U.S. Skincare Market Size, Share, Trends, Growth 2034

U.S. Skincare Market By Product (Body Moisturizers, Face Creams & Moisturizers, Shaving Lotions & Creams, Cleaners & Face Wash, and Others), By Gender (Male and Female), By Distribution Channel (Convenience Stores, Supermarkets & Hypermarkets, Pharmacy & Drugstore, Online Channels, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

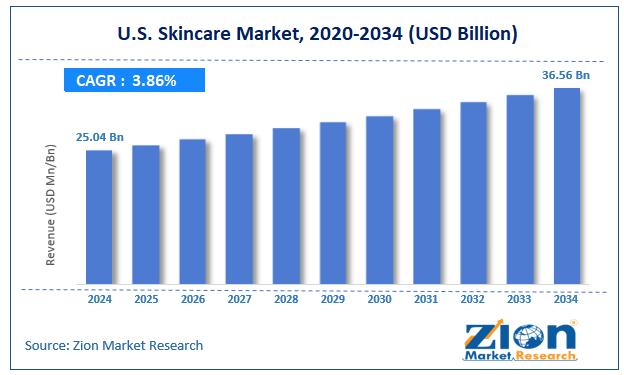

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 25.04 Billion | USD 36.56 Billion | 3.86% | 2024 |

U.S. Skincare Industry Prospective:

The U.S. skincare market size was worth around USD 25.04 billion in 2024 and is predicted to grow to around USD 36.56 billion by 2034, with a compound annual growth rate (CAGR) of roughly 3.86% between 2025 and 2034.

U.S. Skincare Market: Overview

The U.S. skincare industry is one of the most lucrative and highest revenue-generating markets for the global personal care sector. It deals with skincare items such as face moisturizers and body lotions produced or distributed in the US region. The regional industry is filled with a wide range of companies, including domestic brands as well as international entities.

Furthermore, one of the most crucial current trends in the US skincare sector is the increasing launch of celebrity-owned brands that have gained significant growth momentum in the past few years. The regional market is driven by several favorable factors. For instance, the presence of a large number of high-income groups is creating significant demand for luxury skincare brands.

In addition, the rise and quick expansion of e-commerce channels, some specially dedicated to skincare and cosmetic products, have further shaped the industry’s overall revenue.

During the forecast period, the significant impact of influencer culture in the US will play a dominant role in shaping the regional market. However, concerns regarding the overconsumption of skincare products continue to affect the region’s final growth trajectory.

Key Insights:

- As per the analysis shared by our research analyst, the U.S. skincare market is estimated to grow annually at a CAGR of around 3.86% over the forecast period (2025-2034)

- In terms of revenue, the U.S. skincare market size was valued at around USD 25.04 billion in 2024 and is projected to reach USD 36.56 billion by 2034.

- The U.S. skincare market is projected to grow at a significant rate due to the rising demand for luxury skincare.

- Based on the product, the face creams & moisturizers segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the distribution channels, the supermarkets & hypermarkets2 segment is anticipated to command the largest market share.

- Based on region, Northeastern is projected to dominate the global market during the forecast period.

U.S. Skincare Market: Growth Drivers

Rising demand for luxury skincare to drive market expansion rate

The U.S. skincare market is expected to grow due to the rising demand for luxury skincare in the region. The U.S. is home to a large population of high-profile and high-income groups seeking luxury goods across personal care items.

According to official data, more than 15.01% of the US population is currently categorized under the ‘upper-middle class’ range. In addition, the average spending capacity of a US citizen is considerably higher than citizens of several other countries, especially developing nations.

In March 2025, Rodan + Fields Beauty, LLC, the leading clinical luxury skincare brand in the US, announced its retail debut by signing a strategic partnership with Ulta Beauty. The latter company owns over 150 stores across the US, and the move will allow Rodan + Fields Beauty to broaden its consumer base. Luxury skincare items generally offer exclusive and premium ingredients. They also offer more targeted solutions than drug-store brands.

Furthermore, luxury skincare providers invest heavily in research & development before commercially launching a product, contributing to the higher performance of highly priced products.

Growing trend of celebrity-owned skincare products and influence culture to fuel higher revenue in the industry

One of the fastest-growing trends in the US skincare sector is the increasing launch of products owned fully or partially by known personalities. This trend is especially associated with female celebrity-backed brands. For instance, media personality Scarlet Johanson owns a widely popular skincare brand named ‘The Outset.’ The celebrity skincare brand focuses on providing simple but effective skin maintenance products.

The global U.S. skincare market further benefits from the increasing impact of influencer culture across the U.S. Affiliate marketing campaigns across the nation continue to dominate the advertising and marketing strategies adopted by regional players helping the skincare sector in the country thrive.

U.S. Skincare Market: Restraints

Intense competition and oversaturation of products to limit market expansion rate

The U.S. skincare industry is projected to be restricted by the intense competition within the industry. The US market for personal care and cosmetic items has intensified in the last few years with the emergence of several new domestic players.

In addition, international brands from Europe and Asia-Pacific have paved their way in the regional market, further fragmenting the regional consumer group. The presence of an extremely large number of options with the continuous launch of new product variants of existing lines can be overwhelming for buyers.

U.S. Skincare Market: Opportunities

Surge in demand for organic and clean products has higher growth potential in the future

The U.S. skincare market is expected to generate growth opportunities due to the surge in demand for clean products. Most skincare items sold across the US consist of synthetic chemicals that can be harmful to the skin and the environment in the long run. The damage to the ecosystem caused by the skincare industry is related to several business parameters, such as excessive packaging and the use of toxic chemicals.

Furthermore, most products are tested on lab animals during the research phase, which is considered a severe form of animal cruelty. Buyers are increasingly demanding products that are cruelty-free, organic, and clean as consumer awareness is on the rise.

For instance, Kinship is a popular US brand that offers cruelty-free skincare tested by dermatologists and made of natural ingredients. Several smaller brands have emerged in the US in the last decade, catering to the needs of a niche but growing group of consumers who demand sustainable cosmetic and skincare products.

U.S. Skincare Market: Challenges

Concerns regarding overconsumption and environmental damage to challenge market growth trajectory

The U.S. skincare market is projected to be challenged by claims of the industry promoting overconsumption. The rise of the ‘more is better’ trend across the US forged by marketing techniques and consistent launch of new products has become a major reason for overconsumption, ultimately putting more pressure on natural resources and impacting environmental conditions.

Another crucial factor limiting regional expansion is related to the changes in consumer preferences and ensuring long-term brand loyalty. The availability of new products in the market with varying prices leads to a lack of customer allegiance over the long term.

U.S. Skincare Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Skincare Market |

| Market Size in 2024 | USD 25.04 Billion |

| Market Forecast in 2034 | USD 36.56 Billion |

| Growth Rate | CAGR of 3.86% |

| Number of Pages | 217 |

| Key Companies Covered | Neutrogena, Sunday Riley, The Estée Lauder Companies, Drunk Elephant, Dr. Dennis Gross, The Honest Company, Tata Harper, Mary Kay Inc., SkinCeuticals, CeraVe, Paula’s Choice, iS Clinical, Olay, SkinMedica, Kiehl's, and others. |

| Segments Covered | By Product, By Gender, By Distribution Channel, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. Skincare Market: Segmentation

The U.S. skincare market is segmented based on product type, gender, distribution channel, and region.

Based on the product, the regional market segments are body moisturizers, face creams & moisturizers, shaving lotions & creams, cleaners & face wash, and others. In 2024, the highest growth was listed in the face creams & moisturizers segment, which dominated nearly 43.8% of the total revenue. The growing awareness about the importance of consistent skincare from an early age has helped the segment thrive. Body moisturizers are a growing segment with increased demand for fragrance-free products.

Based on gender, the U.S. skincare industry is divided into male and female.

Based on the distribution channels, the regional market divisions are convenience stores, supermarkets & hypermarkets, pharmacies & drugstores, online channels, and others. In 2024, the highest demand was listed in the supermarkets & hypermarkets segment. It held control over 39.3% of the final market share. The increasing expansion of new supermarkets offering an extremely wide range of products, including luxury and affordable skincare items, is fueling the segmental revenue. The online retailers in the region can expect a CAGR of more than 4.75% during the forecast period.

U.S. Skincare Market: Regional Analysis

Northeastern and west coast regions of the country to propel market expansion

The U.S. skincare market is expected to witness major revenue in the Northeastern states and west coast regions of the country. Northeastern territories such as Massachusetts and New York have a high demand for skincare items due to the presence of professionals and high-income groups.

New York, for instance, is considered the fashion capital of the country due to the presence of several key fashion houses in the region. In addition, working professionals in Northeast states are growing rapidly, further fueling demand for luxury and affordable skincare items.

West Coast areas such as California are considered the major hub for cosmetic and personal care, especially regions such as Los Angeles, which is home to Hollywood, the center of the US entertainment industry. The US skincare sector will witness an increased shift of personal care items on online sales portals, opening new avenues for growth and expansion.

In October 2024, popular luxury skincare company Estée Lauder announced the official launch of its products on the U.S. Amazon Premium Beauty store, widening its consumer reach. The increased demand for environmentally-conscious skincare products is likely to generate higher returns on investment during the forecast period.

U.S. Skincare Market: Competitive Analysis

The U.S. skincare market is led by players like:

- Neutrogena

- Sunday Riley

- The Estée Lauder Companies

- Drunk Elephant

- Dr. Dennis Gross

- The Honest Company

- Tata Harper

- Mary Kay Inc.

- SkinCeuticals

- CeraVe

- Paula’s Choice

- iS Clinical

- Olay

- SkinMedica

- Kiehl's

The U.S. skincare market is segmented as follows:

By Product

- Body Moisturizers

- Face Creams & Moisturizers

- Shaving Lotions & Creams

- Cleaners & Face Wash

- Others

By Gender

- Male

- Female

By Distribution Channel

- Convenience Stores

- Supermarkets & Hypermarkets

- Pharmacy & Drugstore

- Online Channels

- Others

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

The U.S. skincare industry is one of the most lucrative and highest revenue-generating markets for the global personal care sector.

The U.S. skincare market is expected to grow due to the rising demand for luxury skincare in the region.

According to study, the U.S. skincare market size was worth around USD 25.04 billion in 2024 and is predicted to grow to around USD 36.56 billion by 2034.

The CAGR value of the U.S. skincare market is expected to be around 3.86% during 2025-2034.

The U.S. skincare market is expected to witness major revenue in the Northeastern states and west coast regions of the country.

The U.S. skincare market is led by players like Neutrogena, Sunday Riley, The Estée Lauder Companies, Drunk Elephant, Dr. Dennis Gross, The Honest Company, Tata Harper, Mary Kay Inc., SkinCeuticals, CeraVe, Paula’s Choice, iS Clinical, Olay, SkinMedica, and Kiehl's.

The report explores crucial aspects of the U.S. skincare market, including a detailed discussion of existing growth factors and restraints while browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed