Global Clinical Trial Supplies Market Size, Share, Growth Analysis Report - Forecast 2034

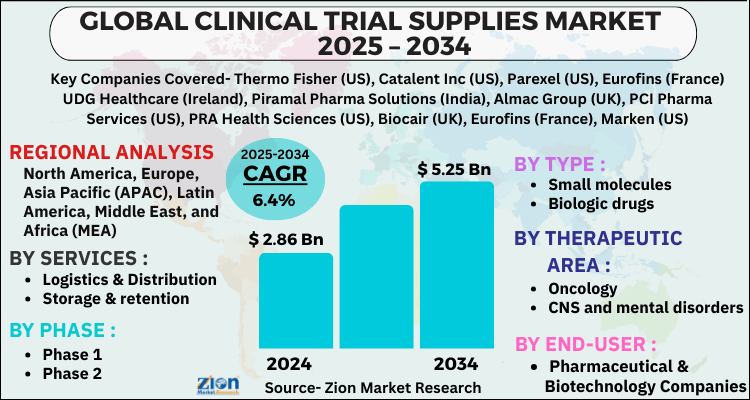

Clinical Trial Supplies Market By Services (Logistics & Distribution, Storage & retention, Packaging, labeling, and blinding, Manufacturing, Comparator sourcing, and Other services (solutions, ancillary supply)), By Phase (Phase 1, Phase 2, Phase 3, Phase 4, and BA/ BE studies), Type (Small molecules, Biologic drugs, and Medical devices), Therapeutic Area (Oncology, CNS and mental disorders, Cardiovascular diseases, Digestive disorders, Infectious diseases, Metabolic disorders, Immunology, Blood disorders, and Other therapeutic areas (respiratory disorders, dermatological disorders, rare diseases, ENT disea), End-User (Pharmaceutical & Biotechnology Companies, Contract Research Organizations (CROs), and Medical Devices Companies), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

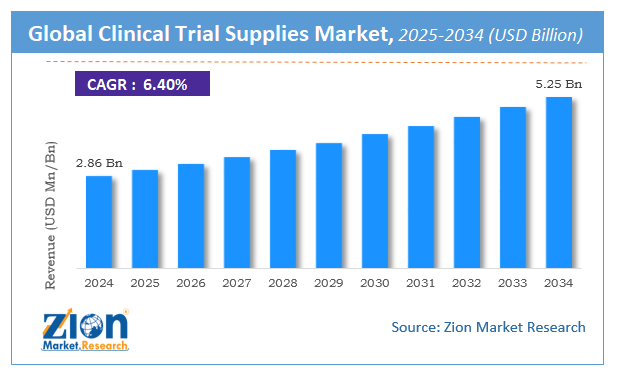

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.86 Billion | USD 5.25 Billion | 6.4% | 2024 |

Clinical Trial Supplies Market: Industry Perspective

The global clinical trial supplies market size was worth around USD 2.86 Billion in 2024 and is predicted to grow to around USD 5.25 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.4% between 2025 and 2034.

The report analyzes the global clinical trial supplies market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the clinical trial supplies industry.

Clinical Trial Supplies Market: Overview

Clinical trial supplies cover a wide range of tools and equipment used in scientific tests, investigations, and clinical research. The increasing R&D spending in pharmaceutical and biopharmaceutical firms, as well as the expanding number of clinical trials done internationally, are driving market expansion. One of the primary factors driving the market's growth is significant growth in the biopharmaceutical industry. Clinical trials are gaining a lot of traction in the fight against diseases like HIV and cancer, as well as the creation of new medication delivery methods.

Additionally, the growing tendency of contract research organizations (CROs) is favorably boosting the market growth. Furthermore, technological advancements that aid in the development of cold chain logistics and monitoring technologies are important growth drivers. Pharmaceutical, biotechnological, and medical instrument producers can outsource research efforts to CROs on a contractual basis, allowing them to use more trial materials. Moreover, extensive research and development (R&D) by both governmental and non-governmental organizations (NGOs) for the development of new pharmaceuticals and treatment procedures is predicted to boost the market's prospects.

A clinical trial is a complex activity which requires management of several processes and functions. The primary aim of a pharmaceutical manufacturer in any of the clinical studies is to optimize the clinical trial supplies so that materials packed for the investigational purpose is distributed to the patients enrolled in the clinical trials on time. The activities included in the clinical trial supplies are clinical packaging, project management, labeling, randomization generation, blinding, supply chain logistics, return drug accountability, distribution, destruction, etc. Due to the escalating costs involved in the discovery and development of new drugs, the clinical trial supplies is gaining traction in the market.

Key Insights

- As per the analysis shared by our research analyst, the global clinical trial supplies market is estimated to grow annually at a CAGR of around 6.4% over the forecast period (2025-2034).

- Regarding revenue, the global clinical trial supplies market size was valued at around USD 2.86 Billion in 2024 and is projected to reach USD 5.25 Billion by 2034.

- The clinical trial supplies market is projected to grow at a significant rate due to increasing R&D investments in pharmaceuticals and biologics, rising demand for personalized medicine, globalization of clinical trials, and stringent regulatory requirements.

- Based on Services, the Logistics & Distribution segment is expected to lead the global market.

- On the basis of Phase, the Phase 1 segment is growing at a high rate and will continue to dominate the global market.

- Based on the Type, the Small molecules segment is projected to swipe the largest market share.

- By Therapeutic Area, the Oncology segment is expected to dominate the global market.

- In terms of End-User, the Pharmaceutical & Biotechnology Companies segment is anticipated to command the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Clinical Trial Supplies Market: Driver

Pharmaceutical and biopharmaceutical businesses are increasing their R&D spending.

The pharmaceutical and biopharmaceutical industries are among the world's largest R&D spenders. Pharmaceutical and biopharmaceutical companies have increased their R&D spending significantly in the recent decade. The number of clinical trials conducted throughout the world is expected to rise as a result of this. Market players are actively seeking to assist in R&D initiatives. Increased R&D investment in the next years will significantly boost drug research and development activities, boosting demand for clinical trial supplies.

Clinical Trial Supplies Market: Restraint

Drug development is expensive.

Due to the high attrition rate of drug candidates in development, drug research and development have substantial expenses. Drug R&D processes can fail because R&D for some rare diseases is difficult and requires a specific group of people to undertake a clinical trial. Only 7 out of 100 cancer treatments that make it to the clinical testing stage are approved by the FDA; the majority of drugs fail long before they reach this stage. Developing a new treatment takes 10–15 years and costs USD 2.6 billion on average, from drug discovery to FDA approval. The FDA approves just about 12% of candidates who progress to Phase I clinical trials. This is a major stumbling block to the industry's expansion.

The market for clinical trials supplies is witnessing strong growth rate due to the rising prevalence of chronic diseases such as HIV, cancer, and epilepsy; increased importance on determining the toxicity level of drug discovery in its early stage of development; and the increasing demand for outsourcing the drug discovery services to the other countries. Growing number of life sciences-related researches carried out in various countries and rising government funding in the discovery and development of new drugs the market for clinical trial supplies is expected to witness rapid growth in the forecast period. Even the new entrants entering the clinical trial supplies market are focusing on the launch of new products and technologies. But, the lack of trained professionals and infrastructure facilities is anticipated to hamper the market growth.

Clinical Trial Supplies Market: Opportunity

R&D investments provide considerable market prospects.

In terms of trial expenses and patient pools, North America and Europe, which have traditionally been the key hubs for clinical trials, are confronting challenges. Recent health changes in the United States, the patent expiration of blockbuster drugs, and the global economic slump have all had an influence on pharmaceutical company profits. As a result, a number of pharmaceutical companies are looking for chances in emerging APAC markets like India, Singapore, South Korea, and China, which offer advantages including cheaper prices and easier access to a diversified patient population. Collaborations or expansions between firms in this sector suggest that they are going towards emerging markets to assist their clients in minimizing the overall time spent in clinical trials, hence lowering their overall cost and allowing for a faster launch of products on the market (post regulatory clearance). CROs can take advantage of these opportunities by assisting pharmaceutical companies in meeting their clinical trial supply demands.

Clinical Trial Supplies Market: Segmentation Analysis

The global clinical trial supplies market is segmented based on Services, Phase, Type, Therapeutic Area, End-User, and region.

Based on Services, the global clinical trial supplies market is divided into Logistics & Distribution, Storage & retention, Packaging, labeling, and blinding, Manufacturing, Comparator sourcing, and Other services (solutions, ancillary supply).

On the basis of Phase, the global clinical trial supplies market is bifurcated into Phase 1, Phase 2, Phase 3, Phase 4, and BA/ BE studies.

By Type, the global clinical trial supplies market is split into Small molecules, Biologic drugs, and Medical devices.

In terms of Therapeutic Area, the global clinical trial supplies market is categorized into Oncology, CNS and mental disorders, Cardiovascular diseases, Digestive disorders, Infectious diseases, Metabolic disorders, Immunology, Blood disorders, and Other therapeutic areas (respiratory disorders, dermatological disorders, rare diseases, ENT disea.

By End-User, the global Clinical Trial Supplies market is divided into Pharmaceutical & Biotechnology Companies, Contract Research Organizations (CROs), and Medical Devices Companies.

Clinical Trial Supplies Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Clinical Trial Supplies Market |

| Market Size in 2024 | USD 2.86 Billion |

| Market Forecast in 2034 | USD 5.25 Billion |

| Growth Rate | CAGR of 6.4% |

| Number of Pages | 166 |

| Key Companies Covered | Thermo Fisher (US), Catalent Inc (US), Parexel (US), Eurofins (France) UDG Healthcare (Ireland), Piramal Pharma Solutions (India), Almac Group (UK), PCI Pharma Services (US), PRA Health Sciences (US), Biocair (UK), Eurofins (France), Marken (US), Infosys (India), Liveo Research (India), Capsugel (a Lonza Group company) (Switzerland), SIRO Clinpharm (India), KLIFO A/S (Denmark), Clinigen (UK), Ancillare (US), N-SIDE (Belgium), ADAllen (UK), Rubicon (India), Durbin (UK), Recipharm (Sweden), Seveillar (India), Myonex (India),, and others. |

| Segments Covered | By Services, By Phase, By Type, By Therapeutic Area, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- In 2021, PPD, Inc. is now owned by Thermo Fisher Scientific. With the addition of PPD, Thermo Fisher will be able to provide a full range of world-class clinical development services, from scientific discovery to analyzing safety, efficacy, and healthcare outcomes, to managing clinical trial logistics, to drug development and manufacturing.

Clinical Trial Supplies Market: Regional Landscape

In terms of market share and revenue, North America dominates the clinical trial supplies market, and this dominance will continue during the projected period. This is owing to the region's large number of essential companies and well-developed healthcare infrastructure. Pharmaceutical and biopharmaceutical businesses' increased spending on R&D is the primary drivers of North America's clinical trial supplies market share. The expanding number of healthcare companies conducting clinical trials in the region, supportive government laws, and the availability of cost-effective goods are all contributing to this expansion.

The Asia Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period, due to a bigger patient pool, more healthcare expenditure, and increased government assistance. Furthermore, large pharmaceutical companies are outsourcing their drug development services to countries like China, Singapore, Malaysia, and India, which is fueling the region's clinical trial supplies industry. This region's quick expansion can be ascribed to rising chronic disease prevalence, lower clinical trial costs compared to the western region, and increased government initiatives to perform clinical trials. Clinical material and supply end-users are also projected to enhance their local presence in these markets due to the strict requirements for importing clinical supplies.

Clinical Trial Supplies Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the clinical trial supplies market on a global and regional basis.

The global clinical trial supplies market is dominated by players like:

- Thermo Fisher (US)

- Catalent Inc (US)

- Parexel (US)

- Eurofins (France) UDG Healthcare (Ireland)

- Piramal Pharma Solutions (India)

- Almac Group (UK)

- PCI Pharma Services (US)

- PRA Health Sciences (US)

- Biocair (UK)

- Eurofins (France)

- Marken (US)

- Infosys (India)

- Liveo Research (India)

- Capsugel (a Lonza Group company) (Switzerland)

- SIRO Clinpharm (India)

- KLIFO A/S (Denmark)

- Clinigen (UK)

- Ancillare (US)

- N-SIDE (Belgium)

- ADAllen (UK)

- Rubicon (India)

- Durbin (UK)

- Recipharm (Sweden)

- Seveillar (India)

- Myonex (India)

The global clinical trial supplies market is segmented as follows;

By Services

- Logistics & Distribution

- Storage & retention

- Packaging

- labeling

- and blinding

- Manufacturing

- Comparator sourcing

- and Other services (solutions

- ancillary supply)

By Phase

- Phase 1

- Phase 2

- Phase 3

- Phase 4

- and BA/ BE studies

By Type

- Small molecules

- Biologic drugs

- and Medical devices

By Therapeutic Area

- Oncology

- CNS and mental disorders

- Cardiovascular diseases

- Digestive disorders

- Infectious diseases

- Metabolic disorders

- Immunology

- Blood disorders

- and Other therapeutic areas (respirato

By End-User

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- and Medical Devices Companies

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global clinical trial supplies market is expected to grow due to rising prevalence of chronic diseases, increasing clinical research activities, growing demand for biologics and personalized medicine, and advancements in cold chain logistics and supply chain management.

According to a study, the global clinical trial supplies market size was worth around USD 2.86 Billion in 2024 and is expected to reach USD 5.25 Billion by 2034.

The global clinical trial supplies market is expected to grow at a CAGR of 6.4% during the forecast period.

North America is expected to dominate the clinical trial supplies market over the forecast period.

Leading players in the global clinical trial supplies market include Thermo Fisher (US), Catalent Inc (US), Parexel (US), Eurofins (France) UDG Healthcare (Ireland), Piramal Pharma Solutions (India), Almac Group (UK), PCI Pharma Services (US), PRA Health Sciences (US), Biocair (UK), Eurofins (France), Marken (US), Infosys (India), Liveo Research (India), Capsugel (a Lonza Group company) (Switzerland), SIRO Clinpharm (India), KLIFO A/S (Denmark), Clinigen (UK), Ancillare (US), N-SIDE (Belgium), ADAllen (UK), Rubicon (India), Durbin (UK), Recipharm (Sweden), Seveillar (India), Myonex (India),, among others.

The report explores crucial aspects of the clinical trial supplies market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed