Wafer Backgrinding Tape Market Size, Share, Trends, Growth 2034

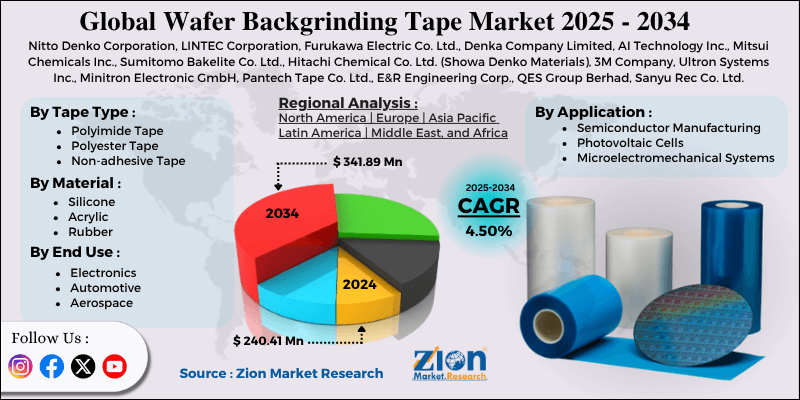

Wafer Backgrinding Tape Market By Tape Type (Polyimide Tape, Polyester Tape, Non-adhesive Tape), By Material (Silicone, Acrylic, Rubber), By Application (Semiconductor Manufacturing, Photovoltaic Cells, Microelectromechanical Systems), By End-Use (Electronics, Automotive, Aerospace), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

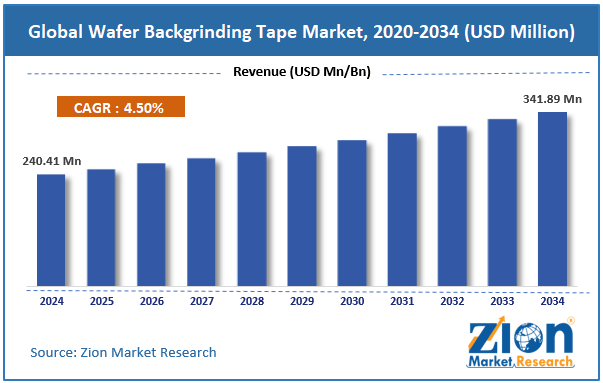

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 240.41 Million | USD 341.89 Million | 4.5% | 2024 |

Wafer Backgrinding Tape Industry Perspective:

The global wafer backgrinding tape market size was approximately USD 240.41 million in 2024 and is projected to reach around USD 341.89 million by 2034, with a compound annual growth rate (CAGR) of approximately 4.50% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global wafer backgrinding tape market is estimated to grow annually at a CAGR of around 4.50% over the forecast period (2025-2034)

- In terms of revenue, the global wafer backgrinding tape market size was valued at around USD 240.41 million in 2024 and is projected to reach USD 341.89 million by 2034.

- The wafer backgrinding tape market is projected to grow significantly due to the growth in consumer electronics production, the expansion of 5G infrastructure and IoT applications, and advancements in grinding and dicing processes.

- Based on tape type, the polyimide tape segment is expected to lead the market, while the polyester tape segment is expected to grow considerably.

- Based on material, the silicone segment is the dominant segment, while the acrylic segment is projected to witness sizable revenue growth over the forecast period.

- Based on application, the semiconductor manufacturing segment holds a leading share, while the microelectromechanical systems segment is projected to grow considerably over the coming years.

- Based on end-use, the electronics segment is expected to lead the market compared to the automotive segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Wafer Backgrinding Tape Market: Overview

Wafer backgrinding tape is a specialized adhesive tape used in the wafer thinning process during semiconductor manufacturing. It offers strong adhesion to hold the wafer securely while safeguarding its surface from contamination or damage during backgrinding. After grinding, the tape is removed by heating or exposure to UV light, which weakens the adhesive, ensuring a clean detachment. The global wafer backgrinding tape market is expected to expand rapidly, driven by increasing demand for miniaturized electronics, growth in semiconductor manufacturing capacity, and the rise of AI and 5G technologies. Growing consumer demand for high-performance and compact devices, such as IoT sensors and smartphones, is driving the need for ultra-thin wafers. Backgrinding tapes assure surface protection and safe thinning, backing the miniaturization trend. As 3D ICs gain popularity, the demand for precision wafer processing grows remarkably.

Moreover, economies like South Korea, Taiwan, and the United States are heavily investing in new fabrication facilities. These expansions surge the consumption of wafer processing materials, comprising backgrinding tapes. For example, Samsung and TSMC's capacity additions are notably driving the demand for supportive consumables. Furthermore, the integration of AI and 5G has heightened the demand for energy-efficient and high-speed chips. These chips require thin wafers for enhanced heat dissipation and improved performance. Hence, the rise in 5G-enabled devices is majorly supporting the wafer backgrinding tape sector.

Despite the growth, the global market is hindered by factors such as the complexity of adhesive removal and low compatibility with various wafer materials. Improper adhesive removal may lead to wafer contamination or cracking. This risk raises defect rates and process complexity. Hence, manufacturers should balance strong adhesion with easy removability, offering continuous challenge. Likewise, some backgrinding tapes struggle with developing substrates like GaN and SiC, as these materials gain traction in power electronics, compatibility issues slow down adoption. Persistent R&D investment is necessary to expand the applicability of tape.

Nonetheless, the global wafer backgrinding tape industry stands to gain from several key opportunities, including the shift towards eco-friendly tape solutions, integration with smart manufacturing and automation, and the growing demand in power electronics. Sustainability trends offer prospects for solvent-free and biodegradable adhesives. Developing eco-friendly tapes provides a competitive benefit. Companies emphasizing green chemistry will hold fresh regulatory-based opportunities.

Additionally, semiconductor fabs are increasingly automating production lines. Smart tapes with traceable barcoding or sensor integration support process monitoring and control. Advancements like these may differentiate premium product lines. With renewable energy and EVs fueling GaN and SiC adoption, specialized tapes are needed for these rigid substrates; manufacturers pointing out these niches may gain early-mover benefits.

Wafer Backgrinding Tape Market Dynamics

Growth Drivers

How do yield sensitivity and the cost of scrap fuel the wafer backgrinding tape market?

As wafer geometries shrink, the cost of wafer breakage increases significantly, making tape quality a direct financial concern. High-performance backgrinding tapes decrease microcracks, post-grind defects, and particle contamination that can lead to high-priced scrap. Even minor advancements in tape reliability translate to significant savings for manufacturers producing high-value wafers. This motivates fabs to prefer validated and premium tapes with proven release and adhesion properties. Tape suppliers invest heavily in testing and qualification to gain long-term contracts and lessen switching risks.

How is material innovation, which expands tape performance and applications, propelling the wafer backgrinding tape market's growth?

Innovations in backing materials and adhesive chemistry, comprising low-particle backings, UV-curable adhesives, and thermally stable silicones, allow cleaner release and safer wafer thinning. These advancements enable wafers to reach thinner final dimensions without compromising quality for sensitive downstream processes.

Specialty chemical startups and suppliers fuel R&D, while established players scale novel materials in wafer fabs and at larger scales. Differentiated products command higher prices and open up opportunities in niche applications, such as automotive sensors and wearable devices. Material advancements, therefore, propel product segmentation and growth in the wafer backgrinding tape market.

Restraints

Supply-chain volatility and limited raw material availability negatively impact the market progress

Specialty adhesives, UV-curable components, and silicone backings rely on a small number of chemical suppliers, creating supply chain threats. Geopolitical issues, export restrictions, or natural disasters can disrupt supply, resulting in production delays and price fluctuations. According to analysts, supply chain disturbances in 2023-2024 temporarily impacted tape availability in major North American and Asian fabs. Manufacturers typically maintain strategic inventories, but restricted raw material options continue to limit the speedy and large-scale adoption worldwide.

Opportunities

How is rising demand from automotive, AI, and 5G applications offering advantageous conditions for the wafer backgrinding tape market development?

Automotive semiconductors, 5G devices, and AI accelerators are progressively dependent on advanced packaging with ultra-thin wafers. These high-value wafers make backgrinding tape performance vital to reliability and production. Growth in AI chips, electric vehicles, and 5G infrastructure is projected to sustain higher tape consumption.

According to industry reports, automotive IC demand is anticipated to progress at a CAGR above 10% by 2025, indicating a surge in the potential of the wafer backgrinding tape industry. Suppliers supporting their product portfolio with these high-growth end markets may hold long-term opportunities.

Challenges

Long qualification cycles and customer switching barriers limit the market growth

Wafer backgrinding tapes require extensive testing, encompassing particle release, peel reliability, and thermal stability, before they can be adopted. Qualification cycles can be time-consuming, taking months, and slowing the industry penetration for novel products. Customers are reluctant to change suppliers once the tape is validated, restricting opportunities for new or smaller entrants. According to news reports, major OSATs and IDMs maintain a multi-month approval process, focusing on reliability over cost. This creates a barrier for new players to gain speedy traction in the market.

Wafer Backgrinding Tape Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Wafer Backgrinding Tape Market |

| Market Size in 2024 | USD 240.41 Million |

| Market Forecast in 2034 | USD 341.89 Million |

| Growth Rate | CAGR of 4.50% |

| Number of Pages | 212 |

| Key Companies Covered | Nitto Denko Corporation, LINTEC Corporation, Furukawa Electric Co. Ltd., Denka Company Limited, AI Technology Inc., Mitsui Chemicals Inc., Sumitomo Bakelite Co. Ltd., Hitachi Chemical Co. Ltd. (Showa Denko Materials), 3M Company, Ultron Systems Inc., Minitron Electronic GmbH, Pantech Tape Co. Ltd., E&R Engineering Corp., QES Group Berhad, Sanyu Rec Co. Ltd., and others. |

| Segments Covered | By Tape Type, By Material, By Application, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Wafer Backgrinding Tape Market: Segmentation

The global wafer backgrinding tape market is segmented by tape type, material, application, end-use, and region.

Based on tape type, the global wafer backgrinding tape industry is divided into polyimide tape, polyester tape, and non-adhesive tape. The polyimide tape segment holds a substantial share due to its optimal heat resistance, suitability for advanced wafer thinning processes, and durability.

On the other hand, polyester tape ranks second in terms of cost-effectiveness and reliable performance in standard backgrinding use cases.

Based on material, the global market is segmented into silicone, acrylic, and rubber. The silicone segment dominates the market due to its excellent heat resistance, easy removal properties during wafer thinning, and strong adhesion.

Conversely, the acrylic segment holds a second-leading position for its balanced adhesion strength, cost-effectiveness, and versatility in standard semiconductor applications.

Based on application, the global wafer backgrinding tape market is segmented into semiconductor manufacturing, photovoltaic cells, and microelectromechanical systems. The semiconductor manufacturing segment holds leadership in the market due to its highest demand for wafer backgrinding tapes in advanced thin-wafer and IC production.

However, the microelectromechanical systems segment holds a secondary position due to its surging use in wearable devices and sensors, which require precise wafer protection and thinning.

Based on end-use, the global market is segmented into electronics, automotive, and aerospace. The electronics segment holds a substantial market share due to the most significant consumption of wafer backgrinding tapes in PCs, smartphones, and consumer electronics.

Nonetheless, the automotive segment is growing considerably due to the increasing use of semiconductors in ADAS, EVS, and automotive electronics that require wafer thinning.

Wafer Backgrinding Tape Market: Regional Analysis

What enables Asia Pacific's strong foothold in the global Wafer Backgrinding Tape Market?

The Asia Pacific is expected to maintain its leading position in the global wafer backgrinding tape market, driven by its dominance in semiconductor manufacturing, rapid growth in the electronics and smartphone industries, and government investments and incentives. The Asia Pacific, led by South Korea, Taiwan, and China, accounts for a significant share of global semiconductor wafer production. Key foundries, such as Samsung, TSMC, and SMIC, fuel significant demand for wafer backgrinding tapes. The region's massive fabrication capacity promises a large-scale and continuous demand for protective tapes.

Moreover, the region is home to key electronics manufacturing hubs, with economies such as those of India and China producing over 50% of the world's smartphones annually. High production volumes of compact devices need ultra-thin wafers, driving the adoption of polyimide and UV-release backgrinding tapes. This strong electronics infrastructure sustains industry dominance in tape consumption.

Furthermore, governments in the region are heavily investing in semiconductor fabs under policies like South Korea's semiconductor support programs and 'Made in China 2025'. These programs motivate local manufacturing and the adoption of advanced packaging. The resultant growth in wafer production directly increases demand for wafer backgrinding tape.

North America ranks as the second-leading region in the global wafer backgrinding tape industry, driven by the high adoption of advanced packaging technologies, a strong R&D and innovation ecosystem, and government support and investment programs. The region leads in the adoption of thin-wafer, advanced packaging, and 3D IC. These processes require precision wafer thinning, increasing the dependency on high-performing tapes, such as UV-released polyimide. The trend towards high-performing and miniaturized chips drives tape consumption.

Additionally, North America boasts its prominent R&D centers in Austin and Silicon Valley. Research into new materials, such as GaN and SiC wafers, fuels the need for specialized protective tapes. Consistent advancement is expected to drive the leading consumption of advanced wafer backgrinding in the region. Policies like the U.S. CHIPS Act incentivize domestic semiconductor manufacturing and facility growth. These investments raise wafer production volumes, fueling the demand for backgrinding tapes. The focus on local sourcing further strengthens the industry growth.

Wafer Backgrinding Tape Market: Competitive Analysis

The leading players in the global wafer backgrinding tape market are:

- Nitto Denko Corporation

- LINTEC Corporation

- Furukawa Electric Co. Ltd.

- Denka Company Limited

- AI Technology Inc.

- Mitsui Chemicals Inc.

- Sumitomo Bakelite Co. Ltd.

- Hitachi Chemical Co. Ltd. (Showa Denko Materials)

- 3M Company

- Ultron Systems Inc.

- Minitron Electronic GmbH

- Pantech Tape Co. Ltd.

- E&R Engineering Corp.

- QES Group Berhad

- Sanyu Rec Co. Ltd.

Wafer Backgrinding Tape Market: Key Market Trends

Rising demand for flexible and thin wafers:

The miniaturization of devices and the rise of 3D ICs are fueling the production of flexible and ultra-thin wafers. This trend needs high-performing tapes that can maintain suitable adhesion and wafer integrity during backgrinding. Tape formulations are changing to meet these strict needs.

Focus on solvent-free and eco-friendly tapes:

Environmental norms and sustainability concerns are driving the adoption of solvent-free and eco-friendly tapes. These tapes reduce the use of hazardous chemicals and comply with global standards. Companies are investing in green formulations while maintaining optimal performance.

The global wafer backgrinding tape market is segmented as follows:

By Tape Type

- Polyimide Tape

- Polyester Tape

- Non-adhesive Tape

By Material

- Silicone

- Acrylic

- Rubber

By Application

- Semiconductor Manufacturing

- Photovoltaic Cells

- Microelectromechanical Systems

By End Use

- Electronics

- Automotive

- Aerospace

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Wafer backgrinding tape is a specialized adhesive tape used in the wafer thinning process during semiconductor manufacturing. It offers strong adhesion to hold the wafer securely while safeguarding its surface from contamination or damage during backgrinding. After grinding, the tape is removed by heating or exposure to UV light, which weakens the adhesive, ensuring a clean detachment.

The global wafer backgrinding tape market is projected to grow due to rising demand for miniaturized semiconductor devices, increasing adoption of advanced packaging technologies, and mounting automotive electronics and EV adoption.

According to study, the global wafer backgrinding tape market size was worth around USD 240.41 million in 2024 and is predicted to grow to around USD 341.89 million by 2034.

The CAGR value of the wafer backgrinding tape market is expected to be approximately 4.50% from 2025 to 2034.

The electronics segment is expected to dominate the wafer backgrinding tape market by 2034.

Emerging trends and innovations in the wafer backgrinding tape market include ultra-thin and high-adhesion tapes, advanced UV-curable tapes, automation in wafer processing, environmentally friendly materials, and integration with 3D and advanced semiconductor packaging technologies.

Technological advancements are driving the wafer backgrinding tape market by enabling thinner and higher-precision wafer processing, supporting advanced semiconductor packaging, improving tape adhesion and UV-curing efficiency, reducing material waste, and enhancing overall production speed and yield.

North America is expected to lead the global wafer backgrinding tape market during the forecast period.

The key players profiled in the global wafer backgrinding tape market include Nitto Denko Corporation, LINTEC Corporation, Furukawa Electric Co., Ltd., Denka Company Limited, AI Technology, Inc., Mitsui Chemicals, Inc., Sumitomo Bakelite Co., Ltd., Hitachi Chemical Co., Ltd. (Showa Denko Materials), 3M Company, Ultron Systems, Inc., Minitron Electronic GmbH, Pantech Tape Co., Ltd., E&R Engineering Corp., QES Group Berhad, and Sanyu Rec Co., Ltd.

The report examines key aspects of the wafer backgrinding tape market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed