US Sesame Oil Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

US Sesame Oil Market By Source (Black Sesame Oil, White Sesame Oil, and Brown Sesame Oil), By Nature (Organic and Conventional), By End-User Industry (Pharmaceutical Industry, Food Industry, and Cosmetics & Personal Care Industry), By Type (Brown, Black, and White), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

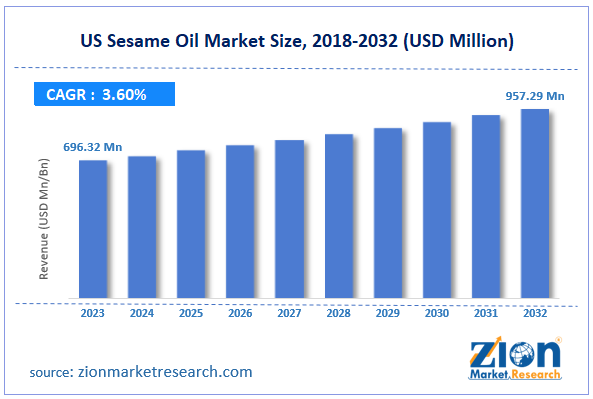

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 696.32 Million | USD 957.29 Million | 3.60% | 2023 |

US Sesame Oil Industry Prospective:

The US sesame oil market size was worth around USD 696.32 million in 2023 and is predicted to grow to around USD 957.29 million by 2032 with a compound annual growth rate (CAGR) of roughly 3.60% between 2024 and 2032.

US Sesame Oil Market: Overview

The US sesame oil industry is a growing market driven by the growing application of sesame oil across several sectors. Sesame oil is an edible vegetable oil. It is derived from sesame seeds. Market research suggests that sesame oil is the oldest known and used form of crop-based oil. In recent times, the demand for sesame oil has improved in the US. However, the manufacturing process is limited due to the unavailability of sufficient manual harvesting processes that are required for oil extraction from the seeds. Dehiscence is the process when the capsule protecting the sesame seeds bursts. This is only recorded when the seeds have completely ripened. Dehiscence time may vary naturally. Thus, farmers are forced to cut the sesame plants manually and place them in an upright position to facilitate ripening. The US market for sesame oil is not fully developed. Currently, the region continues to be dominated by other forms of cooking oil. For instance, soybean oil is the most widely consumed vegetable oil in the United States. However, factors such as increased awareness about the potential health benefits of sesame oil may improve the market growth rate. Concerns over associated allergies could challenge the market expansion trends during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the US sesame oil market is estimated to grow annually at a CAGR of around 3.60% over the forecast period (2024-2032)

- In terms of revenue, the US sesame oil market size was valued at around USD 696.32 million in 2023 and is projected to reach USD 957.29 million, by 2032.

- The US sesame oil market is projected to grow at a significant rate due to the increasing awareness of sesame oil's health benefits

- Based on the source, the white sesame oil segment is growing at a high rate and will continue to dominate the regional market as per industry projection

- Based on the end-user industry, the food industry segment is anticipated to command the largest market share

- Based on region, Northeastern states are projected to dominate the regional market during the forecast period

Request Free Sample

Request Free Sample

US Sesame Oil Market: Growth Drivers

Increasing awareness about sesame oil's health benefits may fuel the market growth rate

The US sesame oil market is expected to grow due to the rising awareness about several health benefits associated with sesame oil. Studies indicate that regular consumption of sesame oil has three major health benefits. The vegetable oil is considered a rich source of lignan, sesamol, and sesamin. These elements are known to facilitate apoptosis which in turn prevents the growth of cancer cells in colon cancer. Thus sesame oil is regarded to deliver anticancer potential. Additionally, it also helps in promoting metabolism and blood circulation due to its richness in omega-3 fats. Blood flow to the body tissues and organs increases if sesame oil is included in the diet. Due to the antioxidant properties of sesame oil, it is known to prevent Deoxyribonucleic acid (DNA) damage caused by radiation. Consumer lifestyle choices in the US are rapidly evolving. Buyers are actively seeking products that can help achieve or maintain a healthy lifestyle as the US is currently battling with dangerously rising levels of obesity and other medical conditions. As per the American Heart Association, around 49% of the US population suffers from some of the cardiovascular conditions with high blood pressure, stroke, and coronary heart disease as the most common medical diseases.

Increasing the expatriate population in the US and promoting food diversity will help fuel demand for sesame oil

The US has registered an increase in migration of people from other nationalities to the US over the years. The rising immigration rate in the country is driven by a rise in job opportunities as well as an increase in student population. For instance, the US is home to some of the world’s most renowned universities such as the Massachusetts Institute of Technology (MIT). As per official reports, more than 1,000,000 international students were studying in the country in the academic year 2022-2023. Additionally, in 2022, the US government offered permanent residency to over 1 million immigrants. The rise in the number of people from global ethnicities has led to an increase in food diversity. Some of the most popular cuisines in the US industry include Indian, Mexican, Italian, and Thai. The growing trend of introducing new food cultures in the United States may promote the US sesame oil market.

US Sesame Oil Market: Restraints

Dominance by other oil variants in the region will limit the industry’s growth rate

The US industry for sesame oil faces growth restrictions due to higher popularity and consumption of other types of edible oil. The most widely consumed oil in the US is derived from soybean. It is highly versatile as it can be used for feeding livestock as well as frying food products. Variants of olive oil are also becoming widely popular in the country. The US is one of the largest consumers of olive oil. The per capita consumption of olive oil per person in the US is 1 liter while the global average is 0.451 liter. Sesame oil is less popular in comparison.

US Sesame Oil Market: Opportunities

Increased investments in sesame cultivation will generate market growth opportunities

The US sesame oil market is expected to generate massive growth opportunities during the forecast period. The US government is investing heavily in promoting sesame cultivation across the country. In November 2023, the US Department of Agriculture (USDA) announced crop insurance for sesame cultivators across the country. As of 2024, the agency's Risk Management Agency (RMA) expanded its Actual Production History (APH) plan. The expansion will now allow sesame producers to seek written agreements in places where sesame and other such crops have been grown. In May 2024, Sabra Dipping Company, a US-based food producer influenced by the Middle East, partnered with Equinom, an Israel-based seed breeding firm. The partnership helped in creating a sesame seed that can easily grow in the US. Apart from sesame-based investments, the US agencies are working on promoting the expansion of organic food companies. In April 2024, Little Sesame, an organic food serving shop, announced that it had received an investment of USD 3 million from several venture groups. The USDA awarded nearly USD 2.2 million to the company to support chickpea farmers in the country. Such measures to assist organic food growers and suppliers will drive demand for sesame oil in the future.

US Sesame Oil Market: Challenges

Challenges associated with sourcing and further distribution may impact the market growth tend

The US sesame oil industry faces growth challenges due to problems arising in sourcing raw materials required for the production of the oil. Sesame seeds are difficult to extract. Moreover, seed growth depends on several environmental factors such as weather conditions and water availability. These factors may change resulting in volatility in product availability. Sesame oil is also known to cause allergies which could impact the regional market growth trend. Severe allergic reactions may cause anaphylaxis.

US Sesame Oil Market: Segmentation

The US sesame oil market is segmented based on source, nature, end-user industry, type, and region.

Based on the source, the regional market divisions are black sesame oil, white sesame oil, and brown sesame oil. In 2023, the highest demand was observed in the white sesame oil segment. This variant has high applications in the food sector especially Asian cuisines. The rising number of Asian restaurants and packaged food items in the US will promote a segmental demand rate. The most common Asian food dominating around 39.01% of the total share is Chinese food.

Based on nature, the US sesame oil industry is fragmented into organic and conventional.

Based on the end-user industry, the regional market segments are the pharmaceutical industry, food industry, and cosmetics & personal care industry. In 2023, the food industry was the leading consumer of sesame oil in the US. Food globalization has promoted the adoption of several global ingredients including sesame oil. The rising demand for organic food in the US will generate high demand for sesame oil during the projection period. Around 45.5% of the US population actively tries to consume some form of organic food in their diet.

Based on type, the US sesame oil industry divisions are brown, black, and white.

US Sesame Oil Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US Sesame Oil Market |

| Market Size in 2023 | USD 696.32 Million |

| Market Forecast in 2032 | USD 957.29 Million |

| Growth Rate | CAGR of 3.60% |

| Number of Pages | 228 |

| Key Companies Covered | International Collection, Eden Foods, Pure Indian Foods, Kadoya USA, Nuvita, Spectrum Organics, Pompeian, Loriva, Banyan Botanicals, La Tourangelle, Ahuacatlán, Kevala, Napa Valley Naturals, Ottogi America, Roland Foods., and others. |

| Segments Covered | By Source, By Nature, By End-User Industry, By Type, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US Sesame Oil Market: Regional Analysis

Northeastern states in the US dominate the market growth rate

The US sesame oil market will be dominated by the Northeastern states of the country. The rising health-conscious population in regions such as Vermont, Massachusetts, New Hampshire, Connecticut, and New York. The general population in these regions has higher health awareness driven by access to world-class healthcare facilities running awareness-generating initiatives. The demand is higher for cold-pressed and high-grade sesame oil as people enjoy popular Asian cuisines. The dining-out culture in Northeastern states of the US further promotes demand for sesame oil. A recent survey indicates that there is at least 1 Asian restaurant in over 72% of all US counties. Most producers of sesame oil and sesame cultivators focus on non-genetically modified organisms and organic certifications. The Southern states of the US including Florida, Alabama, Louisiana, Arkansas, Texas, and Virginia have high demand for sesame oil due to its culinary rich heritage. Moreover, the surging awareness about several health benefits of sesame oil is acting as a key driver for regional growth.

US Sesame Oil Market: Competitive Analysis

The US sesame oil market is led by players like:

- International Collection

- Eden Foods

- Pure Indian Foods

- Kadoya USA

- Nuvita

- Spectrum Organics

- Pompeian

- Loriva

- Banyan Botanicals

- La Tourangelle

- Ahuacatlán

- Kevala

- Napa Valley Naturals

- Ottogi America

- Roland Foods.

The US sesame oil market is segmented as follows:

By Source

- Black Sesame Oil

- White Sesame Oil

- Brown Sesame Oil

By Nature

- Organic

- Conventional

By End-User Industry

- Pharmaceutical Industry

- Food Industry

- Cosmetics & Personal Care Industry

By Type

- Brown

- Black

- White

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

The US sesame oil industry is a growing market driven by the growing application of sesame oil across several sectors.

The US sesame oil market is expected to grow due to the rising awareness about several health benefits associated with sesame oil.

According to study, the US sesame oil market size was worth around USD 696.32 million in 2023 and is predicted to grow to around USD 957.29 million by 2032.

The CAGR value of US sesame oil market is expected to be around 3.60% during 2024-2032.

The US sesame oil market will be dominated by the Northeastern states of the country.

The US sesame oil market is led by players like International Collection, Eden Foods, Pure Indian Foods, Kadoya USA, Nuvita, Spectrum Organics, Pompeian, Loriva, Banyan Botanicals, La Tourangelle, Ahuacatlán, Kevala, , Napa Valley Naturals, Ottogi America and Roland Foods.

The report explores crucial aspects of the US sesame oil market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed