U.S. Polyethylene Market Size, Share, Analysis, Trends, Forecasts, 2032

U.S. Polyethylene Market By Type (HDPE, LLDPE, and LDPE), By End-User (Packaging, Farming, Automotive, Consumer Goods, Construction, Healthcare, and Pharmaceuticals), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

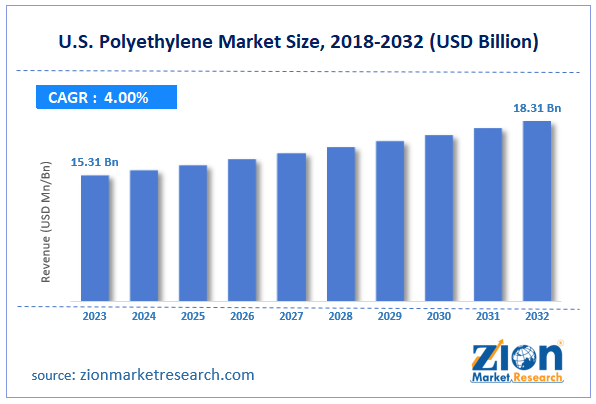

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 15.31 Billion | USD 18.31 Billion | 4% | 2023 |

U.S. Polyethylene Industry Prospective:

The U.S. polyethylene market size was evaluated at $15.31 billion in 2023 and is slated to hit $18.31 billion by the end of 2032 with a CAGR of nearly 4% between 2024 and 2032.

U.S. Polyethylene Market: Overview

Polyethylene is an immensely used thermoplastic polymer produced from ethylene polymerization. Apparently, it is of a versatile nature and is used humungously in packaging and vehicle components. There are two kinds of polyethylene, namely, high-density polyethylene and low-density polyethylene. Key features of the product include lightweight, recyclability, flexibility, and durability.

Key Insights

- As per the analysis shared by our research analyst, the U.S. polyethylene market is projected to expand annually at the annual growth rate of around 4% over the forecast timespan (2024-2032)

- In terms of revenue, the U.S. polyethylene market size was evaluated at nearly $15.31 billion in 2023 and is expected to reach $18.31 billion by 2032.

- The U.S. polyethylene market is anticipated to grow rapidly over the forecast timeline owing to the extensive use of the product in farming, packaging, construction, consumer goods, and automotive sectors.

- In terms of type, the HDPE segment is slated to register the highest CAGR over the forecast period.

- Based on end-user, the packaging segment is predicted to contribute majorly towards the U.S. industry share in the upcoming years.

- Region-wise, the southern polyethylene industry in the U.S. is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

U.S. Polyethylene Market: Growth Factors

Massive product penetration in various end-use sectors to boost the market growth in the U.S.

An extensive use of the product in farming, packaging, construction, consumer goods, and automotive sectors will prop up the expansion of the U.S. polyethylene market. Surging use of the product in pipes & plumbing, automotive parts, household parts, and electrical applications will drive the market trends in the country. Moreover, an increase in the need for infrastructural growth will proliferate the growth of the industry in the country. Easy access to raw components in the country, with the latter having an abundance of ethane and natural gas, is likely to uplift the growth of the market in the U.S.

U.S. Polyethylene Market: Restraints

Non-recyclable nature of the product can impede the growth of the industry in the U.S.

Non-degradable nature of polyethylene along with a ban on the use of polyethylene bags in India & China, as well as developed economies such as the U.S., can retard the expansion of the U.S. polyethylene industry. Rising GHG emissions can further deteriorate the growth of the industry in the country. An increase in quality control activities leading to an increment in operating costs can halt the expansion of the industry in the country.

U.S. Polyethylene Market: Opportunities

A surge in the use of the product in fabrics and agriculture to open lucrative growth opportunities for the market in the country

Large-scale use of the product in trash bags due to the puncture-resistant feature of the latter can open new growth avenues for the U.S. polyethylene market. Furthermore, the product is also used in liners and geomembranes for reservoirs, lakes, and ponds across the U.S. Reportedly, an increase in the product penetration in fishing nets, industrial fabrics, and farming nets will enhance the scope of the market demand in the U.S.

U.S. Polyethylene Market: Challenges

Changing costs of crude oil and rising environmental degradation can reduce the product demand in the upcoming years

Fluctuating crude oil costs and an increase in the pollution created due to plastic waste can impede the expansion of the U.S. polyethylene industry in the coming years. Easy availability of biodegradable plastics will further challenge the growth of the sector in the country. Logistics challenges and supply chain fluctuations, as well as price pressure, can decimate the expansion of the U.S. industry in the years to come.

U.S. Polyethylene Market: Segmentation

The U.S. polyethylene market is divided into type, end-user, and region.

In terms of type, the U.S. polyethylene market across the globe is bifurcated into HDPE, LLDPE, and LDPE segments. Additionally, the HDPE segment, which gained about 70% of the U.S. market revenue in 2023, is expected to register the highest gains during the time-interval from 2024 to 2032 subject to beneficial product features such as reduced production costs, high-strength-to-density ratio, and massive heat resistance. In addition, the product also offers massive resistance to chemicals as well as solvents, thereby leading to its humungous usage in bottle caps and food storage containers.

Based on the end-user, the U.S. polyethylene industry is divided into packaging, farming, automotive, consumer goods, construction, healthcare, and pharmaceutical segments. Additionally, the packaging segment, which accrued about 63% of the industry revenue in 2023, is set to make major contributions towards the industry share in the U.S. during the forecast timeline owing to immense product usage in the production of packaging with a rise in the use of packaging solutions in the consumer goods as well as food & beverages.

U.S. Polyethylene Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Polyethylene Market |

| Market Size in 2023 | USD 15.31 Billion |

| Market Forecast in 2032 | USD 18.31 Billion |

| Growth Rate | CAGR of 4% |

| Number of Pages | 213 |

| Key Companies Covered | Exxon Mobil Corporation, SABIC Industries, Dow Inc., Reliance Industries Limited, Chevron Phillips Chemical Company LLC, China National Petroleum Corporation, LyondellBasell Industries N.V., Ducor Petrochemicals, Formosa Plastics Corporation, INEOS Group Holdings S.A., Formosa Plastic Group, Westlake Chemical Corporation, ISCO Industries, Nova Chemicals Corporation, MOL Group, Braskem S.A., Borealis AG, Sasol Limited, and others. |

| Segments Covered | By Type, By End-User, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. Polyethylene Market: Regional Insights

Northeastern region of the U.S. to dominate the market growth in the country over forecast timeline

The Northeastern region, which accounted for half of the U.S. polyethylene market share in 2023, is expected to set up a dominating position in the U.S. market in the upcoming years. In addition to this, the regional market expansion in the forecast timeline can be a result of the humungous use of the product in the pharmaceuticals, packaging, and consumer goods sectors. Furthermore, the flourishing e-commerce sector and rapid infrastructural surge will multiply the growth of the market in the region.

Southern polyethylene industry in the U.S. is predicted to register the highest growth rate annually in the next few years. The growth of the industry in the southern part of the country can be due to flourishing construction activities in the region. Moreover, an increase in agricultural activities will proliferate the expansion of the industry in the region. A rise in the oil & gas extraction and availability of well-developed and strong logistics & transportation along with major ports such as New Orleans and Houston located in the Southern part of the U.S. will steer the industry expansion in the country.

Key Developments

- In the second half of 2023, Nova Chemicals Corporation signed an MOU with Amcor, a key player in the packaging sector, for supplying mechanically recycled Polyethylene resin to customers.

- In the second quarter of 2022, ExxonMobil Corporation declared of introducing Exceed S performance PE resins, a product reducing complexity in the film design.

U.S. Polyethylene Market: Competitive Space

The U.S. polyethylene market profiles key players such as:Exxon Mobil Corporation

- SABIC Industries

- Dow Inc.

- Reliance Industries Limited

- Chevron Phillips Chemical Company LLC

- China National Petroleum Corporation

- LyondellBasell Industries N.V.

- Ducor Petrochemicals

- Formosa Plastics Corporation

- INEOS Group Holdings S.A.

- Formosa Plastic Group

- Westlake Chemical Corporation

- ISCO Industries

- Nova Chemicals Corporation

- MOL Group

- Braskem S.A.

- Borealis AG

- Sasol Limited

The U.S. polyethylene market is segmented as follows:

By Type

- HDPE

- LLDPE

- LDPE

By End-User

- Packaging

- Farming

- Automotive

- Consumer Goods

- Construction

- Healthcare

- Pharmaceuticals

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

Polyethylene is an immensely used thermoplastic polymer produced from ethylene polymerization. Apparently, it is of a versatile nature and is used humungously in packaging and vehicle components.

The U.S. polyethylene market growth over the forecast period can be owing to the surging use of the product in pipes & plumbing, automotive parts, household parts, and electrical applications.

According to a study, the U.S. polyethylene industry size was $15.31 billion in 2023 and is projected to reach $18.31 billion by the end of 2032.

The global U.S. polyethylene market is anticipated to record a CAGR of nearly 4% from 2024 to 2032.

Southern polyethylene industry in the U.S. is set to register the fastest CAGR over the forecasting timeline owing to flourishing construction activities in the region. Moreover, an increase in agriculture activities will proliferate the expansion of the industry in the region. A rise in the oil& gas extraction and availability of well-developed and strong logistics & transportation along with major ports such as New Orleans and Houston located in the Southern part of the U.S. will steer the industry expansion in the country.

The U.S. polyethylene market is led by players such as Exxon Mobil Corporation, SABIC Industries, Dow Inc., Reliance Industries Limited, Chevron Phillips Chemical Company LLC, China National Petroleum Corporation, LyondellBasell Industries N.V., Ducor Petrochemicals, Formosa Plastics Corporation, INEOS Group Holdings S.A., Formosa Plastic Group, Westlake Chemical Corporation, ISCO Industries, Nova Chemicals Corporation, MOL Group, Braskem S.A., Borealis AG, and Sasol Limited.

The U.S. polyethylene market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed