Credit Management Software Market Size, Share, Growth, and Forecast 2032

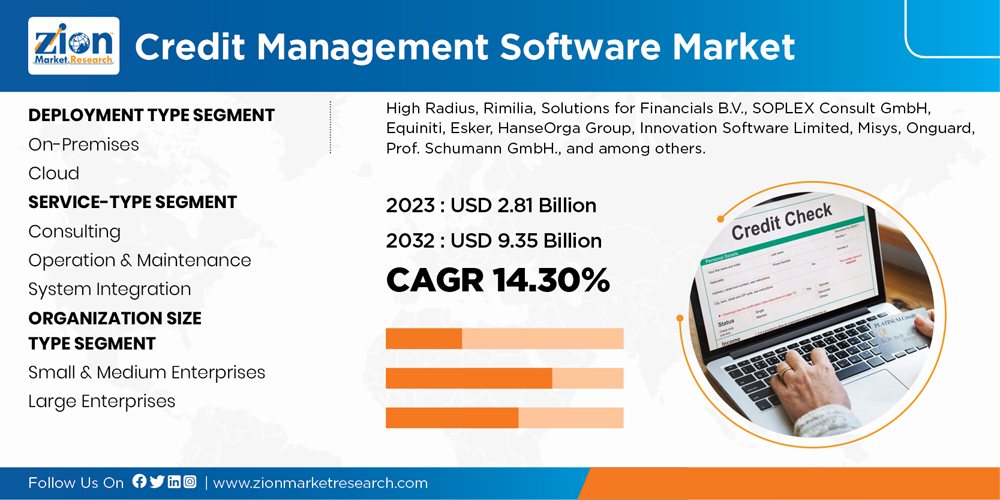

Credit Management Software Market By Deployment Type (On-Premises, And Cloud), By Service Type (Consulting, Operation & Maintenance, And System Integration), By Organization Size (Small & Medium Enterprises, And Large Enterprises), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032

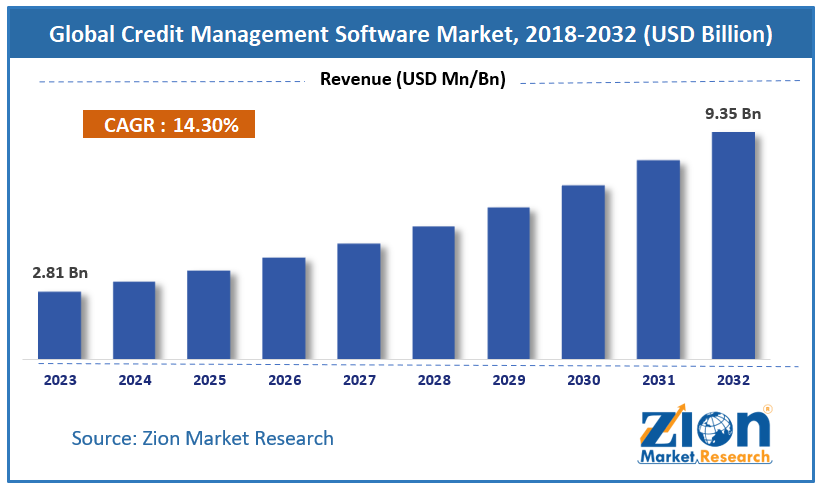

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.81 Billion | USD 9.35 Billion | 14.30% | 2023 |

Credit Management Software Market Size

The global credit management software market size was worth around USD 2.81 billion in 2023 and is predicted to grow to around USD 9.35 billion by 2032 with a compound annual growth rate (CAGR) of roughly 14.30% between 2024 and 2032.

Credit Management Software Market: Summary

Credit management software is used to streamline and prioritize the workflow associated with credit management. At the same time, it also helps in accomplishing several types of day-to-day tasks performed by team members of credit management department and store key information. It also helps in managing the cash flow within organizations along with maintaining appropriate records of the invoices. Credit management software can be incorporated into the entire organization or can also function as a part of some other software. Credit management software is currently being used by companies from diverse domains.

Credit Management Software Market: Drivers and Restraints

Increasing awareness about the benefits of using automation and dedicated software has triggered the growth of the credit management software market. Credit management software provides advantages such efficiency, better cash flow management, maximum insights pertaining to customer behavior, and much more. The end-user industries such as telecom, healthcare, manufacturing, information technology and electronics are implementing the credit management software owing to the benefits offered by credit management software. Moreover, credit management software also provides key insights into the movement of the company invoices for several transactions taking place within or outside the company. Such benefits offered by credit management software are boosting the market over the forecast period. In addition, credit management software can also be used with other widely used software in industries such as Enterprise Resource Management (ERP). In combination with ERP, credit management software helps in better managing the resources as well as transactions in the company.

The major factor that will limit the growth of the credit management software market is a high capital investment.

Credit Management Software Market: Segmentation

By deployment type, cloud segment registered the highest market share of 58.10% and it is also expected to grow at a higher CAGR of around 5.5% over the forecast period. The cloud segment primarily offers online credit application, collaborative workflow, data aggregation, and easy retrieval and storage of data that can be accessed from any remote location. Such benefits overcome the shortfalls associated with the on-premise segment. Hence cloud-based credit management software is being widely used.

By service type, the consulting segment held the largest market share of more than 50% in the global credit management software market. There is an increased demand for the consulting services of the credit management software owing to the growing adoption of the software among the small and medium enterprises. However, it is anticipated that the operation and the maintenance services segment will register the highest CAGR growth in the coming years.

By Organization Size, large enterprises segment dominated the credit management software market in 2023 by contributing a market share of 66.38%. Being expensive, credit management software is more affordable for the large enterprises. In addition, some of the giant consulting firms rely on the credit management software and cater the smaller enterprises in managing the credit accounts. The growing popularity and increasing adoption rate of credit management software are positively influencing the medium enterprises. Owing to which the segment small and medium enterprises is estimated to grow at a CAGR of 6.19% over the forecast period. Moreover, the benefits offered by credit management software such as efficiency in credit management, better cash flow management, maximum insights pertaining to customer behavior, and much more is driving the demand for credit management software over the forecast period.

Credit Management Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Credit Management Software Market Research Report |

| Market Size in 2023 | USD 2.81 Billion |

| Market Forecast in 2032 | USD 9.35 Billion |

| Growth Rate | CAGR of 14.30% |

| Number of Pages | 110 |

| Key Companies Covered | High Radius, Rimilia, Solutions for Financials B.V., SOPLEX Consult GmbH, Equiniti, Esker, HanseOrga Group, Innovation Software Limited, Misys, Onguard, Prof. Schumann GmbH., and among others. |

| Segments Covered | By Deployment Type, By Service-Type, By Organization Size, By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Credit Management Software Market: Regional Analysis

Asia Pacific is expected to grow at the highest CAGR of 6.50% over the forecast period. Heavy investment by international companies in the Asia Pacific region owing to cheap labor has to lead to rapid industrialization over the last decade which, in turn, has increased the adoption of the credit management software in various organizations. This is estimated to continue in the near future. Europe held the highest market share of 32.16% and is growing with a steady CAGR over the forecast period.

Credit Management Software Market: Industry Players

The report includes detailed profiles of the prominent market players that are trending in the market. The lists of the players that are compiled in the report are:

- High Radius

- Rimilia

- Solutions for Financials B.V.

- SOPLEX Consult GmbH

- Equiniti

- Esker

- HanseOrga Group

- Innovation Software Limited

- Misys

- Onguard

- Prof. Schumann GmbH.

- Among others

The prominent market players maintain the competitive edge in the global market by making investments in the mergers and acquisitions and by increasing their product portfolio. In October 2017, OnGuard and Credit Tools, two leading credit management software suppliers merged and formed OnGuard. The new Onguard is a modern FinTech company which acts as a strategic pioneer for clients throughout the entire order to cash process.

The credit management software market is segmented as follows:

Global Credit Management Software Market: Deployment Type Segment Analysis

- On-Premises

- Cloud

Global Credit Management Software Market: Service-Type Segment Analysis

- Consulting

- Operation & Maintenance

- System Integration

Global Credit Management Software Market: Organization Size Type Segment Analysis

- Small & Medium Enterprises

- Large Enterprises

Global Credit Management Software Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Report Brief

- The report covers forecast and analysis for the credit management software market on a global and regional level.

- The report includes the positive and the negative factors that are influencing the growth of the market.

- Market opportunities are discussed in detail in the report.

- The revenue generated by the prominent industry players has been analyzed in the report.

- The market numbers have been calculated using top-down and the bottom-up approaches.

- The credit management software market has been analyzed using Porter’s Five Forces Analysis.

- The market is segmented on the basis of deployment type, service type, and organization size which in turn are bifurcated on a regional level as well.

- All the segments have been evaluated based on the present and the future trends.

- The report deals with the in-depth quantitative and qualitative analyses of the credit management software market.

- The report includes the detailed company profiles of the prominent market players.

Table Of Content

Methodology

FrequentlyAsked Questions

Credit management software is used to streamline and prioritize the workflow associated with credit management.

According to study, the global Credit Management Software Market size was worth around USD 2.81 billion in 2023 and is predicted to grow to around USD 9.35 billion by 2032.

The CAGR value of Credit Management Software Market is expected to be around 14.30% during 2024-2032.

Asia Pacific has been leading the global Credit Management Software Market and is anticipated to continue on the dominant position in the years to come.

The global Credit Management Software Market is led by players like High Radius, Rimilia, Solutions for Financials B.V., SOPLEX Consult GmbH, Equiniti, Esker, HanseOrga Group, Innovation Software Limited, Misys, Onguard, Prof. Schumann GmbH., and among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed