U.S. Online Sports Betting Market Size, Share, Industry Analysis, Trends, Growth, 2032

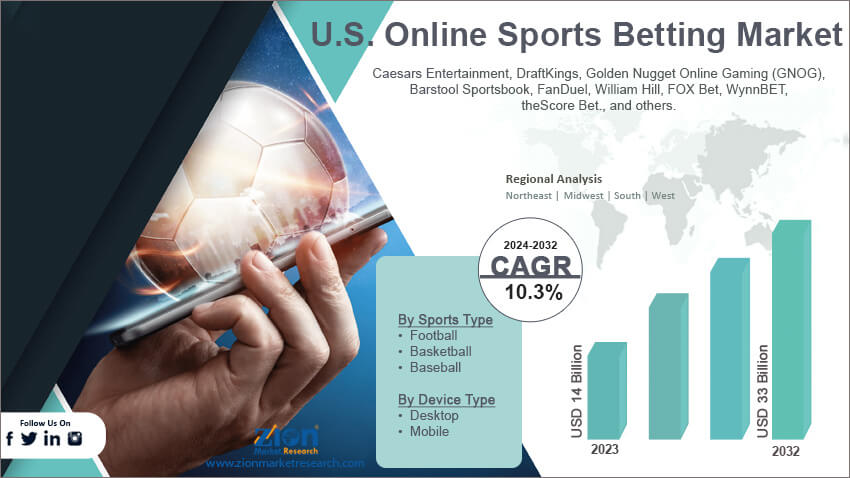

U.S. Online Sports Betting Market By Sports Type (Football, Basketball, and Baseball), By Device Type (Desktop and Mobile), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

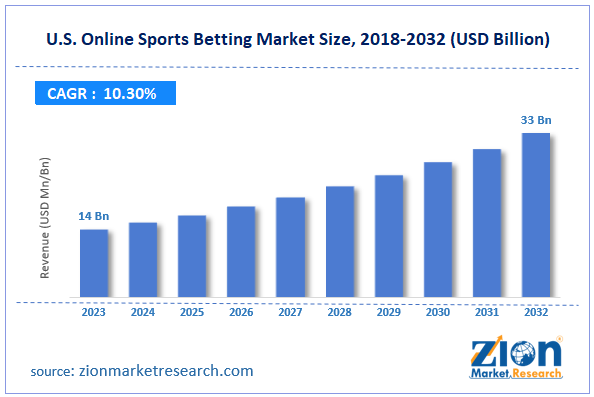

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 14 Billion | USD 33 Billion | 10.3% | 2023 |

U.S. Online Sports Betting Industry Prospective:

The U.S. online sports betting market size was evaluated at $14 billion in 2023 and is slated to hit $33 billion by the end of 2032 with a CAGR of nearly 10.3% between 2024 and 2032.

U.S. Online Sports Betting Market: Overview

Sports betting involves placing wagers on the sports event results. There are various kinds of sports betting such as money line betting, fixed-odds betting, under betting, futures betting, parlay betting, and point spread betting. A rise in online engagement activities and the need for improving betting experience has steered the demand for online sports betting activities in countries such as the U.S.

Key Insights

- As per the analysis shared by our research analyst, the U.S. online sports betting market is projected to expand annually at the annual growth rate of around 10.3% over the forecast timespan (2024-2032)

- In terms of revenue, the U.S. online sports betting market size was evaluated at nearly $14 billion in 2023 and is expected to reach $33 billion by 2032.

- The global U.S. online sports betting market is anticipated to grow rapidly over the forecast timeline owing to an increment in the popularity of online betting on sports in countries such as the U.S.

- In terms of sports type, the football segment is slated to register the highest CAGR over the forecast period.

- Based on device type, the mobile segment is predicted to contribute majorly towards the U.S. industry revenue in the upcoming years.

- Region-wise, the Southern online sports betting industry is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

U.S. Online Sports Betting Market: Growth Factors

A surge in the popularity of e-sports will drive the growth of the market in the U.S. over 2024-2032

The growth of the U.S. online sports betting market over the forecast period can be credited to an increment in the popularity of online betting on sports in countries such as the U.S. Technological innovations and the rise in legalization of sports betting activities in various states of the U.S. will spearhead the growth of the market in the U.S. With large-scale acceptance of online sports betting in the U.S., the market for online sports betting is gaining traction in the country. With e-sports activities ingrained in the routine life of the people of the U.S., the market in the country is projected to expand by leaps & bounds in the years ahead. Big data analytics, zero-sum game theory, and association rule mining (or Apriori algorithm) making use of probability are likely to play a pivotal role in influencing the growth of the market in the U.S.

U.S. Online Sports Betting Market: Restraints

Rise in the cases of hacking to restrict the growth of the industry in the U.S. in the coming eight years

With strict laws governing online sports betting activities and few states in the U.S. legalizing online betting, the U.S. online sports betting industry is likely to experience a sharp decline in growth in the coming years. Cyber-security threats and hacking incidents can prove to be a huge threat to the expansion of the industry in the country.

U.S. Online Sports Betting Market: Opportunities

Large-scale use of AI & IoT for accurately predicting outcomes of online sports betting will prop up the market surge in the U.S.

Large-scale presence of professional sports leagues and macroeconomic factors such as an increase in the per capita income & use of online technologies are likely to pave the way for humungous growth of the U.S. online sports betting market. Furthermore, the utilization of AI and blockchain technologies for enhancing the prediction in online betting activities has further enlarged the scope of growth of online sports betting activities in the U.S.

U.S. Online Sports Betting Market: Challenges

A surge in the match-fixing events and glitches experienced in digital payment can challenge the industry growth in the country

An increase in match-fixing cases and challenges associated with online payment processing can pose a huge impediment to the growth of the U.S. online sports betting industry. Apart from this, a rise in the taxes levied by various U.S. states on the game operators can not only affect the profits of online sports betting business but also challenge the industry growth in the country.

U.S. Online Sports Betting Market: Segmentation

The U.S. online sports betting market is divided into sports type, device type, and region.

In terms of sports type, the U.S. online sports betting market across the globe is bifurcated into football, basketball, and baseball segments. Additionally, the football segment, which gained approximately 68% of the market earnings in 2023, is expected to register the highest gains during the period from 2024 to 2032 subject to an increase in the professional football clubs and events in the U.S. Furthermore, NFL or National Football League is a leading football club in the U.S. and hence people involved in the online sports betting provide a slew of betting alternatives for NFL games such as point spreads, prop betting, futures bets, and money line bets.

Based on the device type, the U.S. online sports betting industry is divided into dissolved desktop and mobile segments. Additionally, the mobile segment, which accrued about three-fourths of the industry revenue in 2023, is set to make major contributions towards the industry share in the U.S. during the forecast timeframe owing to a prominent surge in the use of smartphones in various states of the U.S. Apparently, a large number of online sports betting apps are available on both iOS and Android smartphones, thereby further spurring the segmental growth.

U.S. Online Sports Betting Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Online Sports Betting Market |

| Market Size in 2023 | USD 14 Billion |

| Market Forecast in 2032 | USD 33 Billion |

| Growth Rate | CAGR of 10.3% |

| Number of Pages | 225 |

| Key Companies Covered | Caesars Entertainment, DraftKings, Golden Nugget Online Gaming (GNOG), Barstool Sportsbook, FanDuel, William Hill, FOX Bet, WynnBET, theScore Bet., and others. |

| Segments Covered | By Sports Type, By Device Type, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. Online Sports Betting Market: Regional Insights

Northeast region of the U.S. to lead the market in the country over the forecast period

The northeast region, which accounted for two-fifths of the U.S. online sports betting market share in 2023, is anticipated to establish a major position in the U.S. market in the ensuing years. Moreover, the regional market surge in the forecast timespan can be attributed to an increment in the number of sports fans in Philadelphia, New York, and Boston. Apart from this, thriving sports activities and a rich sports culture with a large number of professional sports teams in the region will boost the growth of the market.

Southern online sports betting industry is predicted to register the fastest growth rate annually in the next few years. The expansion of the industry in the region can be due to a prominent rise in the number of sports enthusiasts in the region. Furthermore, the legalization of online sports betting in Tennessee, Louisiana, and Virginia along with a surge in the popularity of e-sports in Texas and Florida will drive the regional industry growth.

Key Developments

- In January 2021, states such as Arizona, Wyoming, and Connecticut introduced laws in allowing online sports betting. Such moves will drive the growth of online sports betting activities in the U.S.

U.S. Online Sports Betting Market: Competitive Space

The U.S. online sports betting market profiles key players such as:

- Caesars Entertainment

- DraftKings

- Golden Nugget Online Gaming (GNOG)

- Barstool Sportsbook

- FanDuel

- William Hill

- FOX Bet

- WynnBET

- theScore Bet.

The U.S. online sports betting market is segmented as follows:

By Sports Type

- Football

- Basketball

- Baseball

By Device Type

- Desktop

- Mobile

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

Sports betting involves placing wagers on the sports event results. There are various kinds of sports betting such as money line betting, fixed-odds betting, under betting, futures betting, parlay betting, and point spread betting.

The U.S. online sports betting market growth over the forecast period can be owing to the use of big data analytics, zero-sum game theory, and association rule mining (or apriori algorithm) in online sports betting in the U.S.

According to a study, the global U.S. online sports betting industry size was $14 billion in 2023 and is projected to reach $33 billion by the end of 2032.

The global U.S. online sports betting market is anticipated to record a CAGR of nearly 10.3% from 2024 to 2032.

The Southern online sports betting industry is set to register the fastest CAGR over the forecasting timeline owing to a prominent rise in the number of sports enthusiasts in the region. Furthermore, the legalization of online sports betting in Tennessee, Louisiana, and Virginia along with a surge in the popularity of e-sports in Texas and Florida will drive the regional industry growth.

The U.S. online sports betting market is led by players such as Caesars Entertainment, DraftKings, Golden Nugget Online Gaming (GNOG), Barstool Sportsbook, FanDuel, William Hill, FOX Bet, WynnBET, and theScore Bet.

The U.S. online sports betting market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed