accumulated approximately half of the market share in 2023, is forecast to register the highest CAGR during the period from 2024 to 2302 owing to the flexibility and miniature nature of microfluidic components such as sensors, chips, and micro-pumps. Reportedly, these products support screening, automation, analysis, and quantitative determination of galactose. A surge in the demand for the product for examining low-sized samples is likely to increase in the near future, thereby further driving the segmental surge in the years to come.

Based on the material type, the U.S. microfluidics industry is divided into glass, polymer, polydimethylsiloxane (PDMS), and silicon segments. Additionally, the polydimethylsiloxane (PDMS) segment, which accrued about 50% of the industry share in 2023, is set to dominate the segment in the U.S. in the years ahead owing to extensive benefits offered by PDMS such as biocompatibility, non-toxicity, elasticity, oxygen & gas permeability, optical clarity, durability, and ability in creating intricate microfluidic equipment designs.

On the basis of technology, the U.S. microfluidics market is sectored into lab-on-a-chip and organs-on-chips segments. Moreover, the lab-on-a-chip segment, which accounted for about 49% of the market size of the country in 2023, is anticipated to lead the segmental surge owing to the ability of lab-on-a-chip technology to facilitate quick DNA probe sequencing as well as enabling high-speed thermal shifts for DNA amplification with the use of PCR.

Based on the application, the U.S. microfluidics industry is segmented into medical and non-medical segments. Furthermore, the medical segment, which garnered nearly half of the industry proceeds in 2023, is predicted to retain its segmental domination in the coming years owing to the large-scale use of microfluidics devices in the medical segment.

U.S. Microfluidics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Microfluidics Market |

| Market Size in 2023 | USD 9 Billion |

| Market Forecast in 2032 | USD 16 Billion |

| Growth Rate | CAGR of 12% |

| Number of Pages | 208 |

| Key Companies Covered | Danaher Corporation, Agilent Technologies Inc., Illumina Inc., PerkinElmer Inc., Thermo Fisher Scientific, Bio-Rad Laboratories Inc., F. Hoffmann-La Roche Ltd, Abbott Laboratories, Standard BioTools, and others. |

| Segments Covered | By Product, By Material Type, By Technology, By Application, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Key Developments

- In May 2024, Takara Bio USA, Inc., a subsidiary of Takara Bio Inc., declared the introduction of Lenti-X Transduction Sponge, a dissolvable microfluidic transduction enhancer that can be utilized in gene delivery methods for detecting in-vitro lentivirus. Moreover, the product has the ability to achieve high transduction efficacy in various kinds of cells.

U.S. Microfluidics Market: Competitive Space

The U.S. microfluidics market profiles key players such as:

- Danaher Corporation

- Agilent Technologies Inc.

- Illumina Inc.

- PerkinElmer Inc.

- Thermo Fisher Scientific

- Bio-Rad Laboratories Inc.

- F. Hoffmann-La Roche Ltd

- Abbott Laboratories

- Standard BioTools

The U.S. microfluidics market is segmented as follows:

By Product

- Microfluidic Devices

- Microfluidic Components

By Material Type

- Glass, Polymer

- Polydimethylsiloxane (PDMS)

- Silicon

By Technology

- Lab-on-a-chip

- Organs-on-chips

By Application

- Medical

- Non-Medical

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

Microfluidics is a field dealing with fluid manipulation at a very small scale, particularly in channels having dimensions falling in the range of micrometers and millimeters.

The U.S. microfluidics market growth over the forecast period can be owing to technological breakthroughs in fabrication techniques such as additive manufacturing and lithography making it easier for the U.S. firms in manufacturing microfluidic equipment at cost-effective prices.

According to a study, the global U.S. microfluidics industry earnings were $9 billion in 2023 and is projected to reach $16 billion by the end of 2032.

The global U.S. microfluidics market is anticipated to record a CAGR of nearly 12% from 2024 to 2032.

The U.S. microfluidics market is led by players such as Danaher Corporation, Agilent Technologies, Inc., Illumina, Inc., PerkinElmer, Inc., Thermo Fisher Scientific, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd, Abbott Laboratories, and Standard BioTools..

The U.S. microfluidics market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed