US Private Equity Market Size, Share, Trends, Growth and Forecast 2032

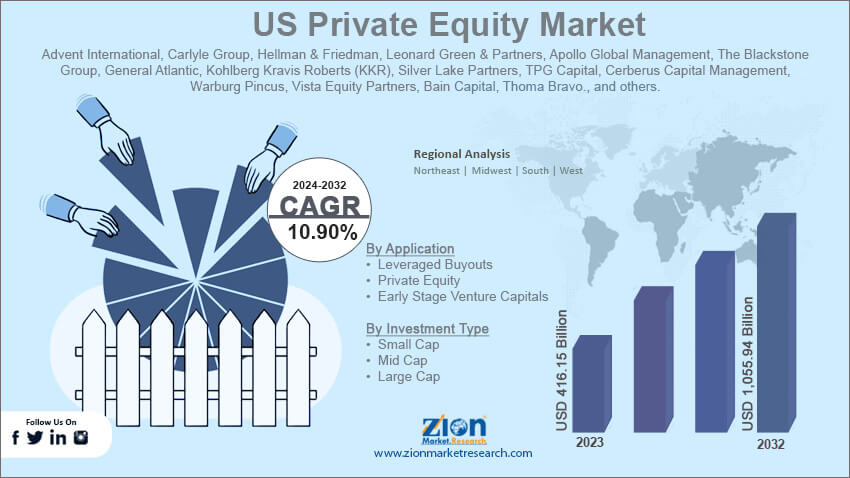

US Private Equity Market By Application (Leveraged Buyouts, Private Equity, and Early Stage Venture Capitals), By Investment Type (Small Cap, Mid Cap, and Large Cap), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

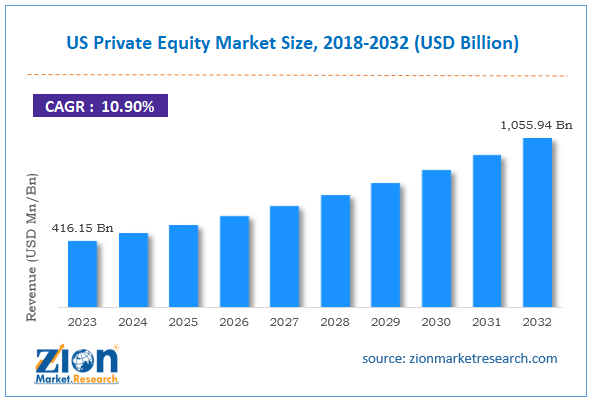

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 416.15 Billion | USD 1,055.94 Billion | 10.90% | 2023 |

US Private Equity Industry Prospective:

The US private equity market size was worth around USD 416.15 billion in 2023 and is predicted to grow to around USD 1,055.94 billion by 2032 with a compound annual growth rate (CAGR) of roughly 10.90% between 2024 and 2032.

US Private Equity Market: Overview

The US private equity industry is one of the world’s strongest industries as of 2024. The term ‘private equity’ refers to investment-based partnerships that focus on buying and managing companies for a limited time before being sold for profit. Funds in private equity may be used for acquiring publicly listed or private companies.

Generally, the most common strategy of a private equity firm is to invest in businesses that are not yet publicly traded on national stock exchanges. The fund managers in private equity are also known as general partners (GPs). They are responsible for selling the acquired company later with improved return on investment (ROI). This can be achieved by improving the company portfolio, expanding into unexplored markets, or adding other acquired businesses.

The US market of private equity is highly lucrative. The country is home to some of the biggest brands competing in the international private equity sector. One of the major reasons for higher regional market dominance is the promising track record of the industry in delivering higher returns even during an economic slowdown. However, the industry is also often associated with high debt which has been known to cause bankruptcy in certain situations. The increasing reports of companies facing heavy financial losses when associating with private equity firms will limit the industry’s growth rate.

Key Insights:

- As per the analysis shared by our research analyst, the US private equity market is estimated to grow annually at a CAGR of around 10.90% over the forecast period (2024-2032)

- In terms of revenue, the US private equity market size was valued at around USD 416.15 billion in 2023 and is projected to reach USD 1,055.94 billion, by 2032.

- The US private equity market is projected to grow at a significant rate due to the growing number of private companies in the US

- Based on the application, the leveraged buyouts segment is growing at a high rate and will continue to dominate the regional market as per industry projection

- Based on the investment type, the large-cap segment is anticipated to command the largest market share

- Based on region, Massachusetts and California are projected to dominate the regional market during the forecast period

Request Free Sample

Request Free Sample

US Private Equity Market: Growth Drivers

Growing number of private companies in the US will fuel the market demand rate

The US private equity market is expected to grow due to the rising number of private companies in the country. The US is a global leader in terms of research, development, and innovation. The country has had several environmental, geographical, and political factors working in its favor allowing it to become one of the most influential regions worldwide. As of current times, the US has a robust infrastructure that supports futuristic technologies and innovation-based ideas. The growing number of start-ups in the country is indicative of its growth prospects. In 2023, the US reported over 75,000 startups out of which over 7.05% were based in the financial technology (FinTech) market. The US runs the ‘Startup America’ initiative through which it focuses on promoting and inspiring high-growth firms that have the potential to bring economic growth to the country. Startup America aims to expand access to high capital required by new companies along with running extensive entrepreneurship education and mentorship programs & other such benefits.

Rising shift of private equity companies toward the energy market may fuel the market revenue

Private equity companies in the US are inclining toward the thriving energy sector in the country and other regions. Energy demand in the US has increased as the country moves toward higher economic growth. The rise in the number of Information Technology (IT) companies, growing fuel consumption among residents and regional companies, and higher focus on green solutions are the essential reasons for higher energy consumption. In 2022, the country’s energy consumption rate was around 4 trillion kilowatt hours as per the US Energy Information Administration. Market research indicates that the energy transition deals backed by private equity funds grew from USD 500.01 million in 2018 to around USD 30 billion in 2023 in the US. In June 2024, Energy Capital Partners, a leading private equity company in the US raised around USD 6.7 billion in its fifth flagship equity strategy fund as the company plans to invest in the clean energy sector. Such moves are expected to help the US private equity market grow.

US Private Equity Market: Restraints

High debt associated with private equity may restrict the market expansion rate

The US industry for private equity is projected to be limited due to the high debt associated with the investment. Private equity through leveraged buyout (LBO) deals with buying a company with a mixture of equity and borrowed money. However, the transaction of the debt is mentioned in the book of accounts of the company that has been bought and not the private equity firm. This means that if the acquired company performs well the profits will be shared with private equity firms. However, if the company suffers a loss, the debt has to be bought by the acquired firm and the private equity company remains free of any repercussions. As per a recent survey conducted by the California Polytechnic State University, around 20% of large-scale companies bought through LBO go bankrupt within a decade of the purchase.

US Private Equity Market: Opportunities

Development of Artificial Intelligence (AI) tools for private equity companies will generate expansion possibilities

The US private equity market is expected to generate high growth opportunities as more companies plan to invest in AI tools. Artificial Intelligence has shown great promise in helping companies navigate through large amounts of data and make informed decisions. In June 2024, Cisco Investments, the investment wing of Cisco, launched a USD 1 billion AI investment fund. The company will use the money to promote infrastructure that supports AI solutions. The company has already made strategic investments in companies such as Mistral AI, Cohere, and Scale AI. In April 2024, Chronograph, a leading player catering especially to the needs of print-generation portfolio monitoring solutions for private equity companies, launched Chrono AI. The novel AI tool for private equity companies will be used by investors for analyzing and monitoring portfolio-related data on the cloud. The US has a broad market for advanced technologies including AI. The country has already made a mark in the global race for expanding AI applications.

US Private Equity Market: Challenges

Intense scrutiny of the US private equity market in recent times will challenge the market expansion rate

The US private equity industry has registered an increasing rate of intense scrutiny from regulatory bodies. Private equity companies are being accused of improper use of leverage and lack of transparency during deal signing. Additionally, the growing uncertainty over an economic slowdown in the country in the coming years may further challenge the industry’s expansion trend.

US Private Equity Market: Segmentation

The US private equity market is segmented based on application, investment type, and region.

Based on the application, the regional market divisions are leveraged buyouts, private equity, and early-stage venture capitals. In 2023, the highest growth was observed in the leveraged buyouts segment. It refers to the process of buying controlling shares of a company using investments outside investments or capital. LBOs function using high amounts of debt leading to greater scrutiny of the process in recent times. On average, the debt is around 60 to 80% of the purchase price.

Based on the investment type, the US private equity industry is fragmented into small-cap, mid-cap, and large-cap. In 2023, the highest demand was observed in the large-cap segment. This form of investment is mostly observed in mature companies or businesses that enjoy extensive market capitalization. The rising number of companies seeking capital for global expansion was the driving factor for segmental demand. Generally, large-cap companies enjoy capitalization of over USD 10 billion.

US Private Equity Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US Private Equity Market |

| Market Size in 2023 | USD 416.15 Billion |

| Market Forecast in 2032 | USD 1,055.94 Billion |

| Growth Rate | CAGR of 10.90% |

| Number of Pages | 229 |

| Key Companies Covered | Advent International, Carlyle Group, Hellman & Friedman, Leonard Green & Partners, Apollo Global Management, The Blackstone Group, General Atlantic, Kohlberg Kravis Roberts (KKR), Silver Lake Partners, TPG Capital, Cerberus Capital Management, Warburg Pincus, Vista Equity Partners, Bain Capital, Thoma Bravo., and others. |

| Segments Covered | By Application, By Investment Type, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US Private Equity Market: Regional Analysis

Massachusetts and California to drive market growth rate during the projection period

The US private equity market is projected to be led by coastal regions during the forecast period. In 2023, Massachusetts and California were among the leading states with the highest number of private equity companies driving the market. As per market research, around 7% of private companies in California were backed by private equity in 2023, On the other hand, the same rate for Massachusetts was around 6.15%. California, for instance, is filled with several high-potential start-ups. Similarly, Massachusetts is home to leading technology-based educational institutes such as the Massachusetts Institute of Technology (MIT). The IT and telecommunications sector along with the energy industry is fueling the regional market demand rate. In June 2024, New York-based private equity company KKR announced that it was seeking an investment of USD 20 billion for its North America-oriented private equity firm. Additionally, the US is home to some of the globally dominating private equity firms such as Blackstone, The Carlyle Group, and Thamo Bravo. As of August 2024, Blackstone’s net worth was reported around USD 100 billion.

US Private Equity Market: Competitive Analysis

The US private equity market is led by players like:

- Advent International

- Carlyle Group

- Hellman & Friedman

- Leonard Green & Partners

- Apollo Global Management

- The Blackstone Group

- General Atlantic

- Kohlberg Kravis Roberts (KKR)

- Silver Lake Partners

- TPG Capital

- Cerberus Capital Management

- Warburg Pincus

- Vista Equity Partners

- Bain Capital

- Thoma Bravo.

The US private equity market is segmented as follows:

By Application

- Leveraged Buyouts

- Private Equity

- Early Stage Venture Capitals

By Investment Type

- Small Cap

- Mid Cap

- Large Cap

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

The US private equity industry is one of the world’s strongest industries as of 2024. The term ‘private equity’ refers to investment-based partnerships that focus on buying and managing companies for a limited time before being sold for profit.

The US private equity market is expected to grow due to the rising number of private companies in the country.

According to study, the US private equity market size was worth around USD 416.15 billion in 2023 and is predicted to grow to around USD 1,055.94 billion by 2032.

The CAGR value of the US private equity market is expected to be around 10.90% during 2024-2032.

The US private equity market is projected to be led by coastal regions during the forecast period. In 2023, Massachusetts and California were among the leading states with the highest number of private equity companies driving the market.

The US private equity market is led by players like Advent International, Carlyle Group, Hellman & Friedman, Leonard Green & Partners, Apollo Global Management, The Blackstone Group, General Atlantic, Kohlberg Kravis Roberts (KKR), Silver Lake Partners, TPG Capital, Cerberus Capital Management, Warburg Pincus, Vista Equity Partners, Bain Capital and Thoma Bravo.

The report explores crucial aspects of the US private equity market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed