U.S. Private 5G Network Market Size, Share, Analysis, Trends, Growth, 2032

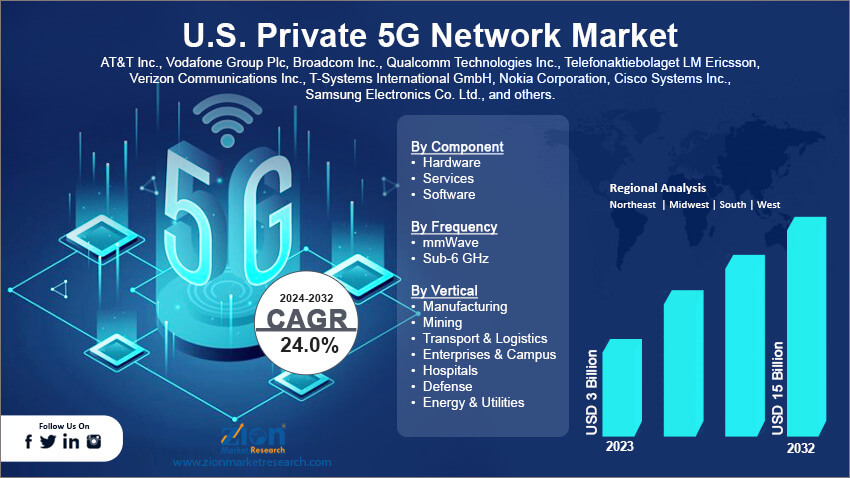

U.S. Private 5G Network Market By Component (Hardware, Services, and Software), By Frequency (mmWave and Sub-6 GHz), By Vertical (Manufacturing, Mining, Transport & Logistics, Enterprises & Campus, Hospitals, Defense, and Energy & Utilities), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032 -

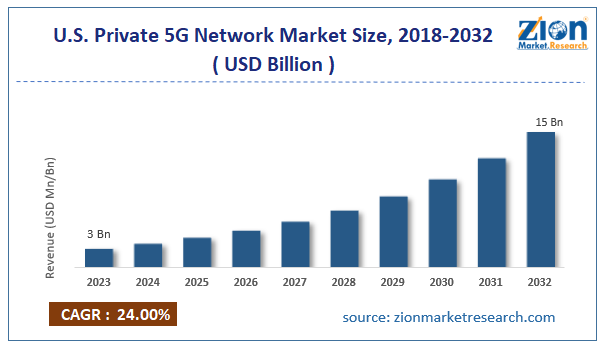

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3 Billion | USD 15 Billion | 24% | 2023 |

U.S. Private 5G Network Industry Prospective:

The U.S. private 5G network market size was evaluated at $3 billion in 2023 and is slated to hit $15 billion by the end of 2032 with a CAGR of nearly 24% between 2024 and 2032.

U.S. Private 5G Network Market: Overview

A private 5G network is a strong mobile network operating in the same manner as a public 5G network. Moreover, it helps the owner offer restricted access and use licensed as well as non-licensed wireless spectrum. Reportedly, it assists in improving current network capabilities. Apparently, a private 5G network is installed as a service that is totally hybrid and sliced.

Key Insights

- As per the analysis shared by our research analyst, the U.S. private 5G network market is projected to expand annually at the annual growth rate of around 24% over the forecast timespan (2024-2032)

- In terms of revenue, the U.S. private 5G network market size was evaluated at nearly $3 billion in 2023 and is expected to reach $15 billion by 2032.

- The global U.S. private 5G network market is anticipated to grow rapidly over the forecast timeline owing to escalating demand for dedicated networks along with the flourishing industrial Internet of Things sector.

- In terms of component, the hardware segment is slated to register the highest CAGR over the forecast period.

- Based on frequency, the sub-6 GHz segment is predicted to contribute humungously towards the industry revenue in the upcoming years.

- On the basis of vertical, the manufacturing segment is predicted to contribute dominate the segmental expansion over the analysis period.

- Region-wise, the Northeast private 5G network industry in the U.S. is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

U.S. Private 5G Network Market: Growth Factors

Huge usage of a robust network is anticipated to proliferate the market growth in the U.S.

Escalating demand for dedicated networks along with the flourishing industrial Internet of Things sector will boost the growth of the market in the country. Favorable government schemes along with allotting of spectrum for private networking have contributed immensely to the growth of the market in the U.S. A surge in the highlight on preventing data breaches, along with rapidly expanding smart cities & IoT equipment, has raised the demand for private 5G network systems in the U.S. An increase in the 5G network providers in various states of the U.S. and joint ventures & agreements between firms such as Lockheed Martin and Verizon for securing their network connections will drive the market growth trends in the U.S.

U.S. Private 5G Network Market: Restraints

Growing competition from competitors to restrict the growth of the industry in the U.S. by 2032

Huge deployment and maintenance costs along with the lack of availability of experts can impede the growth of the U.S. private 5G network industry. An increase in competition from business rivals can also put brakes on the industry surge in the years ahead.

U.S. Private 5G Network Market: Opportunities

An increase in the application of the private 5G network in robotics will open new growth opportunities for the U.S. market

A surge in the utilization of connected things in public safety, energy, transport, and manufacturing sectors will help craft an escalating growth map tending toward the positive axis for the U.S. private 5G network market. Apart from this, surging use of automated guided vehicles and collaborative robots has catapulted the use of private 5G networks in the U.S. market. Moreover, a rise in the number of smart cities in the U.S. and the launching of a private 5G network by Deloitte in the U.S. will prop up the market growth in the country.

U.S. Private 5G Network Market: Challenges

Growing requirement for fund allocation to challenge the industry surge over 2024-2032

Surging investment costs along with strict regulations governing the use of the private 5G network are anticipated to strike down the growth of the U.S. private 5G network industry. Furthermore, surging cases of hacking can further curb the expansion of the industry in the U.S.

U.S. Private 5G Network Market: Segmentation

The U.S. private 5G network market is divided into component, frequency, vertical, and region.

In terms of component, the U.S. private 5G network market is bifurcated into hardware, services, and software segments. Additionally, the hardware segment, which gained approximately half of the market revenue in 2023, is set to register the fastest growth rate yearly during the time interval from 2024 to 2032. The main factor fostering the segmental expansion can be credited to the large-scale installation of a radio access network and backhaul. Additionally, the necessity for enhancing connectivity for linking large sensor chains at various factories is predicted to prop up the scope of the segment surge in the years ahead.

On the basis of frequency, the U.S. private 5G network industry is sectored into mmWave and sub-6 GHz segments. In addition to this, the sub-6 GHz segment, which accrued 55% of the industry share in 2023, is likely to lead the segmental surge in the U.S. in the ensuing years. The segmental expansion can be due to the massive utilization of sub-6GHz frequency models by firms operating in the country.

Based on the vertical, the U.S. private 5G network market is divided into enterprises & campuses, hospitals, manufacturing, transport & logistics, mining, defense, and energy & utilities segments. Furthermore, the manufacturing segment, which dominated the segmental landscape in 2023, is projected to continue the segmental domination in the upcoming years. The growth can be due to the elevated growth of private network infrastructure in the U.S. for enhancing the operational efficacy of the manufacturing units.

U.S. Private 5G Network Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Private 5G Network Market |

| Market Size in 2023 | USD 3 Billion |

| Market Forecast in 2032 | USD 15 Billion |

| Growth Rate | CAGR of 24% |

| Number of Pages | 220 |

| Key Companies Covered | AT&T Inc., Vodafone Group Plc, Broadcom Inc., Qualcomm Technologies Inc., Telefonaktiebolaget LM Ericsson, Verizon Communications Inc., T-Systems International GmbH, Nokia Corporation, Cisco Systems Inc., Samsung Electronics Co. Ltd., and others. |

| Segments Covered | By Component, By Frequency, By Vertical, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. Private 5G Network Market: Regional Insights

Southern part of the U.S. is expected to dominate the market surge over 2024-2032

The Southern part, which accrued 60% of the U.S. private 5G network market share in 2023, is set to uphold its leading place in the U.S. market in the years ahead. In addition, the regional market surge in the forecast timeline can be credited to surging acceptance of industrial Internet of Things solutions in cameras and sensors in various states of the U.S. Need for low-latency connections has translated into extensive use of private 5G networks in IIoT applications. Various states are aiding the installation of private 5G networks in the country. Citing an instance, in 2022, Texas allotted 3.5 GHz spectrum for private 5G networking. Large-scale presence of giant players in the southern part of the U.S. benefitting automotive & aerospace sectors will accentuate the growth of the market in the region.

The Northeast private 5G network industry in the U.S. is predicted to record the highest rate of expansion annually within the next eight years. The growth of the private 5G network industry in the Northeastern part of the U.S. can be due to favorable schemes launched by governors of the states in the Northern part of the U.S. Moreover, smart city concepts and a favorable business environment will steer the growth of the industry growth in the industry.

U.S. Private 5G Network Market: Competitive Space

The U.S. private 5G network market profiles key players such as:

- AT&T Inc.

- Vodafone Group Plc

- Broadcom Inc.

- Qualcomm Technologies Inc.

- Telefonaktiebolaget LM Ericsson

- Verizon Communications Inc.

- T-Systems International GmbH

- Nokia Corporation

- Cisco Systems Inc.

- Samsung Electronics Co. Ltd.,

The U.S. private 5G network market is segmented as follows:

By Component

- Hardware

- Services

- Software

By Frequency

- mmWave

- Sub-6 GHz

By Vertical

- Manufacturing

- Mining

- Transport & Logistics

- Enterprises & Campus

- Hospitals

- Defense

- Energy & Utilities

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

A private 5G network is a strong mobile network that operates in the same manner as a public 5G network.

The U.S. private 5G network market's growth over the forecast period can be attributed to favorable government schemes and the allotting of spectrum for private networking.

According to a study, the global U.S. private 5G network industry size was $3 billion in 2023 and is projected to reach $15 billion by the end of 2032.

The global U.S. private 5G network market is anticipated to record a CAGR of nearly 24% from 2024 to 2032.

The northeast private 5G network industry of the U.S. is set to register the fastest CAGR over the forecasting timeline owing to favorable schemes launched by the governor of the states in the Northern part of the U.S. Moreover, smart city concepts and favorable business environment will steer the growth of the industry growth in the industry.

The U.S. private 5G network market is led by players such as AT&T Inc., Vodafone Group Plc, Broadcom Inc., Qualcomm Technologies, Inc., Telefonaktiebolaget LM Ericsson, Verizon Communications Inc., T-Systems International GmbH, Nokia Corporation, Cisco Systems, Inc., and Samsung Electronics Co., Ltd..

The U.S. private 5G network market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed