Water Infrastructure Repair Technologies Market Size, Share Report, Analysis, Trends, Growth, 2030

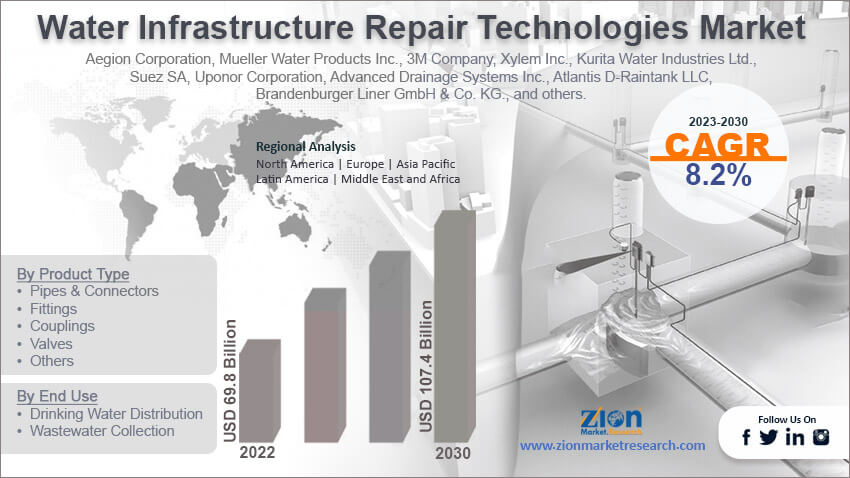

Water Infrastructure Repair Technologies Market by Product Type (Pipes & Connectors, Fittings, Couplings, Valves, and Other Product Types), By End Use (Drinking Water Distribution, and Wastewater Collection), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2023 - 2030

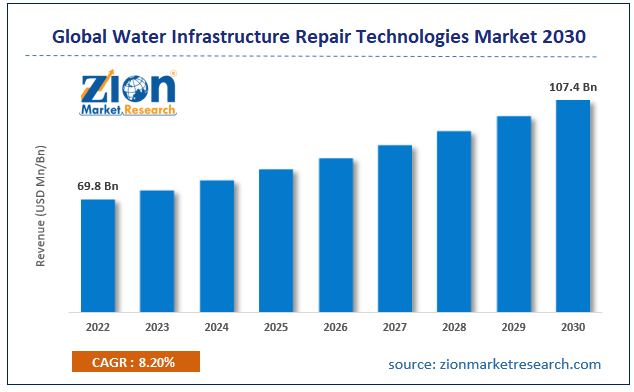

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 69.8 Billion | USD 107.4 Billion | 8.2% | 2022 |

Water Infrastructure Repair Technologies Industry Prospective:

The global water infrastructure repair technologies market size was worth around USD 69.8 billion in 2022 and is predicted to grow to around USD 107.4 billion by 2030 with a compound annual growth rate (CAGR) of roughly 8.2% between 2023 and 2030.

Water Infrastructure Repair Technologies Market: Overview

Water infrastructure repair technologies encompass a wide array of innovative solutions designed to address the aging and deteriorating state of water-related systems. These technologies are crucial in ensuring the reliable and efficient supply of clean water to communities around the world. They cover a broad spectrum, including pipeline rehabilitation, leak detection, water quality monitoring, and wastewater treatment enhancements. Additionally, the integration of smart technologies and data-driven analytics allows for real-time monitoring of water infrastructure, enabling timely interventions and proactive maintenance strategies.

The demand for water infrastructure repair technologies is driven by a range of factors such as aging infrastructure, urbanization, population growth, and environmental concerns all contribute to the need for effective repair and maintenance solutions. In many regions, water systems have been in operation for decades, and their condition has deteriorated over time. This necessitates strategic investments in repair technologies to ensure the continued delivery of safe and clean water. Governments, municipalities, and utility companies are increasingly recognizing the importance of proactive maintenance and repair of water infrastructure. This recognition has led to significant investments in water infrastructure projects worldwide.

Key Insights

- As per the analysis shared by our research analyst, the global water infrastructure repair technologies industry is estimated to grow annually at a CAGR of around 8.2% over the forecast period (2023-2030).

- In terms of revenue, the global water infrastructure repair technologies market size was valued at around USD 69.8 billion in 2022 and is projected to reach USD 107.4 billion, by 2030.

- The global water infrastructure repair technologies market is projected to grow at a significant rate due to escalating demand for the rehabilitation and maintenance of aging water infrastructure systems.

- Based on product type segmentation, pipes & connectors was predicted to hold maximum market share in the year 2022.

- Based on end use segmentation, drinking water distribution were the leading revenue generator in 2022.

- On the basis of region, Asia Pacific was the leading revenue generator in 2022.

Request Free Sample

Request Free Sample

Water Infrastructure Repair Technologies Market: Growth Drivers

The snowballing need for the rehabilitation and maintenance of aging water infrastructure systems is increasing market growth.

The global water infrastructure repair technologies market is experiencing robust growth, primarily driven by the escalating demand for the rehabilitation and maintenance of aging water infrastructure systems. Many water distribution and treatment networks around the world are reaching or surpassing their intended lifespan, resulting in various forms of deterioration, including leaks, corrosion, and structural issues. This pressing need for repair and refurbishment has spurred the adoption of advanced technologies and innovative solutions to address these challenges effectively. Population growth, rapid urbanization, and expanding industrialization have put additional strain on existing water systems. These factors, coupled with increased environmental awareness, have intensified the urgency for reliable and efficient water infrastructure.

Governments, municipalities, and utilities are recognizing the critical importance of proactive maintenance to ensure the continued supply of clean and safe water. Consequently, significant investments are being channeled into water infrastructure projects, including the adoption of cutting-edge repair technologies, further propelling the market's growth trajectory. Moreover, the global trend towards sustainability and water conservation is influencing the choice of repair technologies. Innovative approaches that minimize water wastage and promote efficient use of resources are gaining traction. Trenchless technologies, for example, allow for repairs and upgrades without extensive excavation, reducing disruption and conserving valuable resources. This alignment with sustainable practices not only addresses immediate repair needs but also positions the market for continued expansion as environmental considerations continue to shape the water infrastructure landscape.

Water Infrastructure Repair Technologies Market: Restraints

Financial constraints faced by some municipalities and utilities may restrain the market growth.

The water infrastructure repair technologies industry faces a notable restraint in the form of financial constraints experienced by certain municipalities and utilities. Implementing advanced repair technologies often demands substantial upfront capital investment, which may be challenging for entities operating within limited budgetary constraints. This can lead to delays or compromises in the execution of crucial repair projects, potentially exacerbating the deterioration of water infrastructure systems. Moreover, the availability of funding for infrastructure endeavors is subject to various external factors, including economic conditions, competing priorities, and government policies, all of which can influence the ability to allocate resources toward advanced repair technologies.

These financial limitations can represent a significant hurdle to the widespread adoption of cutting-edge water infrastructure repair solutions. While the benefits of advanced technologies in terms of efficiency, sustainability, and long-term cost savings are evident, not all municipalities and utilities may have the financial capacity to make these investments. As a result, striking a balance between addressing urgent repair needs and managing financial resources remains a critical challenge in ensuring the resilience and sustainability of water infrastructure systems. Efforts to explore alternative funding models, public-private partnerships, and government incentives can play a pivotal role in overcoming this restraint and facilitating the growth of the water infrastructure repair technologies market.

Water Infrastructure Repair Technologies Market: Opportunities

Development and adoption of smart technologies for real-time monitoring and predictive maintenance to provide growth opportunities

The integration of smart technologies for real-time monitoring and predictive maintenance represents a significant growth opportunity in the water infrastructure repair technologies market. With advancements in sensors, data analytics, and Internet of Things (IoT) capabilities, water infrastructure systems can be continuously monitored for performance indicators, potential issues, and anomalies. This proactive approach allows for the early detection of problems, enabling timely interventions before they escalate into costly and disruptive repairs. By leveraging real-time data, municipalities and utilities can optimize maintenance schedules, allocate resources efficiently, and extend the lifespan of critical infrastructure assets. This not only enhances operational efficiency but also leads to substantial cost savings in the long term.

Furthermore, the adoption of smart technologies facilitates a transition towards more sustainable and eco-friendly repair practices. By utilizing innovative materials and techniques that minimize environmental impact, the water infrastructure repair technologies market can align with the global push for sustainable infrastructure solutions. For instance, trenchless technologies reduce the need for extensive excavation, minimizing disruption to communities and preserving natural habitats. Additionally, the incorporation of energy-efficient practices and the use of environmentally friendly materials and coatings contribute to a more eco-conscious approach to water infrastructure repair. This not only addresses immediate repair needs but also positions the market to meet the increasing demand for sustainable and environmentally responsible solutions in the evolving landscape of infrastructure development.

Water Infrastructure Repair Technologies Market: Challenges

Complexity of coordinating repairs within existing urban environments to challenge market growth

The water infrastructure repair technologies industry encounters a significant challenge in the form of coordinating repairs within existing urban environments. Many water systems are deeply integrated into densely populated urban areas, with a labyrinth of underground pipelines and infrastructure. Accessing and repairing these components while minimizing disruption to communities presents a complex logistical puzzle. The intricate web of existing buildings, roads, and utilities requires careful planning and execution to ensure that repair projects are carried out efficiently and with minimal inconvenience to residents and businesses. Moreover, safety considerations are paramount when working in densely populated urban environments. Specialized equipment and skilled personnel are essential to navigate the intricacies of these environments, ensuring that repairs are conducted safely and without compromising the integrity of surrounding structures. Additionally, complying with regulatory requirements and obtaining necessary permits for repair work in urban areas can be a time-consuming and bureaucratic process. These challenges collectively underscore the need for innovative and strategic approaches in order to address repair needs in urban water infrastructure effectively.

Water Infrastructure Repair Technologies Market: Segmentation

The global water infrastructure repair technologies market is segmented based on product type, end-use, and region.

Based on product type, the global market segments are pipes & connectors, fittings, couplings, valves, and others. At present, the global market is dominated by the pipes & connectors segment. This is primarily due to the pivotal role that pipes and connectors play in the overall integrity and functionality of water distribution systems. As essential components, pipes and connectors are crucial for maintaining the seamless flow and distribution of water. Additionally, the need for pipeline rehabilitation and replacement in aging infrastructure further drives the demand for pipes and connectors in the market. Their widespread use and significance in water infrastructure repair contribute to their dominance in the global market.

Based on end-use, the global water infrastructure repair technologies industry is categorized as drinking water distribution and wastewater collection. Out of these, drinking water distribution was the largest shareholding segment in the global market. First and foremost, ensuring access to safe and clean drinking water is a fundamental priority for governments and communities worldwide. As aging infrastructure and environmental challenges continue to pose threats to water quality, there is an urgent need for repair and maintenance technologies to safeguard the integrity of drinking water distribution systems. Additionally, increasing concerns over waterborne diseases and contaminants further underscore the importance of maintaining and upgrading these networks. As a result, substantial investments and initiatives have been directed towards repairing and enhancing drinking water distribution infrastructure, making it the dominant segment in the global market.

Water Infrastructure Repair Technologies Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Water Infrastructure Repair Technologies Market |

| Market Size in 2022 | USD 69.8 Billion |

| Market Forecast in 2030 | USD 107.4 Billion |

| Growth Rate | CAGR of 8.2% |

| Number of Pages | 216 |

| Key Companies Covered | Aegion Corporation, Mueller Water Products Inc., 3M Company, Xylem Inc., Kurita Water Industries Ltd., Suez SA, Uponor Corporation, Advanced Drainage Systems Inc., Atlantis D-Raintank LLC, Brandenburger Liner GmbH & Co. KG., and others. |

| Segments Covered | By Product Type, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Water Infrastructure Repair Technologies Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

Asia Pacific is poised to lead the global water infrastructure repair technologies market during the forecast period, driven by several key factors. The region is experiencing rapid urbanization and population growth, which in turn has led to increased pressure on existing water infrastructure systems. Governments and municipalities are recognizing the need for extensive repairs and upgrades to ensure a reliable supply of clean water to urban centers. This has spurred significant investments in water infrastructure projects, creating a substantial market for repair technologies. Moreover, Asia Pacific is prone to environmental challenges such as flooding, earthquakes, and typhoons.

These natural disasters can cause significant damage to water infrastructure, necessitating prompt repairs and upgrades. As a result, there is a high demand for advanced repair technologies that can withstand such environmental pressures and ensure the resilience of water systems. Furthermore, the region is witnessing a surge in industrialization and economic development, leading to increased demands on water resources for various sectors including manufacturing, agriculture, and energy production. This heightened demand places additional stress on existing water infrastructure, driving the need for repair and maintenance technologies. Overall, with a combination of population growth, urbanization, environmental challenges, and economic development, Asia Pacific is positioned to play a pivotal role in driving the growth of the global water infrastructure repair technologies market.

Key Developments

In 2023, the US Environmental Protection Agency (EPA) awarded a USD 50 billion contract to AECOM to provide water infrastructure repair services for the city of Flint, Michigan.

In 2022, IBM and Jacobs Engineering Group Inc. announced a partnership to develop new digital solutions for water infrastructure repair. This partnership combines IBM's expertise in artificial intelligence and cloud computing with Jacobs' expertise in water infrastructure engineering.

Water Infrastructure Repair Technologies Market: Competitive Analysis

The global water infrastructure repair technologies market is dominated by players like:

- Aegion Corporation

- Mueller Water Products, Inc.

- 3M Company

- Xylem Inc.

- Kurita Water Industries Ltd.

- Suez SA

- Uponor Corporation

- Advanced Drainage Systems, Inc.

- Atlantis D-Raintank, LLC

- Brandenburger Liner GmbH & Co. KG

The global water infrastructure repair technologies market is segmented as follows:

By Product Type

- Pipes & Connectors

- Fittings

- Couplings

- Valves

- Others

By End Use

- Drinking Water Distribution

- Wastewater Collection

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Water infrastructure repair technologies encompass a wide array of innovative solutions designed to address the aging and deteriorating state of water-related systems. These technologies are crucial in ensuring the reliable and efficient supply of clean water to communities around the world. They cover a broad spectrum, including pipeline rehabilitation, leak detection, water quality monitoring, and wastewater treatment enhancements.

The global water infrastructure repair technology market cap may grow owing to the due to escalating demand for the rehabilitation and maintenance of aging water infrastructure systems.

According to study, the global water infrastructure repair technology market size was worth around USD 69.8 billion in 2022 and is predicted to grow to around USD 107.4 billion by 2030.

What will be the CAGR value of the water infrastructure repair technologies market during 2023-2030?

The CAGR value of the water infrastructure repair technology market is expected to be around 8.2% during 2023-2030.

The global water infrastructure repair technologies market growth is expected to be driven by Asia Pacific. It is currently the world’s highest revenue-generating market owing to rapid urbanization.

The global water infrastructure repair technologies market is led by players like Aegion Corporation, Mueller Water Products, Inc., 3M Company, Xylem Inc., Kurita Water Industries Ltd., Suez SA, Uponor Corporation, Advanced Drainage Systems, Inc., Atlantis D-Raintank, LLC, and Brandenburger Liner GmbH & Co. KG.

The report analyzes the global water infrastructure repair technologies market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the water infrastructure repair technologies industry.

Choose License Type

List of Contents

Water Infrastructure Repair TechnologiesIndustry Prospective:OverviewKey InsightsGrowth DriversRestraintsOpportunitiesChallengesSegmentationReport ScopeRegional AnalysisKey DevelopmentsCompetitive AnalysisThe global water infrastructure repair technologies market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed