US Windows Market Size, Share, Trends, Growth 2032

US Windows Market By End-Use (Refurbishment and New Construction), By Type (Tilt & Turn Windows, Awning Windows, Casement Windows, Double/Single-Hung Windows, Sliding Windows, and Others), By Frame Material (Aluminum, Wood, Vinyl, and Others), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

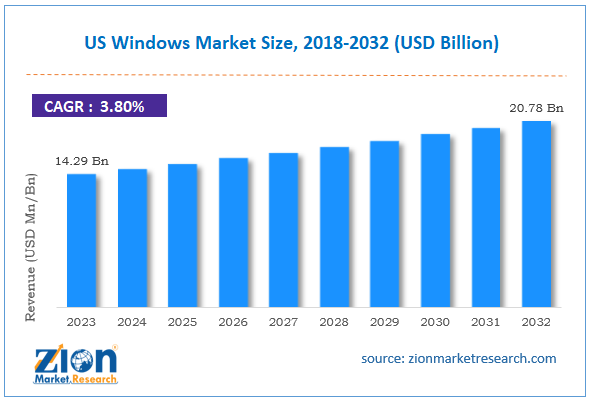

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 14.29 Billion | USD 20.78 Billion | 3.80% | 2023 |

US Windows Industry Prospective:

The US windows market size was worth around USD 14.29 billion in 2023 and is predicted to grow to around USD 20.78 billion by 2032 with a compound annual growth rate (CAGR) of roughly 3.80% between 2024 and 2032.

US Windows Market: Overview

The US windows industry is growing rapidly driven by several influential factors. Windows are vented barriers that are provided in a wall to allow air and light to enter the room. They also provide an outside view. Windows have several functional attributes. For instance, they ensure that the residents within the structure do not feel claustrophobic. They allow entry of essential natural and fresh air. In the United States, single and double-hung windows are the most common types. Several commercial and residential buildings across the country showcase single or double-hung window types.

Additionally, there are several other popular forms of windows including sliding windows, casement windows, and bay & bow windows. Each variant has specific advantages and disadvantages. Moreover, the overall architecture of the building is crucial in determining which type of window would fit the best in a structural setting. For instance, casement windows are easy to clean and suitable for several types of home styles. However, they pose a security threat while the construction of casement windows is expensive. The demand for windows in the US industry is growing rapidly as redevelopment projects are on the rise. However, the changing prices of raw materials and economic slowdown may affect the US windows market growth rate during the projection period.

Key Insights:

- As per the analysis shared by our research analyst, the US windows market is estimated to grow annually at a CAGR of around 3.80% over the forecast period (2024-2032)

- In terms of revenue, the US windows market size was valued at around USD 14.29 billion in 2023 and is projected to reach USD 20.78 billion, by 2032.

- The US windows industry is projected to grow at a significant rate due to the growing home renovation in the US

- Based on the end-use, the new construction segment is growing at a high rate and will continue to dominate the regional market as per industry projection

- Based on the frame material, the wood segment is anticipated to command the largest market share

- Based on region, the Eastern state of New York is projected to dominate the regional market during the forecast period

Request Free Sample

Request Free Sample

US Windows Market: Growth Drivers

Growing home renovation in the US will drive demand for functional and aesthetically pleasing windows

The US windows market is expected to generate high revenue due to the increasing number of home renovation activities in the country. According to official statistics, interior room decoration was the leading home renovation project undertaken by US residents in 2023. Around 50% of citizens who invested in home remodeling also undertook outdoor upgrade projects. As per the Joint Center for Housing Centers of Harvard University (JCHS), home improvement project spending in 2022 in the US was around USD 482 billion. Factors that have been influential in driving revenue in the renovation sector include changes in lifestyle, and demographics, and increasing government policies that allow house development at affordable prices. In June 2024, the US government announced an investment of USD 142 million. The government is expected to use the fund for promoting energy-efficient and climate-resilient renovations in the U.S. Department of Housing and Urban Development-supported housing solutions. The loan is granted under the Green and Resilient Retrofit Program (GRRP) allowing the total fund to reach USD 754 million.

Increase in the number of homeowners in the country may promote market revenue during the projection period

Homeowners in the US have been growing rapidly over the years. The increasing number of immigrants, expatriates, and international students along with rising job opportunities in the region are promoting home ownership. Additionally, the regional government has launched several programs in recent years to make affordable housing available for the people living in the country. In July 2024, HUD announced an investment of USD 325 million in Choice Neighborhoods grants. The funding will be directed toward the construction of new highly affordable houses, revitalizing neighborhoods, and facilitating economic development. The award will allow the construction of over 6500 housing units including other amenities. Such measures are likely to create more demand in the US window market as each house requires to have sufficient space for windows and other ventilation-promoting structures.

US Windows Market: Restraints

Increasing mortgage rates in recent times could affect the market growth rate

The US industry for windows is likely to be impacted by the growing mortgage prices in the country. As of May 2024, the average mortgage rate for a 30-year duration had risen for 5 weeks in a row. Borrowing costs for 15-year fixed-rate mortgages increased from 6.44% to 6.47% in a week in May 2024. Such fluctuations in the home loan and mortgage industry in the US will affect decisions for homeowners to invest in expensive windows structures. Moreover, the US working population has registered several job cut-downs in 2023. More than 7.7 million in the country lost jobs in 2023. Thus impacting the number of potential customers in the windows industry.

US Windows Market: Opportunities

Growing advancements in window material and construction techniques will generate higher growth opportunities

The US windows market is expected to generate more growth opportunities during the forecast period. Market players are developing new windows materials that deliver higher functionality, and offer affordability, and durability. In June 2024, Minnesota-based Marvin announced the launch of a new line of product offerings in the form of a Modern Corner window. The product is designed specifically to cater to the needs of existing novel home design systems. Modern Corner Window will allow builders and architects to maximize light and views in modern housing spaces.

Surging number of commercial properties in the US will propel the demand for windows

Commercial properties in the US have witnessed steady investments in recent times. These properties include corporate houses, hospitality units, healthcare facilities, entertainment centers, and other structures. In May 2024, official announcements suggested that the area of New Lennox in the US is expected to witness the construction of a new 100-acre sports complex. The site will be constructed by Sports Facilities Companies (SFC) in partnership with the Village of New Lenox. In March 2024, the Janesville Wisconsin region is building a new sports and convention center including a 1,500-seat ice arena. The project is expected to deliver an economic impact of around USD 23 million and impact the demand in the US window industry.

US Windows Market: Challenges

Changing prices of raw materials and supply chain disruptions may impact the market growth rate

The US windows industry is expected to be challenged by the fluctuating prices of raw materials required for the construction of windows. The most common raw materials are glass, seals & gaskets, frames, spaces, insulation material, and hardware. Wood is one of the prominent raw materials used for the construction of window frames. However, supply chain disruptions may impact the pricing of the products affecting the final cost of windows.

US Windows Market: Segmentation

The US windows market is segmented based on end-use, type, frame material, and region.

Based on the end-use, the regional market segments are refurbishment and new construction. In 2023, the highest growth was observed in the new construction segment. During the projection period, demand for windows for new construction is expected to grow at a CAGR of more than 3.21%. The growing real estate market in regions such as Florida, Texas, New York, and Boston is driving the segmental demand rate.

Based on type, the US windows industry is divided into tilt & turn windows, awning windows, casement windows, double/single-hung windows, sliding windows, and others.

Based on the frame material, the regional market divisions are aluminum, wood, vinyl, and others. The highest growth was observed in the wood segment. It dominated nearly 22% of the total market share in 2023. Window frames offer excellent durability. Additionally, they assist in improving the overall appearance of the window. Aluminum frames are also significant revenue generators driven by the surge in aluminum adoption during the construction of skyscrapers.

US Windows Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US Windows Market |

| Market Size in 2023 | USD 14.29 Billion |

| Market Forecast in 2032 | USD 20.78 Billion |

| Growth Rate | CAGR of 3.80% |

| Number of Pages | 215 |

| Key Companies Covered | Weather Shield, Marvin Windows and Doors, Champion Windows, Andersen Corporation, Window World, Simonton Windows, Pella Corporation, MI Windows and Doors, Milgard Windows & Doors, JELD-WEN, Harvey Building Products, Atrium Windows, PGT Innovations, Kolbe Windows & Doors, Alside., and others. |

| Segments Covered | By End-Use, By Type, By Frame Material, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US Windows Market: Regional Analysis

Eastern state of New York to generate the highest revenue during the projection period

The US windows market is expected to be led by New York during the projection period. New York City is one of the most lucrative markets for real estate. It mainly caters. As of 2024, the city has more than 7000 completed high-rise buildings towering over 115 feet. In addition to this, the number of house dwellers in New York has increased in the last few years. In 2022, over 20 million people were living in the area. Other prominent eastern states likely to drive the market growth rate are Florida, Massachusetts, Virginia, and Pennsylvania. Florida, for instance, is prone to natural calamities such as hurricanes. Hence the region necessitates the use of stronger windows that can protect against harsh weather. The growing construction of new accommodation centers ranging from economical to luxury will further promote the regional market demand. For instance, General Hotels Corporation is expected to launch 3 new facilities in Florida by 2025. The increased efforts by the regional government to promote housing access to all may further fuel the demand for windows in the coming years.

US Windows Market: Competitive Analysis

The US windows market is led by players like:

- Weather Shield

- Marvin Windows and Doors

- Champion Windows

- Andersen Corporation

- Window World

- Simonton Windows

- Pella Corporation

- MI Windows and Doors

- Milgard Windows & Doors

- JELD-WEN

- Harvey Building Products

- Atrium Windows

- PGT Innovations

- Kolbe Windows & Doors

- Alside.

The US windows market is segmented as follows:

By End-Use

- Refurbishment

- New Construction

By Type

- Tilt & Turn Windows

- Awning Windows

- Casement Windows

- Double/Single-Hung Windows

- Sliding Windows

- Others

By Frame Material

- Aluminum

- Wood

- Vinyl

- Others

By Region

- The U.S.

Table Of Content

Methodology

FrequentlyAsked Questions

The US windows industry is growing rapidly driven by several influential factors.

The US windows market is expected to generate high revenue due to the increasing number of home renovation activities in the country.

According to study, the US windows market size was worth around USD 14.29 billion in 2023 and is predicted to grow to around USD 20.78 billion by 2032.

The CAGR value of the US windows market is expected to be around 3.80% during 2024-2032.

The US windows market is expected to be led by New York during the projection period.

The US windows market is led by players like Weather Shield, Marvin Windows and Doors, Champion Windows, Andersen Corporation, Window World, Simonton Windows, Pella Corporation, MI Windows and Doors, Milgard Windows & Doors, JELD-WEN, Harvey Building Products, Atrium Windows, PGT Innovations, Kolbe Windows & Doors, and Alside.

The report explores crucial aspects of the US windows market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed