Decentralized Finance (DeFi) Market Size, Share, Growth Report 2032

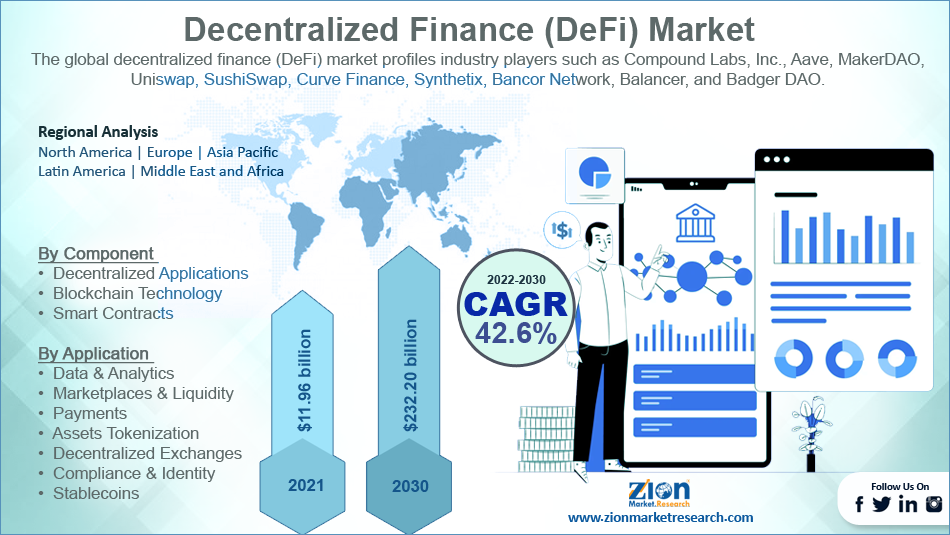

Decentralized Finance (DeFi) Market By Component (Decentralized Applications, Smart Contracts, and Blockchain Technology), By Application (Data & Analytics, Marketplaces & Liquidity, Payments, Assets Tokenization, Decentralized Exchanges, Compliance & Identity, and Stablecoins), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2022 - 2030

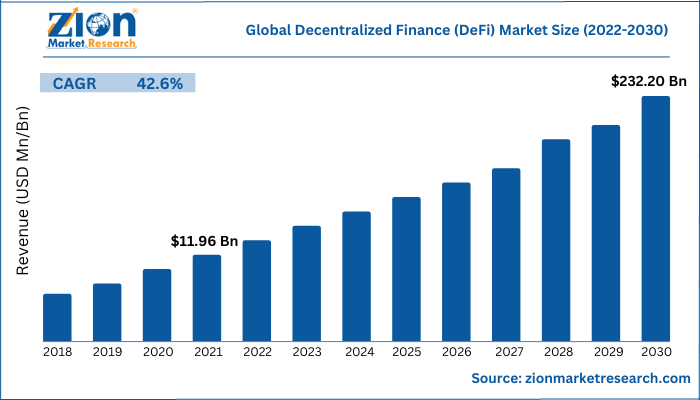

Global decentralized finance (DeFi) industry size was $11.96 billion in 2021 and is set to increase to about $232.20 billion by 2030 with a CAGR of 42.6% Decentralized Finance (DeFi) Industry share By Component, Application, Region

Industry Perspective:

The global decentralized finance (DeFi) market size was evaluated at $11.96 billion in 2021 and is slated to hit $232.20 billion by the end of 2030. The market report is an indispensable guide on growth factors, challenges, restraints, and opportunities in the global marketplace. The report covers the geographical market along with a comprehensive competitive landscape analysis. Additionally, the report explores the investors and stakeholder space to help companies make data-driven decisions.

Decentralized Finance (DeFi) Market: Synopsis

DeFi or decentralized finance is a term for financial services on public blockchains, mainly Ethereum. With the help of DeFi, one can earn interest, lend, buy insurance, borrow, trade derivatives, and trade assets. Moreover, DeFi transactions do not require paperwork or any aid from vendors. Reportedly, DeFi is a peer-to-peer system and is open to all. It is pseudonymous, flexible, transparent, and fast. Decentralized finance creates an entire digital option for Wall Street and takes the basic Bitcoin premise & expands on the bitcoin.

Key Insights

- As per the analysis shared by our research analyst, the global decentralized finance (DeFi)market is projected to expand annually at the annual growth rate of around 42.6% over the forecast timespan (2022-2030)

- In terms of revenue, the global decentralized finance (DeFi) market size was evaluated at nearly $11.96 billion in 2021 and is anticipated to hit $232.20 billion by 2030

- The global market is anticipated to surge at a remarkable rate over the forecast period due to the large-scale consumption of decentralized finance by the millennial population in countries such as the U.S.

- Based on component, the blockchain technology segment accounted for the major market share in 2021

- On basis of application, the data & analytics segment accounted for the highest market share in 2021

- On the basis of region, the North American region is predicted to be a key revenue pocket of the global market over the projected timeline

To know more about this report, request a sample copy.

Decentralized Finance (DeFi) Industry: Growth Drivers

Escalating demand for decentralized finance in blockchain and insurance to augment the global market surge

Escalating demand for decentralized finance in blockchain and insurance will boost the growth of the global decentralized finance (DeFi) market. A massive increase in e-sports events and online gaming activities will boost the global market demand. Apart from this, awareness of the massive benefits provided by DeFi technology service providers will embellish the industry landscape.

Decentralized Finance (DeFi) Market: Hindrances

Fluctuations in oscillation rates on Ethereum blockchain transactions to decimate the global market expansion

Oscillating rate of transactions on Ethereum blockchain leads to a surge in costs of active trading. This will put brakes on the expansion of the decentralized finance (DeFi) market. In addition, high volatility in investments in DeFi technologies can impede the expansion of the global industry.

Decentralized Finance (DeFi) Market: Opportunities

Rapid expansion of blockchain-based prediction tools to create new opportunities for growth for the global market

Emergence of blockchain-driven prediction tools is predicted to generate new growth avenues for the global decentralized finance (DeFi) industry in the years ahead.

Decentralized Finance (DeFi) Market: Challenges

DeFi’s infrastructure is still under development and this can pose a challenge to the growth of the global industry

DeFi tools are related to particular risks apart from their cutting-edge benefits. Moreover, DeFi’s infrastructure is under development. In addition, the capital investments made on DeFi are not covered under insurance and are not regulated by any laws like traditional banking. This is one of the biggest challenges faced by the global decentralized finance (DeFi) market.

Decentralized Finance (DeFi) Market: Segmentation

The global decentralized finance market is divided into component, application, and region.

In terms of component, the global decentralized finance (DeFi) industry is segmented into decentralized applications, smart contracts, and blockchain technology segments. Moreover, the blockchain technology segment, which accounted for the largest market share of more than 42.1% in 2021, is predicted to exhibit massive growth during the forecast timeline. The expansion of this segment over 2022-2030 can be attributed to the large-scale use of blockchain technology in augmenting decentralized financial services across the financial industry.

On the basis of application, the global decentralized finance (DeFi) market is divided into data & analytics, marketplaces & liquidity, payments, assets tokenization, decentralized exchanges, compliance & identity, and stablecoins. Moreover, the data & analytics segment, which led the global decentralized finance (DeFi) industry share in 2021, is anticipated to lead it even in the years ahead. The segmental growth can be due to the openness of DeFi protocols’ in data and network activities.

Recent Breakthroughs

- In January 2022, xWIN Finance, a decentralized finance that enables individual investors in creating their own decentralized fund, introduced an upgraded Web3 DeFi tool referred to as xWIN finance v2 that helps in linking wealth managers as well as health funds with individual investors. Reportedly, this new tool also helps investors in creating their own decentralized fund based on risk preference with the help of the xWIN Robo Advisor engine.

- In January 2022, Bitget, a leading player in the cryptocurrency exchange business globally, introduced MegaSwap, a new feature on its DeFi platform that will facilitate the users of this platform in trading as well as swapping their digital assets for nearly more than 10,000 cryptocurrencies on the decentralized finance (DeFi) platform.

Decentralized Finance (DeFi) Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Decentralized Finance (DeFi) Market Research Report |

| Market Size in 2021 | USD 11.96 Billion |

| Market Forecast in 2030 | USD 232.20 Billion |

| Compound Annual Growth Rate | CAGR of 42.6% |

| Number of Pages | 186 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Compound Labs, Inc., Aave, MakerDAO, Uniswap, SushiSwap, Curve Finance, Synthetix, Bancor Network, Balancer, and Badger DAO. |

| Segments Covered | By Component, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2021 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2022 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Decentralized Finance (DeFi) Market: Regional Analysis

North America to dominate the global market in near future

In terms of region, the global decentralized finance (DeFi) market is sectored into Europe, Asia-Pacific, Latin America, Middle East and Africa, and North America. The North American is slated to dominate the global decentralized finance (DeFi) market in the next eight years subject to the presence of key players including Compound Labs, Inc., and Uniswap. In addition to this, North America is one of the biggest cryptocurrency markets across the globe that also adopts DeFi platforms.

Decentralized Finance (DeFi) Market: Competitive Analysis

The global decentralized finance (DeFi) market profiles industry players such as:

- Compound LabsInc.

- Balancer

- Aave

- MakerDAO

- Bancor Network

- Uniswap

- SushiSwap

- Curve Finance

- Synthetix

- Badger DAO.

The global Decentralized Finance (DeFi) market is segmented as follows:

By Component

- Decentralized Applications

- Blockchain Technology

- Smart Contracts

By Application

- Data & Analytics

- Marketplaces & Liquidity

- Payments

- Assets Tokenization

- Decentralized Exchanges

- Compliance & Identity

- Stablecoins

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global decentralized finance (DeFi) market is projected to expand over 2022-2030 owing to escalating demand for decentralized finance in blockchain and insurance. A massive increase in e-sports events and online gaming activities will boost the global market demand.

According to study, the global decentralized finance (DeFi) market size was $11.96 billion in 2021 and is projected to reach $232.20 billion by the end of 2030 with a compound annual growth rate (CAGR) of roughly 42.6% between 2022 and 2030.

The North American decentralized finance (DeFi) market is anticipated to record the highest growth in the ensuing years owing to the presence of key players including Compound Labs, Inc., and Uniswap. In addition to this, North America is one of the biggest cryptocurrency markets across the globe that also adopts DeFi platforms.

The global decentralized finance (DeFi) market is led by players like Compound Labs, Inc., Aave, MakerDAO, Uniswap, SushiSwap, Curve Finance, Synthetix, Bancor Network, Balancer, and Badger DAO.

Choose License Type

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed