Convection Reflow Soldering Oven Market Size, Share, Growth, Trends, and Forecast 2030

Convection Reflow Soldering Oven Market By Application (Automotive, Telecommunications, Consumer Electronics, and Others), By Product Type (More than 20 Heating Zones, 10-20 Heating Zones, and Less than 10 Heating Zones), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

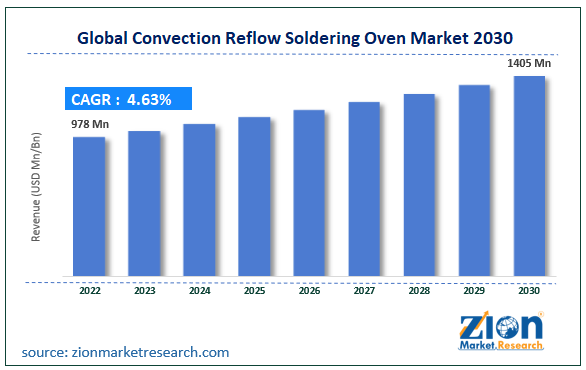

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 978 million | USD 1405 million | 4.63% | 2022 |

Convection Reflow Soldering Oven Industry Prospective:

The global convection reflow soldering oven market size was worth around USD 978 million in 2022 and is predicted to grow to around USD 1405 million by 2030 with a compound annual growth rate (CAGR) of roughly 4.63% between 2023 and 2030.

Convection Reflow Soldering Oven Market: Overview

Surface-mount technology (SMT) is a common term used in the electronics industry. It describes the method used to attach components, also known as surface-mounted components (SMCs) on printed circuit boards (PCB). In today’s time, convention reflow is the preferred method amongst all the other types of SMT reflow that are used for soldering of SMCs on PCBs. During the process of reflow soldering, a melted form of solder paste is used to create a strong electrical connection between all the components of a PCB and in convection reflow soldering, the heat requirement for melting soldering paste is fulfilled by heat circulating through the PCB also known as convective heat. The steps involved in the initial application of solder paste and placing the SMCs using machines.

The PCB has to be preheated with a gradual increase in the temperature. This process helps in eliminating all forms of flux volatiles and moisture content. Once the board has entered the reflow segment, the temperature has to be increased until the soldering paste starts to melt and once the soldering is complete, the PCB is allowed to cool down. There are several benefits of convection reflow soldering which is resulting in higher demand in the global convection reflow soldering oven market. One key advantage is the excellent result shown by the method even while working with complex PCBs.

Key Insights:

- As per the analysis shared by our research analyst, the global convection reflow soldering oven market is estimated to grow annually at a CAGR of around 4.63% over the forecast period (2023-2030)

- In terms of revenue, the global convection reflow soldering oven market size was valued at around USD 978 million in 2022 and is predicted to grow to around USD 1405 million, by 2030.

- The convection reflow soldering oven market is projected to grow at a significant rate due to the growing demand for miniaturization in the electronics industry

- Based on application segmentation, consumer electronics was predicted to show maximum market share in the year 2022

- Based on product segmentation, 10-20 heating zones was the leading product in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Convection Reflow Soldering Oven Market: Growth Drivers

Rising miniaturization in the electronics industry to drive market growth

The global convection reflow soldering oven market is expected to grow owing to the growing demand for miniaturization in the electronics industry. As the technology progresses, consumer demands and expectations have evolved over the years. End-users now expect companies to deliver sleeker and more compact electronic devices. One of the primary reasons is the growing space concern as the world population continues to rise and urban areas are reaching their maximum housing capacity. Modern homes are smaller in size than traditional older housing units meeting the needs of nuclear families or fewer individuals sharing a living space. Moreover, the consumption of portable devices is higher as compared to stationary devices.

Other factors also play a crucial role in the rising trend forcing companies and electronic goods manufacturers to deliver miniaturized versions of their product offerings including aspects such as the growing need for energy efficiency and cost considerations. In June 2022, PCB Technologies announced the launch of iNPACK. It is a novel heterogeneous integration provider dealing with System-in-Package (SiP) solutions. Compact devices are built using complex PCBs and soldering such boards requires the use of advanced systems. Convection reflow soldering oven is one of the most efficient tools that can manage soldering on challenging PCBs.

Growing concern regarding the impact of the electronics industry on the environment to push more users toward convection reflow

The electronic industry is one of the largest lead-based pollutants due to the extensive use of lead-rick components. This has resulted in the growing efforts undertaken by several industry players in the electronics industry to adopt lead-free soldering which can be achieved by the convection reflow method since it is possible to reach higher temperatures that are needed for the soldering process with minimal lead release.

Convection Reflow Soldering Oven Market: Restraints

Higher energy consumption by convection reflow soldering oven to restrict market growth

The technology and machine used in convection reflow soldering ovens require a constant supply of high energy. This is especially applicable while trying to maintain the temperature needed for the soldering paste to melt. While developed nations have significant infrastructure to meet the energy requirements of the oven, developing nations or underdeveloped economies may not have sufficient energy supply. Moreover, it also leads to additions in the overall operational cost which may cause smaller players to rethink the use of the technology.

Concerns associated with lead-free soldering to impede market expansion

While lead-free soldering remains a driving force for the global convection reflow soldering oven market, it can also cause certain limitations. High temperatures are required to solder a component with reduced release of lead. However, this can lead to other issues including warpage and thermal stress. Consumers should have resources in place to deal with the side effects of lead-free soldering.

Convection Reflow Soldering Oven Market: Opportunities

Rising innovation and development in the convection reflow technology to provide growth opportunities

The global convection reflow soldering oven industry size is expected to benefit from the rising number of new product launches driven by innovation, research, and development. In April 2023, BTU International, Inc., a leading global supplier of advanced thermal processing equipment catering to the needs of the electronics manufacturing market, released the newest version of its reflow oven platform. The new release is called Aurora and is a product of the company’s vision to provide the most advanced heating systems. In August 2022, Altus Group, a company that supplies capital equipment to the electronics industry player, introduced products made by Heller Industries to the commercial market. These products include the latest innovation by Heller called the MK7 Reflow Oven which is regarded as the world’s best-performing SMT convection reflow oven.

Suitability of the oven in high-volume production to create more demand

With the ongoing changes in international trade relations, there is a growing need for high-volume production which can be achieved with the help of convection reflow soldering mainly due to the technology’s ability to provide rapid changes in heat temperature.

Convection Reflow Soldering Oven Market: Challenges

High cost of initial investment and the need for skilled labor is a major challenge in the market

The convection reflow soldering oven industry growth is anticipated to be challenged by the high cost of initial investment required to purchase this tool due to the complexities involved in its production. Additionally, it can be utilized optimally with the aid of skilled professionals only and there is a considerable lack of supply of skilled workforce.

Convection Reflow Soldering Oven Market: Segmentation

The global convection reflow soldering oven market is segmented based on application, product type, and region.

Based on application, the global market segments are automotive, telecommunications, consumer electronics, and others. The industry growth was led by the consumer electronics segment in 2022 as the segment registered high demand for products such as laptops, mobile phones & smartphones, television sets, and other items of everyday need. With the rise of remote work culture along with online classes, the sale of smartphones and tablets reached new heights. Factors crucial to the segmental growth include the launch of affordable items along with the availability of growing product options as new players have entered the consumer electronics industry which is currently valued at more than USD 700 billion. The telecommunications and automotive sectors will witness significant revenue.

Based on product type, the convection reflow soldering oven industry is divided into more than 20 heating zones, 10-20 heating zones, and less than 10 heating zones. During the forecast period, more demand can be expected in the 10-20 heating zones segment as soldering ovens in these categories are not only versatile but offer precise temperature control. They are ideal choices in processes requiring the soldering of complex PCBs. The average price of a reflow oven is between USD 650 to USD 25500 per set,

Convection Reflow Soldering Oven Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Convection Reflow Soldering Oven Market |

| Market Size in 2022 | USD 978 Million |

| Market Forecast in 2030 | USD 1405 Million |

| Growth Rate | CAGR of 4.63% |

| Number of Pages | 226 |

| Key Companies Covered | Nordson Corporation, JLW Electronics, PVA Tepla America, Heller, ANTOM, SEHO, VIRTRONIC, Tamura, Nihon Handa, BTU, Shenzhen Riding, Vitronics Soltec, and others. |

| Segments Covered | By Application, By Product Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Convection Reflow Soldering Oven Market: Regional Analysis

North America to be led by the US during the forecast period

The global convection reflow soldering oven market is projected to be led by North America during the forecast period with the US acting as the major contributor. A leading reason for the growth is the presence of an extensive consumer electronics industry which is one of the largest consumers of convection reflow soldering ovens. North America has a high demand for miniaturization in the electronics sector as consumer awareness continues to rise. In addition to this, the US has been spending heavily on expanding its semiconductor industry as it aims to have higher control over the regional supply of chips and other components. It also houses several key players producing convection reflow soldering ovens with a key focus on innovation which is fueled by the growing emphasis on reducing lead pollution caused by the electronics industry. Asia-Pacific will witness a high growth rate as China continues to make strides in the global semiconductor market with the rise in the number of manufacturing setups. It also has a huge export value currently standing at over USD 2. 5 trillion in terms of goods and services.

Convection Reflow Soldering Oven Market: Competitive Analysis

The global convection reflow soldering oven market is led by players like:

- Nordson Corporation

- JLW Electronics

- PVA Tepla America

- Heller

- ANTOM

- SEHO

- VIRTRONIC

- Tamura

- Nihon Handa

- BTU

- Shenzhen Riding

- Vitronics Soltec

The global convection reflow soldering oven market is segmented as follows:

By Application

- Automotive

- Telecommunications

- Consumer Electronics

- Others

By Product Type

- More than 20 Heating Zones

- 10-20 Heating Zones

- Less than 10 Heating Zones

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Surface-mount technology (SMT) is a common term used in the electronics industry. It describes the method used to attach components, also known as surface-mounted components (SMCs) on printed circuit boards (PCB).

The global convection reflow soldering oven market is expected to grow owing to the growing demand for miniaturization in the electronics industry.

According to study, the global convection reflow soldering oven market size was worth around USD 978 million in 2022 and is predicted to grow to around USD 1405 million by 2030.

The CAGR value of convection reflow soldering oven market is expected to be around 4.63% during 2023-2030.

The global convection reflow soldering oven market is projected to be led by North America during the forecast period with the US acting as the major contributor.

The global convection reflow soldering oven market is led by players like Nordson Corporation, JLW Electronics, PVA Tepla America, Heller, ANTOM, SEHO, VIRTRONIC, Tamura, Nihon Handa, BTU, Shenzhen Riding, Vitronics Soltec, and many more.

The global convection reflow soldering oven market explores crucial aspects of the convection reflow soldering oven market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the convection reflow soldering oven market.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed