U.S. Testing, Inspection, and Certification (TIC) Market Size, Share, Trends, Growth 2032

U.S. Testing, Inspection, and Certification (TIC) Market By Type (Testing, Inspection, and Certification), By Application (Consumer Goods & Retail, Government, Automotive, Chemicals, Mining, Agriculture & Food, Energy & Power, Infrastructure, Education, Manufacturing, Healthcare, Oil & Gas, Public Sector, and Aerospace & Defense), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

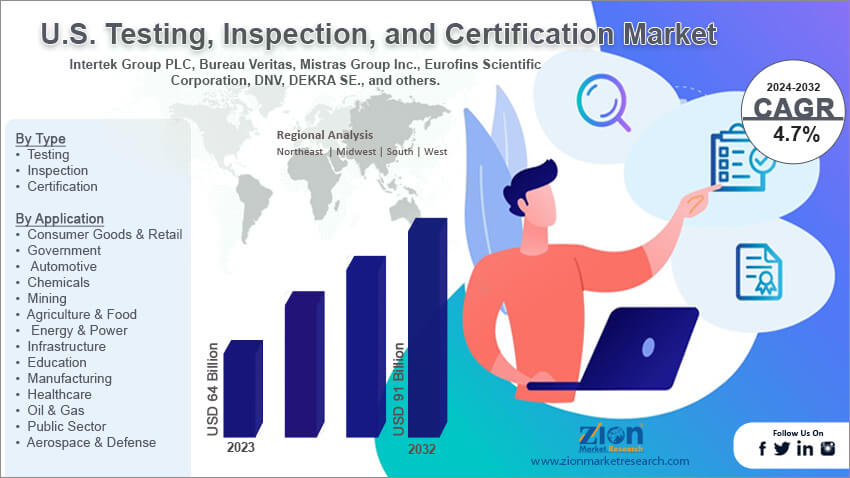

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 64 Billion | USD 91 Billion | 4.7% | 2023 |

U.S. Testing, Inspection, and Certification (TIC) Industry Prospective:

The U.S. testing, inspection, and certification (TIC) market size was evaluated at $64 billion in 2023 and is slated to hit $91 billion by the end of 2032 with a CAGR of nearly 4.7% between 2024 and 2032.

U.S. Testing, Inspection, and Certification (TIC) Market: Overview

The testing, inspection, and certification (TIC) ensure the safety, quality, and integrity of goods & services across various end-use sectors. Moreover, TIC offers services such as product testing, industrial site inspections, and certification of shipment. The most common applications of TIC are quality assurance, product safety, and supply chain management.

Key Insights

- As per the analysis shared by our research analyst, the U.S. testing, inspection, and certification (TIC) market is projected to expand annually at the annual growth rate of around 4.7% over the forecast timespan (2024-2032)

- In terms of revenue, the U.S. testing, inspection, and certification (TIC) market size was evaluated at nearly $64 billion in 2023 and is expected to reach $91 billion by 2032.

- The global U.S. testing, inspection, and certification (TIC) market is anticipated to grow rapidly over the forecast timeline owing to a surging focus on risk management and the need for sustainability.

- In terms of type, the testing segment is slated to register the highest CAGR over the forecast period.

- Based on application, the infrastructure segment is predicted to dominate the segmental growth in the upcoming years.

- Region-wise, the Northeast testing, inspection, and certification (TIC) industry in the U.S. is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

U.S. Testing, Inspection, and Certification (TIC) Market: Growth Factors

Growing highlight on risk management activities to kindle the expansion of the market in the U.S.

Surging focus on risk management and the need for sustainability will propel the growth of the U.S. testing, inspection, and certification (TIC) market expansion. Moreover, technological breakthroughs and the growing complexity of products can expand the scope of growth of the market in the country. In addition to this, strict laws governing various industry verticals such as pharmaceuticals, manufacturing, automotive, and food & beverages will embellish the expansion of the market in the U.S. Implementation of strict protocols such as the Clean Air Act, Toxic Substances Control Act, and the Consumer Product Safety Improvement Act will prompt the expansion of the U.S. market. Large-scale integration of digital systems including AI & data analytics and TIC can bring a paradigm shift in the growth of the market in the U.S.

U.S. Testing, Inspection, and Certification (TIC) Market: Restraints

An increase in costs of TIC solutions can obstruct the expansion of the industry in the U.S. by 2032

Burgeoning prices of TIC services and barriers of entry to new players are some of the factors that can hinder the growth of the U.S. testing, inspection, and certification (TIC) industry. Moreover, economic disruptions are anticipated to obstruct the expansion of the industry in the country. Pricing pressures and a lack of standard protocols can also restrain the expansion of the industry in the country.

U.S. Testing, Inspection, and Certification (TIC) Market: Opportunities

An increase in online retail activities to create new facets of growth for the U.S. market

Flourishing e-commerce sector and rise in awareness among consumers about benefits offered by testing, inspection, and certification services are likely to expand the scope of growth of the U.S. testing, inspection, and certification (TIC) market. Moreover, an increase in partnerships & joint ventures will urge the expansion of the market in the U.S. An increase in the enforcement of health & safety laws in pharmaceuticals for ensuring the health & safety of consumers will steer the growth of the market in the country.

U.S. Testing, Inspection, and Certification (TIC) Market: Challenges

Allocation of immense funds for installing TIC instruments can create obstacles in the growth of the industry in the U.S.

Need for huge investment in the deployment of TIC equipment is expected to challenge the growth of the U.S. testing, inspection, and certification (TIC) industry over the coming years. Growing data security concerns can impede the expansion of the industry in the U.S.

U.S. Testing, Inspection, and Certification (TIC) Market: Segmentation

The U.S. testing, inspection, and certification market is divided into service type, application, and region.

In terms of service type, the U.S. testing, inspection, and certification market is bifurcated into testing, inspection, and certification segments. Additionally, the testing segment, which gained approximately half of the market revenue share in 2023, is anticipated to register the fastest rate of growth yearly during the time interval from 2024 to 2032. The main factor fostering the segmental expansion can be due to a rise in the spread of pandemics and epidemics such as COVID-19 across the globe. Need for constant healthcare screening activities and health concerns will further proliferate the segmental surge in the ensuing years.

On the basis of application, the U.S. testing, inspection, and certification industry is sectored into consumer goods & retail, government, automotive, chemicals, mining, agriculture & food, energy & power, infrastructure, education, manufacturing, healthcare, oil & gas, public sector, and aerospace & defense segments. In addition, the infrastructure segment, which accrued about 49% of the industry share in 2023, is set to lead the segmental expansion in the U.S. in the upcoming years. The segmental expansion can be due to the growing use of testing, inspection, and certification activities in the infrastructural activities in the U.S.

U.S. Testing, Inspection, and Certification (TIC) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Testing, Inspection, and Certification (TIC) Market |

| Market Size in 2023 | USD 64 Billion |

| Market Forecast in 2032 | USD 91 Billion |

| Growth Rate | CAGR of 4.7% |

| Number of Pages | 220 |

| Key Companies Covered | Intertek Group PLC, Bureau Veritas, Mistras Group Inc., Eurofins Scientific Corporation, DNV, DEKRA SE., and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. Testing, Inspection, and Certification (TIC) Market: Regional Insights

Southern region of the U.S. is expected to lead the market surge over 2024-2032

Southern region, which accrued 28% of the U.S. testing, inspection, and certification (TIC) market share in 2023, is set to retain its position in the U.S. market in the upcoming years. In addition to this, the regional market surge in the forecast timeline can be attributed to large-scale investments in the South of the U.S. Apart from this, flourishing production and energy costs along with a huge focus on quality assurance in food & beverages and construction sectors will promote the growth of the market in the region.

The Northeast testing, inspection, and certification (TIC) industry in the U.S. is predicted to record the highest rate of expansion annually within the next few years. The growth of the industry in the Northeastern part of the U.S. can be due to the humungous presence of key players in the region. Apart from this, supportive government policies and the need for product safety will spur regional industry trends.

U.S. Testing, Inspection, and Certification (TIC) Market: Competitive Space

The U.S. testing, inspection, and certification (TIC) market profiles key players such as:

- Intertek Group PLC

- Bureau Veritas

- Mistras Group Inc.

- Eurofins Scientific Corporation

- DNV

- DEKRA SE.

The U.S. testing, inspection, and certification (TIC) market is segmented as follows:

By Type

- Testing

- Inspection

- Certification

By Application

- Consumer Goods & Retail

- Government

- Automotive

- Chemicals

- Mining

- Agriculture & Food

- Energy & Power

- Infrastructure

- Education

- Manufacturing

- Healthcare

- Oil & Gas

- Public Sector

- Aerospace & Defense

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

The testing, inspection, and certification ensure the safety, quality, and integrity of goods & services across various end-use sectors.

The U.S. testing, inspection, and certification (TIC) market growth over the forecast period can be owing to strict laws governing various industry verticals such as pharmaceuticals, manufacturing, automotive, and food & beverages.

According to a study, the global U.S. testing, inspection, and certification (TIC) industry size was $64 billion in 2023 and is projected to reach $91 billion by the end of 2032.

The global U.S testing, inspection, and certification (TIC) market is anticipated to record a CAGR of nearly 4.7% from 2024 to 2032.

The Northeast testing, inspection, and certification (TIC) industry of the U.S. is set to register the fastest CAGR over the forecasting timeline owing to the large presence of key players in the region. Supportive government policies and the need for product safety will also spur regional industry trends.

The U.S. testing, inspection, and certification (TIC) market is led by players such as Intertek Group PLC, Bureau Veritas, Mistras Group, Inc., Eurofins Scientific Corporation, DNV, and DEKRA SE.

The U.S. testing, inspection, and certification (TIC) market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

Choose License Type

List of Contents

U.S. Testing, Inspection, and Certification (TIC)Industry Prospective:OverviewKey InsightsGrowth FactorsRestraintsOpportunitiesChallengesSegmentationReport ScopeRegional InsightsCompetitive SpaceThe U.S. testing, inspection, and certification (TIC) market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed

-market-size.png)