U.S. Virtual Corporate Events Market Size, Share, Trends, Growth 2032

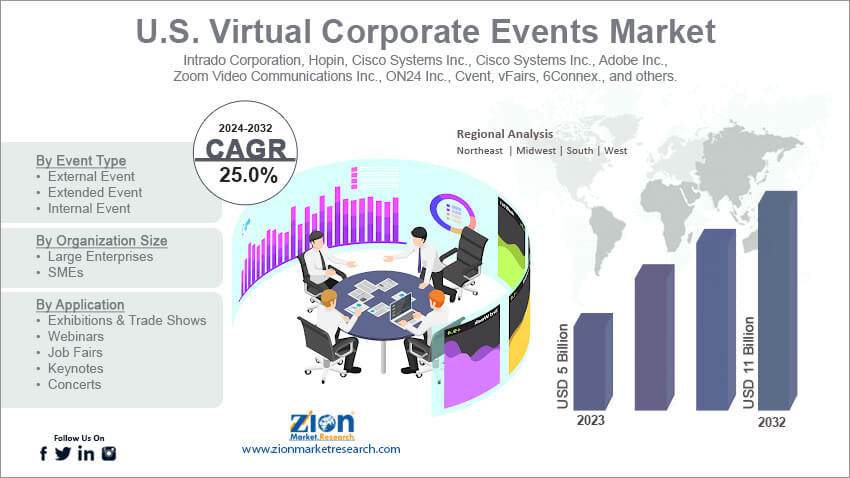

U.S. Virtual Corporate Events Market By Event Type (External Event, Extended Event, and Internal Event), By Organization Size (Large Enterprises and SMEs), By Application (Exhibitions & Trade Shows, Webinars, Job Fairs, Keynotes, and Concerts), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 05 Billion | USD 11 Billion | 25% | 2023 |

U.S. Virtual Corporate Events Industry Perspective:

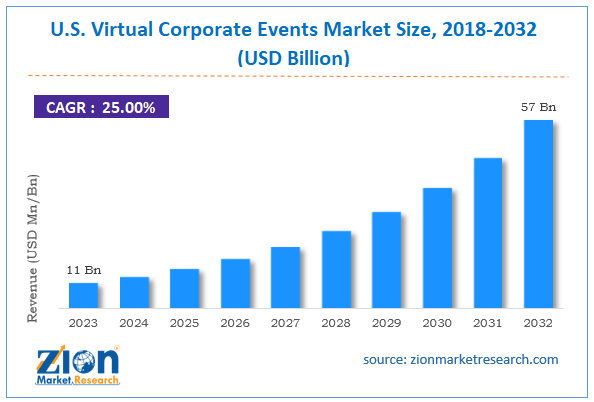

The U.S. virtual corporate events market size was evaluated at $11 billion in 2023 and is slated to hit $57 billion by the end of 2032 with a CAGR of nearly 25% between 2024 and 2032.

U.S. Virtual Corporate Events Market: Overview

Virtual corporate events are becoming popular with firms wanting to connect with staff, owners, and customers. These events range from arranging large conferences to small meetings and team-building activities. There are a slew of kinds of virtual corporate events, including social events, creative workshops, social events, wellness programs, and professional growth.

Key Insights

- As per the analysis shared by our research analyst, the U.S. virtual corporate events market is projected to expand annually at the annual growth rate of around 25% over the forecast timespan (2024-2032)

- In terms of revenue, the U.S. virtual corporate events market size was evaluated at nearly $11 billion in 2023 and is expected to reach $57 billion by 2032.

- The global U.S. virtual corporate events market is anticipated to grow rapidly over the forecast timeline owing to a surge in the demand for remote working, the need for cost-efficacy, technological breakthroughs, and the convenience of data.

- In terms of event type, the external event segment is slated to register the highest CAGR over the forecast period.

- Based on organization size, the large enterprises segment is predicted to dominate the segmental growth in the upcoming years.

- Based on application, the exhibitions & trade show segment is predicted to contribute majorly towards the U.S. industry revenue in the upcoming years.

- Region-wise, the Northeast virtual corporate events industry in the U.S. is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

U.S. Virtual Corporate Events Market: Growth Factors

A rising need for remote operations to boost the market trends in the U.S. over 2024-2032

Cost efficiency, accessibility, improved engagement, and morale-boosting are a few of the factors that are likely to embellish the growth of the U.S. virtual corporate events market. Moreover, a surge in the demand for remote working, the need for cost-efficacy, technological breakthroughs, and the convenience of data will proliferate the expansion of the market in the country. Humungous need for hybrid events will bolster the market trends in the upcoming years. Growing need for personalization of events will proliferate the U.S. market space in the forecasting years.

U.S. Virtual Corporate Events Market: Restraints

Stress of arranging virtual events can hinder the industry growth in the U.S.

Technological breakthroughs and lack of personal contacts for improving communications can impede the growth of the U.S. virtual corporate events industry. Fatigue from virtual events and return-in-person events can also obstruct the industry surge in the country.

U.S. Virtual Corporate Events Market: Opportunities

Thriving AI activities will promote the growth of the market in the U.S. in the ensuing years

Flourishing data analytics and AI sectors along with the need for personalization are anticipated to bolster the growth of the U.S. virtual corporate events market. Integrating virtual corporate events with various digital platforms is predicted to boost the market trends in the country.

U.S. Virtual Corporate Events Market: Challenges

Lack of personal interaction can pose a huge threat to the expansion of the industry in the U.S.

Low physical interaction and emerging regulatory compliances can challenge the expansion of the U.S. virtual corporate events industry. Furthermore, strict laws governing IT activities can put brakes on the industry expansion in the country. Adapting to innovative technologies has become a huge challenge in the path of growth of the industry in the country.

U.S. Virtual Corporate Events Market: Segmentation

The U.S. virtual corporate events market is divided into event type, organization size, application, and region.

In terms of event type, the U.S. virtual corporate events market is bifurcated into external event, extended event, and internal event segments. Additionally, the external event segment, which gained approximately half of the market revenue share in 2023, is forecast to register the fastest rate of growth yearly during the time interval from 2024 to 2032. The main factor fostering the segmental surge can be attributed to the large-scale acceptance of virtual event tools by various businesses for interacting with external entities. In addition to this, firms are collaborating with tech firms to positively impact technological advances along with offering high-end solutions to clients.

On the basis of organization size, the U.S. virtual corporate events industry is sectored into large enterprises and SMEs segments. In addition to this, the large enterprises segment, which accrued about 66% of the industry share in 2023, is set to lead the segmental expansion in the U.S. in the upcoming years. The segmental growth can be ascribed to large firms adopting virtual event management tools as a part of their global plans in negotiating with customers and employees.

Based on the application, the U.S. virtual corporate events market is divided into exhibitions & trade shows, webinars, job fairs, keynotes, and concerts segments. Moreover, the exhibitions & trade shows segment, which led the application space in 2023, is likely to contribute noticeably towards the market share in the country with the escalating need of various firms in promoting their products as well as evaluating their competition.

U.S. Virtual Corporate Events Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Virtual Corporate Events Market |

| Market Size in 2023 | USD 11 Billion |

| Market Forecast in 2032 | USD 57 Billion |

| Growth Rate | CAGR of 25% |

| Number of Pages | 218 |

| Key Companies Covered | Intrado Corporation, Hopin, Cisco Systems Inc., Cisco Systems Inc., Adobe Inc., Zoom Video Communications Inc., ON24 Inc., Cvent, vFairs, 6Connex., and others. |

| Segments Covered | By Event Type, By Organization Size, By Application, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. Virtual Corporate Events Market: Regional Insights

Southern region of the U.S. is expected to dominate the market surge over 2024-2032

Southern region, which accrued two-fifths of the U.S. virtual corporate events market share in 2023, is set to uphold its position in the U.S. market in the years ahead. In addition, the regional market expansion in the forecast timeframe can be credited to business-friendly policies adopted by states such as Georgia, Texas, and Florida in the U.S. Moreover, the rise in the acceptance of cloud solutions and the need for cost-savings will proliferate the growth of the market in the south of the U.S.

The Northeast virtual corporate events industry in the U.S. is predicted to record the highest rate of expansion annually within the next couple of years. The growth of the U.S. virtual corporate events industry can be due to swift digital transformation, cost-savings, and technological breakthroughs. Furthermore, the huge costs of renting physical venues along with the need for minimizing travel & accommodation charges have further promoted the demand for holding virtual corporate events in the Northeast region of the U.S.

Key Developments

- In the first half of 2021, Hopin, a key virtual events tool, acquired StreamYard, a live streaming studio browser. Such moves will spearhead the growth of the U.S. virtual corporate events market.

- In the first quarter of 2021, ON24, a key virtual event service provider, declared its plans to go public by merging with Silverback, a special-purpose acquisition company.

U.S. Virtual Corporate Events Market: Competitive Space

The U.S. virtual corporate events market profiles key players such as:

- Intrado Corporation

- Hopin

- Cisco Systems Inc.

- Cisco Systems Inc.

- Adobe Inc.

- Zoom Video Communications Inc.

- ON24 Inc.

- Cvent

- vFairs

- 6Connex.

The U.S. virtual corporate events market is segmented as follows:

By Event Type

- External Event

- Extended Event

- Internal Event

By Organization Size

- Large Enterprises

- SMEs

By Application

- Exhibitions & Trade Shows

- Webinars

- Job Fairs

- Keynotes

- Concerts

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

Virtual corporate events are becoming popular with firms wanting to connect with staff, owners, and customers. These events range from arranging large conferences to small meetings and team-building activities.

The U.S. virtual corporate events market growth over the forecast period can be owing to a surge in the demand for remote working, the need for cost-efficacy, technological breakthroughs, and convenience of data.

According to a study, the global U.S. virtual corporate events industry size was $11 billion in 2023 and is projected to reach $57 billion by the end of 2032.

The global U.S. virtual corporate events market is anticipated to record a CAGR of nearly 25% from 2024 to 2032.

Northeast virtual corporate events industry of the U.S. is set to register the fastest CAGR over the forecasting timeline owing to swift digital transformation, cost-savings, and technological breakthroughs. Furthermore, the huge costs of renting physical venues, along with the need to minimize travel & accommodation charges, have further promoted the demand for holding virtual corporate events in the Northeast region of the U.S.

The U.S. virtual corporate events market is led by players such as Intrado Corporation, Hopin, Cisco Systems, Inc., Cisco Systems, Inc., Adobe Inc., Zoom Video Communications, Inc., ON24, Inc., Cvent, vFairs, and 6Connex.

The U.S. virtual corporate events market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed