Zero-Carbon Shipping Market Size, Share, Trends, Growth 2032

Zero-Carbon Shipping Market By Vessel Type (Cargo Ships, Tankers, Passenger Ships, Ferries, and Specialized Vessels), By Technology Solutions (Hydrogen Fuel Cells, Ammonia Propulsion, Battery-Electric Propulsion, Wind-Assisted Propulsion, Biofuels, Solar Power, Nuclear Power, and Others), By End-User Industries (Manufacturing, Oil & Gas, Agriculture, Retail, Passenger Transportation, and Other Industries), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

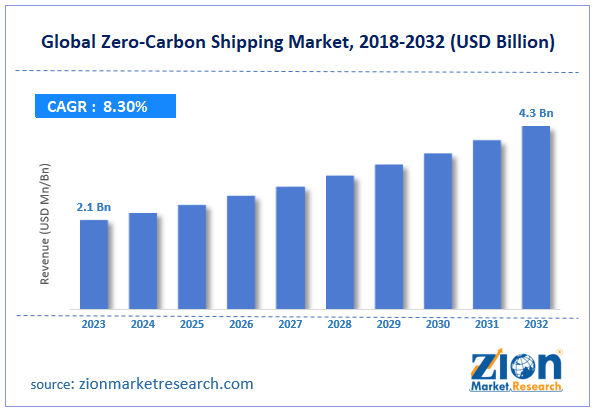

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.1 Billion | USD 4.3 Billion | 8.3% | 2023 |

Zero-Carbon Shipping Industry Prospective:

The global zero-carbon shipping market size was worth around USD 2.1 billion in 2023 and is predicted to grow to around USD 4.3 billion by 2032 with a compound annual growth rate (CAGR) of roughly 8.3% between 2024 and 2032.

Zero-Carbon Shipping Market: Overview

The marine industry's acceptance and implementation of environmentally friendly and sustainable propulsion technologies and practices is included in the Zero-Carbon Shipping Market. It focuses on lowering or doing away with greenhouse gas emissions from shipping activities to lessen the industry's substantial contribution to carbon emissions worldwide.

Among the zero-carbon shipping options are ammonia-based systems, battery-electric propulsion, hydrogen fuel cells, and wind-assisted propulsion. Technological developments, environmental concerns, regulatory restrictions, and a growing global demand for sustainable transportation solutions are driving this market's revolutionary change towards cleaner and greener shipping operations.

Key Insights

- As per the analysis shared by our research analyst, the global zero-carbon shipping market is estimated to grow annually at a CAGR of around 8.3% over the forecast period (2024-2032).

- In terms of revenue, the global zero-carbon shipping market size was valued at around USD 2.1 billion in 2023 and is projected to reach USD 4.3 billion by 2032.

- The increasing shift towards green shipping is expected to drive the zero-carbon shipping market over the forecast period.

- Based on the vessel type, the cargo ships segment is expected to hold the largest market share over the forecast period.

- Based on the technology solutions, the ammonia propulsion segment is expected to dominate the market over the forecast period.

- Based on the end-user industries, the oil & gas segment is expected to hold the largest market share over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Zero-Carbon Shipping Market: Growth Drivers

Stringent environmental regulations drive market growth

One of the main factors propelling the zero-carbon shipping market is strict environmental regulations, which are forcing the maritime sector to adopt sustainable and low-emission solutions. The shift to zero-carbon shipping has been shaped by the IMO's stringent emissions reduction targets:

- Net-zero emissions by 2050 for the shipping industry.

- Intermediate goals: Reduce GHG emissions by 20% by 2030 and 70% by 2040 compared to 2008 levels.

- Carbon Intensity Indicator (CII): Ships are graded (A–E) based on their CO₂ emissions per cargo capacity. Poorly rated ships must improve efficiency or risk operational restrictions.

Therefore, the increasing stringent environmental regulation is expected to flourish the industry growth during the forecast period.

Zero-Carbon Shipping Market: Restraints

High initial investment costs hinder market growth

A major barrier to zero-carbon shipping industry expansion is the substantial capital expenditures needed to make the switch to zero-carbon transport. Shipbuilding, retrofitting, fuel infrastructure, and technology development are all linked to the hefty upfront expenditures. Vessels powered by hydrogen, ammonia, and methanol are 30%–100% more expensive than traditional ships because they need specific engines, fuel storage, and safety measures. A typical container ship, for instance, costs between $100 million and $150 million, while a hydrogen-powered equivalent may cost more than $200 million because of fuel storage and safety adjustments.

Zero-Carbon Shipping Market: Opportunities

Rising partnership offers a lucrative opportunity for market growth

The rising partnership is expected to offer a lucrative opportunity to the zero-carbon shipping market over the forecast period. For instance, in May 2024, the University of Michigan and the Maersk Mc-Kinney Møller Center for Zero Carbon Shipping, located in Copenhagen, formed a strategic cooperation in an attempt to promote the decarbonization of the maritime shipping sector.

The nonprofit research and development center, which aims to achieve zero-carbon maritime shipping by 2050 through cooperation, applied research, and regulatory reform, will become U-M the first academic institution to partner with it. Researchers from throughout the university will be involved in the collaboration, which will be directed at U-M by Thomas McKenney of Michigan Engineering's Department of Naval Architecture and Marine Engineering.

Zero-Carbon Shipping Market: Challenges

The limited availability of zero-carbon fuels poses a major challenge to market expansion

One significant barrier to the shift to zero-emission shipping is the scarcity of zero-carbon fuels. Large-scale adoption of alternative fuels such as green hydrogen, ammonia, methanol, and biofuels is hampered by major manufacturing, supply chain, and cost issues. Zero-carbon transportation requires green hydrogen and ammonia, but their generation is still costly and limited.

For example, only 1% of the approximately 94 million tons of hydrogen produced worldwide in 2023 was green hydrogen. Therefore, the limited availability of zero-carbon fuels poses a major challenge to the zero-carbon shipping industry expansion.

Zero-Carbon Shipping Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Zero-Carbon Shipping Market |

| Market Size in 2023 | USD 2.1 Billion |

| Market Forecast in 2032 | USD 4.3 Billion |

| Growth Rate | CAGR of 8.3% |

| Number of Pages | 206 |

| Key Companies Covered | Maersk, CMA CGM Group, Mediterranean Shipping Company (MSC), NYK Line (Nippon Yusen Kaisha), Hapag-Lloyd, Evergreen Marine Corporation, COSCO Shipping Lines, Mitsui O.S.K. Lines (MOL), China Merchants Group, Kawasaki Kisen Kaisha (K Line), Crowley Maritime Corporation, Stena AB, Wallenius Wilhelmsen, Grimaldi Group, Hyundai Merchant Marine (HMM), and others. |

| Segments Covered | By Vessel Type, By Technology Solutions, By End-User Industries, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Zero-Carbon Shipping Market: Segmentation

The global zero-carbon shipping industry is segmented based on vessel type, technology solutions, end-user industries, and region.

Based on the vessel type, the global zero-carbon shipping market is bifurcated into cargo ships, tankers, passenger ships, ferries, and specialized vessels. The cargo ships segment is expected to hold the largest market share over the forecast period. Cargo ships contribute significantly to global marine emissions, making them a prime candidate for the zero-carbon shipping sector. Heavy fuel oil (HFO) and marine diesel are fossil fuels that are used by cargo ships, such as tankers, bulk carriers, and container ships.

Based on the technology solutions, the global zero-carbon shipping industry is segmented into hydrogen fuel cells, ammonia propulsion, battery-electric propulsion, wind-assisted propulsion, biofuels, solar power, nuclear power, and others. The ammonia propulsion segment is expected to dominate the market over the forecast period. Ammonia has a higher volumetric energy density than hydrogen, making it easier to store and transport. This is expected to drive the industry expansion.

Based on the end-user industries, the global zero-carbon shipping market is bifurcated into manufacturing, oil & gas, agriculture, retail, passenger transportation, and other industries. The oil & gas segment is expected to hold the largest market share over the forecast period. As significant players in international trade, oil and gas firms are looking more and more for zero-carbon shipping options to comply with legal and environmental obligations.

Zero-Carbon Shipping Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global zero-carbon shipping market during the forecast period. The regional expansion of the market is attributed to the increasing government initiatives.

For instance, nearly $3 billion in federal funding has been promised by the US government to upgrade and electrify port infrastructure nationwide. This program seeks to lower carbon emissions, improve environmental sustainability, and generate about 40,000 union jobs.

Also, to increase demand for new green fuels, major corporations like Amazon and IKEA are working together. Beginning in January 2025, they intend to ask shipping companies to submit bids for the use of e-fuels with nearly zero emissions, including e-methanol, to move their goods. Therefore, the aforementioned factor drives the industry growth in the region.

Zero-Carbon Shipping Market: Competitive Analysis

The global zero-carbon shipping market is dominated by players like:

- Maersk

- CMA CGM Group

- Mediterranean Shipping Company (MSC)

- NYK Line (Nippon Yusen Kaisha)

- Hapag-Lloyd

- Evergreen Marine Corporation

- COSCO Shipping Lines

- Mitsui O.S.K. Lines (MOL)

- China Merchants Group

- Kawasaki Kisen Kaisha (K Line)

- Crowley Maritime Corporation

- Stena AB

- Wallenius Wilhelmsen

- Grimaldi Group

- Hyundai Merchant Marine (HMM)

The global zero-carbon shipping market is segmented as follows:

By Vessel Type

- Cargo Ships

- Tankers

- Passenger Ships

- Ferries

- Specialized Vessels

By Technology Solutions

- Hydrogen Fuel Cells

- Ammonia Propulsion

- Battery-Electric Propulsion

- Wind-Assisted Propulsion

- Biofuels

- Solar Power

- Nuclear Power

- Others

By End-User Industries

- Manufacturing

- Oil & Gas

- Agriculture

- Retail

- Passenger Transportation

- Other Industries

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The term "zero-carbon shipping" describes a method of transportation that, throughout its lifecycle, eliminates greenhouse gas (GHG) emissions, mainly carbon dioxide (CO₂). Through the use of energy-efficient technologies, alternative fuels, and operational procedures, this strategy seeks to decarbonize the maritime sector.

The zero-carbon shipping market is driven by stringent environmental regulation, technological advancements, increasing public and private funding, a growing shift towards green energy, and many others.

According to the report, the global zero-carbon shipping market size was worth around USD 2.1 billion in 2023 and is predicted to grow to around USD 4.3 billion by 2032.

The global zero-carbon shipping market is expected to grow at a CAGR of 8.3% during the forecast period.

The global zero-carbon shipping market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the strict environmental regulations and increasing shift towards green energy.

The global zero-carbon shipping market is dominated by players like Maersk, CMA CGM Group, Mediterranean Shipping Company (MSC), NYK Line (Nippon Yusen Kaisha), Hapag-Lloyd, Evergreen Marine Corporation, COSCO Shipping Lines, Mitsui O.S.K. Lines (MOL), China Merchants Group, Kawasaki Kisen Kaisha (K Line), Crowley Maritime Corporation, Stena AB, Wallenius Wilhelmsen, Grimaldi Group and Hyundai Merchant Marine (HMM) among others.

The zero-carbon shipping market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed