Virtual Credit Card Market Trend, Share, Growth, Size and Forecast 2030

Virtual Credit Card Market By Card Type (B2B Virtual Cards, B2C Remote Payment Virtual Cards, and B2C POS Virtual Cards), By End User (Individuals and Enterprises), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2023 - 2030

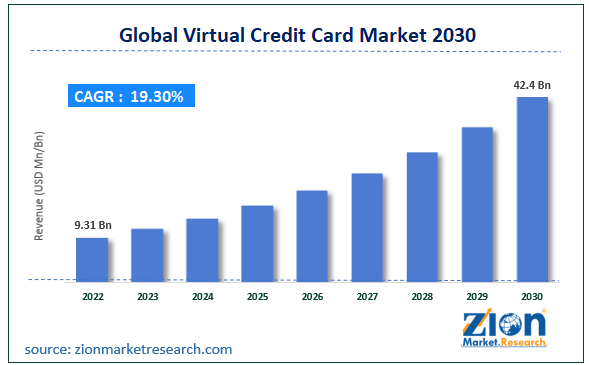

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.31 Billion | USD 42.4 Billion | 19.30% | 2022 |

Virtual Credit Card Industry Prospective:

The global virtual credit card market size was worth around USD 9.31 billion in 2022 and is predicted to grow to around USD 42.4 billion by 2030 with a compound annual growth rate (CAGR) of roughly 19.3% between 2023 and 2030.

Virtual Credit Card Market: Overview

A virtual credit card is a digital representation of a physical credit card that exists only in electronic form. It is designed for online transactions and provides an added layer of security compared to traditional plastic cards. Typically, virtual credit cards are issued by banks or financial institutions and are linked to an individual's existing credit card account. These virtual cards come with a unique card number, expiration date, and security code, just like physical cards. However, they are not tangible and cannot be used for in-person transactions. Users can generate virtual credit card numbers through their bank's online platform or mobile app, enabling them to make secure online purchases without exposing their actual credit card details. One of the main advantages of virtual credit cards is enhanced security. Since the virtual card is separate from the physical card, even if the virtual details are compromised, the actual credit card information remains safe. Additionally, Users can often set spending limits and expiration dates for virtual cards, adding another layer of control and protection against unauthorized transactions. Overall, virtual credit cards offer a convenient and secure solution for online shopping and financial transactions.

Key Insights

- As per the analysis shared by our research analyst, the global virtual credit card industry is estimated to grow annually at a CAGR of around 19.3% over the forecast period (2023-2030).

- In terms of revenue, the global virtual credit card market size was valued at around USD 9.31 billion in 2022 and is projected to reach USD 42.4 billion, by 2030.

- The global virtual credit card market is projected to grow at a significant rate due to increasing emphasis on cybersecurity and fraud prevention.

- Based on card type segmentation, B2B virtual cards were the leading revenue generator in 2022.

- Based on end-user segmentation, individuals were the leading revenue generator in 2022.

- On the basis of region, Europe was the leading revenue generator in 2022.

Request Free Sample

Request Free Sample

Virtual Credit Card Market: Growth Drivers

Increasing emphasis on cybersecurity and fraud prevention to fuel the market growth.

The virtual credit card market is experiencing substantial growth, with one key driver being the increasing emphasis on cybersecurity and fraud prevention. As digital transactions become more prevalent, the need for robust security measures has never been higher. Virtual credit cards address this concern by providing an extra layer of protection against online fraud and unauthorized transactions. This heightened security is particularly attractive to consumers and businesses alike, who are increasingly wary of the risks associated with sharing traditional credit card details in the virtual realm. Moreover, the rising awareness and adoption of contactless payment methods contribute significantly to the virtual credit card market's expansion. With the convenience of making secure online payments without physical card usage, virtual credit cards align with the global shift toward a cashless economy. As consumers seek safer and more efficient payment options, the demand for virtual credit cards is on the rise, driving innovation in the financial technology sector and fostering the growth of this dynamic market.

Virtual Credit Card Market: Restraints

Limited acceptance by merchants may hinder the market expansion.

Despite the growth and advantages associated with virtual credit cards, a notable restraint in their widespread adoption is the limited acceptance by merchants. While online retailers and e-commerce platforms widely support virtual credit card transactions, there remains a significant portion of the market, especially in brick-and-mortar establishments, that may not readily accept virtual card payments. This constraint is often attributed to the need for updated point-of-sale (POS) systems and a general lag in the adoption of newer payment technologies by some businesses. As a result, consumers may find themselves restricted in their ability to use virtual credit cards for certain in-person transactions, limiting the overall utility of these digital alternatives. Furthermore, concerns related to the unfamiliarity of virtual credit cards and potential technical issues contribute to a hesitancy among consumers to fully embrace this payment method. Some individuals may be skeptical or cautious about adopting new technologies, especially if they perceive a lack of widespread understanding or acceptance. Building trust in virtual credit cards and addressing any perceived complexities or risks associated with their use will be essential to overcoming this restraint and fostering broader consumer confidence in adopting these innovative payment solutions.

Virtual Credit Card Market: Opportunities

Potential to cater to the growing trend of digital and mobile-first lifestyles to provide growth opportunities

An exciting opportunity for the virtual credit card market lies in its potential to cater to the growing trend of digital and mobile-first lifestyles. As consumers increasingly rely on smartphones and other digital devices for various aspects of their lives, including financial transactions, virtual credit cards align perfectly with this shift. The opportunity to seamlessly integrate virtual credit cards into mobile wallet applications and digital platforms can enhance User experience and convenience, attracting a broader User base. This convergence of virtual credit cards with the mobile ecosystem creates a fertile ground for innovation, enabling financial institutions and fintech companies to develop User-friendly interfaces and features that resonate with the modern, tech-savvy consumer. Moreover, the global expansion of e-commerce and cross-border trade presents another significant opportunity for virtual credit cards. As businesses and consumers engage in transactions with entities across different regions, virtual credit cards offer a secure and efficient means of making online payments in various currencies. The ability of virtual credit cards to facilitate international transactions with reduced currency conversion hassles and enhanced security positions them as a valuable tool in the era of globalized commerce. Embracing this opportunity can lead to the continued growth and evolution of the virtual credit card market on a global scale.

Governments around the world are promoting digital payments to improve financial inclusion, reduce the use of cash, and make payments more efficient. This is being done through a variety of initiatives. For instance, India's government has launched a number of initiatives to promote digital payments, such as the Pradhan Mantri Jan Dhan Yojana (PMJDY) scheme, which provides financial services to low-income households. The government has also launched the Unified Payments Interface (UPI), a real-time payment system that has been widely adopted by consumers.

Moreover, financial technology (fin-tech) companies are investing heavily in research and development to develop innovative virtual credit card solutions. This is leading to the development of more secure, convenient, and User-friendly virtual credit cards. For instance, Revolut is a leading fintech company that offers a virtual credit card that can be linked to a User's bank account. The Revolut virtual credit card can be used to make online and in-store payments, and it can be easily managed through the Revolut app. The adoption of VCCs has been further accelerated through collaborations between banks and fintech companies.

Another noteworthy example is the collaboration between the Bank of Baroda and OneCard, where a virtual credit card, promising swift delivery in three minutes, was introduced in November 2021. This innovative credit card, facilitated by BOB Financial Services Limited (BFSL) and administered by OneCard on VISA's Signature platform, exemplifies the evolving landscape of secure and efficient payment options.

Virtual credit card Market: Challenges

The persistent concern over data privacy and security to challenge market growth

A notable challenge facing the virtual credit card market is the persistent concern over data privacy and security. While virtual credit cards offer enhanced security features compared to traditional cards, the digital landscape is continuously evolving, presenting new and sophisticated cyber threats. The risk of data breaches, identity theft, and unauthorized access to virtual credit card information remains a significant challenge, deterring some consumers from fully embracing this payment method. Financial institutions and fintech providers must invest heavily in robust encryption technologies, cybersecurity protocols, and regular updates to ensure the ongoing protection of User data and maintain consumer trust in virtual credit cards.

Additionally, regulatory hurdles and varying legal frameworks across different regions pose a challenge to the seamless global adoption of virtual credit cards. The lack of standardized regulations may create complexities in terms of compliance, making it challenging for financial institutions to navigate the regulatory landscape effectively. Addressing these regulatory challenges requires collaboration between industry stakeholders and regulatory bodies to establish clear guidelines that foster innovation while ensuring the security and integrity of virtual credit card transactions. Navigating these challenges is crucial for the sustained growth and widespread acceptance of virtual credit cards in the financial ecosystem.

Virtual credit card Market: Segmentation

The global virtual credit card market is segmented based on card type, end User, and region.

Based on card type the global virtual credit card market categorized as B2B virtual cards, B2C remote payment virtual cards, and C2B POS virtual cards. Out of these, B2B virtual cards was the largest shareholding segment in the global market. This dominance can be attributed to the increasing adoption of virtual credit cards in business-to-business transactions, driven by their convenience, enhanced security features, and the ability to streamline financial processes for corporations. The B2B virtual card segment's robust growth reflects a growing trend among businesses to leverage digital payment solutions for improved efficiency and security in their financial transactions.

Based on end user the global virtual credit card market categorized as individuals and enterprises. Out of these, Individuals were the largest shareholding segment in the global market. The individuals segment claims the largest share, primarily due to its widespread accessibility, convenience, and the ability to offer a diverse range of products to a broad consumer base. Virtual card payments have gained widespread preference among consumers worldwide due to their associated benefits, particularly in terms of convenience and accessibility. This shift is evident in various regions, for instance, a report from the World Bank reveals a significant trend in China, where 89% of adults hold a bank account, and a substantial 82% of them actively engage in digital payments. This data underscores the growing reliance on virtual card transactions, showcasing the widespread adoption of digital payment methods in a leading global economy.

Virtual Credit Card Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Virtual Credit Card Market |

| Market Size in 2022 | USD 9.31 Billion |

| Market Forecast in 2030 | USD 42.4 Billion |

| Growth Rate | CAGR of 19.3% |

| Number of Pages | 206 |

| Key Companies Covered | Privacy.com, Revolut, Skrill, Entropay, Token, Pleo, PayPal, Capital One, Neteller, Adyen., and others. |

| Segments Covered | By Card Type, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Virtual credit card Market: Regional Analysis

Europe to lead the market during the forecast period

In 2022, Europe emerged as the dominant force in the virtual credit card market, commanding a substantial share exceeding 38.0%. This regional stronghold is propelled by a notable shift towards cashless payments, particularly in key European nations such as the U.K. and Germany. The burgeoning preference for digital transactions in the region is not only driven by consumer habits but is also being catalyzed by strategic moves from market players.

A case in point is Stripe, which, in April 2021, introduced Stripe Issuing across European nations. This innovative product empowers businesses by enabling the creation, organization, and distribution of both virtual and physical payment cards, providing heightened control over expenditure.

Meanwhile, the Asia Pacific region is poised to experience the most significant Compound Annual Growth Rate (CAGR) during the forecast period. This anticipated growth is underpinned by the rising prevalence of smartphones in countries like India, China, and Japan. The surge in smartphone usage has cultivated a strong inclination towards digital payment methods among consumers, fostering a heightened demand for virtual card solutions. Notably, in Japan, as per a report from Asian Banker Worldwide in October 2021, boasts a 70.6% penetration of digital wallets, a figure projected to soar to 98.6% by 2025. This data underscores the dynamic landscape in Asia Pacific, marking it as a key driver in the global proliferation of virtual credit card payment solutions.

Key Developments

In 2021: PayPal launched a virtual credit card that can be linked to a User's PayPal account. The PayPal virtual credit card can be used to make online payments, and it can be easily managed through the PayPal website or app.

In 2021, Citibank launched a virtual credit card that can be linked to a User's Citibank checking account. The Citibank virtual credit card can be used to make online and in-store payments, and it can be easily managed through the Citibank website or app.

Virtual credit card Market: Competitive Analysis

The global virtual credit card market is dominated by players like:

- Privacy.com

- Revolut

- Skrill

- Entropay

- Token

- Pleo

- PayPal

- Capital One

- Neteller

- Adyen

The global virtual credit card market is segmented as follows:

By Card Type

- B2B Virtual Cards

- B2C Remote Payment Virtual Cards

- B2C POS Virtual Cards

By End User

- Individuals

- Enterprises

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A virtual credit card is a digital representation of a physical credit card that exists only in electronic form. It is designed for online transactions and provides an added layer of security compared to traditional plastic cards. Typically, virtual credit cards are issued by banks or financial institutions and are linked to an individual's existing credit card account. These virtual cards come with a unique card number, expiration date, and security code, just like physical cards.

The global virtual credit card market cap may grow owing to the due to increasing emphasis on cybersecurity and fraud prevention.

According to study, the global virtual credit card market size was worth around USD 9.31 billion in 2022 and is predicted to grow to around USD 42.4 billion by 2030.

The CAGR value of the virtual credit card market is expected to be around 19.3% during 2023-2030.

The global virtual credit card market growth is expected to be driven by Europe. It is currently the world’s highest revenue-generating market owing to the growing BFSI sector.

The global virtual credit card market is led by players like Privacy.com, Revolut, Skrill, Entropay, Token, Pleo, PayPal, Capital One, Neteller, and Adyen.

The report analyzes the global virtual credit card market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the virtual credit card industry.

Choose License Type

List of Contents

Virtual Credit CardIndustry Prospective:OverviewKey InsightsGrowth DriversRestraintsOpportunitiesVirtual credit card ChallengesVirtual credit card SegmentationReport ScopeVirtual credit card Regional AnalysisKey DevelopmentsVirtual credit card Competitive AnalysisThe global virtual credit card market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed