U.S. Water Testing and Analysis Market Size, Share, Analysis, Trends, Growth, 2032

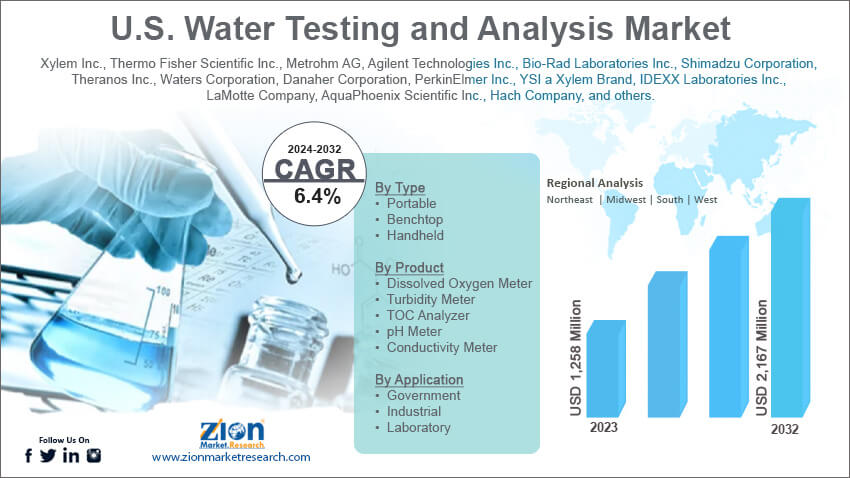

U.S. Water Testing and Analysis Market By Type (Portable, Benchtop, and Handheld), By Product (Dissolved Oxygen Meter, Turbidity Meter, TOC Analyzer, pH Meter, and Conductivity Meter), By Application (Government, Industrial, and Laboratory), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

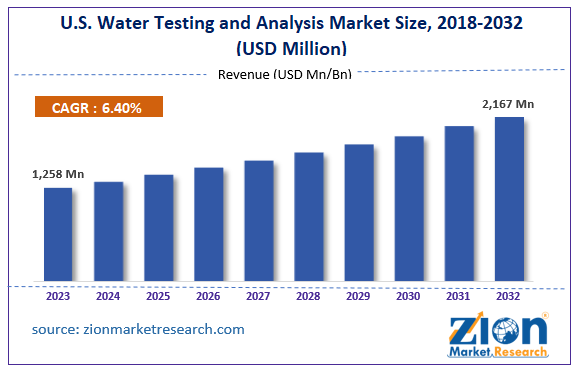

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,258 Million | USD 2,167 Million | 6.4% | 2023 |

U.S. Water Testing and Analysis Industry Prospective:

The U.S. water testing and analysis market size was evaluated at $1,258 million in 2023 and is slated to hit $2,167 million by the end of 2032 with a CAGR of nearly 6.4% between 2024 and 2032.

U.S. Water Testing and Analysis Market: Overview

Water testing and analysis is a key process used for assessing water quality and ensuring that water fulfills safety protocols and meets regulatory standards set by the U.S. government. These activities play a key role in improving public health, retaining a clean environment, and aiding a slew of end-use sectors. Reportedly, the regulation of water quality is carried out by state authorities such as the U.S. Environmental Protection Agency. Now let us have a comprehensive overview of the major aspects of water testing and analysis.

- Purpose of water testing & analysis: The key reason to test and analyze water is to provide safe and portable drinking water to the customers. The main focus of water bodies is to safeguard aquatic ecosystems along with assessing water quality for its usage in production as well as industrial processes.

- Types of water testing & analysis: It includes microbe testing, chemical testing, heavy metal testing, mineral & nutrient testing, biological testing, and physical testing.

- Methods of water testing & analysis: It encompasses field testing, real-time monitoring of water, and laboratory testing.

- Technologies used for water testing & analysis: Chromatography, Biosensors, electrochemical procedures, and spectrophotometry are a few of the technologies used for testing and analyzing water.

Request Free Sample

Request Free Sample

Key Insights

- As per the analysis shared by our research analyst, the U.S. water testing and analysis market is projected to expand annually at the annual growth rate of around 6.4% over the forecast timespan (2024-2032)

- In terms of revenue, the U.S. water testing and analysis market size was evaluated at nearly $1,258 million in 2023 and is expected to reach $2,167 million by 2032.

- The global U.S. water testing and analysis market is anticipated to grow rapidly over the forecast timeline owing to a rise in the pollution of water bodies in the U.S. due to an increase in the migrant population.

- In terms of type, the portable segment is slated to register the highest CAGR over the forecast period.

- Based on product, the TOC analyzer segment is predicted to contribute majorly towards the U.S. industry revenue in the upcoming years.

- Based on application, the industrial segment is predicted to boost the segmental surge over the forecast period.

- Region-wise, the Southern water testing and analysis industry is projected to register the fastest CAGR during the projected timespan.

U.S. Water Testing and Analysis Market: Growth Factors

Surge in proportion of contaminants in the water bodies to boost the market expansion in the U.S. by 2032

A rise in the pollution of water bodies in the U.S. due to an increase in the migrant population is likely to drive the growth of the U.S. water testing and analysis market. Strict laws enforced by the U.S. EPA regarding water testing & analysis for ensuring the safety of drinking water will further drive the growth trends of the market in the U.S. A rise in industrialization in various states of the U.S. and public awareness about clean water leading to a rise in the water testing service providers in the country will proliferate the size of the market in the country. Growing issues related to the health of individuals and the availability of scarce water will promote the market space in the U.S. Launching of advanced water testing products will embellish the expansion of the market in the U.S. in the upcoming years.

U.S. Water Testing and Analysis Market: Restraints

Surging prices of product can hinder the growth of the industry in the U.S. over the forecast period

Escalating costs of water testing and analysis equipment and complex regulations are some of the factors that are likely to create hurdles in the growth of the U.S. water testing and analysis industry. Huge technical challenges faced in aptly testing water along with low awareness among the people about water testing can hinder the growth of the industry in various states of the United States of America.

U.S. Water Testing and Analysis Market: Opportunities

Favorable government schemes promoting use of water testing & analysis equipment to open new growth for the market in the country

Government initiatives for educating the public about the significance of water quality along with incentives offered by the government to develop innovative water testing and analysis equipment will open new avenues of growth for the U.S. water testing and analysis market. Growing need of monitoring treated wastewater and examining waters in lakes, ponds, and rivers for safeguarding aquatic life will expand the scope of the market surge in the U.S. Need for checking well water for pollutants will further spike the demand for water testing and analysis in the U.S.

U.S. Water Testing and Analysis Market: Challenges

An increment in the costs of new systems can obstruct the growth of the industry in the U.S.

A surge in the prices of new technologies along with immense costs incurred in installing cutting-edge water testing systems can pose a huge challenge to the expansion of the U.S. water testing and analysis industry. Entry of local players in the business of producing water testing & analysis equipment along with lack of standardization & uniformity in the product as well as technological obsolescence can impact the growth of the industry in the U.S.

U.S. Water Testing and Analysis Market: Segmentation

The U.S. water testing and analysis market is divided into type, product, application, and region.

In terms of type, the U.S. water testing and analysis market across the globe is bifurcated into portable, benchtop, and handheld segments. Additionally, the portable segment, which gained approximately 67% of the market earnings in 2023, is expected to register the highest CAGR during the period from 2024 to 2032 subject to myriad benefits offered by portable water testing and analysis equipment such as convenience, accessibility, real-time results, and cost-efficiency. Furthermore, ease of use and the ability of improved water monitoring will steer the segmental surge.

Based on the product, the U.S. water testing and analysis industry is divided into dissolved oxygen meter, turbidity meter, TOC analyzer, pH meter, and conductivity meter segments. Additionally, the TOC analyzer segment, which accrued about two-thirds of the industry revenue in 2023, is set to make major contributions towards the industry expansion in the U.S. during the forecast timeframe owing to the ability of TOC analyzers in determining the percentage of TOC in water. Reportedly, more amount of TOC indicates a high presence of pollutants such as organic carbon in water which can affect the quality of water.

On the basis of application, the U.S. water testing and analysis market across the globe is sectored into government, industrial, and laboratory segments. Moreover, the industrial segment, which captured two-fifths of the U.S. market share in 2023, is likely to prop up the segmental growth in the upcoming years owing to the large-scale use of water testing and analysis equipment in industrial processes.

U.S. Water Testing and Analysis Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Water Testing and Analysis Market |

| Market Size in 2023 | USD 1,258 Million |

| Market Forecast in 2032 | USD 2,167 Million |

| Growth Rate | CAGR of 6.4% |

| Number of Pages | 223 |

| Key Companies Covered | Xylem Inc., Thermo Fisher Scientific Inc., Metrohm AG, Agilent Technologies Inc., Bio-Rad Laboratories Inc., Shimadzu Corporation, Theranos Inc., Waters Corporation, Danaher Corporation, PerkinElmer Inc., YSI a Xylem Brand, IDEXX Laboratories Inc., LaMotte Company, AquaPhoenix Scientific Inc., Hach Company, and others. |

| Segments Covered | By Type, By Product, By Application, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. Water Testing and Analysis Market: Regional Insights

Northeast region of the U.S. to lead the market in the country over the forecast period

The northeast region, which accounted for 40% of the U.S. water testing and analysis market share in 2023, is expected to establish a key position in the U.S. market in the upcoming years. In addition to this, the regional market expansion in the forecast timespan can be credited to a surging focus on remaking contaminants in the pharmaceutical sector. Moreover, efforts on enhancing water conservation and reducing environmental pollution through effective analysis and testing activities to spearhead the growth of the market in the region. Reportedly, ongoing research and development activities aimed at enhancing water testing will boost the market trends in the Northeastern region of the U.S. An increase in investments in infrastructure will scale up the growth of the market in the region.

Southern region water testing and analysis industry is predicted to register the highest growth rate annually in the next few years. The growth of the industry in the region can be due to an increase in the population in the southern part of the U.S. Additionally, a rise in the population has led to an increase in the demand for clean and safe water, thereby steering the growth of the market in the southern part of the country. Reportedly, the southern region is severely affected by hurricanes and heavy rains, leading to water pollution. This, in turn, has resulted in the need for frequent water testing for ensuring clean and potable water. Apart from this, a rise in farming activities in the southern part of the U.S. has led to an increase in the use of fertilizers and has severely impacted the water quality, thereby translating into huge demand for water testing and analysis equipment.

Key Developments

- In January 2024, Aquaculture Diagnostics Company introduced water screening, a water analysis service facilitating fish peasants to examine water for particular kinds of pathogens that can impact health.

U.S. Water Testing and Analysis Market: Competitive Space

The U.S. water testing and analysis market profiles key players such as:

- Xylem Inc.

- Thermo Fisher Scientific Inc.

- Metrohm AG

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Shimadzu Corporation

- Theranos Inc.

- Waters Corporation

- Danaher Corporation

- PerkinElmer Inc.

- YSI a Xylem Brand

- IDEXX Laboratories Inc.

- LaMotte Company

- AquaPhoenix Scientific Inc.

- Hach Company

The U.S. water testing and analysis market is segmented as follows:

By Type

- Portable

- Benchtop

- Handheld

By Product

- Dissolved Oxygen Meter

- Turbidity Meter

- TOC Analyzer

- pH Meter

- Conductivity Meter

By Application

- Government

- Industrial

- Laboratory

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

Water testing and analysis is a key process that is used for assessing the water quality along with ensuring that water fulfills safety protocols as well as meets regulatory standards set by the U.S. government. These activities play a key role in improving public health, retaining a clean environment, and aiding a slew of end-use sectors.

The global U.S. water testing and analysis market growth over the forecast period can be owing to a rise in industrialization in various states of the U.S. and public awareness about clean water leading to a rise in the water testing service providers in the country.

According to a study, the global U.S. water testing and analysis industry size was $1,258 million in 2023 and is projected to reach $2,167 million by the end of 2032.

The global U.S. water testing and analysis market is anticipated to record a CAGR of nearly 6.4% from 2024 to 2032.

Which region will record the highest rate of growth in the U.S. water testing and analysis industry?

The southern region water testing and analysis industry is set to register the fastest CAGR over the forecasting timeline owing to an increase in the population in the southern part of the U.S. Additionally, a rise in the population has led to an increase in the demand for clean and safe water, thereby steering the growth of the market in the southern part of the country. Reportedly, the southern region is severely affected by hurricanes and heavy rains, leading to water pollution. This, in turn, has resulted in the need for frequent water testing for ensuring clean and potable water.

The U.S. water testing and analysis market is led by players such as Xylem Inc., Thermo Fisher Scientific Inc., Metrohm AG, Agilent Technologies Inc., Bio-Rad Laboratories Inc., Shimadzu Corporation, Theranos Inc., Waters Corporation, Danaher Corporation, PerkinElmer Inc., YSI a Xylem Brand, IDEXX Laboratories Inc., LaMotte Company, AquaPhoenix Scientific Inc., and Hach Company.

The U.S. water testing and analysis report covers the geographical market and a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed