US Vertical Farming Market Size, Share, Trends, Growth 2032

US Vertical Farming Market By Crop Type (Herbs & Microgreens, Fruits & Vegetables, Flowers & Ornamentals, and Others), By Growth Mechanism (Hydroponics, Aeroponics, and Aquaponics), By Structure (Shipping Container Vertical Farm and Building-Based Vertical Farm), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

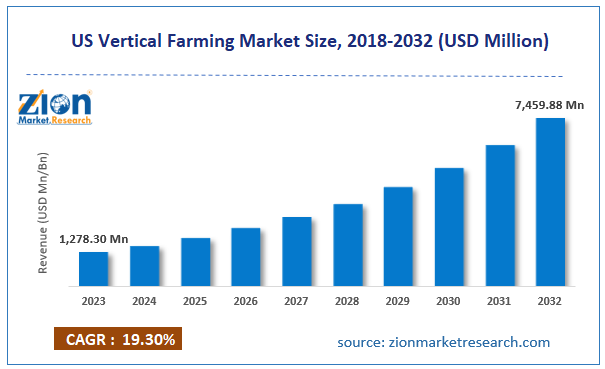

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1278.30 million | USD 7459.88 million | 19.30% | 2023 |

US Vertical Farming Industry Prospective:

The US vertical farming market size was worth around USD 1,278.30 million in 2023 and is predicted to grow to around USD 7,459.88 million by 2032 with a compound annual growth rate (CAGR) of roughly 19.30% between 2024 and 2032.

US Vertical Farming Market: Overview

The US vertical farming industry refers to the promotion, commercialization, and development of vertical farming techniques in the country. Unlike traditional farming which generally occurs on horizontal land, vertical farming refers to leveraging vertical spaces for crop cultivation. This method is known to be more environmentally friendly as farmers can grow a large number of crops in limited spaces. The layers in vertical farming are generally integrated into long vertical structures such as shipping containers, skyscrapers, and other places that may be considered unfit for cultivation.

However, vertical farming requires managing essential external parameters. It requires a supply of artificial light, temperature, water, and control measures for managing humidity. The US industry for vertical farming is the world’s most renowned sector. The US has more than 1950 vertical farms spread across the country. In addition to this, the US market also allows food grown through vertical farming to be marketed as organic products thus creating more expansion possibilities for companies investing in the modern agricultural technique. During the forecast period, the US vertical farming industry is expected to deliver exceptional results since food demand in the country is growing rapidly.

Key Insights:

- As per the analysis shared by our research analyst, the US vertical farming market is estimated to grow annually at a CAGR of around 19.30% over the forecast period (2024-2032)

- In terms of revenue, the US vertical farming market size was valued at around USD 1,278.30 million in 2023 and is projected to reach USD 7,459.88 million, by 2032.

- The US vertical farming market is projected to grow at a significant rate due to the surge in efforts by regional governments to reduce agriculture-based environmental

- Based on the crop type, the herbs & microgreens segment is growing at a high rate and will continue to dominate the regional market as per industry projection

- Based on the structure, the building-based vertical farming technique segment is anticipated to command the largest market share

- Based on region, Eastern and southern states are projected to dominate the regional market during the forecast period

Request Free Sample

Request Free Sample

US Vertical Farming Market: Growth Drivers

Surge in efforts by regional governments to reduce agriculture-based environmental impact may promote a market growth rate

The US vertical farming market is expected to grow due to the increasing focus of the regional government on curbing the environmental impact of the agricultural sector. Traditional methods of crop cultivation are known to have several environmental effects. Studies conclude that agriculture is associated with some of the most pressing concerns of the modern world. These issues include serious environmental damages such as loss of biodiversity, climate change, problems with irrigation, dead zones, soil degradation, and generation of massive waste. As per official statistics, around 30% of total greenhouse gas emissions caused by humans are due to agricultural activities. The US government is keen on curbing the impact of horizontal cultivation on the regional ecosystem. Vertical farming techniques employ a highly controlled environment. Crops do not get exposed to harmful chemicals in the form of pesticides and insecticides. Additionally, the water requirement for vertical farming is over 90% less in vertical farming compared to the horizontal variant. As the US official continues to seek more ways to achieve net zero carbon emissions, the investments in the country’s vertical farming segment are likely to grow.

Concerns over regional food security may drive more investors toward vertical farming

One of the major attention-demanding problems in the US is the growing concerns over food security in the future. The rapid change in weather conditions and the overall climate has affected global and regional food supply. Additionally, the rise in the number of crop diseases, the prevalence of improper farming techniques, and disruptions in the supply chain further impact food availability for the regional population. As per Feeding America, over 44 million people in the US are currently facing hunger. Millions of people lack access to clean and sufficient food or water. The statistics are expected to rise over the coming years. In August 2024, the US Department of Agriculture announced an additional investment of USD 300 million through the Regional Agricultural Promotion Program launched in 2023. The initiative is drafted to promote businesses operating in the agriculture sector. The US vertical farming market may benefit from such projects.

US Vertical Farming Market: Restraints

High initial investment in vertical farming will limit the industry growth trend

The US industry for vertical farming is expected to be restricted due to the high cost of initial investment. Technologies required for vertical farming such as aeroponics, aquaponics, hydroponics, climate control systems, and others are in a nascent stage of development. Businesses focusing on vertical farming currently rely on third-party providers of these technologies. Hence they are unable to achieve economies of scale. Moreover, the crop yield through vertical farming depends heavily on the proper functioning of technology which further limits the industry adoption rate.

US Vertical Farming Market: Opportunities

Growing investments in vertical farming technologies in the US will generate expansion opportunities

The US vertical farming market is growing rapidly. This is evident in the recent increase in the number of associated investments promoting vertical farming. In July 2024, Plenty, a US-based vertical farming start-up, announced forming a partnership with Mawarid. The deal with the Alpha Dhabi Holding subsidiary is worth USD 680 million. Through the joint venture, the companies will develop an intense network of indoor farms in the Middle Eastern region, thus proving beneficial for the US-based firm. In February 2024, Oishii, another US-based company operating in the vertical farming sector, announced that it had raised around USD 134 million in Series B funding. The company is expected to use the investment for developing solar energy-powered vertical farming units along with investments in other technologies such as robotics & automation and breeding.

US Vertical Farming Market: Challenges

Cultivation of limited crops using vertical farming will challenge the market growth trajectory

Vertical farming at present cannot completely replace the traditional farming methods. The players in the US vertical farming industry face problems in diversifying technique application to a wide range of crops. While space constraint is an important factor restricting market expansion, the economic viability of using vertical farming for certain crops is poor. For instance, certain companies are growing essential food such as potatoes and cucumbers through vertical farming. However, these companies may find better economic results if the plants are grown in large areas. Moreover, vertical farming is not recommended for tall field crops and protein-dense variants.

US Vertical Farming Market: Segmentation

The US vertical farming market is segmented based on crop type, growth mechanism, structure, and region.

Based on the crop type, the regional market segments are herbs & microgreens, fruits & vegetables, flowers & ornamentals, and others. In 2023, the highest growth was witnessed in the herbs & microgreens segment. Vertical farming is considered suitable for specific food types. Herbs and microgreens can be easily grown using vertical farming techniques. Since microgreens and herbs have short growth cycles, farmers can easily achieve economies of scale. Vertical farming can produce over 10 to 15 pounds of herbs per square foot if vertical farming techniques are correctly followed.

Based on growth mechanisms, the US vertical farming industry is divided into hydroponics, aeroponics, and aquaponics.

Based on the structure, the US vertical farming industry divisions are shipping container vertical farming and building-based vertical farming. In 2023, the building-based vertical farming technique was the highest revenue generator. Vertical farms are developed on existing tall buildings thus eliminating the need to develop special structures. As per projections by world-renowned professor Dickson D. Despommier, developing around 150 structures with 30 stories dedicated to vertical farms can feed the entire population of New York City.

US Vertical Farming Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US Vertical Farming Market |

| Market Size in 2023 | USD 1,278.30 Million |

| Market Forecast in 2032 | USD 7,459.88 Million |

| Growth Rate | CAGR of 19.30% |

| Number of Pages | 216 |

| Key Companies Covered | Vertical Harvest, Gotham Greens, Crop One Holdings, AeroFarms, Freight Farms, Plenty, Kalera, Square Roots, Bowery Farming, Farm.One, BrightFarms, Inno-3B, Iron Ox, Green Sense Farms, Fifth Season., and others. |

| Segments Covered | By Crop Type, By Growth Mechanism, By Structure, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US Vertical Farming Market: Regional Analysis

Eastern and southern states of the US to deliver the most optimal results during the projection period

The US vertical farming market is expected to grow the highest in the eastern and southern states of the country. The most prominent regions driving the regional demand are New Jersey, New York, California, Texas, and Illinois. Some of these regions have a high revenue-generating agriculture sector. Urban cities such as New York and New Jersey host several buildings that allow vertical farming. In January 2024, Buffalo Go Green, a leading provider of training and services to the underprivileged sections of the western New York region, launched a new vertical farm. The structure spans across a 40-foot-long shipping container located in the company’s Zenner Street urban farm. The investment was funded by the New York Power Authority valued at USD 300,000. In April 2023, Farm. One, a regional player, announced that DK-Bell Holding Company had provided the company with long-term growth capital. The investment allowed Farm. One to reopen its Neighborhood Farm in the Brooklyn area. In June 2024, Soli Organic Inc. launched a new indoor vertical farming unit at the Brooks Air Force Base in Texas. The 140,000 sq. ft. facility has a production capacity of 100,000 sq. ft.

US Vertical Farming Market: Competitive Analysis

The US vertical farming market is led by players like:

- Vertical Harvest

- Gotham Greens

- Crop One Holdings

- AeroFarms

- Freight Farms

- Plenty

- Kalera

- Square Roots

- Bowery Farming

- Farm.One

- BrightFarms

- Inno-3B

- Iron Ox

- Green Sense Farms

- Fifth Season.

The US vertical farming market is segmented as follows:

By Crop Type

- Herbs & Microgreens

- Fruits & Vegetables

- Flowers & Ornamentals

- Others

By Growth Mechanism

- Hydroponics

- Aeroponics

- Aquaponics

By Structure

- Shipping Container Vertical Farm

- Building-Based Vertical Farm

By Region

- The U.S.

Table Of Content

Methodology

FrequentlyAsked Questions

The US vertical farming industry refers to the promotion, commercialization, and development of vertical farming techniques in the country.

The US vertical farming market is expected to grow due to the increasing focus of the regional government on curbing the environmental impact of the agricultural sector.

According to study, the US vertical farming market size was worth around USD 1,278.30 million in 2023 and is predicted to grow to around USD 7,459.88 million by 2032.

The CAGR value of the US vertical farming market is expected to be around 19.30% during 2024-2032.

The US vertical farming market is expected to grow the highest in the eastern and southern states of the country.

The US vertical farming market is led by players like Vertical Harvest, Gotham Greens, Crop One Holdings, AeroFarms, Freight Farms, Plenty, Kalera, Square Roots, Bowery Farming, Farm.One, BrightFarms, Inno-3B, Iron Ox, Green Sense Farms, and Fifth Season.

The report explores crucial aspects of the US vertical farming market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed