US School Bus Market Size, Share, Trends, Growth and Forecast 2032

US School Bus Market By Powertrain Type (Hybrid & Electric and Internal Combustion Engine), By Bus Type (Type D, Type C, Type B, and Type A), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

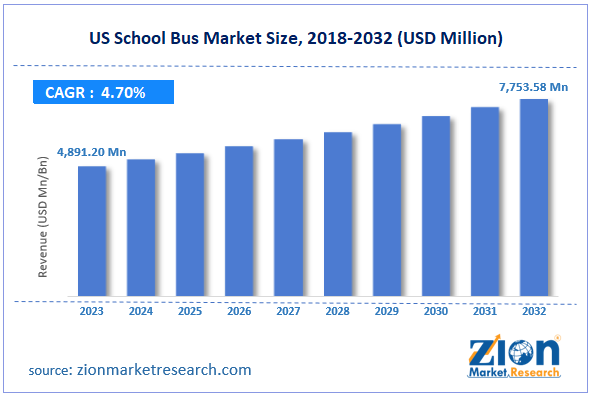

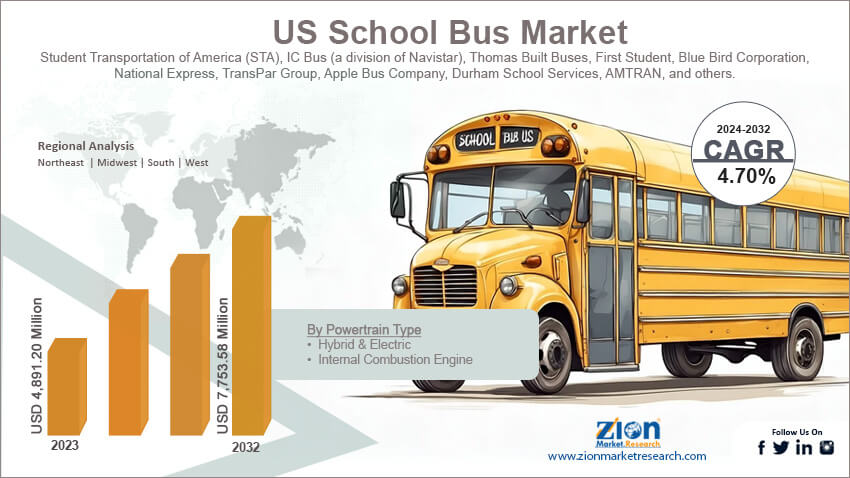

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4,891.20 Million | USD 7,753.58 Million | 4.70% | 2023 |

US School Bus Industry Prospective:

The US school bus market size was worth around USD 4,891.20 million in 2023 and is predicted to grow to around USD 7,753.58 million by 2032 with a compound annual growth rate (CAGR) of roughly 4.70% between 2024 and 2032.

US School Bus Market: Overview

The US school bus industry is a special segment of the regional automotive industry. It deals with designing, producing, and distributing buses designed especially for schools in the US. These vehicles are purpose-built and showcase designs that are significantly different from traditional buses used for public commuting and other purposes. School buses in the US are painted in distinct glossy yellow. Additionally, they are fitted with warning lights on the outside to ensure student safety. According to official reports, the US currently has more than 500,000 operational school buses. The growing number of schools and students in the US is expected to fuel the regional market demand. Additionally, the country’s school bus sector is expected to be further driven by the growing introduction of hybrid and electric buses that are environmentally friendly. One of the key restraints for the regional market growth rate is the high cost of manufacturing school buses.

Key Insights:

- As per the analysis shared by our research analyst, the US school bus market is estimated to grow annually at a CAGR of around 4.70% over the forecast period (2024-2032)

- In terms of revenue, the US school bus market size was valued at around USD 4,891.20 million in 2023 and is projected to reach USD 7,753.58 million by 2032.

- The US school bus market is projected to grow at a significant rate due to the rising number of schools in the US

- Based on the powertrain type, the internal combustion engine segment is growing at a high rate and will continue to dominate the regional market as per industry projection

- Based on the bus type, the type C segment is anticipated to command the largest market share

- Based on region, Massachusetts in the Eastern USA is projected to dominate the regional market during the forecast period

Request Free Sample

Request Free Sample

US School Bus Market: Growth Drivers

Rising number of schools in the US will drive the market demand rate

The US school bus market is projected to witness high growth due to the growing number of schools across the country. According to Mission Graduate, the US has around 115,171 schools. In the academic year 2020 and 2021, around 50.4 million students enrolled in public and private secondary and elementary schools. In July 2024, the state officials of the Newark region in the country responsible for funding school construction projects announced a new plan worth USD 153 million. The investment will be used for the construction of a new South Ward high school while also relocating a nearby elementary school. In July 2024, the Madison County Board of Education in Harvest, Alabama, approved a new project. The region is expected to register the construction of a new intermediate school worth over USD 43,766,500 and spread across 114,000 square feet. The first half of 2023 witnessed the construction inauguration of two building projects in Somerset County. Additionally, the US government has been focusing relentlessly on providing more funds for the improvement of the regional education sector. In March 2024, the US government proposed an investment of USD 82 billion in discretionary funding. The money is expected to be invested in early learning and K-12 education during the 2025 fiscal year.

Increasing digitization in the regional school bus sector will promote higher revenue during the projection period

School bus infrastructure in the US is undergoing massive changes in the form of the growing introduction of novel digital systems. These applications aim to enhance the safety features of the buses while focusing on improved communication and accountability. For instance, in January 2024, New York City announced the launch of the much-awaited school bus global positioning system (GPS) application. The NYC School Bus App is developed in association with Via, a rideshare company. The parents of around 150,000 students who ride through school buses can now track the school buses in real-time. Developing applications that make buses more secure will help promote greater confidence among parents.

US School Bus Market: Restraints

High cost of developing school buses in the US will limit the industry’s growth rate

The US school bus market is expected to be limited in terms of growth due to the high cost of developing the vehicles. For instance, the type C and D diesel variants can cost between USD 90,000 and USD 110,000. The price increases further as electric vehicles get introduced in the market. The price of developing a type C electric vehicle may be around USD 300,000. Several schools in the US have reported operating at limited or reduced budgets due to several factors. A 2020 report by The Century Foundation found that k-12 public schools in the country were underfunded by USD 150 billion per year. The reduced budgets significantly reduce the number of students who undertake educational activities.

US School Bus Market: Opportunities

Growing launch of new school buses, including electric variants, will generate massive expansion possibilities

The US school bus industry is projected to be led by the growing launch of new vehicles with improved features. In July 2024, IC Bus announced the launch of the next-generation CE Series school bus. The latest launch is a redesigned version of the existing CE Series, launched two decades ago. The most prominent features of the buses include improved total cost of ownership (TCO), enhanced driver comforts, and increased safety features. The introduction of electric school buses will promote higher adoption during the forecast period. The US is keen on changing the regional automotive industry with a special focus on reducing its impact on the regional environment. School buses in the US constitute a major part of the country’s automotive industry. In March 2024, Thomas Built Buses (TBB), one of the most prominent school bus manufacturers in North America, announced the delivery of its 1000th Saf-T-Liner C2 Jouley battery-electric school bus. In May 2024, Zum launched Oakland Unified School District's bidirectional, fully electric vehicle-to-grid (V2G) school bus fleet.

US School Bus Market: Challenges

Shortages in the availability of sufficient bus drivers in the country are a major challenge

The US school bus market faces a key challenge in terms of accessibility to reliable school bus drivers. According to the National Conference of State Legislatures, nearly 92% of education transportation staff face problems due to a shortage in the supply of bus drivers. Moreover, another key factor that affects the market growth rate is the struggle to achieve operational optimization and improve student experience. The regional industry is further impacted by the presence of several other alternatives for student transportation that lead to market segmentation.

US School Bus Market: Segmentation

The US school bus market is segmented based on powertrain type, bus type, and region.

Based on the powertrain type, the regional market divisions are hybrid & electric and internal combustion engines. In 2023, the highest demand was observed in the internal combustion engine segment. Market research indicates that over 90% of school buses in the USA are powered using diesel. However, efforts are underway to encourage more institutes to adopt electric vehicles. As per official reports by The White House, the US has set a vision for net-zero emissions by 2050. Additionally, the surge in the number of domestic electric vehicle makers may contribute to growth in the hybrid and electric segment during the projection period.

Based on the bus type, the regional market is fragmented into type D, type C, type B, and type A. In 2023, the highest demand was observed in the type C segment. These vehicles have a capacity of 78 students. They are the most widely used school buses across the country. Type D buses have a larger capacity, extending up to 90 passengers. The rise in investment for improvements in bus safety and operations will fuel the segmental demand.

US School Bus Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US School Bus Market |

| Market Size in 2023 | USD 4,891.20 Million |

| Market Forecast in 2032 | USD 7,753.58 Million |

| Growth Rate | CAGR of 4.70% |

| Number of Pages | 209 |

| Key Companies Covered | Student Transportation of America (STA), IC Bus (a division of Navistar), Thomas Built Buses, First Student, Blue Bird Corporation, National Express, TransPar Group, Apple Bus Company, Durham School Services, AMTRAN, and others. |

| Segments Covered | By Powertrain Type, By Bus Type, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US School Bus Market: Regional Analysis

Massachusetts in Eastern USA to dominate the market growth rate

The US school bus market is projected to register an exceptional growth rate in the eastern states. Massachusetts is likely to emerge as the leading revenue generator. The state has one of the best school systems in the country, which has led to a higher number of migrations across several parts of the state. For instance, Lawrence, Massachusetts is currently witnessing the construction of the new Henry K. Oliver K-8 School at the location of the previous Oliver Elementary School. The new structure is expected to retain some parts of its initial architecture. Upon completion, the school is likely to house 1,000 students. Across the United States, more schools and regions are incorporating advanced technologies to enhance student safety. For instance, in May 2024, Miami-Dade County Police and Miami-Dade County Public Schools (M-DCPS) announced a partnership with BusPatrol America. The joint collaboration is focusing on implementing South Florida's Largest and first school bus stop-arm camera enforcement program. More than 1000 buses in the region have been equipped with cameras for student safety. These cameras will help in catching drivers who may illegally pass halted school buses.

US School Bus Market: Competitive Analysis

The US school bus market is led by players like:

- Student Transportation of America (STA)

- IC Bus (a division of Navistar)

- Thomas Built Buses

- First Student

- Blue Bird Corporation

- National Express

- TransPar Group

- Apple Bus Company

- Durham School Services

- AMTRAN

The US school bus market is segmented as follows:

By Powertrain Type

- Hybrid & Electric

- Internal Combustion Engine

By Bus Type

- Type D

- Type C

- Type B

- Type A

By Region

- The U.S.

Table Of Content

Methodology

FrequentlyAsked Questions

The US school bus industry is a special segment of the regional automotive industry.

The US school bus market is projected to witness high growth due to the growing number of schools across the country.

According to a study, the US school bus market size was worth around USD 4,891.20 million in 2023 and is predicted to grow to around USD 7,753.58 million by 2032.

The CAGR value of the US school bus market is expected to be around 4.70% during 2024-2032.

The US school bus market is projected to register an exceptional growth rate in the eastern states.

The US school bus market is led by players like Student Transportation of America (STA), IC Bus (a division of Navistar), Thomas Built Buses, First Student, Blue Bird Corporation, National Express, TransPar Group, Apple Bus Company, Durham School Services and AMTRAN.

The report explores crucial aspects of the US school bus market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed