Test & Burn-in Socket Market Size, Share, Analysis, Trends, Growth Report, 2030

Test & Burn-in Socket Market By Type (Burn-in Socket And Test Socket), By Application (Memory, CMOS Image Sensor, High Voltage, Radio Frequency (RF), Central Processing Unit (CPU), Graphics Processing Unit (GPU), System-on-a-Chip (SoC), And Other Applications), By End-user Industry (IT & Telecommunications, Automotive, Consumer Electronics, Manufacturing & Automation, Aerospace & Defense, And Other End-user Industries), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2023 - 2030

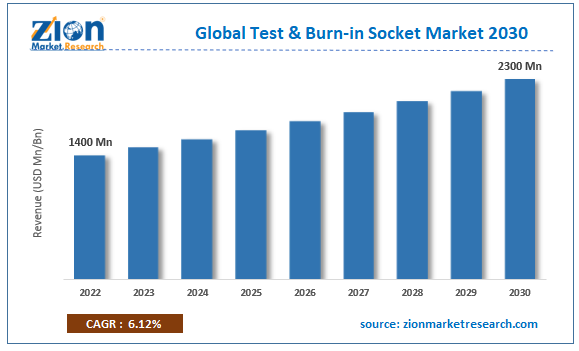

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1400 Million | USD 2300 Million | 6.12% | 2022 |

Test & Burn-in Socket Industry Prospective:

The global test & burn-in socket market size was worth around USD 1400 million in 2022 and is predicted to grow to around USD 2300 million by 2030 with a compound annual growth rate (CAGR) of roughly 6.12% between 2023 and 2030.

Test & Burn-in Socket Market: Overview

Test & burn-in sockets are used for inspection of integrated circuit (IC). The semiconductor inspection process comprises wafer inspection in the front-end process & finished product inspection in the back-end process. Test & burn-in IC sockets are fixing tools used in the back-end process. These sockets are also called sockets for semiconductor inspection. These sockets connect integrated circuits (ICs) to the inspection boards, without any soldering. There are two types of inspection sockets, including, test sockets & burn-in sockets. Before being supplied to the customer, the produced ICs must be tested. During this production phase, a number of tests, including burn-in, functional, fuse, failure analysis, etc., take place. Specifically, test sockets are used for the inspection of certain characteristics of ICs such as electrical characteristics, functionality, & defects. Whereas burn-in sockets are used for performing burn-in tests. Through using these sockets, semiconductors are subjected to voltage stress in high-temperature environments. These sockets check the durability of the IC in a high-temperature environment. Rapid production of chips for various end-user industries such as automotive, consumer electronics, & information technology & telecommunications are expected to support the demand for the test & burn-in sockets industry.

Key Insights

- As per the analysis shared by our research analyst, the global test & burn-in socket market is estimated to grow annually at a CAGR of around 6.12% over the forecast period (2023-2030).

- In terms of revenue, the global test & burn-in socket market size was valued at around USD 1400 million in 2022 and is projected to reach USD 2300 million , by 2030.

- The global test & burn-in socket market is projected to grow at a significant rate due to the rising demand for semiconductors from automotive, consumer electronics, telecommunication & information technology applications.

- Based on type segmentation, burn-in sockets were predicted to show maximum market share in the year 2022.

- Based on application segmentation, memory was the leading revenue generator in 2022.

- Based on end-user industry segmentation, IT & telecommunications was the leading revenue-generating application in 2022.

- On the basis of region, Asia Pacific was the leading revenue generator in 2022.

Request Free Sample

Request Free Sample

Test & Burn-in Socket Market: Growth Drivers

Rising demand for semiconductors from automotive, consumer electronics, telecommunication & information technology applications to drive market growth during the forecast period.

The global test & burn-in socket market is projected to grow owing to the rising demand for semiconductors from automotive, consumer electronics, telecommunication & information technology applications. In the automotive industry, a wide range of semiconductors are used including functional chips such as microcontroller units (MCU), sensors, power semiconductors, and others. Semiconductors are used in infotainment systems, automatic driving equipment, vehicle movement systems, body electronics, powertrains, and others. Power semiconductors such as insulated-gate bipolar transistor (IGBT) chips are used for power conversions. Semiconductor sensors are used for airbags, radars, tire pressure detection, and others. According to the World Semiconductor Trade Statistics (WSTS), the global automotive industry accounted for around 14% share of global semiconductor sales in 2022, compared to a 12% share in 2021.

Further, the increasing production of automobiles, across the globe, is increasing the demand for semiconductor manufacturing, which is expected to increase the demand for test & burn-in sockets during the testing phase of chip production. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), in 2022, around 85.02 million vehicles were produced with a growth rate of around 6% compared to the previous year.

Consumer electronics such as washing machines, refrigerators, televisions, and others use semiconductor chips. According to the Japan Electronic Information Technology Association (JEITA), the global electronics & information technology industries are estimated to increase by 3% year-on-year (Y-o-Y) in 2023 to reach USD 3,526.6 billion. Further, as per the World Semiconductor Trade Statistics (WSTS), the global consumer electronic industry accounted for around 14% share of global semiconductor sales in 2022, compared to a 12% share in 2021.

In IT & Telecommunications, a significant volume of semiconductor chips is used. Semiconductors are used in routers, satellites, communications systems, and others. According to the World Semiconductor Trade Statistics (WSTS), the global communication industry accounted for around 30% share of global semiconductor sales in 2022.

All the above-mentioned factors are expected to increase the demand for the test & burn-in socket industry.

Test & Burn-in Socket Market: Restraints

The expected downturn in the semiconductor industry to restrict market expansion

Increasing inflation & decreasing demand for semiconductors from various end-user sectors are expected to hinder the usage of test & burn-in sockets. In 2023, as per World Semiconductor Trade Statistics (WSTS), the global semiconductor industry is estimated to reach around USD 515.09 billion, witnessing a decline rate of around 10.3% year-on-year (Y-o-Y). Specifically, Asia Pacific & Americas are likely to register a downturn of around 15.1% & 9.1%, respectively, in 2023.

As per WSTS, the global integrated circuit industry is expected to reach around USD 470.35 billion in 2023, witnessing a decline rate of 13%, compared to the previous year. However, most of the trends are likely to improve with a positive outlook beyond 2023.

Test & Burn-in Socket Market: Opportunities

Increasing innovations in the test & burn-in socket & 5G industry to provide growth opportunities

Various innovations in the test & burn-in socket industry are expected to create opportunities in the coming years. In July 2022, SABIC launched a new surface mount technology (SMT) capable ULTEM 3473 resin to reduce the weight of radio frequency (RF) filters in 5G macro cells by up to 40%. Earlier in November 2021, Sensata Technologies based in South Korea used SABIC’s Superflow ULTEM SF2250EPR resin to produce burn-in test sockets (BiTS). Superflow ULTEM SF2250EPR resins are good substitutes for materials such as glass fiber-reinforced liquid crystal polymers (LCPs) & polyethersulfone (PES) resins.

Increasing adoption of 5G technology across the globe is favoring the growth of the test & burn-in socket market in the coming years. In May 2023, Avnet & Fujikura announced their 5G FR2 phased array antenna development platform for 5G mmWave frequency bands.

According to the Telefonaktiebolaget LM Ericsson, the global 5G mobile subscriptions accounted for around 1,050 million in 2022 and are expected to reach around 4,970 million by 2028 with a compound annual growth rate (CAGR) of around 30%.

Test & Burn-in Socket Market: Challenges

High cost of the burn-in-sockets & geopolitical factors for chip supply to challenge market cap growth

Burn-in sockets are costlier, compared to test sockets. These high-end sockets are used high high-temperature environments; therefore, good-quality materials are used to produce burn-in sockets.

Further, the geopolitical tensions between economies such as China & United States are creating challenges for semiconductor industry players in their raw material procurement & product distribution. Both the United States & China play key roles in the global semiconductor industry supply chain. Trade restrictions imposed by the United States have limited the accessibility of the United States market for certain Chinese players in the semiconductor industry.

Test & Burn-in Socket Market: Segmentation

The global test & burn-in socket market is segmented based on type, application, end-user industry, and region.

Based on type, the global market segments are burn-in sockets & test sockets. Currently, the global market is dominated by burn-in sockets. Burn-in sockets are used for performing voltage stress burn-in tests. Through using these sockets, semiconductors are subjected to voltage stress in high-temperature environments.

Based on application, the test & burn-in socket industry is segmented into memory, CMOS image sensor, high voltage, radio frequency (RF), central processing unit (CPU), graphics processing unit (GPU), system-on-a-chip (SoC), and other applications. The memory segment dominated the market share in 2022. According to World Semiconductor Trade Statistics (WSTS), global memory integrated circuits semiconductor sales accounted for around USD 129.77 billion in 2022, registering a decline rate of around 15.6% compared to the previous year. However, global memory integrated circuits semiconductor sales are expected to increase by 43.2% year-on-year (Y-o-Y) in 2024.

Based on the end-user industry, the global test & burn-in socket market segments are IT & telecommunications, automotive, consumer electronics, manufacturing & automation, aerospace & defense, and other end-user industries. Currently, the test & burn-in socket industry is dominated by the IT & telecommunication segment. Memory, CPU & GPU are the key components of the IT & telecommunication industry. According to the India Brand Equity Foundation (IBEF), India’s 5G subscription is expected to reach around 350 million by 2026, accounting for around 27% of overall mobile subscriptions. Further, as of January 2023, the total subscriber base in India accounted for around 1,170.75 million.

Test & Burn-in Socket Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Test & Burn-in Socket Market |

| Market Size in 2022 | USD 1400 Million |

| Market Forecast in 2030 | USD 2300 Million |

| Growth Rate | CAGR of 6.12% |

| Number of Pages | 226 |

| Key Companies Covered | 3M, Advanced Interconnections Corp., ADVANTEST CORPORATION, Ardent Concepts, Aries Electronics, C.C.P. Contact Probes Co., Ltd., Cohu, Inc, CONTECH SOLUTIONS INC., Enplas Corporation, E-tec Interconnect, Exatron, FoundPac Technologies Sdn Bhd., GOLD TECHNOLOGIES, INC., Ironwood Electronics, ISC Co., Ltd., JC CHERRY INC., JF TECHNOLOGY BERHAD, Johnstech, LEENO INDUSTRIAL INC., Loranger International Corp., M specialties LLC., Megatone Electronics Corp., MICRONICS JAPAN CO., LTD., Mill-Max Mfg. Corp., OKINS ELECTRONICS CO. LTD., Qualmax Inc., RIKA DENSHI CO., LTD., Robson Technologies, Inc., Sensata Technologies, Inc., Smiths Interconnect (Plastronics), TE Connectivity, WinWay Tech. Co., Ltd., Yamaichi Electronics Co., Ltd., Yokowo co., ltd., and others. |

| Segments Covered | By Type, By Application, By End-user Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Test & Burn-in Socket Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

The global test & burn-in socket market growth is expected to be driven by Asia Pacific, during the forecast period. Asia Pacific has a strong footprint in semiconductor manufacturing, owing to the easy availability of raw materials. Countries such as Taiwan, South Korea, China, & Japan have various established players in the semiconductor industry. Moreover, India is also investing heavily in the semiconductor industry to become self-dependent on the supply of chips for its domestic end-user industry. Apart from production, Asia Pacific was the largest consumer of semiconductors in 2022. According to the World Semiconductor Trade Statistics (WSTS), semiconductor sales in Asia Pacific accounted for around USD 330.94 billion in 2022, representing a share of around 57.65% of the global semiconductor sales.

Taiwan Semiconductor Manufacturing Company Limited, based in Taiwan, is a global leader in the semiconductor industry. The annual capacity of Taiwan Semiconductor Manufacturing Company Limited & its subsidiaries accounted for around 15 million 12-inch equivalent wafers in 2022. In Taiwan, the company has 4 facilities for 12-inch wafer GIGAFAB fabs, four 8-inch wafer fabs, and one 6-inch wafer fab facility. Moreover, in China, the company produces 12-inch wafer fabs at a wholly owned subsidiary, TSMC Nanjing Company Limited.

According to the National Bureau of Statistics (NBS), integrated circuit (IC) output in China declined by 11.6% in 2022. Further, according to the China Semiconductor Industry Association (CSIA), semiconductor market sales accounted for around CNY 1,100 billion (around USD 163 billion) in 2022.

In September 2023, TATA Projects was awarded the contract to build Micron Technology’s advanced semiconductor assembly & test plant in Sanand, Gujarat, India. Phase 1 comprises the construction of around 5,00,000 square feet of cleanroom space and is scheduled to open by late 2024. The project will be a first-of-its-kind DRAM (used to store code for algorithms) & NAND (used to store data for pictures, music, etc.) assembly and test facility in India.

Moreover, in Japan, domestic semiconductor production by the Japanese Electronics Industry accounted for JPY 3,074.6 billion in 2022, witnessing a growth rate of around 9.56% compared to the previous year. Such trends support the demand for the test & burn-in socket industry.

North America is the second largest consumer of semiconductors, after Asia Pacific, according to the WSTS. Americas accounted for USD 141.14 billion in semiconductor sales in 2022, representing around 24.59% share of global semiconductor sales. The United States is the leading country engaged in R&D expenditure for the semiconductor industry. In the United States, according to the Semiconductor Industry Association, semiconductor industry R&D expenditure accounted for around 18% of overall industry sales. All such factors will favor the growth of the test & burn-in socket industry.

Test & Burn-in Socket Market: Competitive Analysis

The global test & burn-in socket market is dominated by players like:

- 3M

- Advanced Interconnections Corp.

- ADVANTEST CORPORATION

- Ardent Concepts

- Aries Electronics

- C.C.P. Contact Probes Co., Ltd.

- Cohu, Inc

- CONTECH SOLUTIONS INC.

- Enplas Corporation

- E-tec Interconnect

- Exatron

- FoundPac Technologies Sdn Bhd.

- GOLD TECHNOLOGIES, INC.

- Ironwood Electronics

- ISC Co., Ltd.

- JC CHERRY INC.

- JF TECHNOLOGY BERHAD

- Johnstech

- LEENO INDUSTRIAL INC.

- Loranger International Corp.

- M specialties LLC.

- Megatone Electronics Corp.

- MICRONICS JAPAN CO., LTD.

- Mill-Max Mfg. Corp.

- OKINS ELECTRONICS CO. LTD.

- Qualmax Inc.

- RIKA DENSHI CO., LTD.

- Robson Technologies, Inc.

- Sensata Technologies, Inc.

- Smiths Interconnect (Plastronics)

- TE Connectivity

- WinWay Tech. Co., Ltd.

- Yamaichi Electronics Co., Ltd.

- Yokowo co., ltd.

The global test & burn-in socket market is segmented as follows:

By Type

- Burn-in Socket

- Test Socket

By Application

- Memory

- CMOS Image Sensor

- High Voltage

- Radio Frequency (RF)

- Central Processing Unit (CPU)

- Graphics Processing Unit (GPU)

- System-on-a-Chip (SoC)

- Other Applications

By End-user Industry

- IT & Telecommunications

- Automotive

- Consumer Electronics

- Manufacturing & Automation

- Aerospace & Defense

- Other End-user Industries

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Test & burn-in sockets are used for inspection of integrated circuit (IC). These sockets connect integrated circuits (ICs) to the inspection boards, without any soldering. There are two types of inspection sockets, including, test sockets & burn-in sockets. Before being supplied to the customer, the produced ICs must be tested. During this production phase, a number of tests, including burn-in, fuse, functional, failure analysis, etc., take place.

The global test & burn-in socket market cap may grow owing to the rising demand for semiconductors from automotive, consumer electronics, telecommunication & information technology. Significant growth opportunities can be expected due to the rising innovations in the test & burn-in socket & 5G industry.

According to study, the global test & burn-in socket market size was worth around USD 1400 million in 2022 and is predicted to grow to around USD 2300 million by 2030.

The CAGR value of the test & burn-in socket market is expected to be around 6.12% during 2023-2030.

The global test & burn-in socket market growth is expected to be driven by Asia Pacific. Currently, Asia Pacific is the highest revenue-generating market, across the globe, owing to the huge footprint of the semiconductor production in regional countries such as Taiwan, China, and others.

The global test & burn-in socket market is led by players like 3M, Advanced Interconnections Corp., ADVANTEST CORPORATION, Ardent Concepts, Aries Electronics, C.C.P. Contact Probes Co., Ltd., Cohu, Inc, CONTECH SOLUTIONS INC., Enplas Corporation, E-tec Interconnect, Exatron, FoundPac Technologies Sdn Bhd., GOLD TECHNOLOGIES, INC., Ironwood Electronics, ISC Co., Ltd., JC CHERRY INC., JF TECHNOLOGY BERHAD, Johnstech, LEENO INDUSTRIAL INC., Loranger International Corp., M specialties LLC., Megatone Electronics Corp., MICRONICS JAPAN CO., LTD., Mill-Max Mfg. Corp., OKINS ELECTRONICS CO. LTD., Qualmax Inc., RIKA DENSHI CO., LTD., Robson Technologies, Inc., Sensata Technologies, Inc., Smiths Interconnect (Plastronics), TE Connectivity, WinWay Tech. Co., Ltd., Yamaichi Electronics Co., Ltd., and Yokowo co., ltd.

The report incorporates demand & in-depth market insights on the global test & burn-in socket industry and analyzes the market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the test & burn-in socket industry. Moreover, the study covers the competitive landscape, as well as related geopolitical insights, for test & burn-in socket industry.

Choose License Type

List of Contents

Test Burn-in SocketIndustry Prospective:Test Burn-in Socket OverviewKey InsightsTest Burn-in Socket Growth DriversTest Burn-in Socket RestraintsTest Burn-in Socket OpportunitiesTest Burn-in Socket ChallengesTest Burn-in Socket SegmentationTest Burn-in Socket Report ScopeTest Burn-in Socket Regional AnalysisTest Burn-in Socket Competitive AnalysisThe global test burn-in socket market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed