Vehicle Telematics Market Size, Share, Trends, Growth 2032

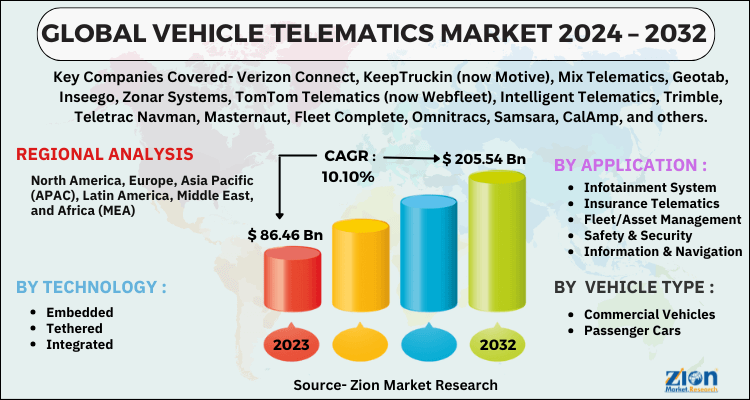

Vehicle Telematics Market By Technology (Embedded, Tethered, and Integrated), By Application (Infotainment System, Insurance Telematics, Fleet/Asset Management, Safety & Security, Information & Navigation, and Others), By Vehicle Type (Commercial Vehicles and Passenger Cars), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

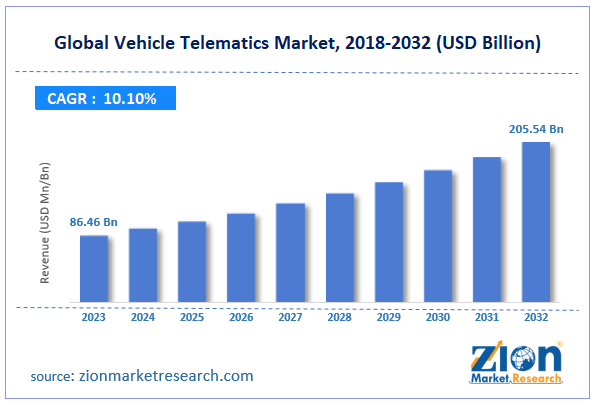

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 86.46 Billion | USD 205.54 Billion | 10.10% | 2023 |

Vehicle Telematics Industry Prospective:

The global vehicle telematics market size was worth around USD 86.46 billion in 2023 and is predicted to grow to around USD 205.54 billion by 2032 with a compound annual growth rate (CAGR) of roughly 10.10% between 2024 and 2032.

Vehicle Telematics Market: Overview

Vehicle telematics is an interdisciplinary field working as a combination of onboard vehicle diagnostics, black box technologies, global positioning systems (GPS), and wireless telematics devices. These technologies work in tandem to record and transmit critical vehicle data such as fuel consumption rate, speed, braking, maintenance requirements, and location. The information thus collected can be further used by companies to take necessary rectification steps such as undertaking servicing or improving driver safety features.

Vehicle telematics are used across several automotive-based industries such as fleet management, emergency assistance, optimization of public transport systems, and logistics & supply chain management. One of the major drivers for increased demand for vehicle telematics is the emergence of the rising sharing trend.

In addition to this, insurance companies widely used vehicle telematics for risk assessment and learning driver’s behavior. During the forecast period, the demand in the vehicle telematics industry is expected to grow due to growing investments in public transport systems. The development of new tools with improved features will help the industry players generate extensive growth opportunities in the future.

Key Insights:

- As per the analysis shared by our research analyst, the global vehicle telematics market is estimated to grow annually at a CAGR of around 10.10% over the forecast period (2024-2032)

- In terms of revenue, the global vehicle telematics market size was valued at around USD 86.46 billion in 2023 and is projected to reach USD 205.54 billion by 2032.

- The market is projected to grow at a significant rate due to the growing demand for efficient fleet management solutions.

- Based on the technology, the integrated segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the vehicle type, the commercial vehicles segment is anticipated to command the largest market share.

- Based on region, Europe is projected to dominate the global market during the forecast period.

Vehicle Telematics Market: Growth Drivers

Growing demand for efficient fleet management solutions will drive market demand rates

The global vehicle telematics market is expected to grow due to the rising demand for efficient fleet management solutions. It refers to the comprehensive process of managing and optimizing a company’s vehicle fleet to reduce costs, improve performance, and increase overall productivity. Fleet management is crucial for companies that rely heavily on a large number of in-house vehicles for the supply of goods and commodities. Efficient fleet management can help companies reduce losses and thus increase overall profit while also ensuring smoother business operations.

In addition to this, the use of vehicle telematics promotes optimization of fuel usage. Users of vehicle telematics benefit by obtaining information on optimal routes that reduce overall fuel consumption. Furthermore, it provides critical information on the driving skills of the drivers allowing users to engage in training activities for the fleet drivers. The increasing emphasis by regional governments to employ digital tools for fleet management will further create demand for cost-effective vehicle telematics systems.

Surging demand for hybrid and electric vehicles will promote the industry's overall revenue in the long term

Vehicle telematics are critical for the operation of electric vehicles (EVs) or hybrid automobiles. The offerings provided by vehicle telematics include information on charging infrastructure and the overall health of batteries allowing users to undertake maintenance and repair projects before unwanted incidents occur. EV users are generally plagued with range anxiety due to the requirement of frequent charging for EVs to run without any hindrance. Vehicle telematics-based solutions can help manage driver’s range anxiety by promoting critical information such as available time for the next recharge, nearby charging stations, and other parameters.

In September 2024, Geotab, a leading telematics company, analyzed data from 5000 fleet and private electric vehicles regarding battery health. According to the reports, modern EV batteries are expected to last more than 20 years thus outrunning the life expectancy of the vehicles. The study concluded that the battery degradation rate is currently at 1.8% per year. Such exemplary applications of the solutions in the global vehicle telematics market will create more revenue in the coming years.

Vehicle Telematics Market: Restraints

High cost of initial investment and limited awareness may impact the overall revenue in the industry

The global industry for vehicle telematics is anticipated to be restricted by the high cost of the initial investment required for deploying the advanced technology. The cost increases further in cases requiring customized solutions. Large fleet management companies may have to pay per vehicle leading to additional expenses.

Furthermore, awareness regarding the importance and advantages of vehicle telematic solutions is highly limited, especially in developing economies and nations suffering from social-political turmoil affecting the overall revenue in the industry.

Vehicle Telematics Market: Opportunities

Emerging trends concerning technology will generate expansion possibilities in the future

The global vehicle telematics market is expected to generate growth opportunities during the forecast period due to several emerging trends in the industry. Some of the leading trends include highly advanced analytics and predictive maintenance features, environmentally-friendly routing and electric vehicles, advertising technology (AdTech), enhanced safety features, integration with smart city infrastructure, and automotive biometric vehicle access systems. The surging investments in the development of ancillary tools that are part of vehicle telematics will ultimately lead to increased revenue in the industry.

For instance, in October 2024, Netradyne, a global provider of Artificial Intelligence (AI) as a Software-as-a-Service (SaaS) model, announced the launch of a novel Driver Drowsiness with Driver Monitoring System (DMS) Sensor. According to official claims, the new system outperforms currently available systems that detect and address driver drowsiness. The sensor is programmed to detect late and early stages of drowsiness hence improving fleet and passenger safety. Furthermore, the launch of 5G-powered communication systems will promote higher research & development of improved vehicle telematics.

Vehicle Telematics Market: Challenges

Lack of standardization in the market is a key challenge for the industry players

The global industry for vehicle telematics is expected to be challenged by the lack of standardization in the industry. The absence of specific international guidelines governing the development and application of vehicle telematics systems creates problems for the industry players since they must adapt to changing frameworks leading to higher expenses and time-consuming research. The lack of supporting infrastructure for large-scale deployment of vehicle telematics may also cause limitations in the industry’s overall revenue.

Request Free Sample

Request Free Sample

Vehicle Telematics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Vehicle Telematics Market |

| Market Size in 2023 | USD 86.46 Billion |

| Market Forecast in 2032 | USD 205.54 Billion |

| Growth Rate | CAGR of 10.10% |

| Number of Pages | 210 |

| Key Companies Covered | Verizon Connect, KeepTruckin (now Motive), Mix Telematics, Geotab, Inseego, Zonar Systems, TomTom Telematics (now Webfleet), Intelligent Telematics, Trimble, Teletrac Navman, Masternaut, Fleet Complete, Omnitracs, Samsara, CalAmp, and others. |

| Segments Covered | By Technology, By Application, By Vehicle Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Vehicle Telematics Market: Segmentation

The global vehicle telematics market is segmented based on technology, application, vehicle, and region.

Based on the technology, the global market segments are divided into embedded, tethered, and integrated. In 2023, the highest demand was listed in the integrated segment. It held dominance over 47% of the total revenue. The segmental demand is led by the greater application of integrated systems during emergency situations such as crashes or vehicle breakdowns. Integrated vehicle telematics assists in quick response toward road assistance leading to greater favoritism among end-users. During the forecast period, the embedded system is likely to create higher revenue.

Based on application, the global vehicle telematics industry is divided into infotainment systems, insurance telematics, fleet/asset management, safety & security, information & navigation, and others.

Based on the vehicle type, the global market divisions are commercial vehicles and passenger cars. In 2023, the highest revenue was listed in the commercial vehicles segment. According to market research, vehicle telematics proves cost-efficient in the case of managing fleets of vehicles. The growing introduction of new assistive technologies such as accident assistance, driver behavior monitoring, and real-time driver coaching will aid higher revenue in the industry. In2023, the global fleet management market was valued at over USD 24 billion.

Vehicle Telematics Market: Regional Analysis

Europe is likely to dominate the industry during the forecast period

The global vehicle telematics market will be led by Europe during the projection period. The regional market growth rate is a result of increased government regulations concerning the use of vehicle telematics in commercial and passenger cars. The use of vehicle telematics across Europe is heavily regulated with transparent and comprehensive guidelines on the correct use of obtained information related to vehicles.

According to the European regulation effective date 1 January2021, the correct use of data generated in connected vehicles is legally covered in two areas that are cybersecurity and commercialization of data to third parties. Such regulations encourage regional players to opt for vehicle transmission systems. Furthermore, Europe has been focusing heavily on improving the energy efficiency index across industries including logistics & supply chain and fleet management sectors.

The use of solutions provided by vehicle telematics can help companies meet regulatory guidelines concerning the optimization of energy usage. The surge in focus on the prevention and management of road accidents across major European nations will also be crucial to the regional growth rate. According to the new rule that became effective on July 7, 2024, all new vehicles in Europe should be equipped with advanced driver assistance systems (ADAS).

Vehicle Telematics Market: Competitive Analysis

The global vehicle telematics market is led by players like:

- Verizon Connect

- KeepTruckin (now Motive)

- Mix Telematics

- Geotab

- Inseego

- Zonar Systems

- TomTom Telematics (now Webfleet)

- Intelligent Telematics

- Trimble

- Teletrac Navman

- Masternaut

- Fleet Complete

- Omnitracs

- Samsara

- CalAmp

The global vehicle telematics market is segmented as follows:

By Technology

- Embedded

- Tethered

- Integrated

By Application

- Infotainment System

- Insurance Telematics

- Fleet/Asset Management

- Safety & Security

- Information & Navigation

- Others

By Vehicle Type

- Commercial Vehicles

- Passenger Cars

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Vehicle telematics is an interdisciplinary field working as a combination of onboard vehicle diagnostics, black box technologies, global positioning systems (GPS), and wireless telematics devices.

The global vehicle telematics market is expected to grow due to the rising demand for efficient fleet management solutions.

According to study, the global vehicle telematics market size was worth around USD 86.46 billion in 2023 and is predicted to grow to around USD 205.54 billion by 2032.

The CAGR value of the vehicle telematics market is expected to be around 10.10% during 2024-2032.

The global vehicle telematics market will be led by Europe during the projection period.

The global vehicle telematics market is led by players like Verizon Connect, KeepTruckin (now Motive), Mix Telematics, Geotab, Inseego, Zonar Systems, TomTom Telematics (now Webfleet), Intelligent Telematics, Trimble, Teletrac Navman, Masternaut, Fleet Complete, Omnitracs, Samsara and CalAmp.

The report explores crucial aspects of the vehicle telematics market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed