In-Flight Entertainment and Connectivity Market Size, Share, Trends, Growth and Forecast 2032

In-Flight Entertainment and Connectivity Market By Component (Hardware, Connectivity, and Content), By Aircraft Type (Narrow-Body Aircraft (NBA), Wide-Body Aircraft (WBA), and Very Large Aircraft (VLA)), By Offering Type (In-flight Entertainment (IFE) and In-flight Connectivity (IFC)), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

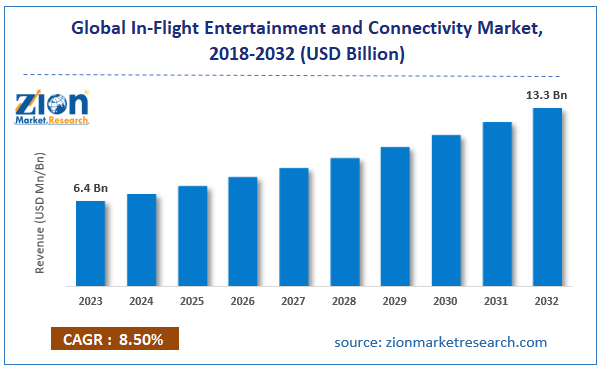

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.4 Billion | USD 13.3 Billion | 8.5% | 2023 |

In-Flight Entertainment and Connectivity Industry Prospective:

The global in-flight entertainment and connectivity market size was worth around USD 6.4 billion in 2023 and is predicted to grow to around USD 13.3 billion by 2032, with a compound annual growth rate (CAGR) of roughly 8.5% between 2024 and 2032.

In-Flight Entertainment and Connectivity Market: Overview

The internet service that airlines offer to passengers flying in business and commercial aircraft is known as "In-Flight Entertainment and Connectivity" (IFEC). Anyone can use this service to browse the internet, play games, watch movies, and watch TV shows on personal electronic devices (PEDs) such as laptops and smartphones. It appears that IFEC systems can function without visible wires.

The wiring is concealed behind the aircraft walls and begins in the top panel, adjacent to the oxygen masks and air conditioning controls. These wires are then connected to the power units, which are positioned along the aircraft's sides in a few rows. The growth of connection technologies in industrialized countries, the increase in airline passengers, and regulations that promote the use of personal electronic devices on board are driving the need for advanced in-flight connectivity and content streaming services. However, the expensive cost of networking technologies and connection hardware, together with growing concerns about data security and privacy, are expected to limit the use of wireless communication and connectivity services.

Key Insights

- As per the analysis shared by our research analyst, the global in-flight entertainment and connectivity market is estimated to grow annually at a CAGR of around 8.5% over the forecast period (2024-2032).

- In terms of revenue, the global in-flight entertainment and connectivity market size was valued at around USD 6.4 billion in 2023 and is projected to reach USD 13.3 billion by 2032.

- The increasing passenger traffic is expected to drive the in-flight entertainment and connectivity market over the forecast period.

- Based on the component, the hardware segment is expected to dominate the market over the forecast period.

- Based on the aircraft type, the Narrow-Body Aircraft (NBA) segment is expected to hold the largest market share over the forecast period.

- Based on the offering type, the In-flight Entertainment (IFE) segment is expected to hold the largest market share over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

In-Flight Entertainment and Connectivity Market: Growth Drivers

Technological advancement drives market growth

The in-flight entertainment and connectivity sector has grown as a result of airline passengers being able to use their electronic devices thanks to advancements in wireless connectivity technology. One of the main factors propelling the in-flight entertainment and connectivity market expansion is customers' growing need for bug-free connectivity onboard. Due to the significant technical changes occurring in the aviation sector, market players must modify their current offerings.

Traditional seatback screens and a restricted entertainment selection with a modestly personalized model are being replaced by in-flight entertainment and connectivity (IFEC) systems, which are essential in giving passengers access to modern onboard wireless connectivity solutions and services. Additionally, advancements in real-time data, connectivity, and seat design have had a positive effect on the market for in-flight entertainment and connectivity. To increase demand, the main rivals concentrate on expanding the extensive range of delivery choices.

In-Flight Entertainment and Connectivity Market: Restraints

The high cost of installation hinders market growth

The in-flight entertainment and connectivity industry growth is expected to be hampered by installation costs associated with networking technology and connectivity devices. For instance, the deployment of satellite technology costs about USD 400,000, whereas air-to-ground technology costs about USD 80,000 per aircraft. This severely restricts airlines' ability to use connectivity equipment and services, particularly in developing regions like Asia-Pacific and Latin America. Furthermore, the cost of in-flight connectivity services such as network design, planning, implementation, and integration is high.

In-Flight Entertainment and Connectivity Market: Opportunities

Rising service launch by major flight companies offers a lucrative opportunity for market growth

The growing service launch by major flight companies is expected to offer a lucrative opportunity to the in-flight entertainment and connectivity market during the forecast period. For instance, in August 2024, to give passengers continuous entertainment until the retrofit, Air India, the top international airline in India, recently introduced its wireless in-flight entertainment (IFE) service, Vista, throughout its current wide-body fleet. After that, narrow-body aircraft will also be able to use Vista. Vista, which is powered by the award-winning digital services provider Bluebox, is being distributed to clients over the Bluebox Wow wireless network system and implemented on Bluebox's Blueview digital services platform.

Customers can stream material on their electronic devices with ease thanks to Vista. The greatest material in the world will now be available to Air India customers, including Hollywood premieres, Bollywood blockbusters, international music superstars, and engrossing documentaries. Vista further offers a real-time map display for tracking flights. Vista, which is accessible on iOS, Android, Windows, and macOS devices, guarantees that passengers can quickly access and interact with fresh in-flight entertainment content.

In-Flight Entertainment and Connectivity Market: Challenges

Limited bandwidth and connectivity issues pose a major challenge to market expansion

The expansion and uptake of in-flight entertainment and connectivity (IFEC) solutions are substantially impacted by the problem of restricted bandwidth and connectivity. Bandwidth difficulties have been brought on by the sharp rise in connected airplanes and passenger demand for fast internet.

Furthermore, conventional geostationary satellites have a 35,786-kilometer height, which causes latency problems that impact real-time applications like gaming and video conferencing. Therefore, the limited bandwidth and connectivity issues pose a major challenge for the in-flight entertainment and connectivity market.

In-Flight Entertainment and Connectivity Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | In-Flight Entertainment and Connectivity Market |

| Market Size in 2023 | USD 6.4 Billion |

| Market Forecast in 2032 | USD 13.3 Billion |

| Growth Rate | CAGR of 8.5% |

| Number of Pages | 221 |

| Key Companies Covered | BAE Systems, Cobham plc., Collins Aerospace, Eutelsat Communications, Global Eagle Entertainment Inc., Gogo LLC, Honeywell International Inc., Inmarsat plc., Iridium Communications Inc., Panasonic Corporation, Safran (Zodiac Aerospace SA), SITAONAIR, Thales SA, ViaSat Inc., and others. |

| Segments Covered | By Component, By Aircraft Type, By Offering Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

In-Flight Entertainment and Connectivity Market: Segmentation

The global in-flight entertainment and connectivity industry is segmented based on component, aircraft type, offering type, and region.

Based on the component, the global in-flight entertainment and connectivity market is segmented into hardware, connectivity, and content. The hardware segment is expected to dominate the market over the forecast period. The BYOD trend and wireless mobile electronic gadgets are expected to drive category development.

Based on the aircraft type, the global in-flight entertainment and connectivity industry is bifurcated into Narrow-Body Aircraft (NBA), Wide-Body Aircraft (WBA), and Very Large Aircraft (VLA). The Narrow-Body Aircraft (NBA) segment is expected to hold the largest market share over the forecast period. This segment's notable growth was driven by the expansion of travel routes and airports as well as the growing demand for short-haul flights.

Based on the offering type, the global in-flight entertainment and connectivity market is bifurcated into In-flight Entertainment (IFE) and In-flight Connectivity (IFC). The In-flight Entertainment (IFE) segment is expected to hold the largest market share over the forecast period. IFE is one of the most crucial things that airlines offer to enhance the travel experience of their patrons, especially on lengthy trips.

Recently developed IFE systems offer several benefits to both passengers and airline operators, such as reduced aircraft weight, less cabling infrastructure, and the possibility for consumers to use their own devices.

In-Flight Entertainment And Connectivity Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global in-flight entertainment and connectivity market during the forecast period. It is anticipated that wealthy nations' regional airlines will use these technologies more frequently, which will continue to fuel the growth of the regional business.

Several of the most well-known airlines in the area, such as United Airlines, Inc. and Delta Air Lines, Inc., are always trying to provide passengers with medicines or compensated content via Wi-Fi. Additionally, the BYOD movement's increasing acceptance is probably going to relieve airlines of the need to nest back-seat screens, which will reduce the overall weight of the aircraft.

Furthermore, the Asia Pacific is expected to grow at the highest CAGR during the forecast period. The demand for aircraft with cutting-edge communication and entertainment systems is increasing due to the increase in passenger volume. This is fueling the expansion of regional markets.

Several well-known airlines in the area provide their first-class passengers with modern IFEC facilities. For instance, the flag carrier of Indonesia, Garuda Indonesia, provides its first-class passengers with a range of onboard entertainment choices, including games, in-flight shopping, and live TV streaming.

In-Flight Entertainment and Connectivity Market: Competitive Analysis

The global in-flight entertainment and connectivity market is dominated by players like:

- BAE Systems

- Cobham plc.

- Collins Aerospace

- Eutelsat Communications

- Global Eagle Entertainment Inc.

- Gogo LLC

- Honeywell International Inc.

- Inmarsat plc.

- Iridium Communications Inc.

- Panasonic Corporation

- Safran (Zodiac Aerospace SA)

- SITAONAIR

- Thales SA

- ViaSat Inc.

The global in-flight entertainment and connectivity market is segmented as follows:

By Component

- Hardware

- Connectivity

- Content

By Aircraft Type

- Narrow-Body Aircraft (NBA)

- Wide-Body Aircraft (WBA)

- Very Large Aircraft (VLA)

By Offering Type

- In-flight Entertainment (IFE)

- In-flight Connectivity (IFC)

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The internet service that airlines offer to passengers flying in business and commercial aircraft is known as "In-Flight Entertainment and Connectivity" (IFEC).

The growth of connection technologies in industrialized countries, the increase in airline passengers, and regulations that promote the use of personal electronic devices on board are driving the need for advanced in-flight connectivity and content streaming services.

According to the report, the global in-flight entertainment and connectivity market size was worth around USD 6.4 billion in 2023 and is predicted to grow to around USD 13.3 billion by 2032.

What will be the CAGR value of the in-flight entertainment and connectivity market during 2024-2032?

The global in-flight entertainment and connectivity market is expected to grow at a CAGR of 8.5% during the forecast period.

The global in-flight entertainment and connectivity market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the growing passenger traffic and technological advancements.

The global in-flight entertainment and connectivity market is dominated by players like BAE Systems, Cobham plc., Collins Aerospace, Eutelsat Communications, Global Eagle Entertainment Inc., Gogo LLC, Honeywell International Inc., Inmarsat plc., Iridium Communications Inc., Panasonic Corporation, Safran (Zodiac Aerospace SA), SITAONAIR, Thales SA and ViaSat Inc. among others.

The in-flight entertainment and connectivity market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed