Used Car Market Size, Share, Growth, Analysis, Forecasts, 2032

Used Car Market By Fuel Type (Petrol, Diesel, and Others), By Vendor Type (Organized and Unorganized), By Vehicle Type (Electric, Hybrid, and Conventional), By Sales Channel (Online and Offline), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

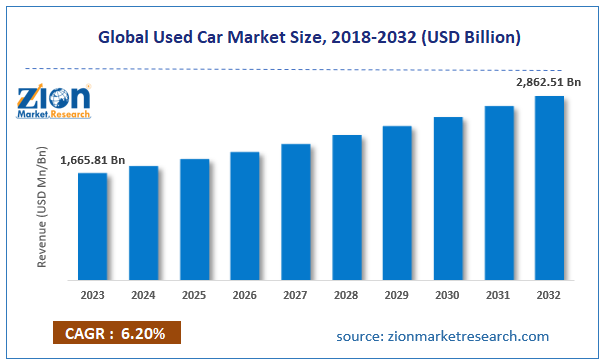

| USD 1,665.81 Billion | USD 2,862.51 Billion | 6.20% | 2023 |

Used Car Industry Prospective:

The global used car market size was worth around USD 1,665.81 billion in 2023 and is predicted to grow to around USD 2,862.51 billion by 2032 with a compound annual growth rate (CAGR) of roughly 6.20% between 2024 and 2032.

Used Car Market: Overview

A used car, also known as a secondhand car, is a pre-owned vehicle. It means that the vehicle has previously had at least one retail owner. In some cases, the vehicles have passed through several owners. The industry of owned cars has become extremely popular in the last few years. These vehicles are sold through various channels including certified car dealers, franchise stores, private parties, and rental car companies. In some regions, the used car industry is highly unorganized in which the buyers and the sellers come together and perform the transaction without the involvement of a third party.

In addition to this, used cars have found consumers across borders with sellers in high-income countries preferring to sell their cars in low-income economies as it allows them higher returns. The pricing of used cars is typically based on three models including private-party price, dealer trade-in price, and dealer price. The international used car industry is heavily regulated in some parts of the world and market players must ensure compliance to avoid repercussions. The rising cost of new vehicles is expected to push more consumers toward the used car industry since they are comparatively more affordable.

Key Insights:

- As per the analysis shared by our research analyst, the global used car market is estimated to grow annually at a CAGR of around 6.20% over the forecast period (2024-2032)

- In terms of revenue, the globally used car market size was valued at around USD 1,665.81 billion in 2023 and is projected to reach USD 2,862.51 billion by 2032.

- The market is projected to grow at a significant rate due to the increasing digitization in the used car sector

- Based on fuel type segmentation, the petrol segment is growing at a high rate and is projected to dominate the global market.

- Based on vehicle type segmentation, the conventional segment is projected to swipe the largest market share.

- On the basis of region, Asia-Pacific is expected to dominate the global market during the forecast period.

Request Free Sample

Request Free Sample

Used Car Market: Growth Drivers

Increasing digitization in the used car sector will drive the market growth rate

The global used car market is expected to grow due to the rising digitization of the industry. Until a few years ago, the used car industry did not enjoy the perks of an organized sector. Several players were operating in the industry without implementing standard procedures. However, the industry has since become well-regulated as government rules and regulations have become clearer and implementation policies have been drafted. In addition to this, consumers are evidently more aware of the possible concerns that are often associated with used cars. The launch of several new applications and websites dedicated to used cars is an indication of the increasing organization in the industry.

In February 2024, CARFAX, a US-based company providing vehicle information to businesses and individuals, announced the launch of new car listings. The platform offers extensive assistance to car traders. Vehicle buyers can research which car to choose, the right process of maintaining and servicing a vehicle, along with every other aspect associated with car trading.

In January 2022, General Motors (GM) announced the launch of CarBravo. It is a website listing used car information across the company’s participating dealerships. The website currently hosts information for 400,000 used vehicles. Digital platforms offer convenience to customers. Most modern digital platforms are fully equipped to handle all queries and concerns of the buyers or the sellers. For instance, used car websites provide financial information and connect traders with car finance providers for a smoother experience. Such measures will contribute to higher demand in the industry.

Increasing number of companies offering financial loans for used cars to drive the market revenue

While there are multiple financial aid providers operating in the new car segment, such services were limited to the used car segment until a few years ago. As the demand for used cars is on the rise, financial assistance providers are steadily making their way into the industry by offering suitable assistance.

In March 2023, the financial wing of India’s leading automotive company, Mahindra Finance Services, announced the launch of used car digi loans. The company has partnered with regional players Rupyy and Car&Bike. Such measures are likely to improve the global used car market revenue.

Used Car Market: Restraints

Large scale presence of the unorganized sector will restrict market revenue

The global used car industry is expected to be restricted due to the presence of a large unorganized segment. Countries with poor regulatory policies governing the used car sector are often at risk of becoming the ground for the unorganized selling of used cars. In such cases, used car buyers may end up buying poor-performance cars at higher rates.

Additionally, the majority of players in the unorganized sector do not have proper maintenance records of the vehicles being sold. The inspection of the vehicle is done by local mechanics offering false reports. The buying and selling of low-grade vehicles at high-cost acts as a growth barrier for legitimate companies offering valid services.

Used Car Market: Opportunities

Increasing initiatives by the government to regulate the industry will generate high-growth opportunities

The global used car market will generate high growth opportunities due to the growing initiatives by regional governments to regulate the market and create scope for integration of the unorganized sector in the organized industry. In December 2022, the Indian Ministry of Road Transport and Highways (MoRTH) announced amendments to the existing Central Motor Vehicle Rules, 1989. The new changes are expected to create an ecosystem for helping the used bike or car market thrive further as the number of used car buyers in the country is rising at a sharp rate. As per the new rules, the car deal will be conducted through a dealer. The original owner and the buyer will not have any direct contact.

In December 2021, the European Union launched the Guarantees law which modified the ways in which the regional used car segment operated. As per the new law, the sellers of used cars are now liable to pay for any repair work related to car breakdown during the 12 months of the warranty. Additionally, the sellers have to offer at least 2 years of warranty. Such measures will help in helping the consumers become more confident about the industry.

Rising prices of new automobiles direct new buyers toward used cars

The price of new automobiles is increasing significantly. The cost of raw materials has risen sharply. In addition to this, supply chain management has become more complex. Used cars offer a way for car buyers to opt for a vehicle at an affordable price. Vehicles sold through authorized dealers come with extended warranties thus offering higher return on investment. The growing prices of new vehicles will drive the demand in the global used car market.

Used Car Market: Challenges

Extreme depreciation of used car value is a challenge that must be addressed

One of the key challenges in the global industry for used cars is the depreciating value of the vehicle. Once a car is bought, the value of the original car automatically reduces. In the case of used cars, the final value is further reduced. Hence used car owners cannot expect high returns in case they want to sell it at a later time. In most cases, the vehicle must be sold in scrap.

Used Car Market: Segmentation

The global used car market is segmented based on fuel type, vendor type, sales channel, vehicle type, and region.

Based on fuel type, the global market segments are petrol, diesel, and others. In 2023, the petrol-type segment was the leading revenue generator. It dominated around 42.01% of the total segment. The increasing demand for petrol-powered vehicles and the shrinking demand for diesel vehicles led to higher segmental demand. Diesel vehicles must meet strict government regulations thus limiting the number of buyers in the industry.

Based on vendor type, the global used car industry is divided into organized and unorganized.

Based on vehicle type, the global market divisions are electric, hybrid, and conventional. In 2023, the highest growth rate was registered in the conventional segment. It held control over 47.01% of the total market share. The electric vehicle and hybrid vehicle sector has witnessed recent growth. The conventional segment has existed for a longer time and hence enjoys a significant consumer base. Additionally, the demand for conventional sports utility vehicles (SUVs) is higher in the commercial market.

Based on sales channels, the global market segments are online and offline.

Used Car Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Used Car Market |

| Market Size in 2023 | USD 1,665.81 Billion |

| Market Forecast in 2032 | USD 2,862.51 Billion |

| Growth Rate | CAGR of 6.20% |

| Number of Pages | 211 |

| Key Companies Covered | Autotrader, CarMax, Enterprise Car Sales, Cars.com, Vroom, TrueCar, Carvana, eBay Motors, Beepi, Sonic Automotive, CarGurus, Hertz Car Sales, Shift, Penske Automotive Group, Carmudi, and others. |

| Segments Covered | By Fuel Type, By Vendor Type, By Vehicle Type, By Sales Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Used Car Market: Regional Analysis

Asia-Pacific to register significant growth during the projection period

The global used car market will be dominated by Asia-Pacific during the forecast period. In 2023, the region dominated nearly 38.05% of the global revenue. Countries such as India, China, South Korea, and others have a high demand for used cars. China is the leading automobile producer. This significantly also impacts the demand and supply rate in the region’s used car segment. In 2022, more than 16.5 million user cars were transacted in China. The rising disposable income of the general population in addition to the rise of several financial institutes backing used car buying decisions has encouraged more buyers to opt for pre-owned cars.

The regional governments are also working toward drafting laws and regulations that can help the used car industry players to grow at a steady pace in the coming years. The launch of comprehensive digital solutions powered by artificial intelligence (AI) has further promoted regional revenue. North America is also expected to register a significant growth rate. The high consumption of vehicles is a major growth driver in the North American market. Additionally, the regional market is well-regulated and has a high consumer awareness rate.

Used Car Market: Competitive Analysis

The global used car market is led by players like:

- Autotrader

- CarMax

- Enterprise Car Sales

- Cars.com

- Vroom

- TrueCar

- Carvana

- eBay Motors

- Beepi

- Sonic Automotive

- CarGurus

- Hertz Car Sales

- Shift

- Penske Automotive Group

- Carmudi

The global used car market is segmented as follows:

By Fuel Type

- Petrol

- Diesel

By Vendor Type

- Organized

- Unorganized

By Vehicle Type

- Electric

- Hybrid

- Conventional

By Sales Channel

- Online

- Offline

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A used car, also known as a secondhand car, is a pre-owned vehicle.

The global used car market is expected to grow due to the rising digitization of the industry.

According to study, the global used car market size was worth around USD 1,665.81 billion in 2023 and is predicted to grow to around USD 2,862.51 billion by 2032.

The CAGR value of used car market is expected to be around 6.20% during 2024-2032.

The global used car market will be dominated by Asia-Pacific during the forecast period.

The global used car market is led by players like Autotrader, CarMax, Enterprise Car Sales, Cars.com, Vroom, TrueCar, Carvana, eBay Motors, Beepi, Sonic Automotive, CarGurus, Hertz Car Sales, Shift, Penske Automotive Group, Carmudi, and others

The report explores crucial aspects of the used car market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed