Global Crypto Trading Platforms Market Size, Share, Analysis, Growth, 2028

Global Crypto Trading Platforms Market By Cryptocurrency Type (Ethereum, Bitcoin, Solanda, Cardano, and Others), By End-User (Credit Unions, Fintech Companies, Banks, and Others), And By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2028

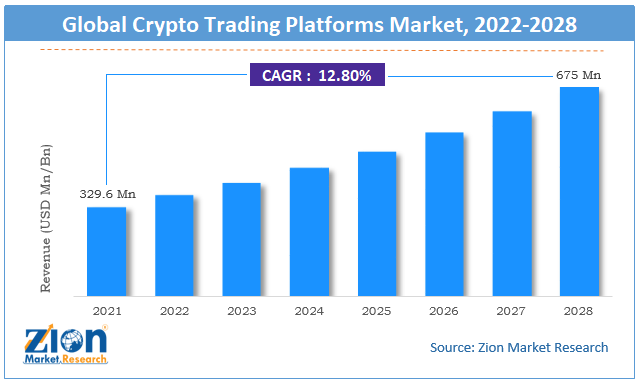

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 329.6 Million | USD 675 Million | 12.8% | 2021 |

Crypto Trading Platforms Market Industry Prospective:

The global crypto trading platforms market size was worth around USD 329.6 million in 2021 and is predicted to grow to around USD 675 million by 2028 with a compound annual growth rate (CAGR) of roughly 12.8% between 2022 and 2028. The report analyzes the global crypto trading platforms market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the crypto trading platforms market.

Crypto Trading Platforms Market: Overview

Cryptocurrency refers to any form of digital currency which is money, currency, or money-like assets that are managed, stored, or exchanged with the aid of electronic systems and on the Internet. Cryptos are designed to function as a medium of exchange via a computer network that has no reliability of connection with any central authority like a bank, or government that manages it.

Coin ownership of individual participants is recorded in a digital or electronic ledger which is a computerized form of manual ledgers and uses strong cryptography in order to conduct safe and secure transactions. It is also used to create any additional coins or to verify ownership. Even though the name suggests that cryptocurrencies are like actual currencies, in reality even though efforts have been made to classify them as securities, commodities, or actual currencies, as of 2022 they still remain a distinct asset and do not fall under any existing category in practice.

Cryptocurrency does not exist in physical forms and is not issued by any central authority, Platforms trading in crypto generally use decentralized control unlike central bank digital currencies (CBDC) which are issued by central banks. Decentralized cryptocurrency is created by an entire cryptocurrency system together at a predefined rate which is stated when the system is first created and declared publicly. In the case of centralized banking systems like the US Federal Reserve System, government or corporate boards control the supply or authority however in decentralized systems, they do not have such control nor have they backed any such institute which possesses assets measured in cryptocurrency. As of 2022, there are more than 9000 crypto trading platforms and 70% of them have already generated more than USD 1 billion in terms of revenue.

Key Insights

- As per the analysis shared by our research analyst, the global crypto trading platforms market is estimated to grow annually at a CAGR of around 12.8% over the forecast period (2022-2028).

- In terms of revenue, the global crypto trading platforms market size was valued at around USD 329.6 million in 2021 and is projected to reach USD 675 million, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on cryptocurrency type segmentation, the Bitcoin segment was predicted to show maximum market share in the year 2021

- Based on end-user segmentation, the fintech companies were the leading revenue-generating users in 2021.

- On the basis of region, North America was the leading revenue generator in 2021

Crypto Trading Platforms Market: Growth Drivers

Increase in the use of smartphones to propel market growth

The global crypto trading platforms market growth may be attributed to the rising digitization and use of smartphones across the globe. Cryptocurrencies have been in existence for a long time, however, there was a lack of awareness amongst the general population. With the growth of information technology (IT) and multiple advancements in digital space, there is a rising trend of information flow related to advanced systems present around us.

This is propelled by the help of smart technologies like smartphones, laptops, and mobile applications to name a few. Up until a few years ago, smartphones were not easily accessible due to high pricing and a lower number of smartphone producers. As of current times, the number of manufacturers providing smartphones that are technologically advanced has considerably increased. People in all areas now have access to affordable mobile technology. In India, more than 750 million of the population were estimated to be using smartphones as of 2020. Since the accessibility to technology like crypto applications, and other platforms that have aided the transfer of knowledge, has increased, the global market may grow owing to this change.

Growth in venture capitalists (VC)is also expected to aid the increase in the adoption of crypto trading platforms as they seem to be receiving a lot of funding from VCs. For example in 2021, CoinSwitch Kuber, an upcoming crypto trading platform managed to raise funds of over USD 260 million. Such initiatives may assist in further market penetration.

Crypto Trading Platforms Market: Restraints

The ambiguity surrounding the understanding of cryptocurrency impedes the market growth

The global market growth trend may suffer a few setbacks owing to the large-scale ambiguity surrounding cryptos and agencies offering digital currency. There seems to be a lot of incorrect information or hesitancy amongst the general population related to the origin, functioning, reliability, and authenticity of digital money. The world runs on the fact that systems that generate physical money provide the necessary guarantee to the end users related to monetary safety. However, since crypto trading platforms run with the aid of the internet, the ambiguity surrounding them is higher and this may restrict global market expansion in case these platforms fail to generate confidence amongst the users.

Crypto Trading Platforms Market: Opportunities

Backing from established firms to provide growth opportunities

Crypto trading platforms may witness more growth opportunities if they are able to prove their authenticity amongst the population. One of achieving this is by initiating backing from well-established firms since the end-users will then know that their money is in safe hands. For example, in 2021, after Elon Musk, the CEO of Tesla, made an online statement about Bitcoin, the company registered a growth of 12% in one day. Other firms like Ether also followed suit and their revenue grew by 7%. Such backings are expected to create higher growth opportunities for the global market cap.

Crypto Trading Platforms Market: Challenges

Security concerns related to digital money create challenges for market growth

The global market is projected to face challenges during its growth trend owing to cyber security concerns related to crypto trading platforms. Some of the threats include activities like malware, user perplexity, non-regulated cryptocurrency, illegal trading platforms, phishing attacks, and the use of third-party software. Since these platforms deal with larger sums of money they are prone to various attacks with some platforms not receiving legal status due to various reasons. The market may suffer losses if digital currency platforms are not able to upgrade their security systems on time and eliminate any risk of malfunction.

Crypto Trading Platforms Market: Segmentation

The global crypto trading platforms market is segmented based on cryptocurrency type, end-user, and region.

Based on cryptocurrency type, the global market segments are Ethereum, Bitcoin, Solanda, Cardona, and others. The global market is dominated by Bitcoin. It is the original cryptocurrency, one of the first digital currencies, and continues to lead the segment with the highest user database popularity. Bitcoin’s market capitalization currently stands at 42% of the total market share.

Based on end-users, the global market segments are credit unions, fintech companies, banks, and others. Fintech companies are projected to generate the highest revenue in the global market. More than 9 cryptocurrency-related companies made it to the Forbes Fintech 50 list of 2022.

Recent Developments:

- In July 2021, Visa announced that it will partner with 50 crypto companies allowing clients to convert and spend digital currencies. The users will now be able to buy products from merchants accepting Visas, even if they do not accept crypto. The move is seen as a stepping stone toward making cryptocurrencies more usable.

- In June 2022, Kraken, a USA-based cryptocurrency exchange and bank, announced that it will expand its hiring plan and onboard around 500 employees by the end of 2022. The company does not intend to lay off but increase its employee strength to meet the growing demand. The mission of the company is to bring financial freedom to the financially excluded population.

Crypto Trading Platforms Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Crypto Trading Platforms Market Research Report |

| Market Size in 2021 | USD 329.6 Million |

| Market Forecast in 2028 | USD 675 Million |

| Growth Rate | CAGR of 12.8% |

| Number of Pages | 206 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Bitstamp, FTX, Coinbase, eToro, AirSwap, BlockFi, and Binance. |

| Segments Covered | By Cryptocurrency Type, By End-User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Base Year | 2021 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2022 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Crypto Trading Platforms Market: Regional Analysis

North America to dominate the market during the forecast period

The global crypto trading platforms market was led by North America in the last few years and is expected to follow the same trend during the forecast period owing to the presence of many key players in the USA. Kraken, Coinbase, etc. the leading organizations are located in this region which is expected to aid regional growth. In the first quarter of 2021, Coinbase announced that it had more than 56 million active users and generated a trading value of USD 335 billion. The abundant awareness amongst the population about digital currency and its trading platforms is another contributing factor to the growth in regional market share.

Europe is expected to be led by Germany in terms of a higher adoption rate of cryptocurrency. Some of the key factors for regional growth are quicker transactions, safer, and minimal ownership costs provided by the digital money platform to the end-user. In Gemini’s 2022 report on the Global State of Crypto, around 53% of Germans accepted that they were crypto-curious and 43% of high-income groups accepted having crypto-based assets.

Crypto Trading Platforms Market: Competitive Analysis

The global crypto trading platforms market is led by players like

- Bitstamp

- FTX

- Coinbase

- eToro

- AirSwap

- BlockFi

- Binance.

The global crypto trading platforms market is segmented as follows:

By Cryptocurrency Type

- Ethereum

- Bitcoin

- Solanda

- Cardano

- Others

By End-User

- Credit Unions

- Fintech Companies

- Bank

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global crypto trading platforms market growth may be attributed to the rising digitization and use of smartphones across the globe. Since the accessibility to technology like crypto applications, and other platforms that have aided the transfer of knowledge, has increased, the global market may grow owing to this change. Growth in venture capitalists (VC)is also expected to aid the increase in the adoption of crypto trading platforms as they seem to be receiving a lot of funding from VCs.

According to Zion Market Research, the global crypto trading platforms market size was worth around USD 329.6 million in 2021 and is predicted to grow to around USD 675 million by 2028 with a compound annual growth rate (CAGR) of roughly 12.8% between 2022 and 2028.

The global crypto trading platforms market was led by North America in the last few years and is expected to follow the same trend during the forecast period owing to the presence of many key players in the USA.

The global crypto trading platforms market is led by players like Bitstamp, FTX, Coinbase, eToro, AirSwap, BlockFi, and Binance.

Choose License Type

List of Contents

Crypto Trading Platforms Market Industry Prospective:Crypto Trading Platforms OverviewKey InsightsCrypto Trading Platforms Growth DriversCrypto Trading Platforms RestraintsCrypto Trading Platforms OpportunitiesCrypto Trading Platforms ChallengesCrypto Trading Platforms SegmentationRecent Developments:Crypto Trading Platforms Report ScopeCrypto Trading Platforms Regional AnalysisCrypto Trading Platforms Competitive AnalysisRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed